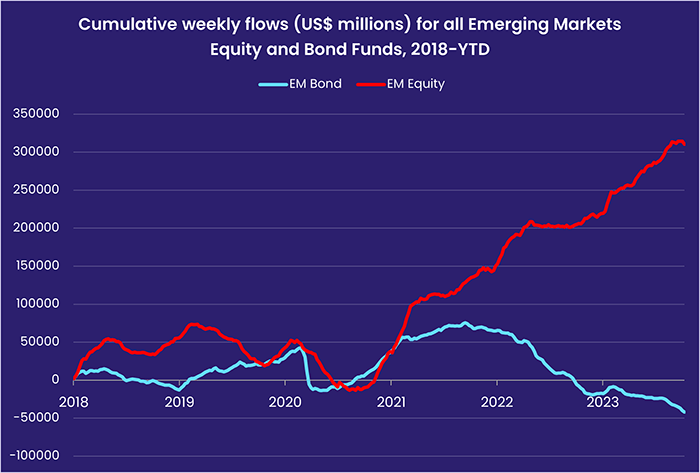

Investors pulled a combined $6 billion out of EPFR-tracked Emerging Markets Bond and Equity Funds during the second week of October, with the latter posting their biggest outflow in over 16 months, as markets adjusted to the higher-for-longer US interest rate narrative and absorbed the shock of the Hamas-led assault on Israel.

Exposure to emerging markets was not the only thing on the chopping block during the week ending Oct. 11. Consumer Goods Sector Funds saw over $1 billion flow out for the third week running, High Yield Bond Funds‘ latest outflow streak hit four weeks and $13 billion and Alternative Funds experienced net redemptions for the ninth time in the past 10 weeks.

Reservations about Europe’s economic health continue to dog Europe Equity Funds, which racked up their 31st consecutive outflow, and Europe Bond Funds posted consecutive weekly outflows for only the third time year-to-date. But flows into Europe Money Market Funds hit a 51-week high.

Overall flows into all EPFR-tracked Money Market Funds during the latest week totaled $16.8 billion. Bond Funds took in a net $3.6 billion while investors removed $1 billion from Alternative Funds, $3 billion from Balanced Funds and $8.2 billion from Equity Funds.

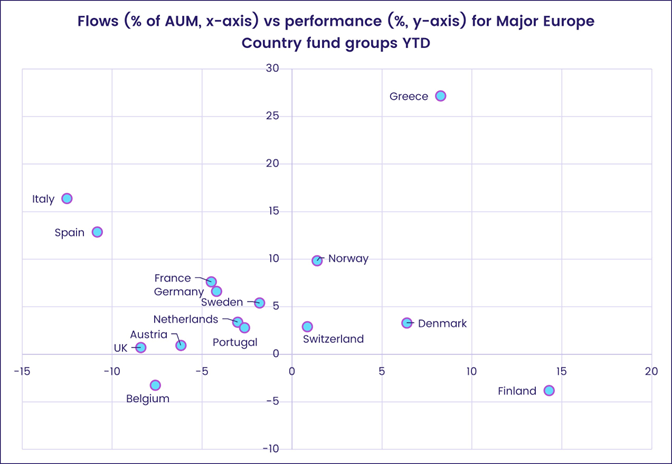

At the single country and asset class fund level, Denmark Bond and UAE Equity Funds both set new weekly inflow records, redemptions from Greece Equity Funds hit their highest level since the first week of 2022 and China Bond Funds recorded their 17th outflow of the past 20 weeks. Gold Funds extended a redemption streak that began in late May, Inflation Protected Bond Funds recorded their 39th outflow in the 41 weeks YTD and money flowed out of Convertible Bond Funds for the 15th straight week.

Emerging markets equity funds

The week ending Oct. 11 saw the biggest outflow from China Equity Funds since the first week of February and the 11th straight week of net redemptions from the diversified Global Emerging Markets (GEM) Equity Funds. As a result, EPFR-tracked Emerging Markets Equity Funds recorded their biggest collective outflow since mid-2Q22, with redemptions from EM Equity ETFs hitting levels last seen in late 2Q20.

While fresh hopes of additional stimulus measures to boost the Chinese economy lifted key indexes in Europe, Australia and Latin America, redemptions from China Equity Funds were broadly based with 40 funds posting outflows of $20 million or more. Money flowed out of retail share classes for the 11th straight week and 23rd time in the past six months.

