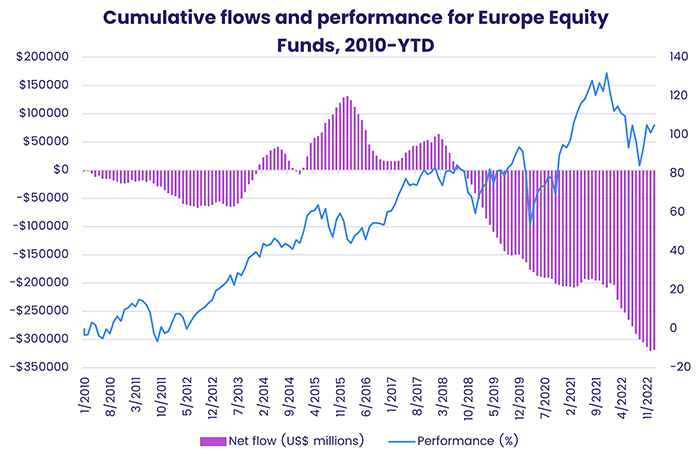

Helped by a warm winter that has left natural gas storage tanks nearly full and the prospect of renewed Chinese demand for the region’s exports, sentiment towards European assets has thawed rapidly in early 2023. During the latest week EPFR-tracked Europe Equity Funds, which carried their longest outflow streak on record into January, posted their biggest weekly inflow in nearly a year while Europe Bond Funds took in over $2 billion for the third week running.

Elsewhere, optimism about China’s economy and the turning point for the current US interest rate cycle saw Emerging Markets Equity and Bond Funds record above average flows for the second straight week with the latter chalking up their biggest inflow in exactly three years.

Overall, the week ending Jan. 25 saw a net $2.8 billion flow into Alternative Funds – a 44-week high – while Bond Funds took in $12.2 billion and Equity Funds $13.7 billion. For the first time since the first week of 2022, flows into actively managed Bond Funds exceeded those going to Bond ETFs. The ratio for Equity Funds and ETFs during the latest week was over 4-to-1 in favor of ETFs.

Money Market Funds collectively recorded a modest outflow as redemptions from Europe MM Funds hit a level last seen in late 3Q21. But US MM Funds took in fresh money for the fifth straight week, extending their longest inflow streak since mid-3Q21, and China MM Funds snapped a run of outflows stretching back to mid-October.

At the asset class and single country fund levels, redemptions from Denmark and Norway Bond Funds hit 24 and 103-week highs, respectively, while France Equity Funds absorbed over $200 million for the first time since late 1Q20 and India Equity Funds extended their longest inflow streak since 2Q17. Total Return Funds absorbed over $2 billion for the second straight week, Inflation Protected Bond Funds added to their longest outflow streak since 2013 and Cryptocurrency Funds recorded their biggest inflow since early August.

Emerging Markets Equity Funds

The prospect of strong growth in two of Emerging Asia’s heavyweights, the assumption that US interest rate hikes will end during the second quarter and an improving outlook for Europe bolstered sentiment towards emerging markets in late January. A week after they recorded their biggest collective inflow in nearly a year, EPFR-tracked Emerging Markets Equity Funds absorbed another $7.8 billion.

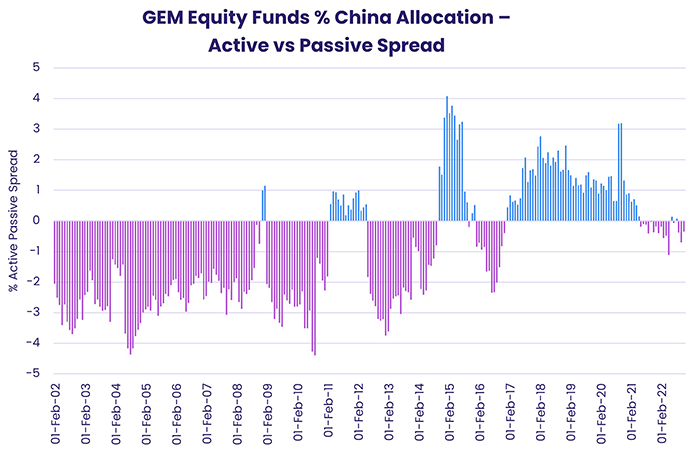

Once again, the bulk of the fresh money found its way into Asia ex-Japan and the diversified Global Emerging Markets (GEM) Equity Funds. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their 10th straight inflow and Frontier Markets Equity Funds extended their recent run of above average inflows.

China Equity Funds absorbed another $2.9 billion during a week when millions of Chinese travel home to celebrate the Lunar New Year. Investors hope those millions will return to their workplaces with the peak of the post-lockdown Covid surge behind them, setting the stage for strong growth. GEM Equity Fund managers are also positioning themselves for the rebound, with average allocations rising to a four-month high coming into 2023. Actively managed funds remain slightly underweight their passive counterparts.

Investors also anticipate strong growth from India during the year when it claims the mantle of the world’s most populous country from China. India Equity Funds recorded their ninth straight inflow during the week ending Jan. 25, with the latest week’s total the biggest since 1Q18.

