After a two-week influx of fresh money into China Equity Funds totaling $53 billion, the spotlight in mid-October shifted to US Equity Funds as a new corporate earnings season gathered momentum and data suggested that the world’s largest economy is – by some measures – in rude health.

The more than $23 billion committed to US Equity Funds underpinned the headline number for all EPFR-tracked Equity Funds during the week ending Oct. 16. That week also saw a net $3.7 billion flow into Alternative Funds and $22 billion into Bond Funds while $85 million was redeemed from Balanced Funds and $18.8 billion from Money Market Funds.

Among the winners during the latest week were Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates, which posted their sixth collective inflow since the beginning of September and their biggest since mid-4Q23.

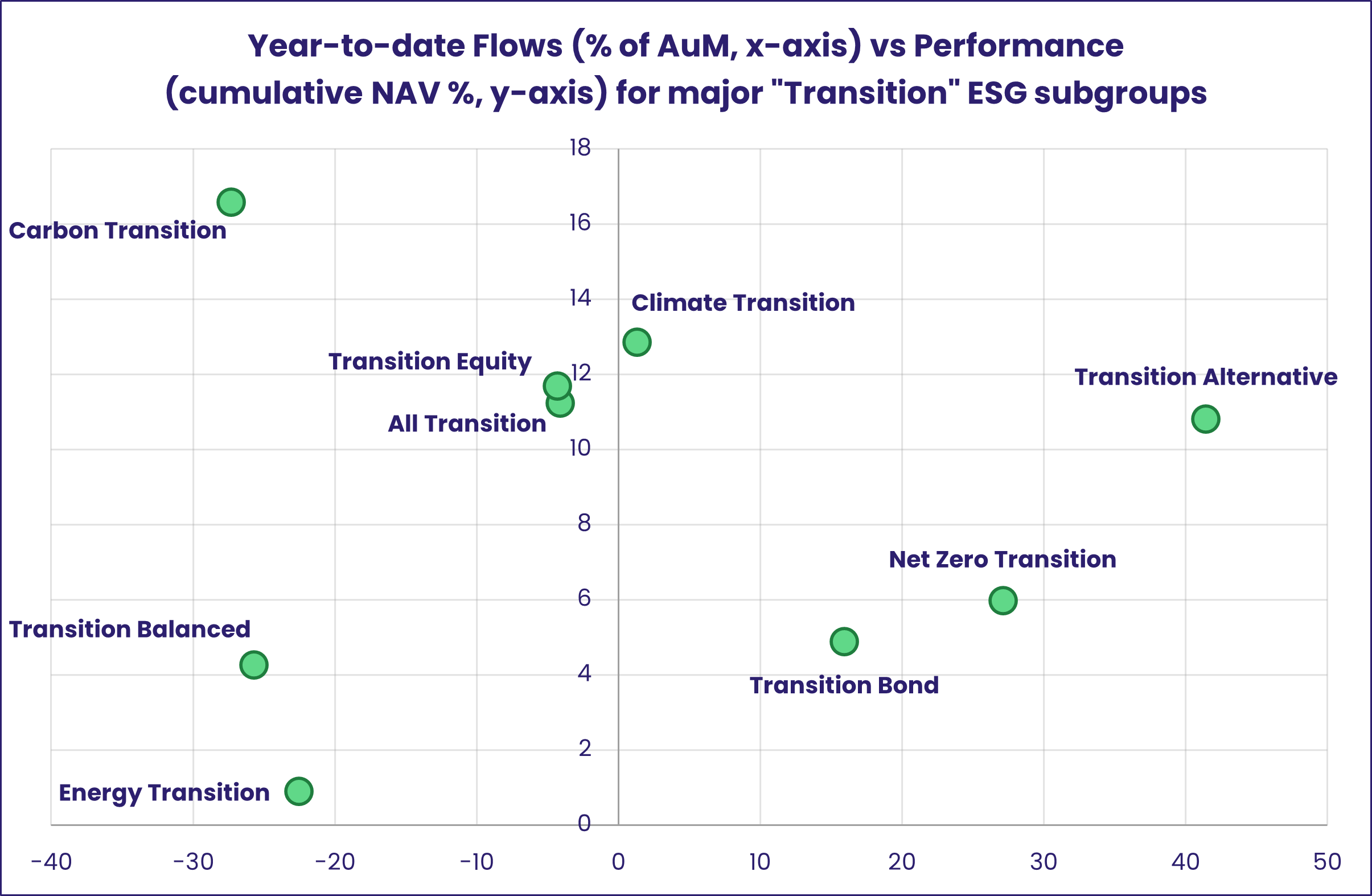

In recent months there has been growing interest in ‘transition funds’ whose remit includes companies on the journey to ESG outcomes rather than focusing only on those that are deemed to have arrived. Investors remain cautious, however, with several of these groups struggling to attract fresh money.

At the single country and asset class fund level, Dividend Equity Funds posted their 16th inflow since mid-June, flows into Cryptocurrency Funds climbed to a 12-week high and Total Return Funds extended their current inflow streak to 14 weeks and $38.6 billion. Flows into China Money Market Funds climbed to their highest level since 1Q21, Ireland Equity Funds experienced their heaviest redemptions in over 18 months and Thailand Bond Funds posted their biggest inflow year-to-date.

