The third week of May was marked by lackluster sovereign debt auctions, America being stripped of its final AAA debt rating and angst about the new US administration’s “big and beautiful” tax and spending bill. These developments revived fears that interest rates in key markets have less scope to fall in the face of slowing growth than was expected only a few weeks ago.

Investors responded by piling into Bond Funds dedicated to markets where inflation seems contained, aggressively cutting their exposure to leveraged strategies and rotating from Physical Gold to Cryptocurrency Funds.

The record outflow posted by all Leveraged Equity Funds was driven by redemptions from a single technology focused fund domiciled in the US. In a release, the fund’s administrator noted that, “[the ETN was] launched in January 2018 with fees and charges that reflected the then-current market environment…the costs associated with supporting the leverage embedded in the ETNs have increased and, therefore, the existing fees and charges applicable no longer reflect the current market environment.”

Overall, the week ending May 21 saw EPFR-tracked Bond Funds post a collective inflow of $24.9 billion, the highest total since the first week of 4Q20, while Alternative Funds absorbed $1.4 billion and Money Market Funds $16 billion. Balanced Funds experienced redemptions totaling $1.4 billion and investors pulled $4 billion out of Equity Funds.

At the asset class and single country fund levels, redemptions from Physical Gold Funds posted their biggest outflow since 1Q13, Cryptocurrency Funds took in over $1 billion for the fourth time during the past five weeks despite the cyberattack on crypto exchange Coinbase, and Bear Funds extended their longest run of inflows in over two years. Flows into Austria Equity Funds jumped to a more than three-year high, outflows from Netherland Bond Funds set a new weekly record and China Money Market Funds posted a ninth consecutive inflow for the first time since 3Q22.

Emerging Markets Equity Funds

EPFR-tracked Emerging Markets Equity Funds posted another collective outflow during the third week of May as redemptions from funds dedicated to mainland China again overwhelmed modest inflows into Latin America and EMEA Equity Funds. The latest headline number was the biggest in over three months.

Behind the overall number, EM Dividend Funds extend their longest run of outflows in exactly a year, retail share classes added to their lengthy redemption streak and leveraged funds tallied their fourth outflow over the past five months. On the other hand, funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their second-largest weekly inflow since mid-1Q23 and Frontier Markets Equity Funds posted a third consecutive inflow for the first time this year.

Among the major Asia ex-Japan Country Fund groups, China Equity Funds chalked up their fourth straight consecutive outflow while India Equity Funds recorded their sixth inflow running and money flowed out of Korea Equity Funds for the third week in a row. In the case of China, the grass does not appear to be greener elsewhere: GEM ex-China Equity Funds posted their biggest outflow since EPFR started tracking them.

