Global asset markets hit a speed bump coming into August. They hit another during the first week of September as the tires on the investment cases for Artificial Intelligence and a ‘soft landing’ for the US economy received another kicking.

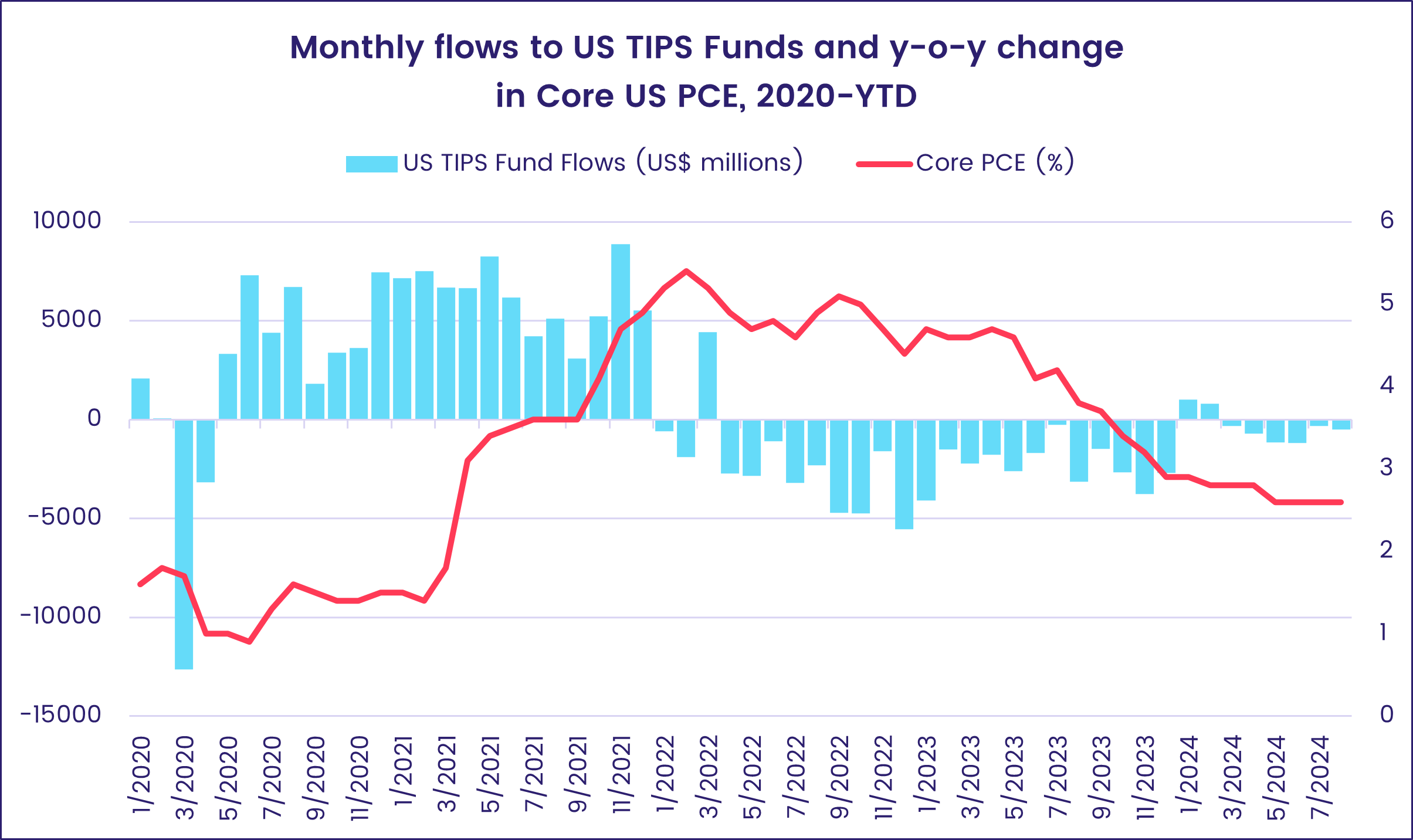

Although fund flows for the week ending Sept. 4 captured investors’ defensive reflex to the latest sell-off, the overall pattern suggested that many are still focused on the prize they expect in mid-September: the first cut in US interest rates since late 1Q20. With the latest reading from the Federal Reserve’s preferred measure of inflation coming in at a relatively benign 2.5%, expectations of at least 25 basis points of easing remain intact.

