EPFR-tracked Equity Funds extended their longest run of outflows since 3Q19 during the week ending May 18 as slowing global growth, tighter monetary policy in the US, war in Ukraine and widespread lockdowns in China kept investors on the defensive. Bond, Money Market, Balanced and Alternative Funds also recorded outflows going into the second half of May.

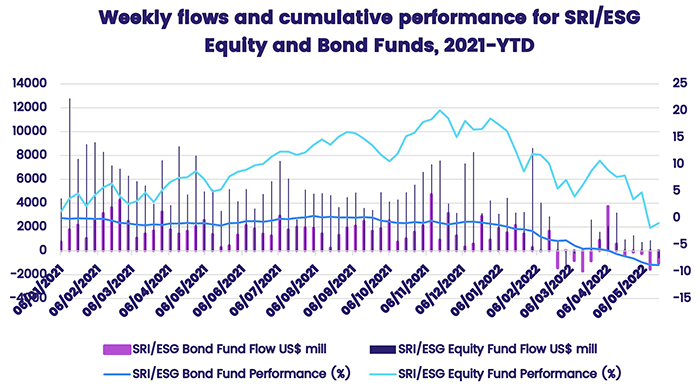

The hostile investment climate has taken a toll on Equity and Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates. In 2021 these groups posted inflows every week of the year on their way to new full-year inflow records. So far this year, SRI/ESG Bond Funds have racked up 10 weekly outflows and SRI/ESG Equity Funds three.

In the case of SRI/ESG Equity Funds, their bias towards technology stocks has hit overall performance. Year-to-date, only one group – Global Emerging Markets (GEM) Equity Funds – has seen funds with SRI or ESG mandates outperform their non-SRI/ESG peers. Non-SRI/ESG Latin America and EMEA Equity Funds have collectively outperformed their SRI/ESG counterparts by 9.7% and 9.4% respectively.

Elsewhere, Europe Equity Funds chalked up their 14th straight outflow as Russia’s invasion of Ukraine moves into its 13th week, Emerging Markets Bond Funds recorded their biggest weekly outflow in over eight quarters and investors pulled $6 billion out of High Yield Bond Funds. Among the handful of groups to see more than token inflows were Infrastructure and Utilities Sector Funds, Dividend Equity Funds and Europe Money Market Funds.

At the asset class and single country fund levels, Italy Equity Funds posted their 13th outflow in the past 14 weeks and Italy Bond Funds their 16th in the past 20 weeks while flows into Finland Equity Funds hit a record high. Redemptions from Bank Loan Funds hit a 111-week high, Municipal Bond Funds recorded their 13th consecutive outflow and Cryptocurrency Funds saw over $60 million flow out.

Did you find this useful? Get our EPFR Insights delivered to your inbox.