Emerging Markets Equity Funds

The week ending Oct. 16 saw China Equity Fund flows following the country’s benchmark CSI 300 index down, resulting in the biggest weekly outflow for the group since 3Q15. Those redemptions also spelled the end of the 19-week inflow streak compiled by all EPFR-tracked Emerging Markets Equity Funds as they canceled out – by a wide margin – modest flows into Latin America and the diversified Global Emerging Markets (GEM) Equity Funds.

While domestically domiciled China Equity Funds surrendered over $6.3 billion during the latest week, those domiciled overseas extended their longest inflows streak in over 17 months and funds dedicated to state owned enterprise (SOEs) posted only their second inflow since the beginning of August.

Among the other Asia ex-Japan Country Fund groups, redemptions from Indonesia Equity Funds came in at a 10-week high, Thailand Equity Funds extended an outflow streak stretching back to the first week of the year, Malaysia Equity Funds absorbed fresh money for the 24th straight week and India Equity Funds bounced back from their first outflow in over 18 months.

Latin America focused investors favored regional over single country funds, with Latin America Regional Funds recording their biggest inflow in three months while Brazil, Mexico, Peru and Chile Equity Funds posted outflows. Headline inflation in three of those four markets is still north of 4%, albeit with different trajectories, and Brazil’s central bank is expected to lift its key Selic rate back over 11% by year’s end.