The latest week did see Technology Sector Funds post their first outflow since late June, US Equity Funds hit with (modest) redemptions and Cryptocurrency Funds take their biggest hit in over 14 months. But High Yield Bond Funds attracted fresh money for the eighth time over the past 10 weeks, Bank Loan Funds snapped their longest outflow streak in over a year and Emerging Markets Equity Funds recorded their 14th consecutive inflow.

Overall, investors steered a net $3 billion into EPFR-tracked Equity Funds during the latest week while Alternative Funds absorbed $582 million and Bond Funds $9.5 billion. Money Market Funds took in $60.7 billion as flows into US-mandated funds hit a 17-week high.

At the single country and asset class fund level, Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates snapped their eight-week run of outflows, Dividend Equity Funds extended their longest inflow streak since mid-2022 and Physical Gold Funds recorded their 12th inflow since the beginning of June. Canada Equity Funds posted their eighth consecutive outflow, redemptions from Canada Bond Funds jumped to a 35-week high and the small universe of Russia Money Market Funds tracked by EPFR chalked up their 13th straight inflow.

Emerging Markets Equity Funds

Coming into September, EPFR-tracked Emerging Markets Equity Funds added to their current inflow streak as Asia ex-Japan Country Funds pulled in more money and the diversified Global Emerging Markets (GEM) Equity Funds added to their longest run of inflows since early 3Q23.

The latest week saw money flow out of retail share classes for the seventh straight week, Leveraged EM Equity Funds post their third consecutive outflow and EM Dividend Funds extend an inflow streak stretching back to late May.