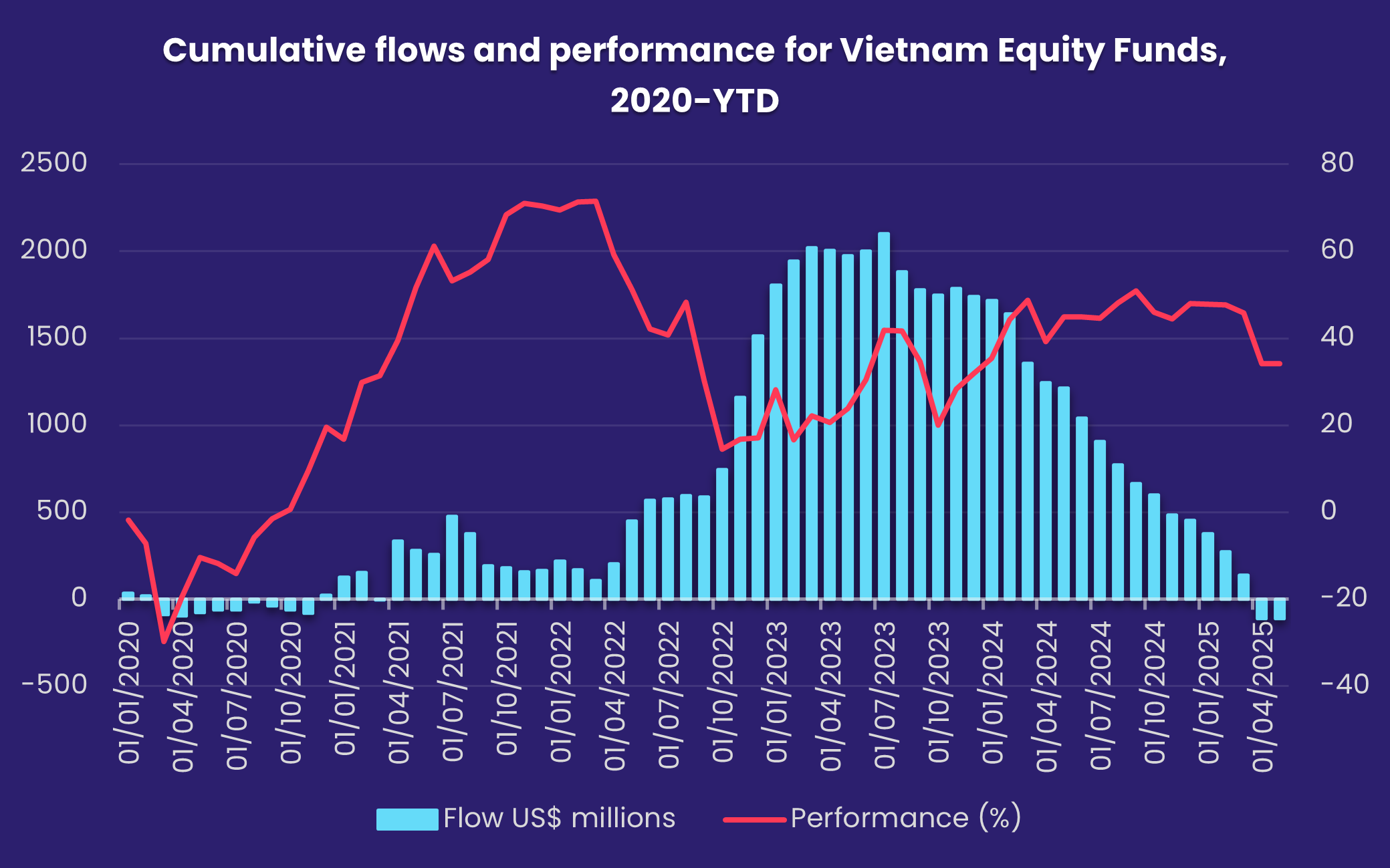

Also seeing inflows were Vietnam Equity Funds, a group that saw inflows surge during US President Donald Trump’s first term as investors bought into its supply chain relocation story. Since 2023, however, political transitions, trade dynamics and the impact of a major anticorruption drive on major institutions have dulled investor appetite for this market.

Flows into Latin America Equity Funds continued at an above average pace. But the headline number was driven by the diversified Latin America Regional Funds, which absorbed over $150 million while Mexico and Brazil Equity Funds pulled in under $1 million apiece. Chile Equity Funds recorded their biggest inflow since late 3Q23 and the rebound in flows to Argentina Equity Funds rolled on for another week.

EMEA Equity Funds eked out a small collective inflow that hinged on commitments to Saudi Arabia and Poland mandated funds. Funds dedicated to Africa have struggled recently, with South Africa Equity Funds posting outflows eight of the past 10 weeks and redemptions from Africa Regional Equity Funds hitting an eight-week high.