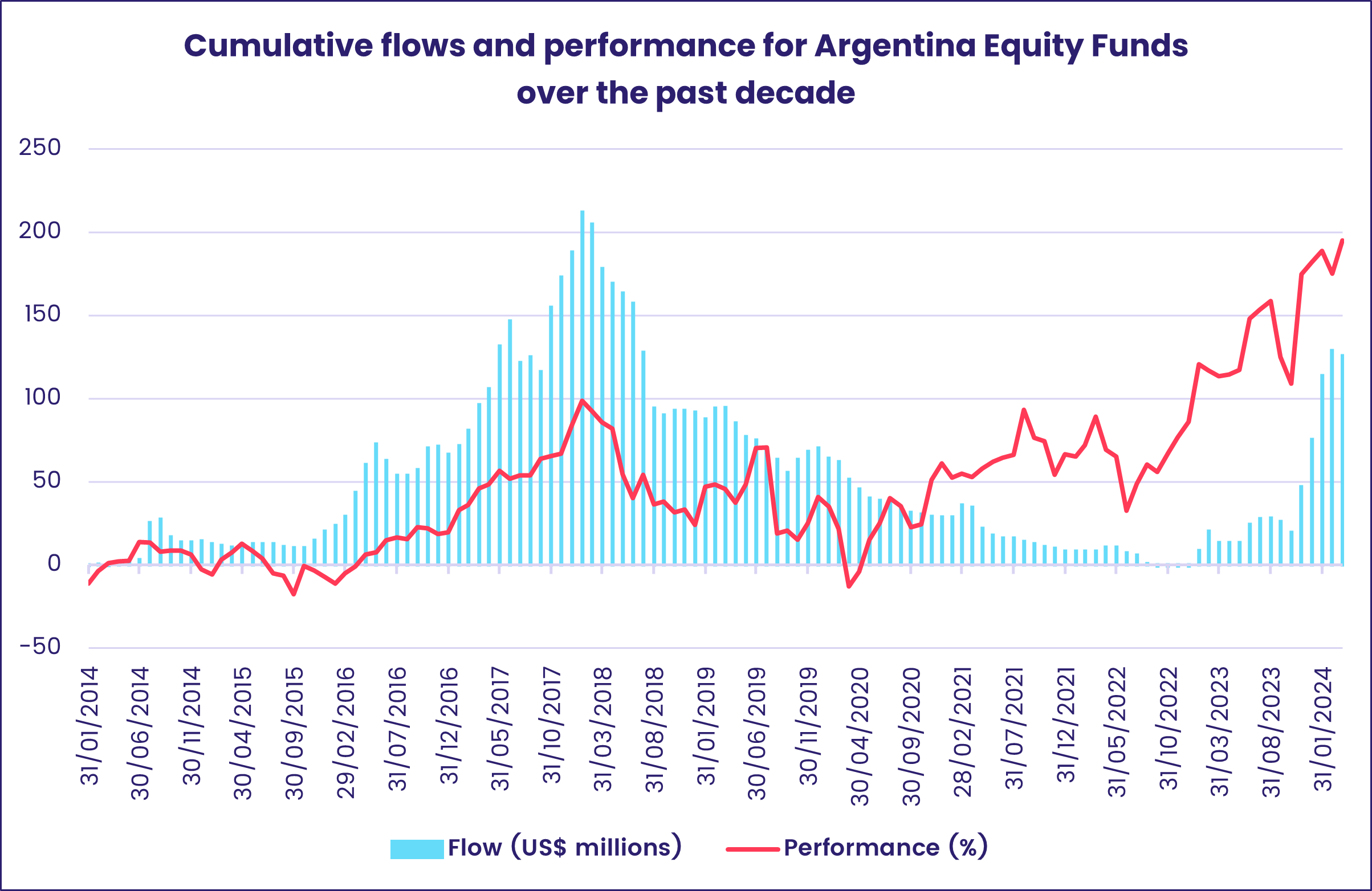

Year-to-date, three of the six major Latin America Country Fund groups have collectively delivered outflows and negative performance, while, among the remainder, only Argentina Equity Funds have seen flows and performance take off.

EMEA Equity Funds continue to be buffeted by multiple headwinds ranging from the conflicts in Ukraine, Horn of Africa and the Middle East to the weak growth outlook for developed European markets. Romania Equity Funds remain a bright spot in the EMEA universe, posting their 65th inflow since the beginning of July 2023, and Saudi Arabia Equity Funds have attracted fresh money three of the past four weeks.

