The third month of 2023 started with investors pulling another $5 billion out of EPFR-tracked US Equity Funds, extending that group’s longest outflow streak since 2Q20, as stronger-than-expected consumer spending and a resilient labor market undermined the case for an early end to the current US rate hiking cycle.

With US Federal Reserve Chair Jerome Powell testifying to Congress that rate setters could return to 50 basis point hikes if the data warrants it, interest in US assets remains focused on the short end of the Treasury curve as US Short Term Sovereign Bond Funds extended their current inflow streak to four weeks and $15.3 billion.

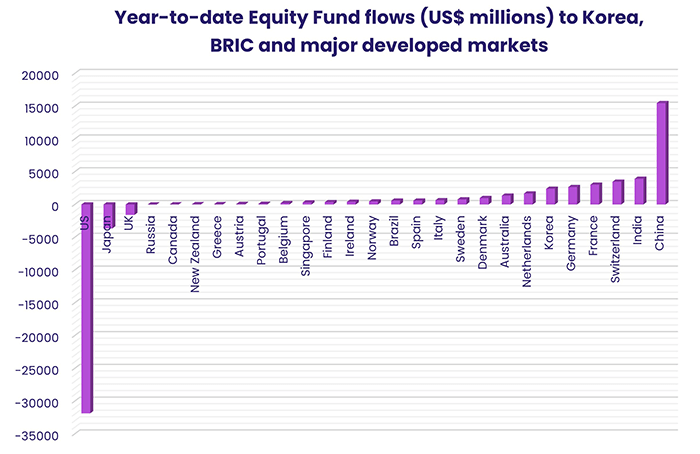

The China economic rebound story, bolstered by recent manufacturing data, saw more money flow into China, Hong Kong and Taiwan (POC) Equity Funds and helped lift flows into Commodities and Energy Sector Funds to six and 20-week highs, respectively. But the goodwill was largely confined to funds dedicated to Greater China. Japan, Australia, Korea and India Equity Funds all experienced above average redemptions during the first week of March.

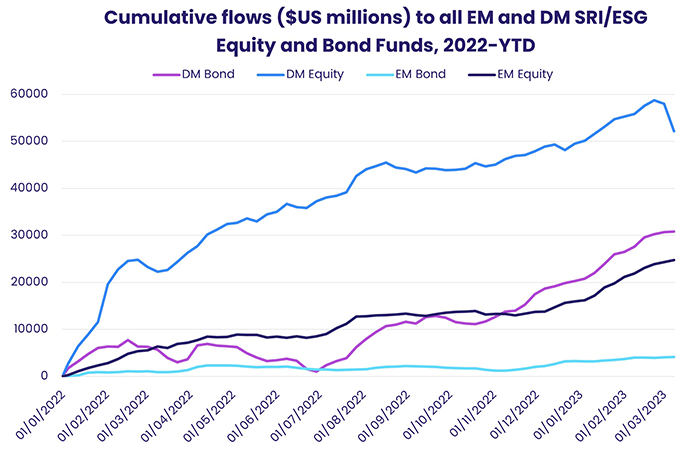

After 15 consecutive weekly inflows, Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their biggest collective outflow on record. But a single UK-domiciled fund accounted for the bulk of the headline number.

Overall, EPFR-tracked Equity Funds recorded an outflow of $20 million during the latest week. A net $1.3 billion flowed out of Balanced Funds while Alternative Funds absorbed $1 billion and Bond Funds $8 billion. Flows into Money Market Funds were less than a third of the previous week’s total, but Europe MM Funds absorbed $14.4 billion and flows into Japan MM Funds hit a 12-week high.

At the asset class and single country fund levels, Peru Equity Funds posted their biggest outflow year-to-date and Argentina Equity Funds since mid-3Q22, Germany Bond Funds snapped their longest run of outflows since 2Q21 and UK Bond Funds saw a 15-week inflow streak come to an end. With another player in the cryptocurrency space – Silvergate Bank – running into trouble, redemptions from Cryptocurrency Funds hit a 37-week high.

Emerging Markets Equity Funds

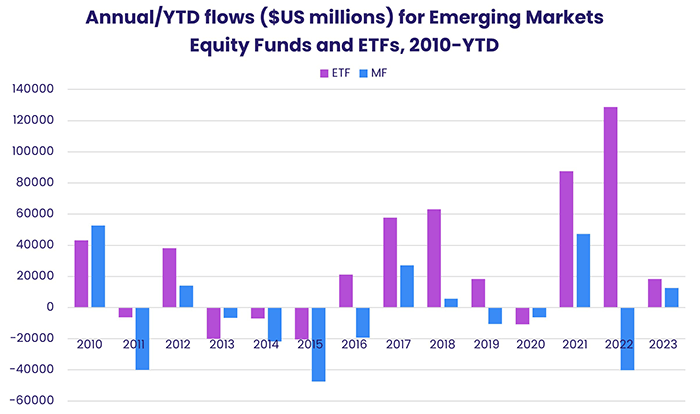

EPFR-tracked Emerging Markets Equity Funds kicked off March by chalking up their 11th inflow in the past 12 weeks as optimism about Chinese growth offset fears that the US tightening cycle has further to run. Three of the four major regional groups and Frontier Markets Equity Funds took in fresh money, more than offsetting redemptions from Latin America Equity Funds.