Developed Markets Equity Funds

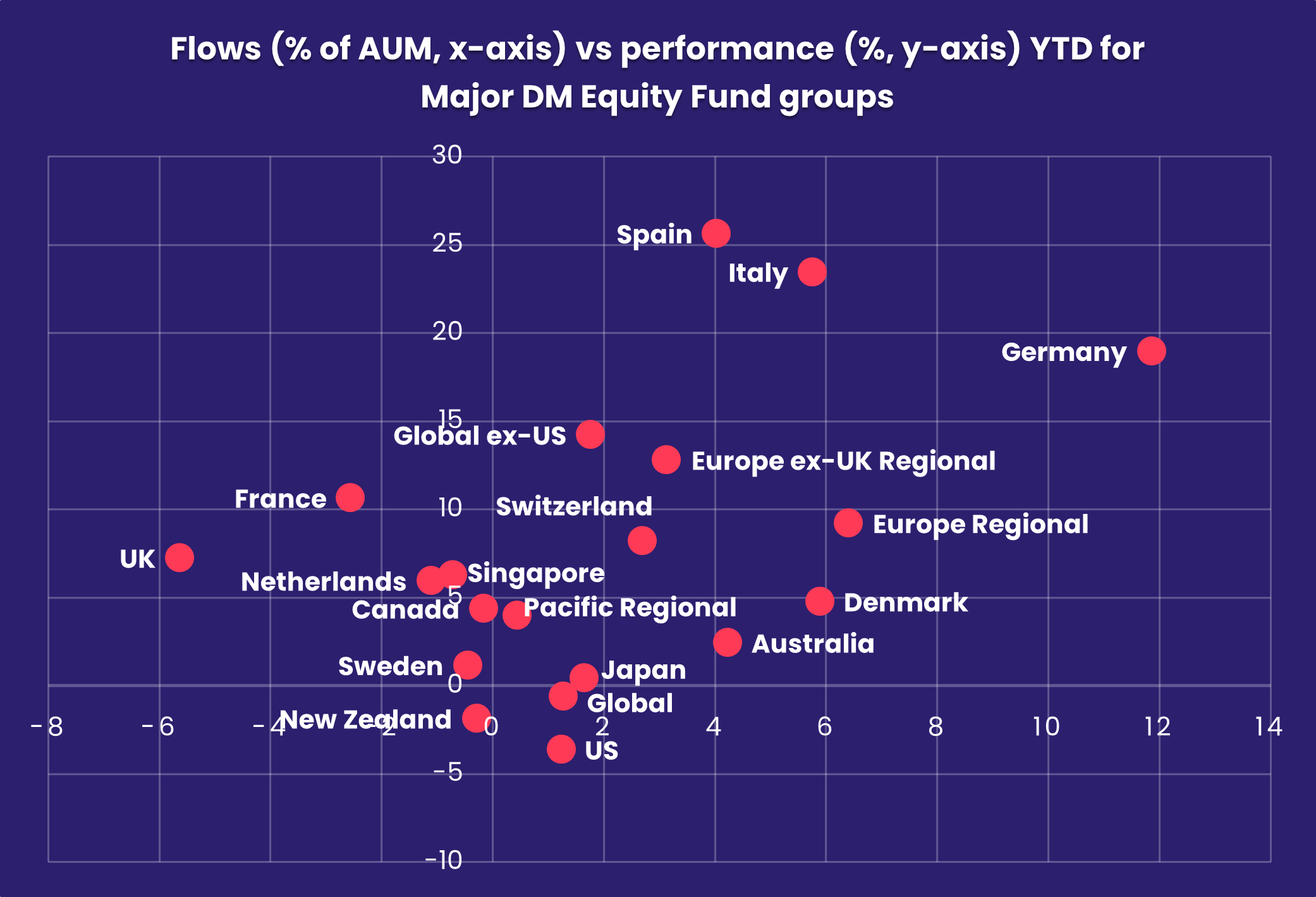

Flows into Global, Europe and Australia Equity Funds enabled EPFR-tracked Developed Markets Equity to post their eighth consecutive inflow during the third week of May, offsetting redemptions from US and Japan Equity Funds. Debt dynamics, and their impact on the ability of central banks to keep cutting interest rates, supplanted tariffs – at least for one week – as the biggest variable for investors.

The prospect of US interest rates staying higher for longer to sustain appetite for US debt weighed on US Equity Funds, which recorded their fifth outflow since the beginning of the current quarter. Of the major groups by capitalization and style, Large Cap Blend, Growth and Value Funds all recorded modest inflows, as did Small Cap Blend Funds. But nearly $3 billion was pulled out of retail share classes and over $9 billion from Leveraged US Equity Funds with 3x-mandated funds hit particularly hard.