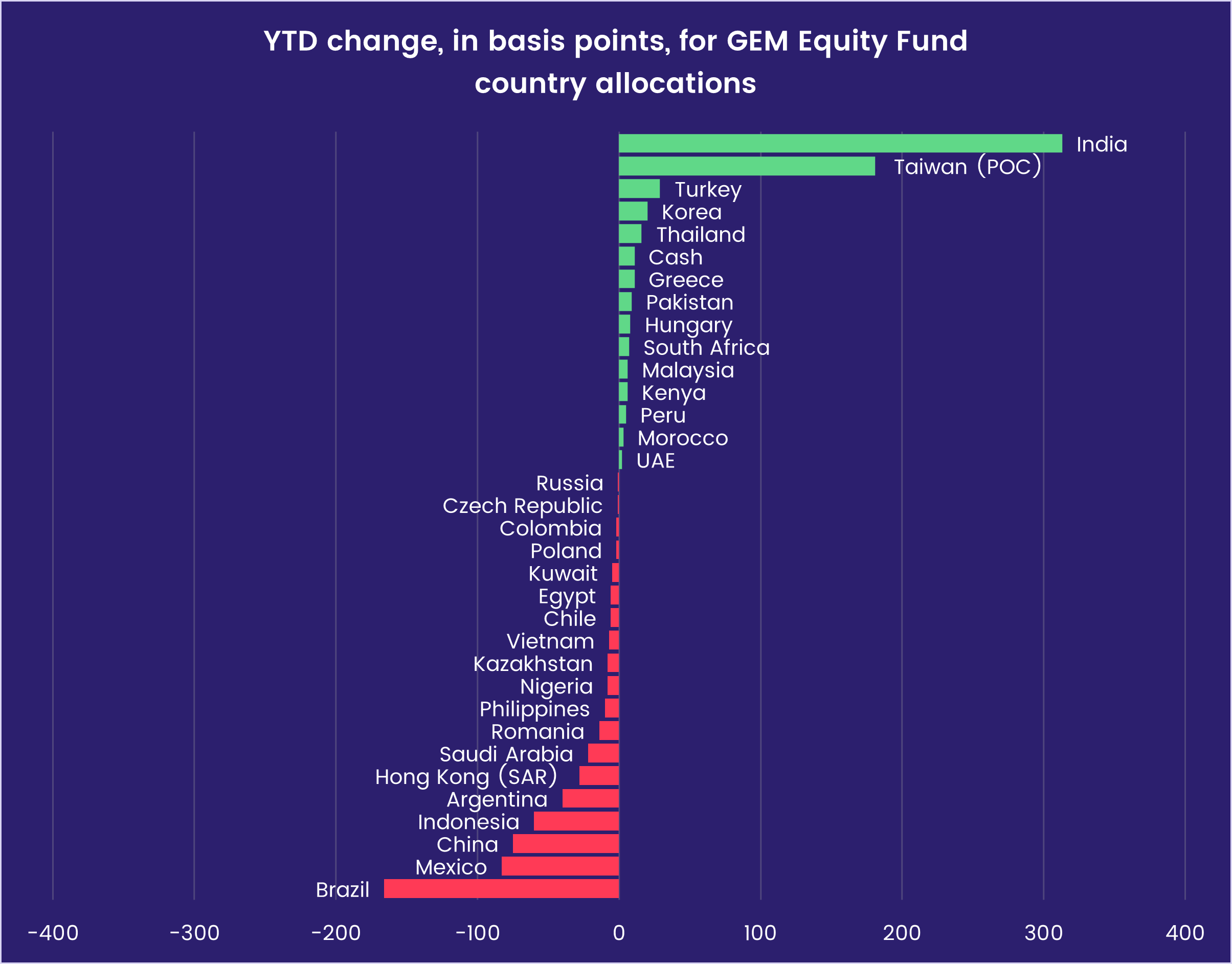

Latin America Equity Funds continued to struggle as concerns about the fate of the region’s one reform story, questions about US and Chinese demand for raw materials and fears about the trajectory of Brazilian interest rates weigh on both investor and fund manager sentiment. Of the five markets that have seen the biggest reductions in their average GEM Equity Fund weighting so far this year, three are in the Americas.

Among the Asia ex-Japan Country Fund groups, China Equity Funds pulled in another $1.3 billion during a week when flows to EM ex-China Funds hit a six-week high and China State Owned Enterprise (SOE) Equity Funds posted their 16th outflow over the past 18 weeks.

Elsewhere, India Equity Funds took in fresh money for the 77th straight week, Taiwan (POC) Equity Funds extended their longest inflow streak since the first half of 2022 and Philippines Equity Funds recorded their biggest inflow in over seven months while Thailand Equity Funds racked up their 35th straight outflow.

EMEA Equity Funds recorded a modest collective inflow as the fifth straight outflow from Saudi Arabia Equity Funds and the sixth from Turkey Equity Funds were offset by the biggest inflow for Emerging Europe Regional Funds in over 10 months.

Developed Markets Equity Funds

Flows to Global and Japan Equity Funds during the week ending Sept. 4 provided enough support for EPFR-tracked Developed Markets Equity Funds for the group to record its 20th consecutive inflow. But, against a backdrop of angst about the strength of the US economy, the headline number was the smallest since the current run began in late April.

With key US stock indexes retreating from their latest record highs, US Equity Funds posted only their second outflow since the beginning of May. Large Cap Mixed and Value ETFs saw the biggest outflows while actively managed Large Cap Growth Funds posted their biggest outflow since the first week of August. Foreign domiciled funds, however, extended an inflow streak stretching back to mid-April. Those funds continue to enjoy significantly stronger retail support than their US-based counterparts.

To the north, trade tensions with China, fears that current economic forecasts have overstated the strength of the US economy and the breakdown of the current coalition government hit Canada Equity Funds. The group’s current outflow streak is the longest since 2Q08.