Russia’s ongoing assault of Ukraine and the economic struggles of South Africa and Turkey continue to cast a shadow over EMEA Equity Funds, which posted their second straight outflow. Slovak Republic Equity Funds have seen interest pick up in recent weeks and the fund group’s collective AUM has grown by 15% since the beginning of 4Q22.

Latin America Equity Funds also posted outflows as redemptions from Brazil Equity Funds offset the biggest inflow for Mexico Equity since late November. Mexico’s stock market has shrugged off lingering fears of recession and inflation running at a two-decade high, with the country’s benchmark index up 12% going into the final week of January.

Developed Markets Equity Funds

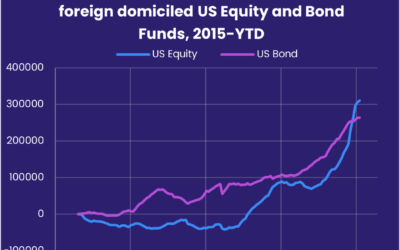

With flows into Europe Equity Funds gathering momentum and Global Equity Funds absorbing over $3 billion, EPFR-tracked Developed Markets Equity Funds were able to post their second inflow of the New Year during the week ending Jan. 25. US Equity Funds also posted modest inflows while Japan, Canada, Pacific Regional and Australia Equity Funds recorded outflows ranging from $75 million to $1.1 billion.

The collective inflow recorded by US Equity Funds was minimal, despite the first flows into retail share classes year-to-date, as investors looked ahead to fourth-quarter GDP data and the US Federal Reserve’s first policy meeting of 2023 at the end of the month. US Dividend Equity Funds posted their second straight outflow while funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their biggest inflow since the second week of September.

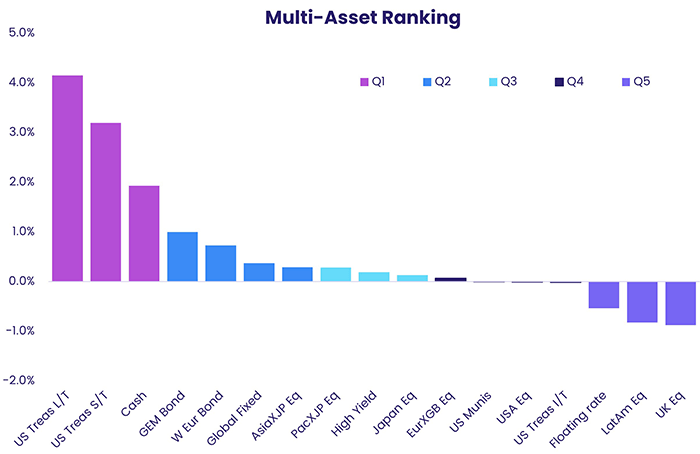

US equity remains well down the latest multi-asset rankings released weekly by EPFR, occupying a spot in the middle of the fourth quintile while both Japanese and Europe ex-UK equity are ranked in the third quintile.

Flows into Europe Equity Funds during the week ending Jan. 25 were the biggest since 1Q22. Europe Regional Funds were the biggest contributors to the headline number, with inflows hitting a level last seen in late 4Q13. Spain and France Equity Funds, meanwhile, recorded their biggest inflows since 2Q21 and 1Q20, respectively. The latest country allocations data shows that US-domiciled Europe Regional Equity Funds are significantly overweight Switzerland, the UK, Belgium and Finland compared to their European-domiciled counterparts and markedly underweight France.

Redemptions from Japan Equity Funds jumped to a 10-week high as leveraged funds recorded their biggest outflow in over three months. Coming into 2023, managers of Japan Equity Funds had lifted their allocations for financial and industrial plays to 41 and 44-month highs, respectively, while exposure to the consumer discretionary and technology sectors was at 23 and 28-month lows.

Global Sector, Industry and Precious Metals Funds

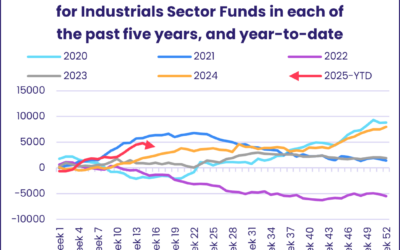

A corporate earnings season market by generally positive numbers for last quarter and gloomy guidance for the ones ahead was reflected in the latest flows for Sector Fund groups. The week ending Jan. 25 saw five of the 11 major EPFR-tracked groups post inflows and six record an outflow. The outflows ranged from $90 million for Consumer Goods Sector Funds to $1.8 billion for Healthcare/Biotechnology Sector Funds while Commodities and Utilities Sector Funds topped the list of funds attracting fresh money.

