Investors went into the final week of January expecting more support from Chinese policymakers and hoping the US Federal Reserve would put a date – the sooner the better – on the pivot to an easing bias it signaled at its December meeting. China Equity Funds extended their current inflow streak to 10 weeks and $35.5 billion while flows to US Equity Funds climbed to a five-week high.

Chinese authorities duly injected more liquidity in the country’s banking system, imposed restrictions on short selling, and unveiled more measures to support the struggling property sector, while the Fed signaled rate cuts may start later and come more slowly than the market anticipated.

Against this backdrop, flows to other EPFR-tracked groups retained by now familiar patterns. Over $30 billion flowed into US Money Market Funds, India Equity Funds extended their record-setting inflow streak and Technology Sector, Europe Bond, Total Return and Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates absorbed significant sums of fresh money. The opposite was true for Europe Equity, Balanced, SRI/ESG Equity, Emerging Markets Bond and Energy Sector Funds.

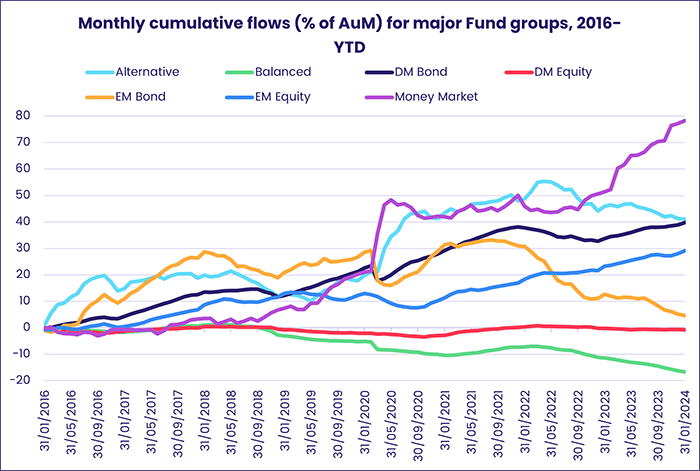

Overall, the week ending Jan. 31 saw EPFR-tracked Equity Funds post a collective inflow of $20.1 billion and Bond Funds $5.8 billion while $896 million flowed out of Alternative Funds and $3.2 billion out of Balanced Funds. A net $15.1 billion flowed into Money Market Funds as commitments to US-mandated funds were partially offset by redemptions from Europe Money Market Funds, which hit a 53‑week high.

At the single country and asset class fund levels, redemptions from Netherlands and Denmark Equity Funds hit 16 and 103-week highs, respectively, Korea Bond Funds posted their biggest inflow since late November and Argentina Equity Funds extended their longest run of inflows since 4Q17. Physical Gold Funds chalked up their fifth consecutive outflow while redemptions from Silver Funds climbed to a 44-week high, Inflation Protected Bond Funds posted their third inflow year-to-date and flows into Total Return Funds hit their highest level since 1Q21.

Emerging markets equity funds

Fund groups dedicated to the biggest Emerging Asian markets again drove the headline number for all EPFR-tracked Emerging Markets Equity Funds during the final week of January. China, India and Korea Equity Funds pulled in over $7 billion between them, handily offsetting further outflows from Latin America, EMEA and Frontier Equity Funds.

The week ending Jan. 31 did see Leveraged EM Equity Funds chalk up their fourth straight inflow and ninth over the past 10 weeks, EM Collective Investment Trusts (CITS) record their biggest inflow since mid-4Q22 and EM Dividend Funds extend an inflow streak that started in early August.

China Equity Funds also added to their current inflow streak as authorities talked up domestic equity markets, curbed short selling and urged Chinese companies to use offshore reserves to support stock prices. Flows into foreign-domiciled funds climbed to a seven-week high, but sentiment towards Chinese equities began to crumble again after the latest reporting period ended.

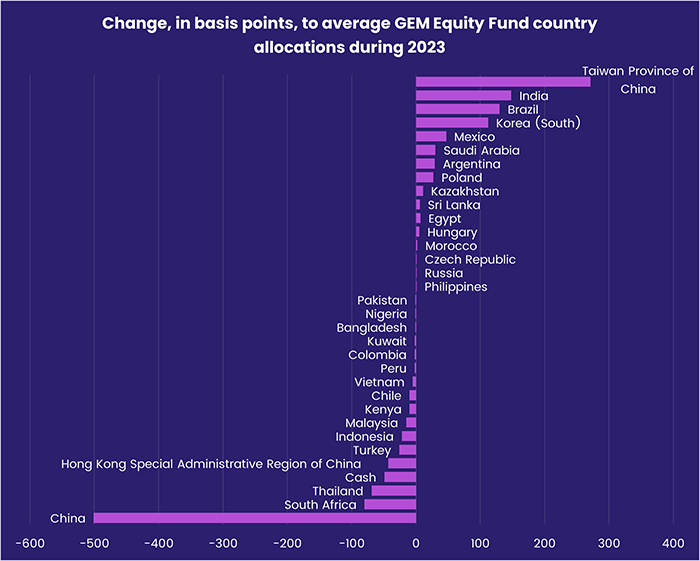

Fresh money flowed into the diversified Global Emerging Markets (GEM) Equity Funds, which recorded only two inflows between late July and mid-December, for the fourth time during the past six weeks. This group is more exposed to the big Latin American and ex-China Asian markets than they were coming into last year.