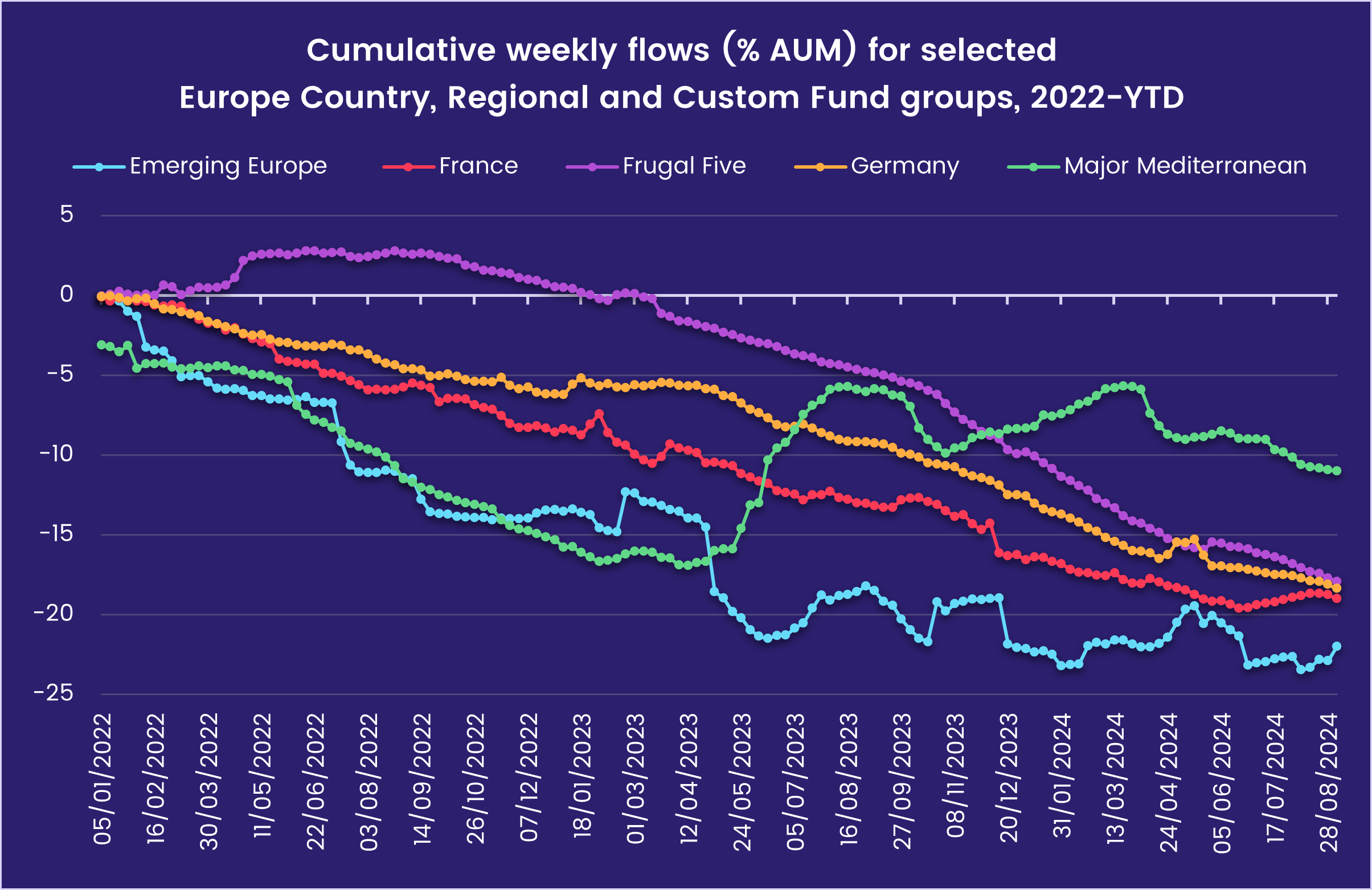

Europe Equity Funds also experienced net redemptions as weakness in the core Eurozone markets, France and Germany, added to the geopolitical, trade and energy headwinds facing the region. Redemptions from France Equity Funds hit an 11-week high and Germany Equity Funds posted their 15th outflow during the past 16 weeks. The dour mood has hit flows into funds dedicated to the major Mediterranean markets, which had swum against the overall tide between 2Q23 and 1Q24 before rolling over in early April.

While Japan’s stock markets continued their recent bumpy ride, Japan Equity Funds managed to record a modest inflow on the back of solid flows to domestically domiciled ETFs. While discussion of US monetary policy centers on the timing and size of the first interest rate cut in over four years, investors are debating whether the Bank of Japan will tighten further before the end of the year.

Elsewhere in Asia, redemptions from Australia Equity Funds climbed to an 18-week high and Pacific Regional Equity Funds posted their seventh outflow over the past eight weeks.

