Between Feb. 15 and 22, Japan, Europe and the US saw benchmark equity indexes hit fresh record highs while China’s CSI 300 climbed to a level last seen in late November. Against this backdrop, investors committed another $14.7 billion to EPFR-tracked Equity Funds during the third week of January. That took the year-to-date total over the $65 billion mark, more than five times the amount that flowed in during the comparable period last year.

Elsewhere, recent flow patterns largely held up. China, Japan and India Equity Funds added to their current inflow streaks, another $748 million flowed into Technology Sector Funds and Bond Funds saw their collective YTD total hit $120 billion while Balanced and European Equity Funds experienced further redemptions.

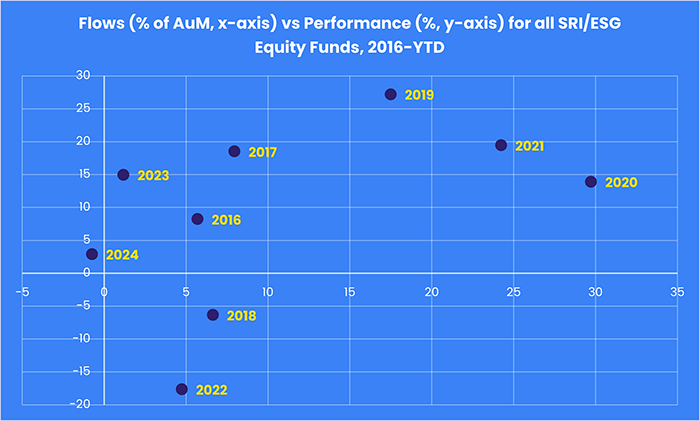

Also seeing outflows were Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates, which added to their longest outflow streak in over a decade. The redemptions have been broadly based, with 24 different funds seeing over $50 million flow out over the past 10 weeks.

Overall, EPFR-tracked Bond Funds pulled in another $15 billion during the week ending Feb. 21 and Money Market Funds absorbed a net $2 billion while outflows for Alternative and Balanced Funds totaled $267 million and $3.8 billion, respectively.

At the single country and asset class fund levels, Romania Equity Funds posted their 16th consecutive inflow, redemptions from Brazil Equity Funds climbed to a 24-week high, Brazil Bond Funds recorded their biggest inflow since early 4Q22 and investors pulled money out of Hong Kong Bond Funds for the 59th week running. Cryptocurrency Funds attracted over $1 billion for the second straight week, flows out of Inflation Protected Bond Funds hit an eight-week high and High Yield Bond Funds added another $2.1 billion to their YTD total.

Emerging markets equity funds

Another week, another slug of fresh money into dedicated China and India Equity Funds that offset redemptions from other groups. The third week of February saw EPFR-tracked Emerging Markets Equity Funds extend their longest inflow streak since 1Q22. Underpinning the headline number were the over $3 billion that flowed into Asia ex-Japan Equity Funds, the 29th consecutive inflow for EM Dividend Funds and the biggest inflow recorded by the diversified Global Emerging Markets (GEM) Equity Funds in over nine months.

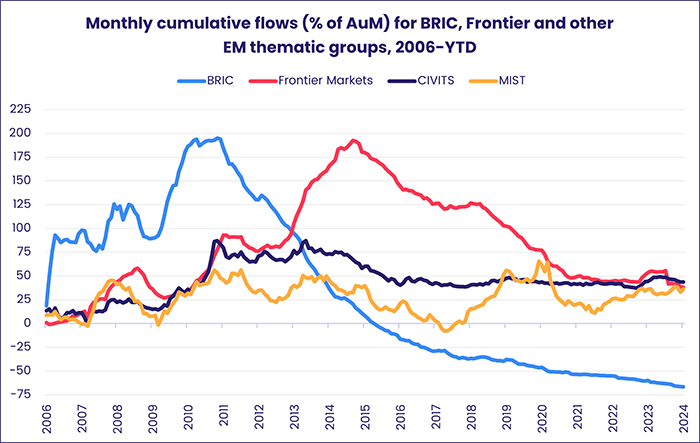

Among the groups experiencing net redemptions were BRIC (Brazil, Russia, India and China) Equity Funds, which posted their 18th outflow since the beginning of 4Q23. The BRICS group was joined earlier this year by Iran, Ethiopia and the UAE, but its expanding political base – South Africa joined in 2010 – has been mirrored by a declining appetite for the BRIC investment theme. Other thematic EM groups have also seen interest peak.

Funds dedicated to individual BRIC markets experienced mixed fortunes during the third week of February. India Equity Funds extended their record-setting inflow streak, China Equity Funds took their year-to-date inflow total past the $45 billion mark, Russia Equity Funds remain frozen as the second anniversary of Russia’s assault of Ukraine approaches and Brazil Equity Funds racked up their biggest outflow in nearly six months.