Developed Markets Equity Funds

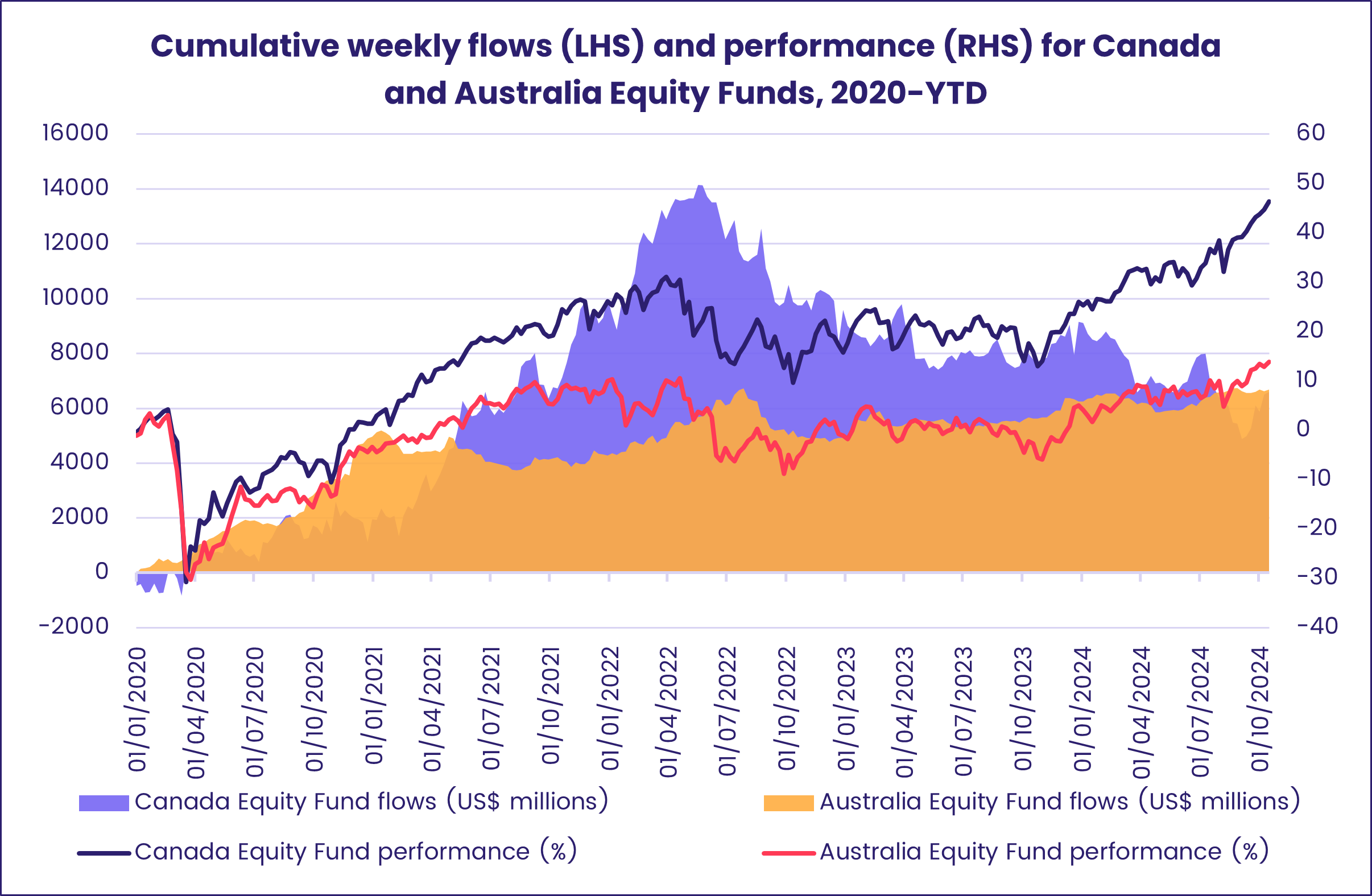

With early reports suggesting that expectations of a new expansionary phase for US corporate earnings will be realized, US equity markets tested fresh record highs during the week ending Oct. 16 and flows into US Equity Funds rebounded to a four-week high. That helped EPFR-tracked Developed Markets Equity Funds bounce back after they posted consecutive outflows for the first time since early 2Q24. In addition to US-mandated funds, Global, Australia, Canada and Pacific Regional Equity Funds posted inflows while Japan and Europe Equity Funds extended their latest outflow streaks.

Japan Equity Funds posted consecutive weekly outflows for the first time since late August as the country joins the ranks of developed nations holding snap elections in 2024. New Prime Minister Shigeru Ishiba has dissolved the Diet’s lower house ahead of an Oct. 27 vote that he hopes will deliver a mandate for greater spending on the military and poorer regions that could be funded by a hike in Japan’s corporate tax rate.

Among the other major Asia Pacific Country Fund groups, Australia Equity Funds chalked up their third inflow over the past four weeks. Funds domiciled in Japan, which absorbed over $2.5 billion in both 2016 and 2017, have recorded only one weekly inflow so far this year. Funds dedicated to the other major developed markets resource play, Canada, are also enjoying a good patch when it comes to attracting fresh money.