Global sector, Industry and Precious Metals Funds

For sector-oriented investors trying to get their bearings in early September, there was a lot to digest. Market turbulence, further support for expectations of a cut in US interest rates later this month, another contraction in Chinese manufacturing and business sentiment, shifts in Australian trade, geopolitics and another cut in Canadian interest rates kept those investors on edge.

As a result, just four of the 11 major EPFR-tracked Sector Fund groups managed to record inflows that ranged from $55 million for Healthcare/Biotechnology Sector Funds to nearly $500 million for Utilities Sector Funds. Overall, it was the smallest total trading value (absolute value of outflows + inflows) in nearly four months.

The usual star of the show, Technology Sector Funds, reported their first outflow in nine weeks, ending a run that saw nearly $20 billion flow into the group. Though stellar by most measures, the latest earnings from AI bellwether Nvidia prompted investors to revisit their assumptions for the artificial intelligence theme.

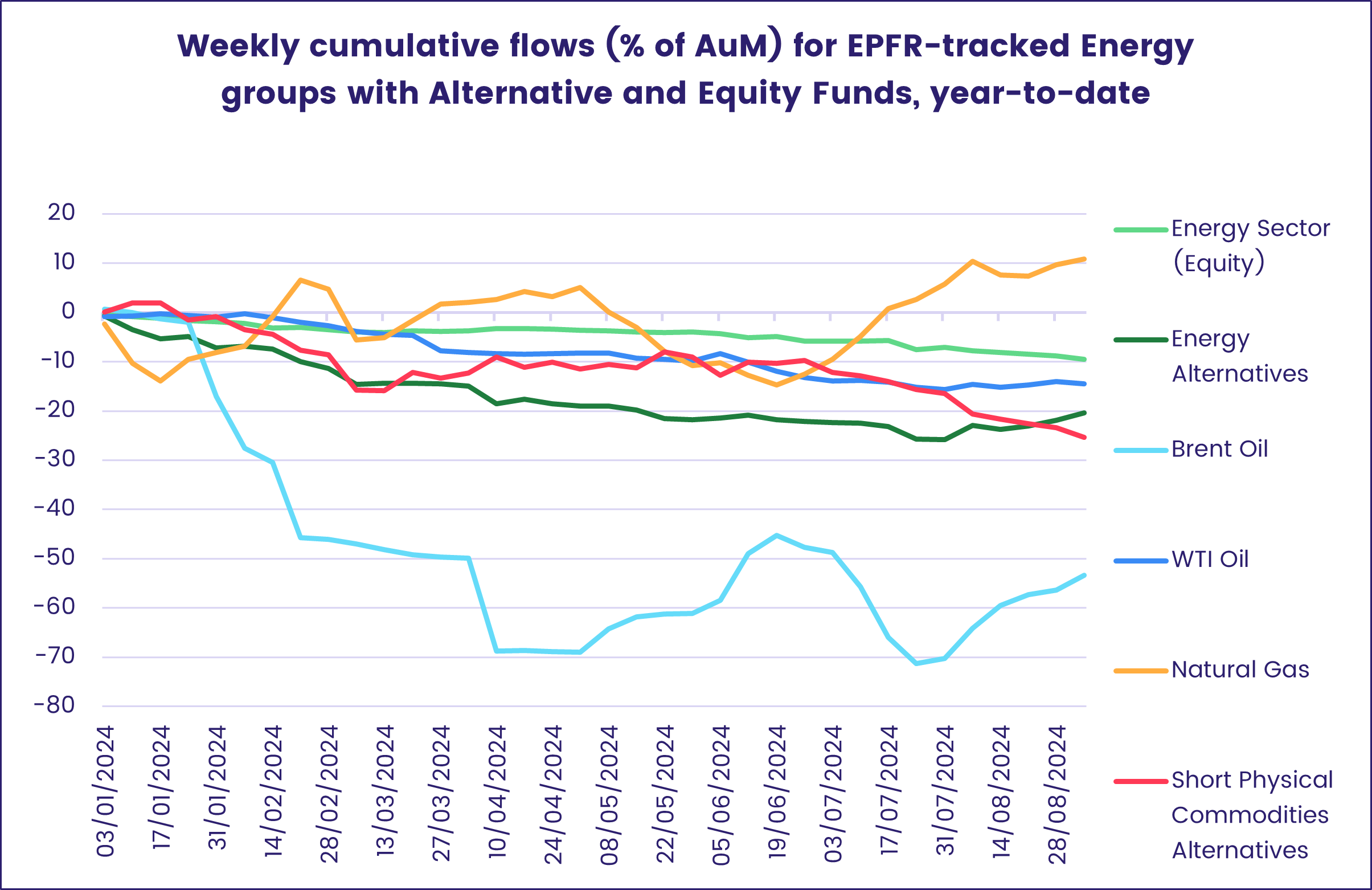

Energy Sector Funds, however, were hit even harder during the latest week as redemptions in excess of $1 billion lifted the total for their five-week outflow streak to nearly $4 billion. Nearly half of the headline number was accounted for by a single US-domiciled ETF benchmarked to the S&P, while five of the top 10 funds reporting outflows tracked the MSCI World, Europe or US Energy Indices.

EPFR also tracks 216 energy funds within its Alternative Funds universe. A large portion of these funds track WTI, Brent oil and natural gas prices. Year-to-date, only Natural Gas Alternative Funds have attracted inflows while Brent and WTI Alternative Funds have suffered outflows of $1.4 billion and over $600 million, respectively. Some of these are included within the Short Physical Commodities Alternatives group.