Among the other major Asia ex-Japan Country Fund groups, India Equity Funds extended their longest run of inflows since 1H04, Taiwan (POC) Equity Funds saw a nine-week inflow streak come to an end and Korea Equity Funds absorbed fresh money for the 11th week running.

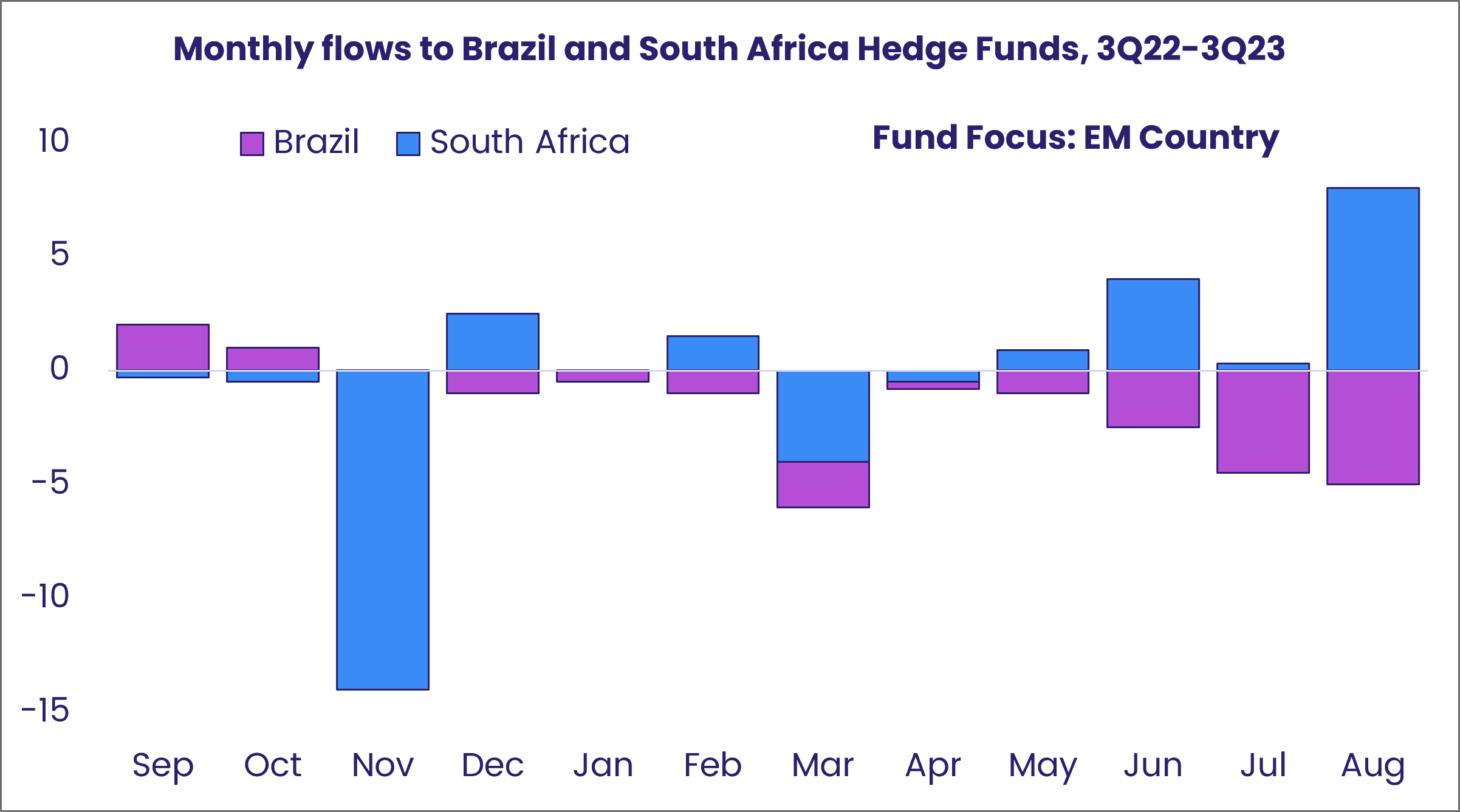

Investors looking to Latin America pulled money out of Brazil Equity Funds for the fifth time in the past six weeks as rebounding inflation and the gravitational pull of US interest rates raised questions about the Brazilian central bank’s rate cutting cycle. Hedge funds dedicated to Brazil have been experiencing redemptions for even longer, with investors who use those vehicles shifting their attention to South Africa mandated funds.