India’s story continues to resonate with investors despite concerns about the impact of stronger disclosure requirements for foreign buyers. The latest flows into India Equity Funds extended an inflow streak stretching back to late 1Q23. During this run, these funds have absorbed over $32 billion.

Two major conflicts, rangebound oil prices and no credible reform stories are keeping sentiment towards the EMEA universe pinned to the floor. EMEA Equity Funds have posted outflows in 16 of the past 21 weeks. The latest week did see Sharia Equity Funds post their first consecutive inflows since early 3Q23.

Latin America offers one significant reform story, Argentina. But questions about the outlook for the region’s two largest markets, Brazil and Mexico, are sapping appetite for Latin America Equity Funds.

Developed markets equity funds

With key US equity indexes hitting fresh record highs, Chinese policymakers rolling out new stimulus measures and central bankers making positive noises about the trajectory of inflation on both sides of the Atlantic, flows into EPFR-tracked Developed Markets Equity Funds hit a year-to-date high during the final week of January. US, Japan and Global Equity Funds all recorded solid inflows while redemptions from Europe Equity Funds were well off the $1.8 billion they averaged weekly during the final nine months of 2023.

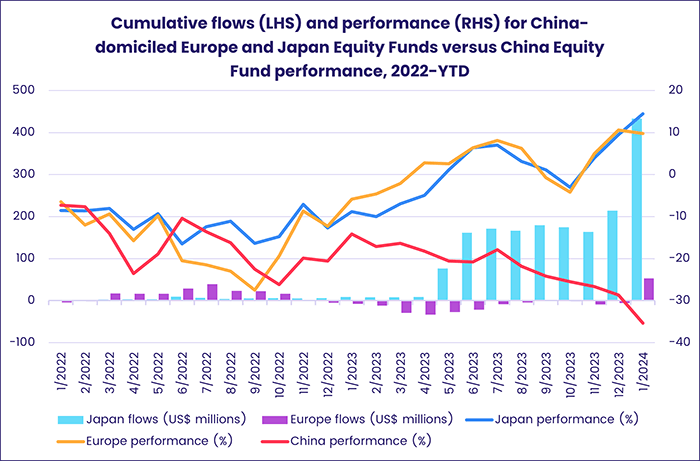

The latest flows into Japan Equity Funds extended their longest run since early 4Q23 as domestically domiciled funds posted their biggest inflow in three months. The Bank of Japan has been largely inactive as a buyer of domestic ETFs: official data shows the last purchase made under the program occurred on Oct. 4, 2023. But Japanese equity is picking up two tailwinds from China. These are (a) the hope that more aggressive stimulus measures will boost Chinese appetite for Japanese exports and (b) increased interest in Japanese equity from Chinese investors.

Europe Equity Funds domiciled in China are also seeing a modest pick-up in demand, and China’s role as a destination for European exports makes any hint of acceleration in Chinese economic growth a welcome development. But Germany’s economic struggles, and the European Central Bank’s post-meeting statement that discussing rate cuts is “premature”, kept the pressure on Europe Equity Funds which have posted outflows 46 of the past 47 weeks.

It has been a similar story for the retail share classes of US Equity Funds, which have posted inflows only four times over the past year with the last one coming in late September. Investor appetite for funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates or dedicated to dividend-paying stocks also remains at a low ebb. But, overall, US Equity Funds have recorded inflows in 13 of the past 16 weeks and flows into US Leveraged Funds jumped to a 17-week high.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, posted their fifth consecutive inflow and their biggest since early September. Pacific Regional Equity Funds, meanwhile, are mired in their longest outflow streak since 4M20.

Global sector, industry and precious metals funds

Flows to the 11 major EPFR-tracked Sector Fund groups during the final week of January ranged from the $1 billion redeemed from Utilities Sector Funds to the $2 billion that flowed into Technology Sector Funds. For the third week running, the number of groups reporting inflows crept up despite a mixed 4Q23 earnings season and less bullish expectations for central bank easing.

Although outflows have been more the rule than the exception for Utilities Sector Funds, with just four inflows recorded since the start of 4Q23, the amount of money exiting was exceptional. It was the heaviest redemption since a record $1.7 billion flowed out in early March of 2015, and the fourth largest since EPFR started tracking this group in November 2000. Driving the headline number this week was a single US ETF tied to the S&P Utilities benchmark which saw just $500 million redeemed in all of 2023, while the rest of the top 10 funds reporting outflows were non-ETFs or mutual funds.

Investors chasing yield are finding it hard to stay in this sector, with high interest rates compromising the promise of high dividend yields and returns. Complicating sentiment towards electricity and water industries is the unpredictability and intensity of weather factors like Hawaii’s wildfires, Spain declaring drought emergency and the debt burden weighing on the UK’s major water utilities. EPFR-tracked Water Funds have seen $2.4 billion flow out over the past 24 straight weeks, the longest since a 31-week streak starting mid-3Q11. The group experienced outflows of $2.58 billion in 2023, nearly doubling the previous record set in 2011.