Debt dynamics, and the impact on cost of capital and the Japanese government’s ability to keep stimulating consumer demand, also weighed on sentiment towards Japan Equity Funds which racked up their biggest outflow in just under six months. Leveraged funds posted their fifth consecutive outflow, but foreign domiciled Japan Equity Funds recorded a modest inflow for the second week running.

Europe Equity Funds posted their 14th inflow since mid-February, but the headline number was the second lowest over that period. At the country level, redemptions from Germany Equity Funds jumped to a 51-week high as investors weighed the impacts, good and bad, of the country’s latest spending plans. They also pulled another $698 million from UK Equity Funds as that country’s April inflation rate and public borrowing requirements both exceeded expectations.

Global Equity Funds, the largest of the diversified Developed Markets Equity Funds groups, extended their current inflow streak to six weeks and $43.3 billion. So far this year, Global Equity Funds domiciled in Europe have absorbed $2 for every $1 committed to US domiciled funds.

Global sector, Industry and Precious Metals Funds

Tariff-related uncertainty was joined in the week ending May 21 by concerns about the cost of capital. The upshot, for the 11 major EPFR-tracked Sector Fund groups, was a reversal of the recent growth in the number of those groups attracting fresh money. During the latest week, eight of those groups recorded outflows with three of them – Financials, Technology and Healthcare/Biotechnology Sector Funds – seeing more than $1 billion being redeemed.

Of those three, Technology Sector Funds posted the most eye-catching number thanks to the dissolution of a US-focused 3x Leveraged ETN. But China Technology Sector Funds posted their 11th inflow during the past 12 weeks and dedicated Artificial Intelligence Funds their 27th over the past 30 weeks. Recent earnings reports from technology bellwethers, and the accompanying guidance on AI initiatives, offers some hope that flows will rebound.

US President Donald Trump’s executive order capping some drug prices has added to the headwinds facing Healthcare/Biotechnology Sector Funds. The latest outflow was the biggest since mid-December.