Conventional South Africa Equity Funds were also in the money in early October, chalking up their biggest weekly inflow since early 4Q22. With flows into Turkey and UAE Equity Funds hitting 20-week and record highs, respectively, the headline number for all EMEA Equity Funds was positive despite the outbreak of violence along the Israeli-Gaza border.

Frontier Markets Funds, which invest in the riskiest developing countries, posted their sixth inflow since the beginning of August. Vietnam remains by far the biggest single country allocation for this group, followed by Kazakhstan.

Developed markets equity funds

With unemployment and price data from the US in early October giving added credence to the new consensus on interest rates in the world’s largest economy – higher for longer – EPFR-tracked Developed Markets Equity Funds posted their first collective outflow of the fourth quarter, and their sixth since the beginning of the third quarter.

The latest week saw US, Europe, Pacific Regional and Global Equity Funds post outflows ranging from $472 million to $2 billion. That offset flows into Japan, Australia and Canada Equity Funds. Year-to-date, a net $88.6 billion has flowed out of all Developed Markets Equity Funds while their emerging markets counterparts have absorbed $93.4 billion.

While the latest US macroeconomic data threw cold water on hopes of an early shift by the US Federal Reserve to an easing bias, it did highlight the relative strength of the American economy ahead of a 3Q23 earnings season that is expected to see positive year-on-year growth. Although the headline number for US Equity Funds was negative, Large Cap Funds posted their sixth inflow in the past seven weeks and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates chalked up their biggest weekly inflow since mid-3Q22.

Europe Equity Funds added to their lengthy outflow streak as economic growth in Germany remains flat, Russia’s invasion of Ukraine grinds into its 20th month and European Central Bank policymakers continue to talk tough on inflation. Leveraged Europe Equity Funds, however, posted a third consecutive inflow for the first time since late March. At the country level, redemptions from Greece Equity Funds hit their highest level since early 1Q22 while flows into Sweden Equity Funds climbed to a 10-week high and UK Equity Funds recorded an inflow for only the third time YTD.

Flows for Japan Equity Funds were positive for the fifth straight week and 17th time in the past 19 weeks as Japan Dividend Funds recorded their 28th inflow since mid-March. Foreign domiciled funds, which took in fresh money 23 of the 26 weeks in the second and third quarters, recorded their second outflow in the past three weeks.

While comfortable with direct exposure to Japan and Australia, investors showed no appetite for regional exposure. Pacific Regional Equity Funds, which on average allocated 52% of their portfolios to Japanese and Australian stocks, recorded their biggest outflow since late 4Q18.

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, are also facing this drop-off in appetite for broad exposure. During the latest week, redemptions hit a two-month high despite solid flows into funds with ex-US mandates.

Global sector, industry and precious metals funds

With key financial plays set to kick off the 3Q23 earnings season for US corporations, investors spent the week ending Oct. 11 adjusting their sector exposure and hoping that the coming forecasts will shed light on a host of issues from the supply of skilled workers to the impact of higher-for-longer interest rates.

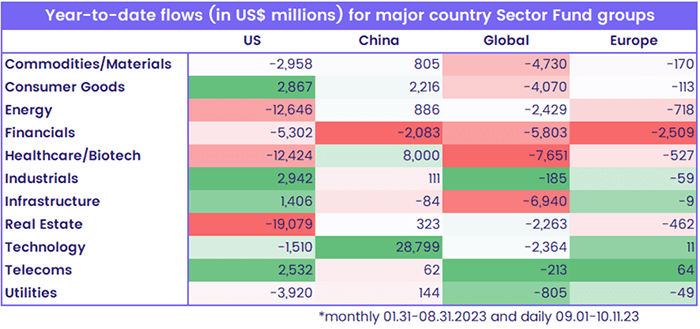

For the second week running five of the 11 major EPFR-tracked Sector Fund groups recorded inflows that ranged from $44 million to $320 million. Once again, it was the numbers in the outflow column that were the more eye-catching, with Consumer Goods Funds seeing over $1 billion flow out for the third week running and Financial Sector Funds posting their 11th collective outflow.