US Equity Funds pulled in nearly $24 billion during the latest week, with the bulk of that money going to US Large Cap Blend Funds. In relative terms, however, Mid Cap Blend Funds enjoyed bigger flows as a % of AuM. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their biggest collective inflow since mid-June, and US Dividend Equity Funds tallied their 12th weekly inflow since the beginning of July.

Although the European Central Bank (ECB) has delivered on expectations of its third 0.25% interest rate cut of the year so far, Europe Equity Funds posted another collective outflow going into the second half of October. Funds dedicated to markets outside the Eurozone generally fared better than those tied to members of the currency union, with Switzerland Equity Funds absorbing over $300 million and UK Equity Funds posting their smallest outflow since the fourth week of July.

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, extended their current inflow streak as funds with fully global mandates absorbed $2 for every $1 committed to their ex-US counterparts.

Global sector, Industry and Precious Metals Funds

With the latest corporate earnings season in the US now underway and just 10 weeks remaining in the year, investors remained confident about two cyclical sectors, Commodities and Financials, and also embraced two more defensive sectors – Industrials and Infrastructure. The remaining seven groups experienced net redemptions ranging from $62 million to $1.2 billion.

As the week progressed, investors shifted their focus from the stellar earnings reports released by major banks – JPMorgan Chase, Wells Fargo, Bank of America – and keyed into semiconductor plays and the magnificent seven. The lower 2025 sales forecast from ASML, a Europe-based supplier of systems for the semiconductor industry, dented sentiment towards its customers and major tech stocks: Taiwan Semiconductor, Nvidia and Apple.