Other groups seeing an end to their inflow streaks were Telecoms, Industrials, and Real Estate Sector Funds. At five consecutive weeks and $1.2 billion, it was the longest inflow streak for the latter since mid-1Q22. This week, the custom grouping of REIT Funds posted their heaviest outflow since late 4Q23. However, EPFR’s Liquidity Analyst, Winston Chua, notes that, “Some encouraging news for real estate investors were the pickup in US new home sales in July, which is being attributed to the recent declines in mortgage rates and the upward revision of new home sales in June.”

Flows into Utilities Sector Funds reached nearly $500 million – a four-week high – and two other groups with defensive characteristics pulled in fresh money. Infrastructure Sector Funds extended their streak to three weeks as a 13-week high inflow rolled in, and Healthcare/Biotechnology Sector Funds managed to eke out their fourth inflow of the past six weeks. On the cyclical front, Financials Sector Funds posted consecutive weekly inflows for the first time in five weeks, though the week’s total was nowhere near the level seen the previous week.

Bond and other Fixed Income Funds

Although the total flow was less than half the previous week’s total, EPFR-tracked Bond Funds ended the latest week $9.5 billion closer to setting a new full-year inflow record. Most of the major groups by geographic focus attracted fresh money, as did a majority of the asset class groups. US Bond Funds maintained their record of posting inflows every week year-to-date, Europe Bond Funds absorbed another $1.7 billion and Asia Pacific Bond Funds recorded their biggest inflow since the fourth week of February.

At the asset class level, year-to-date flows into High Yield Bond Funds climbed past the $38-billion mark, Bank Loan Funds snapped their four-week outflow streak, Mortgage-Backed Bond Funds tallied their 34th inflow of the year so far and Total Return Funds absorbed fresh money for the eighth week running.