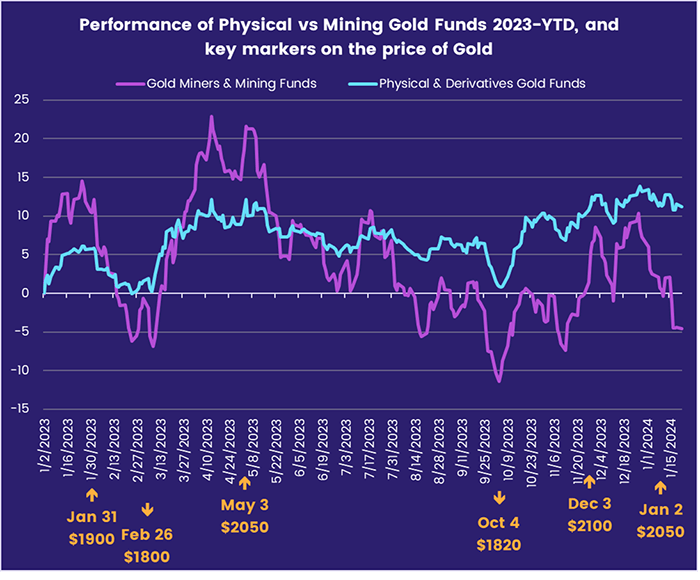

Commodities/Materials Sector Funds racked up their biggest inflow in two-and-a-half months, snapping a two-week outflow streak along the way. At the fund-level, three gold-related ETFs contributed equally to this week’s headline number. Gold Mining Funds, which are tracked through the equity universe, enjoyed their second inflow of the past three weeks. Physical Gold Funds, which sit within alternative assets and whose performance follows the price of gold, saw outflows edge up to a three-week high.

The other major precious metals group, Silver Funds, is not benefiting from the commodity’s links to the technology and industrial sectors and saw redemptions climb to their highest level since late 1Q23. Despite some major tech bellwethers failing to impress with quarterly results this past week, investors did continue to pump fresh money into Technology Sector Funds which racked up a fourth straight week of inflows with three above the $2 billion mark.

Bond and other fixed income funds

Although EPFR-tracked Bond Funds ended the final week of January with another inflow that took their year-to-date total over $58 billion, they ended the month with their biggest daily outflow since mid-November as the US Federal Reserve followed the European Central Bank in cooling hopes of first quarter interest rate cuts.

The latest week saw Europe Bond Funds absorb another $2.5 billion, flows into Global Bond Funds hit a 51-week high, Emerging Markets Bond Funds rack up their 25th outflow since the beginning of August and US Bond Funds record an inflow that was less than a 20th of the previous week’s total.

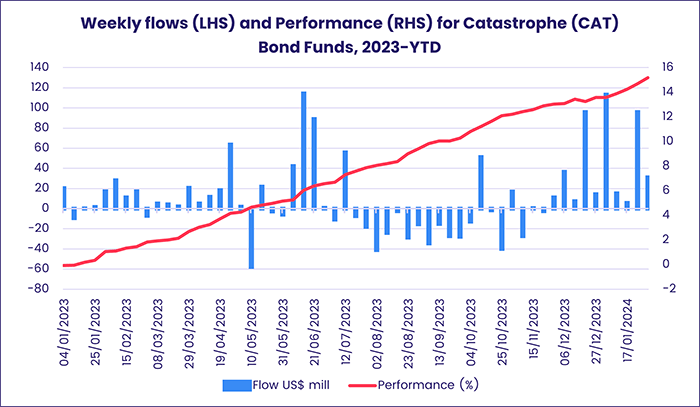

Risk appetite among fixed income investors remains robust. High Yield Bond Funds attracted fresh money for the 13th time over the past 14 weeks while Catastrophe (CAT) Bond Funds, which expose investors to loss of principal if the insured costs of a natural disaster breach pre-determined levels, chalked up their 10th consecutive inflow.

Emerging Markets Hard Currency Funds ended January with an inflow, their first since late November, but this was offset by redemptions from Local and Mixed Currency EM Funds. At the country level, flows into Korea Bond Funds and redemptions from South Africa Bond Funds both hit nine-week highs while China Bond Funds narrowly recorded their fourth inflow over the past six weeks.

Spain and Netherlands Bond Funds were the most eye-catching of the Europe Country Bond Fund groups, with the former taking in over $100 million for the third week running and Netherlands Bond Funds recording their biggest inflow since the fourth week of 1Q22. Europe Bond Funds with corporate mandates attracted bigger inflows than their sovereign counterparts for the seventh straight week.

In a reversal of the previous week, when flows strongly favored US Sovereign Bond Funds, that group posted its biggest collective outflow in over 17 months as funds with short-term mandates experienced their heaviest redemptions since EPFR started tracking them weekly in 1Q07. Two ETFs accounted for over two-thirds of the headline number.

Did you find this useful? Get our EPFR Insights delivered to your inbox.