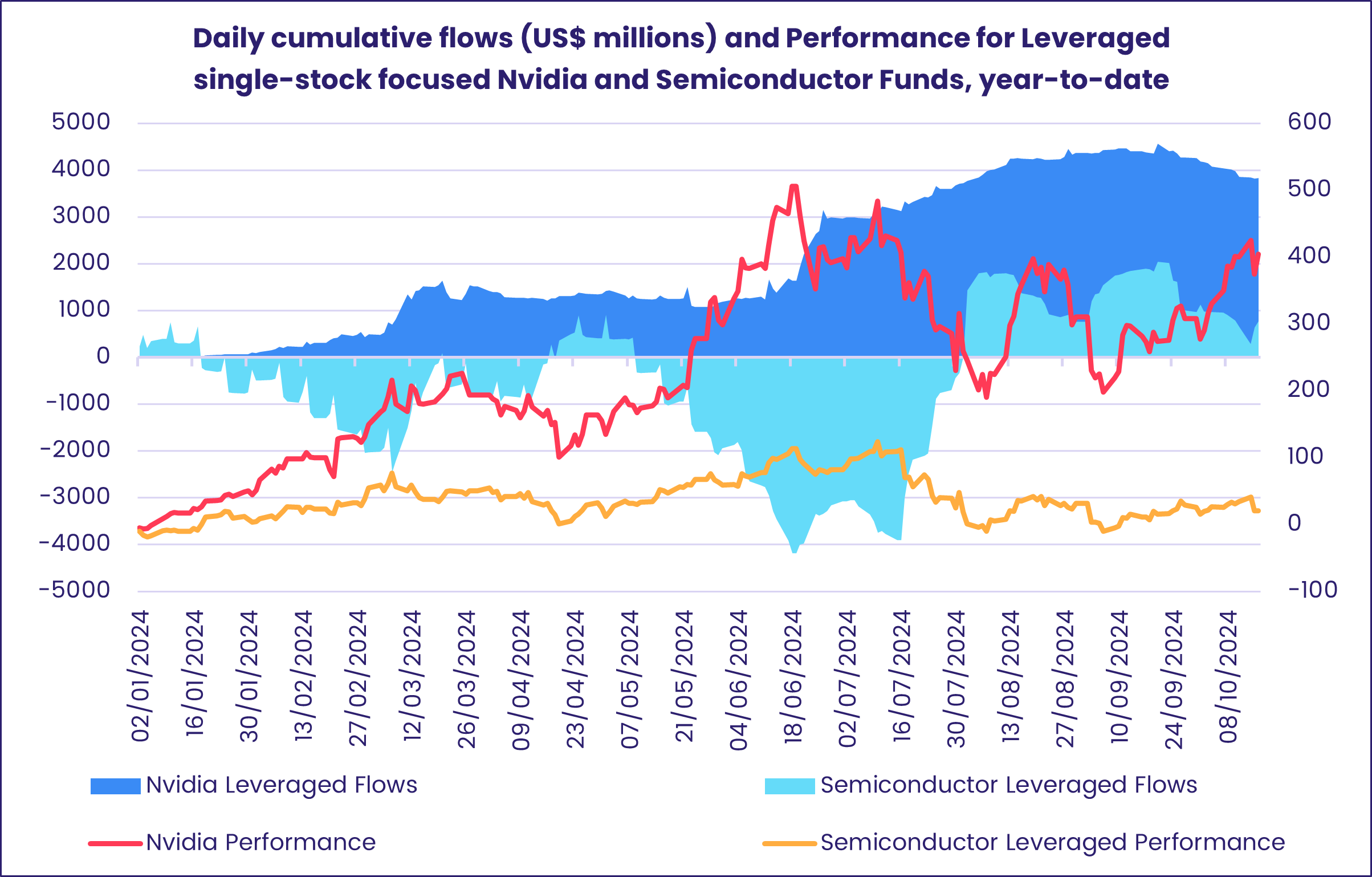

This contributed to the $1.2 billion outflow posted by Technology Sector Funds, which reversed a fifth of the previous week’s inflow. Leveraged single-stock funds tied to Nvidia – which have absorbed roughly $4 billion year-to-date – posted their third consecutive outflow, with the latest close to a five-month high. That group of just eight funds account for $6.4 billion in AuM, up from a modest $300 million at the end of last year. Other groups of single-stock leveraged funds include those investing in Apple (7 funds tracking $6.4 billion in Aum) and more broadly, those tied to semiconductors (10 funds with $13.6 billion in AuM).

Elsewhere, Financials Sector Funds chalked up a second consecutive week of inflows as a single regional banking ETF pulled in $480 million and another US ETF benchmarked to the S&P saw $230 million flow in. Two ETFs benchmarked to CSI indexes did pull the headline number down by a similar amount, with combined redemptions totaling $720 million.

Infrastructure Sector Funds tacked on another weekly inflow, their third consecutive and 18th of the past 24 weeks. Over the past six months, two funds with both SRI/ESG mandates and “smart grid” in their name have attracted over $1 billion collectively. Flows into all Infrastructure SRI/ESG Sector Funds this week climbed to their highest level since mid-May.

Bond and other Fixed Income Funds

Flows into EPFR-tracked Bond Funds during the second week of October climbed to their highest level since early 4Q20 as the group remains on track to set a new full-year inflow record. The latest week saw Emerging Markets Bond Funds add to their longest run of inflows since 1Q23, US Bond Funds absorb fresh money for the 44th straight week and Global Bond Funds post their biggest inflow in nearly two months.

At the asset class level, High Yield Bond Funds pulled in over $3 billion for the seventh time year-to-date, something they achieved only four times in 2023, while Bank Loan Funds chalked up their fourth largest inflow year-to-date. Fresh money flowed into Convertible Bond Funds for the fifth straight week, the first time that has happened since 3Q21, and Mortgage-Backed Bond Funds recorded their 41st inflow of the year.