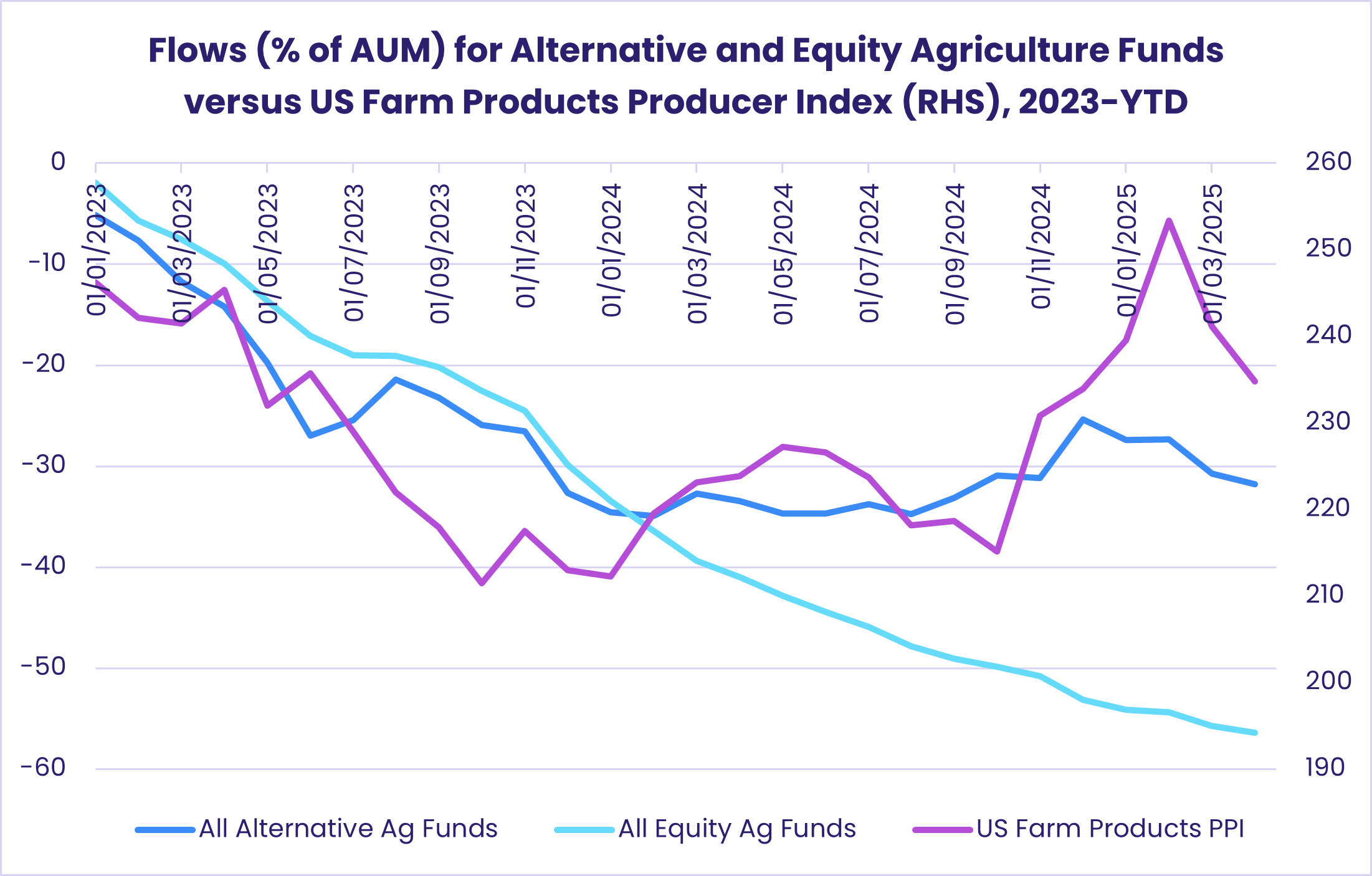

Commodities/Materials Sector Funds recorded their seventh straight outflow, with gold mining funds significant contributors to the headline number. Agriculture Funds, the bulk of which sit in the Alternative Fund universe, posted their fifth straight inflow. But, despite the attention rising egg and coffee prices have received this year, investors have been reluctant to chase key indexes higher.

Of the three groups recording an inflow for the week, Telecoms Sector Funds chalked up the biggest number followed by Industrial Sector Funds. In the case of the latter, dedicated Aerospace & Defense Funds again absorbed one out of every two dollars committed to this group.