Money flowed into retail share classes for the ninth week running and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates racked up their 16th consecutive inflow. Both mutual funds and ETFs took in new money, with the latter taking in $3 for every $2 committed to actively managed

funds.

China’s accelerating growth helped China Equity Funds attract over $750 million, while flows into Taiwan (POC) and Hong Kong Equity Funds hit 16 and 52-week highs respectively. But fund groups dedicated to other regional markets did not fare as well. India Equity Funds posted their biggest outflow since early 3Q22 and Philippines Equity Funds in nearly a year. In the case of India, investors were digesting 4Q22 data that showed solid but slowing growth.

Visions of stronger Chinese demand for raw materials did not move the needle for most Latin America Country Fund groups. Over $140 million flowed out of Brazil Equity Funds while redemptions from funds dedicated to Argentina and Peru hit a year-to-date high.

Among the EMEA Country Fund groups, Turkey Equity Funds enjoyed another week of strong inflows as domestic pension funds and other pools of capital heeded official prompting to steer more money in Turkish stocks. Elsewhere, Poland Equity Funds recorded inflows for the ninth time in the past 11 weeks and South Africa Equity Funds snapped their longest run of outflows since 4Q20.

Developed Markets Equity Funds

Dwindling enthusiasm for US stocks meant that EPFR-tracked Developed Markets Equity Funds posted their fourth outflow in the past five weeks in early March. Redemptions from US Equity Funds were, once again, the biggest drag on the headline number for all funds as fears that the pace of US interest rate hikes could accelerate back to a 0.5% per Fed policy meeting kept investors on edge.

Fears of tighter-than-expected monetary policy in the second half of the year is also weighing on Japanese equity markets. Under the leadership of Haruhiko Kuroda, who steps down the second week of April, Japan’s central bank has kept domestic borrowing costs pinned to the floor and actively supported the country’s stock market by purchasing ETFs. But, with inflation now above the BOJ’s target, incoming governor Kazuo Ueda is expected to take the first – albeit cautious – steps toward policy normalization.

The latest week saw outflows from Japan Equity Funds hit their highest level in over three years. Not surprisingly, the US and Japan rank one and two among developed equity markets in terms of net selling by all EPFR-tracked Equity Funds so far this year.

Solid support from diversified Europe Regional and Global Equity Funds, meanwhile, has more than offset consistent selling by some Europe Country Funds to meet redemptions. Year-to-date flows for France and Germany are positive even though France Equity Funds have posted outflows 20 of the past 26 weeks and Germany Equity Funds nine of the past 13.

During the latest week, flows into Italy Equity Funds climbed to their highest level since mid-1Q22, Switzerland Equity Funds pulled in over $600 million and UK Equity Funds posted their ninth consecutive outflow.

Institutional investors pulled money out of US Equity Funds for the fifth straight week, a run last matched in 1Q16. Large Cap Blend Funds were again the group experiencing the heaviest redemptions overall, with a single fund accounting for a significant share of the headline number. Canada Equity Funds, meanwhile, posted their third inflow in the past four weeks.

Global Sector, Industry and Precious Metals Funds

US Federal Reserve Chair Jerome Powell’s testimony to Congress notwithstanding, flows to EPFR-tracked Sector Funds rebounded in early March showed with nine of the 11 major groups recording inflows. These ranged from $3 million for Real Estate Sector Funds to $739 million for Energy Sector Funds, while Utilities and Healthcare/Biotechnology Sector Funds posted outflows.