The redemptions from Brazil Equity Funds offset further inflows to Mexico Equity Funds chasing that country’s supply chain relocation story and proximity to strong US growth. As a result, Latin America Equity Funds posted their eighth collective outflow over the past nine weeks. The latest week also saw an end to Argentina Equity Funds’ longest run of inflows since 4Q17.

Among the Asia ex-Japan Country Fund groups, Indonesia Equity Funds stood out for the second week running as investors translated Defense Minister Prabowo Subianto’s election victory into more business-friendly policies when he takes office in the fourth quarter. The latest flows into this group hit a level last seen in 4Q22.

Developed markets equity funds

EPFR-tracked Developed Markets Equity Funds recorded their fifth inflow of 2024 during the week ending Feb. 21 as major equity markets continued their climbs into record-setting territory. US, Global, Japan and Pacific Regional Equity Funds posted inflows ranging from $12 million to $12 billion that offset modest outflows from Canada, Australia and Europe Equity Funds.

A significant share of the latest redemptions from Europe Equity Funds is attributable to dedicated UK Equity Funds, which posted their 13th consecutive outflow and their 55th since the beginning of last year. In the 92 months since Britain voted to leave the European Union, a net $118 billion, equal to 31% of their asset base in early 3Q16, has been pulled out of UK Equity Funds. Over the same period, $369 billion has been redeemed from all other Europe Equity Fund groups.

While Japan also saw a new record high for its benchmark equity index going into the final week of February, funds dedicated to this market posted an inflow – their sixth in a row – rather than an outflow. Flows for overseas domiciled Japan Equity Funds remain positive but lost momentum for the second week running while domestically domiciled funds, whose flows have been tracking the overseas funds with a two to eight-week lag, absorbed another $585 million.

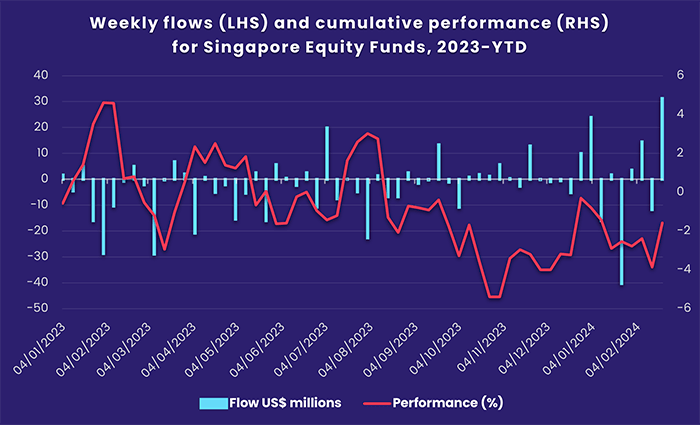

Another Asia Pacific Country Fund group saw inflows surge to their highest level in 27 months. Singapore Equity Funds have struggled to attract fresh money in recent months even though the city-state avoided recession last year and is widely viewed as an alternative location for Hong Kong-based businesses after China’s government tightened its grip on the special administrative region.

Flows to US Equity Funds again bypassed retail share classes, which have recorded only three inflows during the past year, and Leveraged Funds which racked up their seventh outflow year-to-date. But Large and Small Cap Blend Funds pulled in over $14 billion between them.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, recorded their eighth consecutive inflow with flows again favoring funds with ex-US mandates.

Global sector, industry and precious metals funds

With the US benchmark interest rate at 5.5% and fears that second round inflationary pressures may stay the hand of the Federal Reserve, sector-oriented investors scratched their heads and headed toward the exits during the third week of February. For the first time in two months, only two of the 11 major EPFR-tracked Sector Fund groups posted an inflow – though, for the first time in four months, one of those groups was Energy Sector Funds – while the other nine were hit with redemptions that ranged from $121 million for Telecom Sector Funds to $831 million for Financials Sector Funds.

Energy Sector Funds finally saw an end to their 16-week outflow streak that cost the group $9.89 billion. US-dedicated funds, which were responsible for two-thirds of that total outflow, guided the group to positive territory during the latest week. However, Global and Canada Energy Sector Funds kept the headline number in check with, respectively, a 10th straight outflow and biggest outflow in over six months.