While Global, Europe, US and China-dedicated funds have weighed on the headline 9M23 number for all Financial Sector Funds, there has been interest in other key markets. Year-to-date, Canada Financials Sector Funds have seen $1.2 billion flow in – the second largest yearly inflow behind their 2021 record of $2.3 billion – and Japan, India and Turkey-mandated funds have pulled in decent sums of fresh money.

Although both US and China Consumer Goods Funds have recorded net inflows YTD, over the past three weeks the former have posted two outflows in excess of $700 million while China Consumer Goods Sector Funds have recorded outflows eight of the past 10 weeks.

With a second major conflict breaking out on Europe’s periphery, flows into a custom group of Aerospace & Defense Funds jumped to an eight-week high of $141 million and brought their three-week outflow streak to an end. YTD, the group has attracted a net $1.3 billion compared to the record inflows of $3.9 billion last year. The latest inflows helped the overall Industrials Sector Fund group to snap their four-week redemption streak.

Bond and other fixed income funds

Fixed income investors continued their pivot from riskier asset classes during the week ending Oct. 11. But the lure of higher sovereign yields was enough for all EPFR-tracked Bond Funds to snap their two-week outflow streak and post their 37th inflow year-to-date.

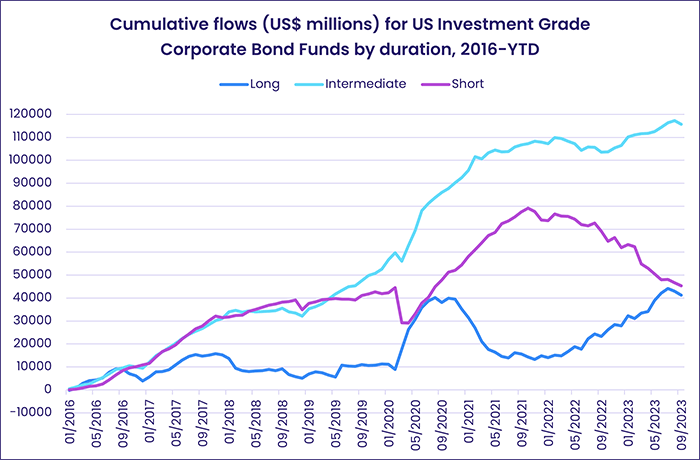

Driving the week’s headline number was the more than $6 billion absorbed by US Bond Funds, which posted their biggest inflow in nearly three months. The bulk of that fresh money went to funds with sovereign mandates while flows to Investment Grade Corporate Bond Funds were more than offset by redemptions from US High Yield Bond Funds. In recent weeks, investors seeking exposure to investment grade corporate debt have favored funds specializing in long duration issues, but over the past six years have preferred intermediate term issues.

The week was also marked by the biggest inflow for Japan Bond Funds in over two years. The Bank of Japan’s ultra-accommodative policies are under pressure due to higher US and European yields, which have also cut into the value of the yen, and investors expect that yields on Japanese government bonds –which are already at the highest levels since 2013– will move even higher before the end of the year.

Once again, Europe Sovereign Bond Funds posted inflows. But both High Yield and Investment Grade Corporate Funds experienced net redemptions which, combined, added up to the biggest outflow from Europe Corporate Bond Funds since late 2Q22. At the country level, Denmark Bond Funds attracted record-setting inflows, redemptions from Germany Bond Funds climbed to a 27-week high and Italy Bond Funds posted consecutive weekly outflows for the first time since mid-February.

As is the case with their equity counterparts, Global Bond Funds have suffered from the recent reluctance of investors to take on diversified geographic exposure. This group has now posted outflows for six of the past seven weeks.

Global Emerging Markets (GEM) Bond Funds are even more out of favor. Their current outflow streak is the longest since a 12-week run ended in mid-4Q22 and the biggest contributor to the collective outflows posted by all EPFR-tracked Emerging Markets Bond Funds. Asia-mandated funds have also struggled to attract fresh money despite Korea Bond Funds‘ 12-week inflow streak, in part due to the ongoing struggles of Chinese property developers to service their outstanding debt.

Did you find this useful? Get our EPFR Insights delivered to your inbox.