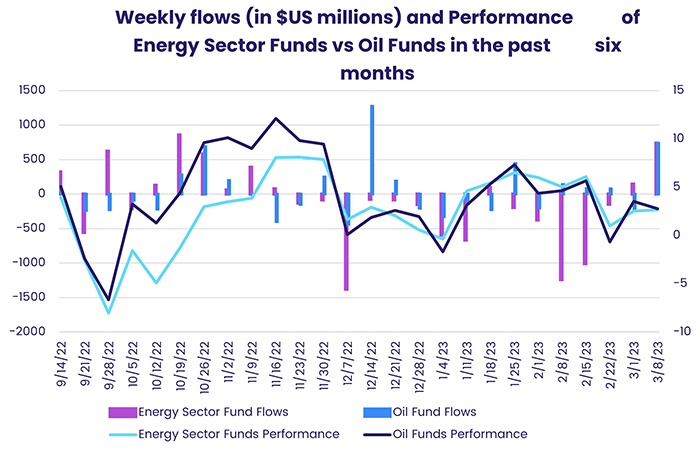

Although the conflict between Russia and Ukraine rippled through energy markets in 2022, it is China’s economic rebound and the potential demand that will likely accompany it that investors are currently focused on. With US shale oil production at or near peak, public policy shifting in favor of ‘clean’ energy, and Russian output still in question, it is easy to make the case for another leg up for oil and gas prices. Overall flows into Energy Sector Funds hit a 20-week high and Europe Regional Energy Sector Funds recorded their biggest inflow in over a year.

Of the top five funds in the US Energy Sector Fund group ranked by inflows for the week, four have oil and/or natural gas mandates. The subgroup of all dedicated Oil & Gas Funds recorded their largest inflow year-to-date at $735 million and have taken in fresh money five of the past seven weeks.

Hong Kong and China Technology Sector Funds again dominated the flow picture for all Technology Sector Funds, pulling in a combined $1 billion that handily offset the more than $200 million outflow from US and Global Technology Sector Funds. Drilling down, dedicated Semiconductor Funds continued their longest stretch of inflows since late August at three weeks and just shy of $1 billion total.

Bond and other Fixed Income Funds

EPFR-tracked Bond Funds posted their 10th consecutive inflow during the first week of March as investors responded to the vastly improved combination of yield and duration risk currently offered by short-term US Treasuries. Over $5 billion flowed into all US Bond Funds and over $1 billion into both Global and Europe Bond Funds, offsetting redemptions from Asia Pacific and Emerging Markets Bond Funds.

The pressure from rising US sovereign yields has also improved the risk-reward profile of US junk bonds, whose average yield has climbed from 4.4% in 3Q21 to over 8%. US High Yield Bond Funds posted their second inflow in the past five weeks and biggest since mid-January.

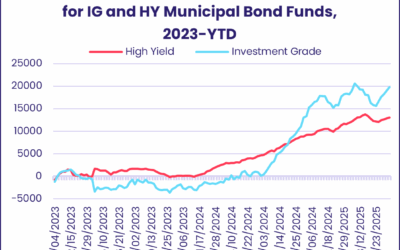

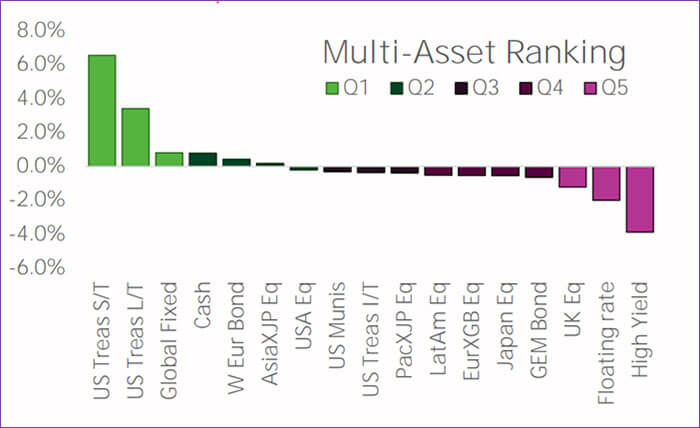

Junk bonds remain at the bottom of EPFR’s weekly Multi Asset rankings and short-term Treasuries at the top, with municipal bonds mid-table and diversified emerging markets debt dropping to the bottom of the fourth quintile.

The latest redemptions from Emerging Markets Bond Funds were less than a third of the previous weeks, and funds with local currency mandates eked out a modest collective inflow. Retail flows were positive, and funds socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their sixth inflow in the past eight weeks. At the country level, Korea Bond Funds extended their current run of inflows to 16 weeks and $4.5 billion.

Europe Bond Funds racked up their ninth inflow year-to-date despite expectations of another 50 basis point interest rate hike when European Central Bank policymakers meet next week. Furthermore, the ECB earlier announced that March is the starting point for plans to run down its balance sheet. Redemptions from Spain Bond Funds and flows into Italy Bond Funds both hit 17-week highs, Switzerland Bond Funds took in fresh money for the 11th time in the past 12 weeks and UK Bond Funds posted their first outflow since mid-November.

Uncertainty about the outlook for Japanese monetary policy saw over $300 million – a 24-week high – flow out of Japan Bond Funds.

Did you find this useful? Get our EPFR Insights delivered to your inbox.