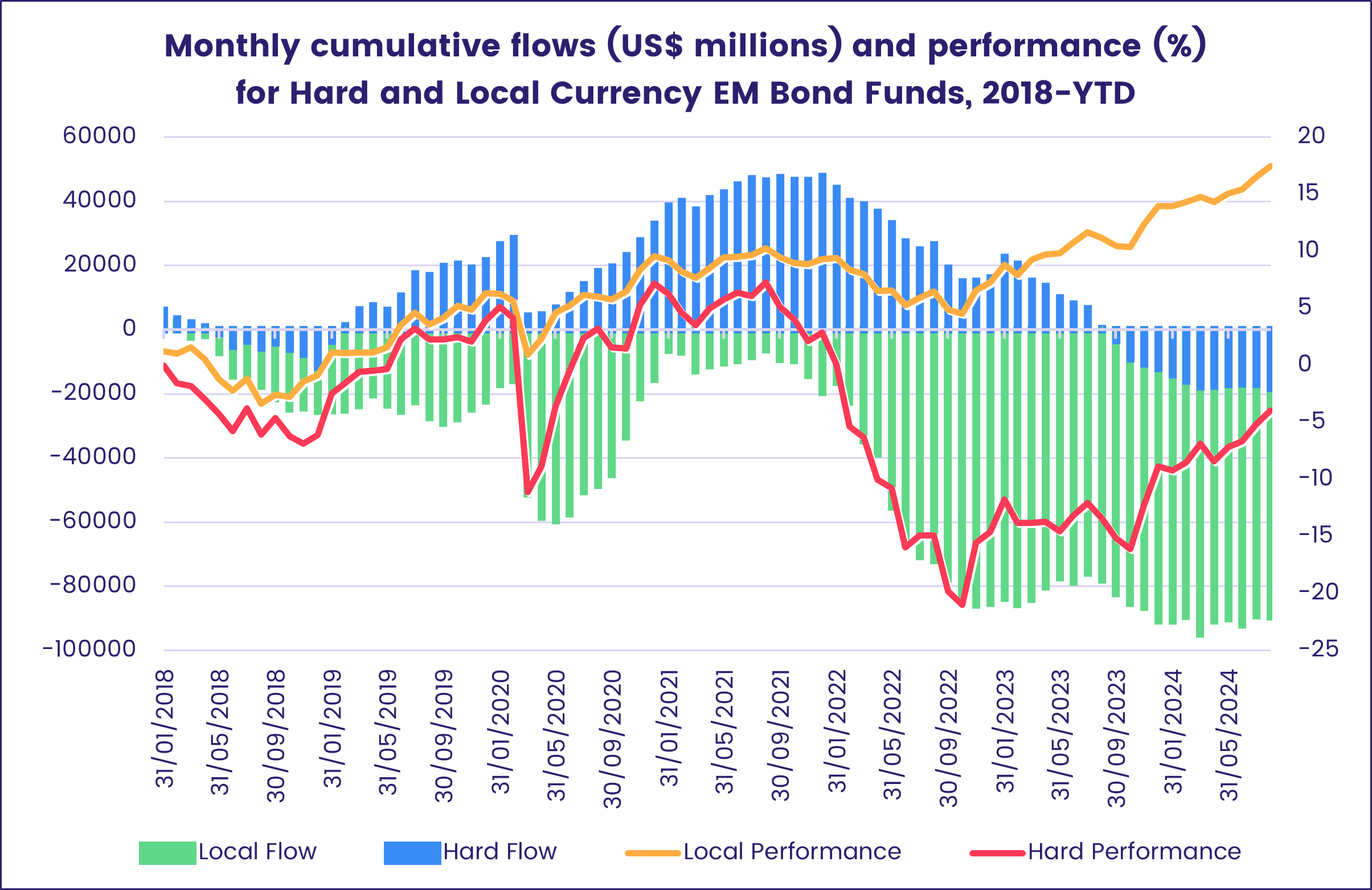

Emerging Markets Bond Funds were among the groups that did not record inflows as redemptions from funds with hard currency mandates handily offset flows into their local currency counterparts. Retail share classes did post their biggest collective inflow since mid-April, Sharia Bond Funds bounced back from their biggest outflow since the first week of the year and flows into funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates climbed to a seven-week high.

At the country level, investors showed renewed interest in African debt, with flows into South Africa Bond Funds hitting an eight-week high and Africa Regional Bond Funds posting their biggest inflow since early 3Q22.

Flows into Europe Bond Funds continue to favor funds with corporate mandates over those dedicated to sovereign debt. Coming into August, both Europe and Europe ex-UK Regional Bond Funds cut their exposure to France, whose projected budget deficit for 2024 has climbed from 5.1 to 5.6% of GDP. In the case of Europe Regional Bond Funds, that took their average allocation to a fresh record low.

Both Japan and Australia Bond Funds took in above average sums, with flows hitting 27 and 52-week highs, respectively.

Short Term US Sovereign Bond Funds saw the previous week’s inflows, which hit their highest total in nearly 18 months, reversed with several of the same funds driving both week’s headline numbers.

Did you find this useful? Get our EPFR Insights delivered to your inbox.