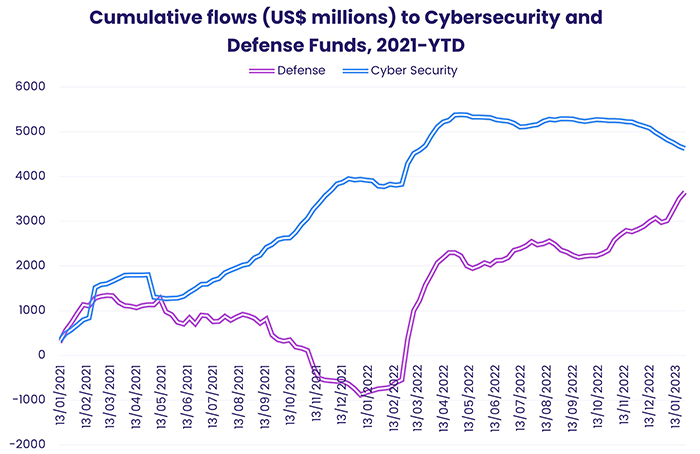

With Western nations debating the delivery of main battle tanks to Ukraine as Russia’s assault of that country entered its 11th month, questions of security and defense dominated the headlines in the second half of January. From a fund perspective, the focus on cybersecurity when tensions between the US and China occupied center stage has given way to a focus on conventional military hardware, with flows into Cybersecurity Funds leveling off in 2Q22 while flows into Defense and Aerospace Funds surged.

Investors committed fresh money to Commodities/Materials Sector Funds for the third time in the past four weeks. Looking at some of the major subgroups, Steel, Rare Earth & Metals and Chemicals Funds took in fresh money while Lithium & Battery and Timber & Forestry Funds saw outflows.

Healthcare Sector Funds chalked up their largest outflow since the end of 3Q20, with a single smart beta/biotechnology-mandated ETF accounting for the bulk of the headline number, and Technology Sector Funds extended their longest outflow streak since 4Q12.

Despite a positive backdrop that includes the demand for new military and clean energy infrastructure in Europe and bipartisan discussions about new projects in the US, redemptions for Infrastructure Sector Funds climbed to a 57-week high. It was the seventh outflow in the past eight weeks, a run that has seen a collective $1.1 billion flow out of this previously popular group.

Bond and other Fixed Income Funds

With recent macroeconomic data, the guidance accompanying many 4Q22 earnings reports and trends in the US labor market all pointing to slower growth and weaker corporate pricing power in the world’s largest economy, investors believe that the rationale for further US rate hikes is evaporating rapidly. That belief prompted them to steer another $12 billion into EPFR-tracked Bond Funds during the fourth week of January.

A little over half of the headline number found its way into Global and Emerging Markets Bond Funds, which recorded their biggest inflows since 4Q21 and 1Q20, respectively, and both US and Europe Bond Funds absorbed over $2 billion apiece.

At the asset class level, investors signaled their belief that the current battle against inflation is nearing an end, pulling over $1 billion out of Inflation Protected Bond Funds as they extended that group’s longest run of outflows in over nine years. Flows also reflected an awareness that, in addition to making it easier to cut interest rates, a slowing economy will make it harder for weaker issuers to service their debts. Both High Yield Bond and Bank Loan Funds posted an outflow.

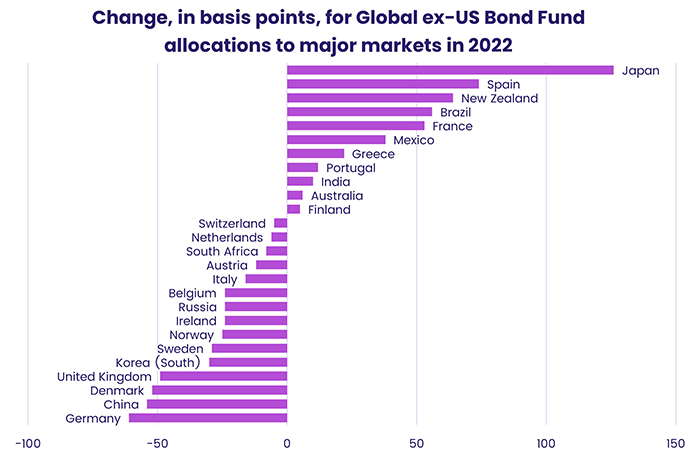

The latest flows into Global Bond Funds favored funds with fully global mandates, but Global ex-US Bond Funds still posted their biggest inflow since late 3Q20. Analysis of that group’s country allocations last year shows managers increased their exposure to Japan, Spain, New Zealand and Brazil at the expense of China and a number of European markets.

Brazil Bond Funds were among the Emerging Markets Bond Fund groups to record inflows during a week when funds with hard currency mandates outgained – in flow terms – their local currency counterparts by a more than 5-to-1 margin.

Investors pulled money out of Europe Bond Fund retail share classes for the first time since mid-November, but overall inflows exceeded $2 billion for the third straight week. At the country level, flows into Netherlands and Germany Bond Funds hit 30-week and three-year highs, respectively, while Norway Bond Funds recorded their biggest outflow in nearly two years. Europe Corporate Funds again attracted more fresh money than Europe Sovereign Bond Funds.

Among US Bond Funds, the best performing group year-to-date is Long Term Sovereign Funds. For 2022, Short Term Sovereign Bond Funds topped the list.

Did you find this useful? Get our EPFR Insights delivered to your inbox.