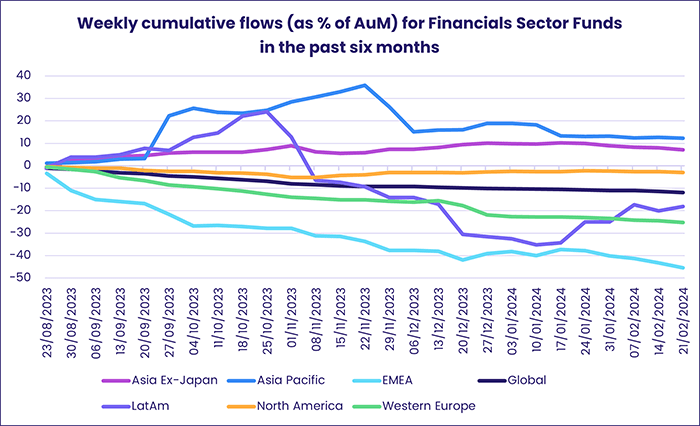

Financials Sector Funds extended their current redemption streak to four weeks as US and Canada Financials Sector Funds collectively saw over $500 million flow out. Latin America Financials Sector Funds are the only regional group seeing a sliver of light so far this year when it comes to attracting fresh money. But, over the past six months, Asian markets have been the preferred choice. Flows into Asia Ex-Japan Financials Sector Funds climbed steadily to just shy of $1 billion (7.11% of assets) since mid-September while Asia Pacific Financial Funds have attracted $172 million (12.23% of assets), dropping from a peak of $500 million (35% of assets) in late November.

The excitement behind artificial Intelligence plays has outweighed worries of market volatility and regulatory challenges so far this year and kept the money flowing into Technology Sector Funds. The group extended its current inflow streak to seven weeks and $12.6 billion total, the longest since a 10-week stretch starting at the end of 2Q23. With chipmaker and AI leader Nvidia’s latest earnings report rallying markets, investors pumped money into Artificial Intelligence (AI) Funds which recorded their 10th largest inflow on record. That pushed their inflow streak to nine weeks and $1.9 billion.

Skyrocketing countrywide outages reported by cell service providers AT&T, Verizon and T-Mobile customers this past week may have spooked some investors, as Telecoms Sector Funds saw their first outflow in four weeks and flows out of Utilities Sector Funds surpassed $500 million for the third time in the past six weeks.

Bond and other fixed income funds

Flows into EPFR-tracked Bond Funds hit a 58-week high going into the final days of February as investors continue to indulge their appetite for the higher yields on offer for sovereign issues. Year-to-date inflows now exceed $100 billion.

Once again, Emerging Markets Bond Funds were the only major group by geographic focus to post an outflow during the week ending Feb. 21. US, Global and Europe Bond Funds attracted fresh money for the ninth, 15th and 16th consecutive week, respectively, with Global Bond Funds compiling their longest inflow streak since the second and third quarters of 2021, and Asia Pacific Bond Funds added $153 million to their YTD total.

At the asset class level, Bank Loan Funds posted their second outflow of 2024, Municipal Bond Funds extended their longest inflow streak in over two years, High Yield Bond Funds chalked up their 16th inflow since the end of October and redemptions from Inflation Protected Bond Funds climbed to a YTD high.

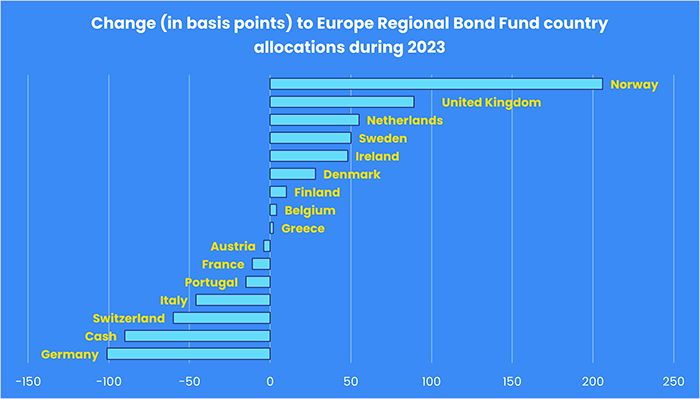

The latest flows to Europe Equity Funds favored the two major regional groups, with inflows for Europe ex-UK and Europe Regional Funds hitting 12 and 126-week highs, respectively. At the country level, UK Bond Funds extended their longest redemption streak since 1Q23. Europe Regional Fund managers boosted their exposure to the UK and Norway last year at the expense of Germany, Switzerland and Italy.

Emerging Markets Local Currency Bond Funds remained the preferred option for investors, but again their commitments were not enough to offset the more than $1 billion redeemed from EM Hard Currency Funds. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted consecutive weekly outflows for the first time since December. But the latest redemptions were less than a 20th of the previous week’s record-setting total.

Retail flows to US Bond Funds were positive for the seventh time so far this year. During 2023, retail share classes only posted nine weekly inflows and in 2022 they did not record a single inflow.

Japan Bond Funds posted above average inflows for the third week running, although recent Japanese economic data gives the Bank of Japan plenty of ammunition for delaying any normalization of its ultra-accommodative monetary policies.

Did you find this useful? Get our EPFR Insights delivered to your inbox.