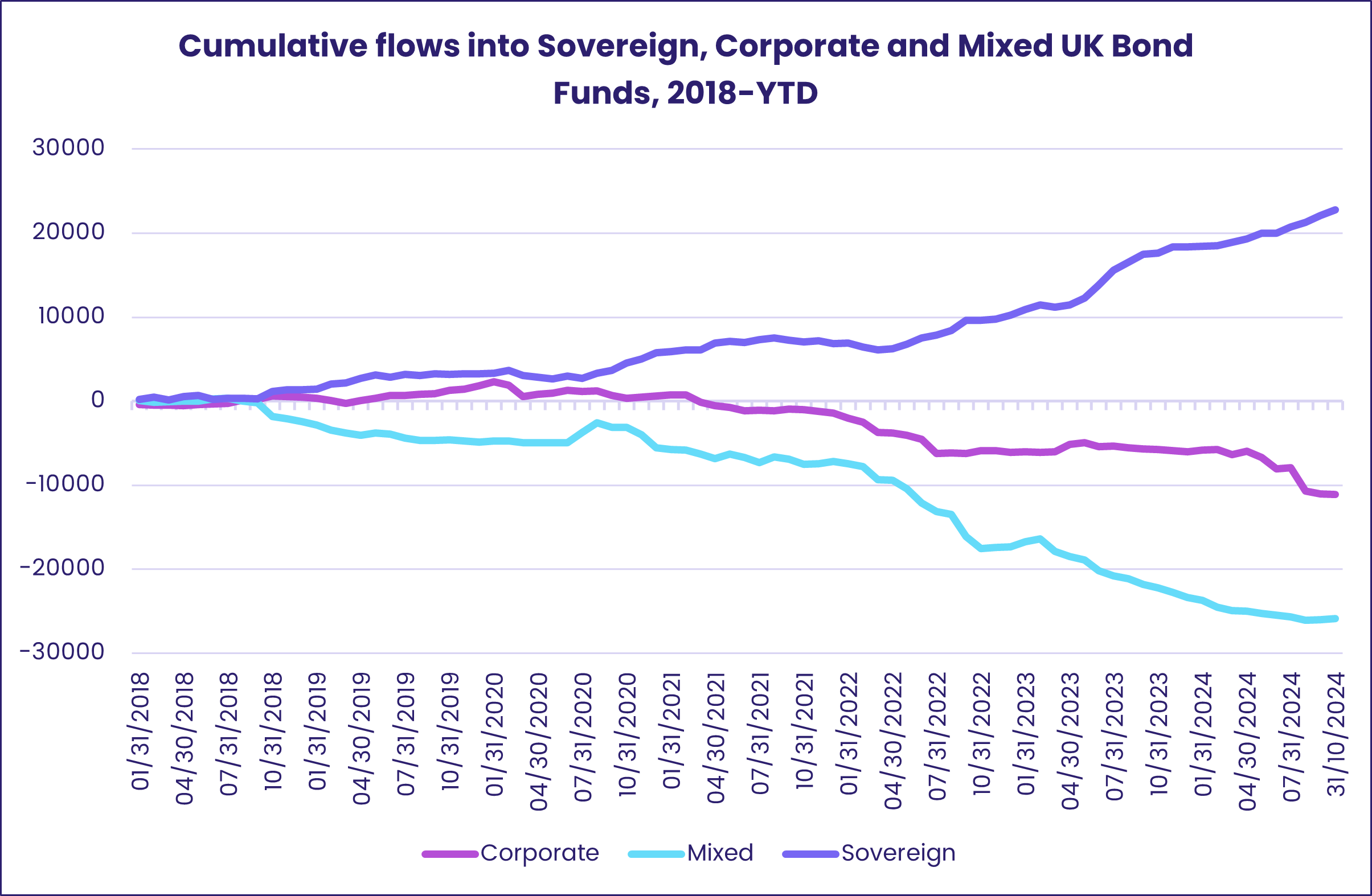

Investors steered another $3.5 billion into Europe Bond Funds, with the latest flows sending mixed messages about sentiment towards the UK ahead of a late October budget expected to raise thorny questions about the country’s debt profile. Flows into Europe ex-UK Regional Bonds climbed to a 20-week high while UK Bond Funds posted their fifth straight inflow and eighth over the past nine weeks. There is a strong preference for funds with sovereign debt mandates.

Local Currency Emerging Markets Bond Funds with Asian mandates were the clear favorites going into the second half of October as flows into China and Korea Bond Funds hit 10 week and YTD highs, respectively, and Thailand Bond Funds pulled in over $150 million.

It was another strong week, flow wise, for US Bond Funds. Only Short Term Sovereign Funds experienced significant redemptions while Intermediate Term Mixed Funds posted their biggest inflow since mid-April and flows into US Municipal Bond Funds hit a 10-week high. Since the beginning of July, there has been a marked pivot toward Municipal Bond Funds with investment grade mandates.

Did you find this useful? Get our EPFR Insights delivered to your inbox.