Bond and other Fixed Income Funds

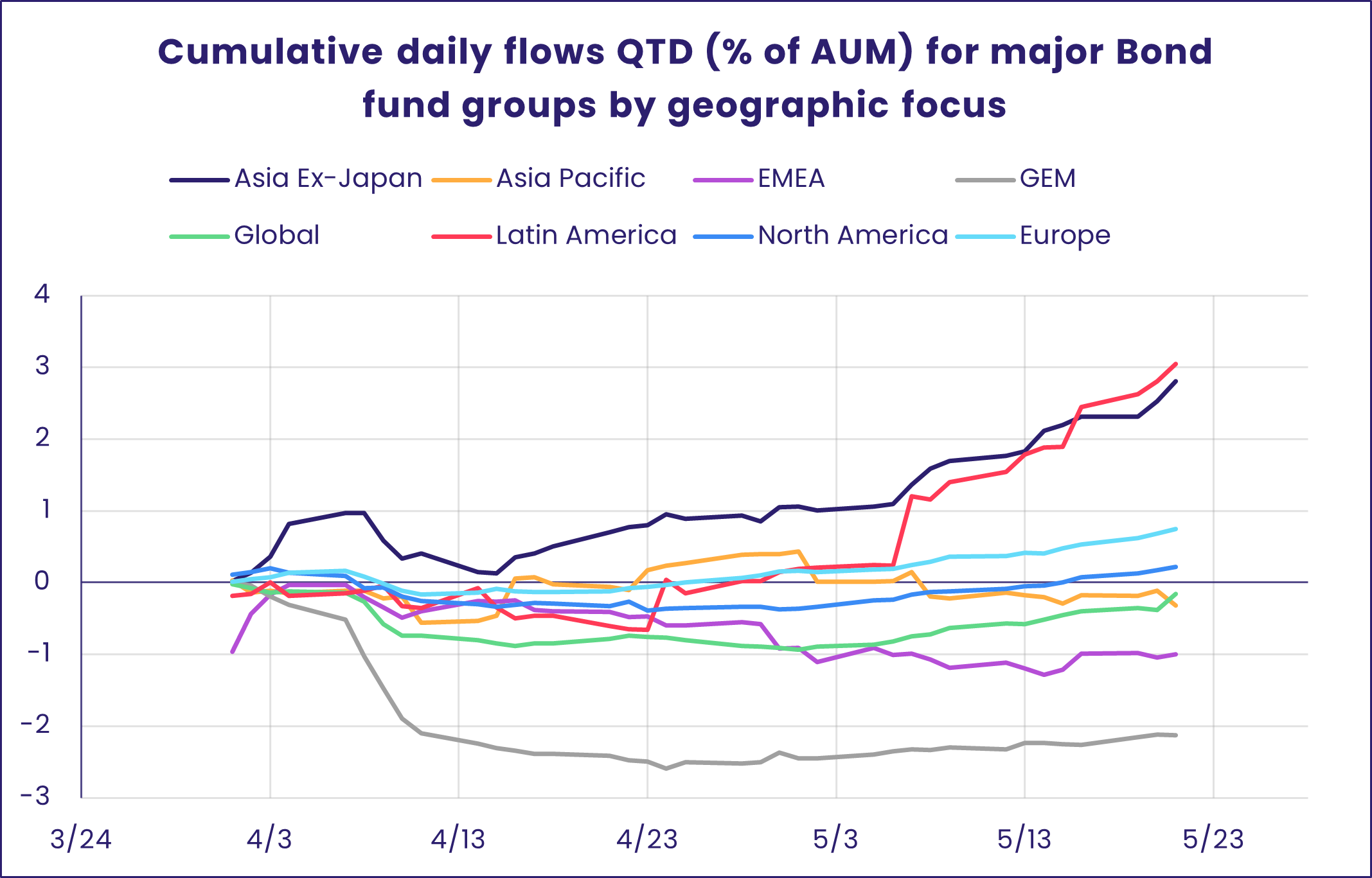

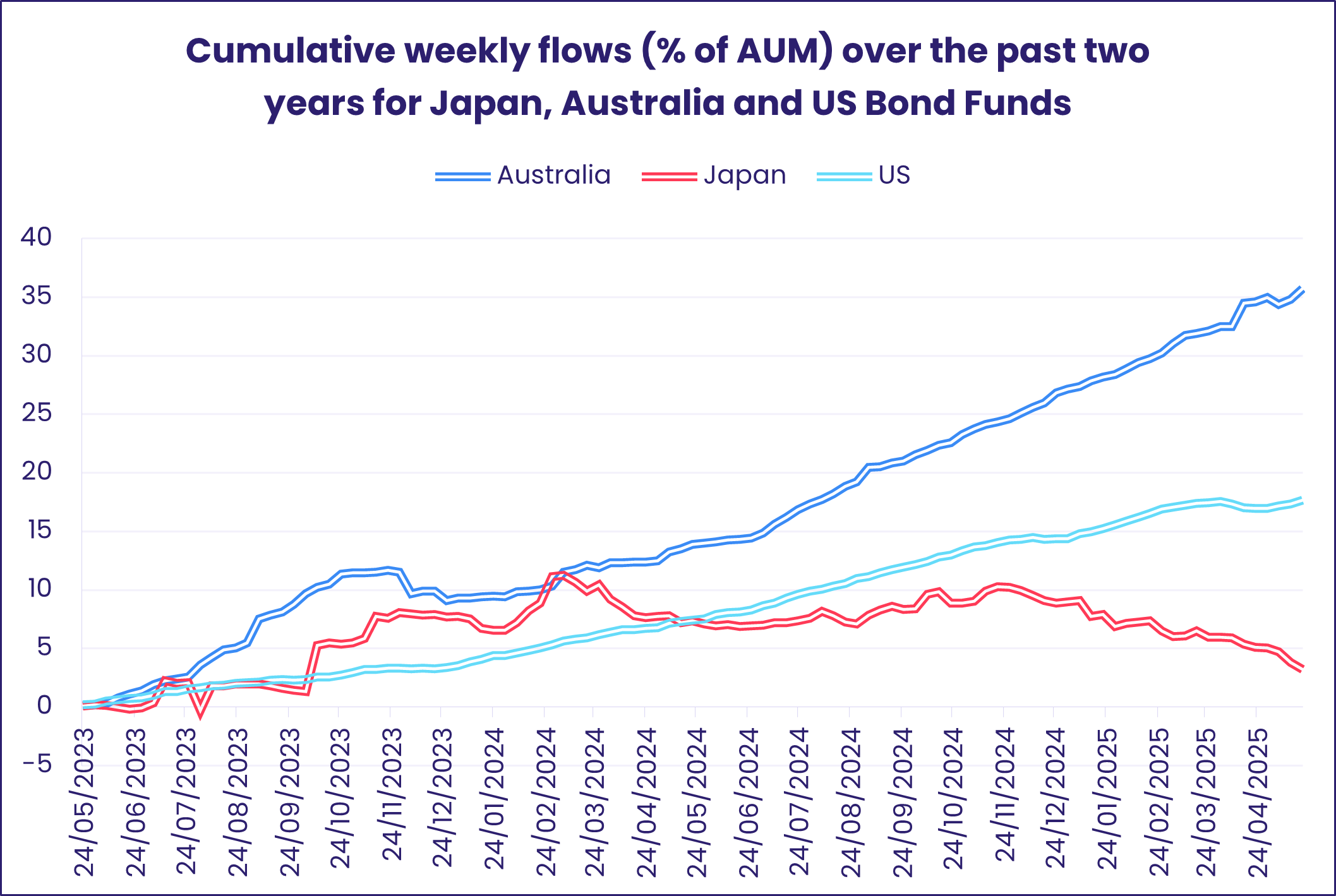

Less risk, more yield was the mantra for fixed income investors during the third week of May as debt markets showed signs of imposing some discipline on free-spending governments in the US, Europe and Japan. EPFR-tracked Bond Funds posted their biggest collective inflow in over four years and flows into Long Term Sovereign Bond Funds climbed to a 72-week high.

Among the major groups by geographic focus, flows for US, Emerging Markets and Global Bond Funds hit 12, 120 and 253-week highs, respectively, while Europe Bond Funds posted their biggest weekly inflow since EPFR started tracking them.

Asia Pacific Bond Funds also posted inflows despite concerns about Japan’s debt pile as core inflation hit 3.5% and weak investor demand for an auction of 20-year government bonds.

At the asset class level, Municipal Bond Funds posted their fourth straight inflow, Inflation Protected Bond Funds tallied their fourth largest inflow year-to-date, High Yield Bond Funds absorbed another $2.3 billion and Convertible Bond Funds extended an outflow streak stretching back to the third week of February.

The flows to Europe Bond Funds went largely to the two major regional groups, with ex-UK mandated funds attracting seven times the amount of fresh money absorbed by Europe Regional Bond Funds. At the country level, there were record-setting redemptions from both Netherlands and Italy Bond Funds. In the case of the latter, a single Spain-domiciled fund accounted for the bulk of the headline number.

Single country funds were more supportive when it came to Emerging Markets Bond Funds, with China and Korea Bond Funds taking in over $1 billion between them. Funds with local currency mandates outgained their hard currency counterparts by a 15-to-1 margin and Corporate EM Funds took in nearly seven times the amount absorbed by Sovereign EM Funds.

EM Local Currency Bond Funds have turned in the best collective performance YTD among the major groups by geographic focus, followed by Europe Regional and EM Hard Currency Funds, while Germany and Japan Bond Funds are the worst performers.

Long Term US Bond Funds posted their biggest inflow since early 1Q24 and flows into foreign domiciled funds climbed to a seven-week high.

Did you find this useful? Get our EPFR Insights delivered to your inbox.