Going into the final days of July, the Equity and Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates tracked by EPFR chalked up their 51st and 70th consecutive inflows respectively. ESG investing clearly has long-term momentum and is becoming increasingly mainstream.

With this broader acceptance comes closer scrutiny. Now that these funds are getting money – and plenty of it – investors are increasingly asking what their managers are doing with it.

This is a hard question to answer. Fund managers know that the people who hand them their money want to see it grow. But they also want to see it doing good.

To complicate matters, the true believers are much more vocal about the latter criteria. For them, success has very tangible criteria. One of those is the composition and philosophy of the management teams and boards guiding major public companies.

On the face of it, this should the best of times for the true believers. There have been several eye-catching successes over the last two months – think Chevron and Exxon – and ESG language in company reports is increasingly the norm rather than the exception.

But ESG advocates say much more needs to be done for ESG investing to make a lasting difference. In fact, their assessment of investor engagement projects to date is damning. If it was an end-of-term report, it would read “must do better”.

Theory…

While the river of fresh money pouring into SRI/ESG funds presents a great opportunity their managers, it also carries an expectation that promised goals will be pursued. If you claim to invest according to ESG factors you must show your involvement has a tangible impact on those factors.

How quickly that impact becomes evident is important too. For many retail investors, targets such as zero carbon emissions across funds or portfolios can feel too slow-moving and intangible. The pressure is on fund managers to show more immediate results. Among the avenues open to fund managers to meet these accelerated timelines is shareholder action and engagement.

Such action can take many forms, from meetings with companies and interim target setting to voting at annual general meetings. It often overlaps environmental, social and governance factors, because companies can’t hope to impact the first two significantly without leadership buy-in.

Furthermore, business leaders should – in theory – be receptive. A decade ago, economic issues dominated the top risks cited by business leaders in the World Economic Forum global risk report. This year, four of the five top risks are environmental. The other relates to infectious disease.

….and practice

Action along these lines by professional investors won a flurry of successes in May and June this year.

In late May, investors unseated three board members from energy firm Exxon Mobil because of their perceived lack of concern for climate issues. They successfully argued that greater emphasis on decarbonization, rather than ramping up oil and gas production, will provide shareholders with better long-term rewards.

During the same month, nearly two thirds of oil major Chevron’s shareholders voted for a non-binding resolution that calls for sharp reductions in the company’s greenhouse gas emissions. Elsewhere, global bank HSBC committed to ending funding for the coal industry by 2030 in the OECD and 2040 worldwide. This came after pressure from a $2.4 trillion shareholder group.

On the social side, supermarket Tesco pledged to increase healthier food and drinks sales after pressure from a £140 billion investor coalition.

A report by FTI Consulting said most of the world’s largest investors now have climate-related expectations in their voting guidelines. This pressure has pushed more companies to give shareholders a vote on climate strategy, and many more will follow, said FTI.

The sound of one hand clapping

Encouraging from an ESG perspective as these recent developments are, they remain the exception rather than the rule.

Until now, investor engagement has been limited at best. Most investors do not file resolutions, vote against directors, set deadlines for companies to act, or do anything when companies fail to take action or meet targets. Pressure group ShareAction calls investors’ general record of engagement “terrible”.

In ShareAction’s opinion, the Exxon campaign was the type of forceful engagement necessary to effect change. But ShareAction’s research shows managers responsible for $36 trillion worth of investible assets are still paying little or no attention to the social and ecological damage of their investments.

Despite comforting words about ESG, these managers are stalling on action, with no accounting for real-world impacts across their mainstream assets even though all the asset managers covered in ShareAction’s research are members of the UN Principles of Responsible Investing (PRI), which promotes incorporation of ESG into investment decisions.

Climate Action 100+’s recent benchmark results show that, after four years of “engagement” with 159 target companies, not one has aligned their capital expenditure with the Paris Agreement climate goals.

Success in percentage terms?

If fund managers are slow to engage, how are they doing with the historic criteria for success?

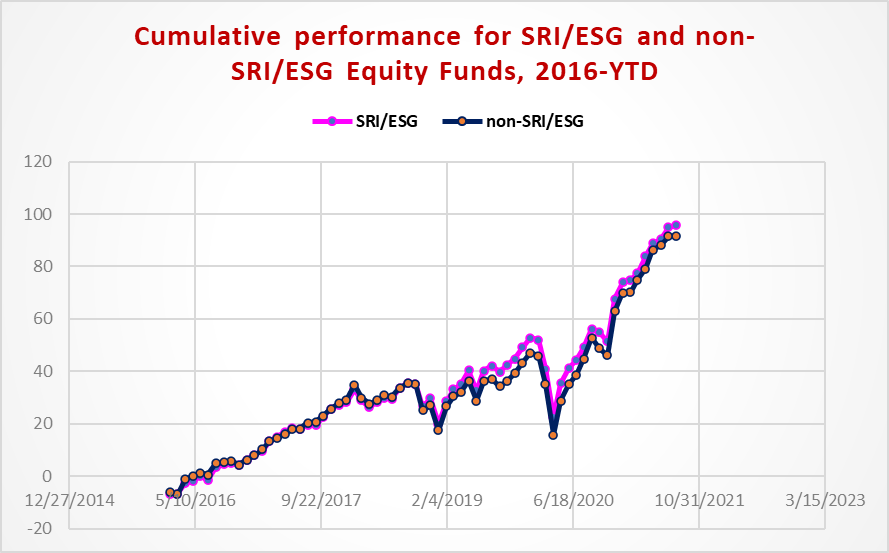

So far this year, EPFR-tracked Equity Funds with SRI/ESG mandates have modestly outperformed their unconstrained peers. SRI/ESG Equity Funds generally have higher operating costs because of screening and due diligence requirements. But they pick up ground when returns are risk adjusted.

Since the beginning of 2016, the collective performance for all SRI/ESG Equity Funds is about 4% higher than that of their non-SRI/ESG counterparts.

Did you find this useful? Get our EPFR Insights delivered to your inbox.