Flows to EPFR-tracked funds during the second week of May had a pre-Liberation Day look as US Equity Funds snapped their longest run of outflows since 3Q23 and risk appetite among fixed income investors continues to move through the gears.

As US equity market indexes pushed towards –and through – their late March levels and President Donald Trump toned down his rhetoric on tariffs, Balanced Funds posted their inflow in two months, flows into High Yield Bond Funds climbed to a 44-week high, Emerging Markets Bond Funds chalked up their biggest inflow in over two years and Physical Gold Funds extended their longest redemption streak since mid-4Q24.

Elsewhere, investors continued to build their exposure to European stocks and bonds, diversify their developed markets exposure, favor Chinese debt over Chinese equity and steer more money into Dividend Equity Funds.

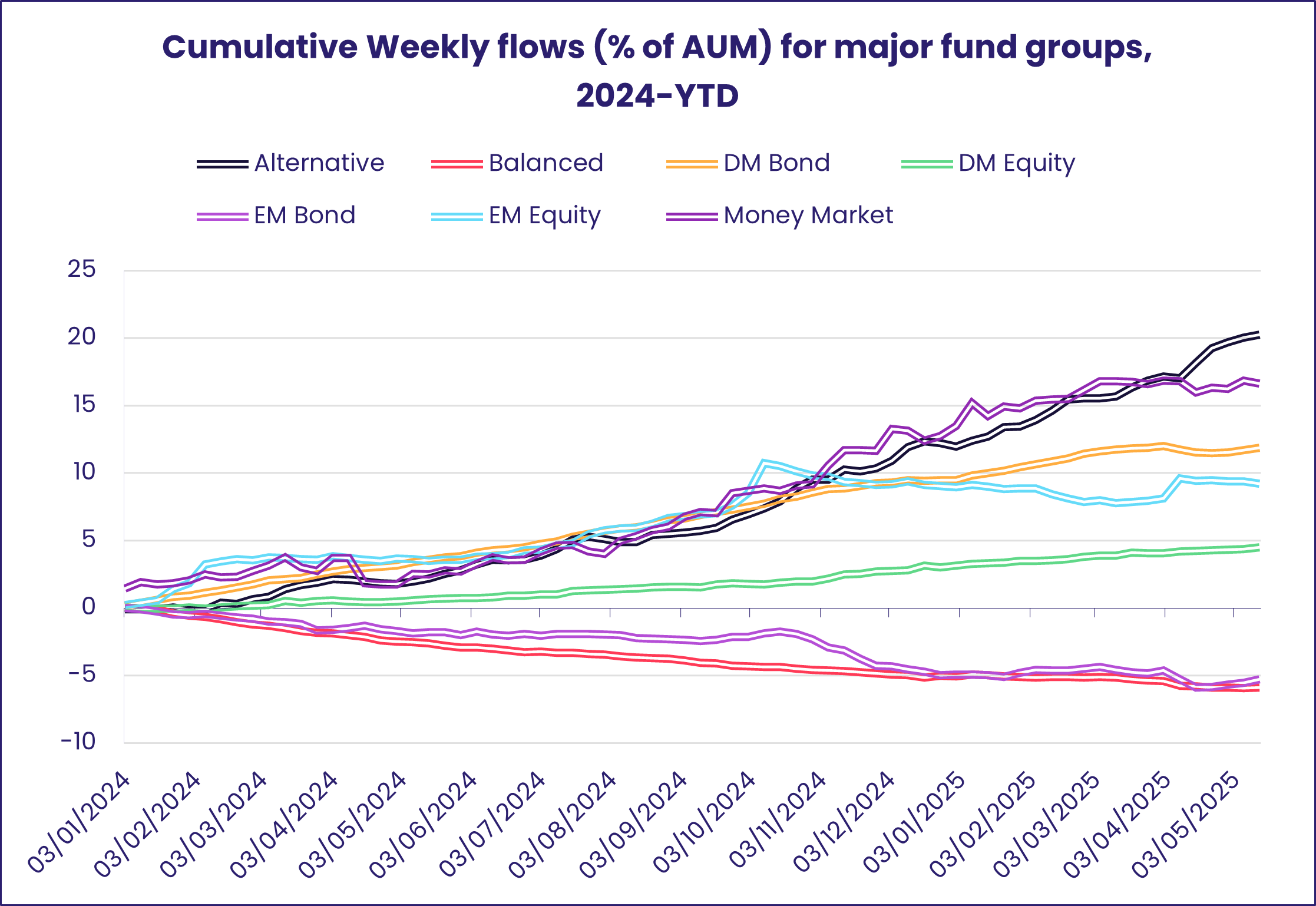

Overall, the week ending May 14 saw a net $25 billion flow into all EPFR-tracked Equity Funds while Balanced Funds absorbed $1.2 billion, Alternative Funds $1.7 billion and Bond Funds $13.6 billion. Money Market Funds experienced net redemptions totaling $17 .5 billion, with diversified Europe-mandates funds the biggest contributor to that headline number.

At the single country fund and asset class levels, Romania Bond Funds posted their biggest outflow since 2Q22, Brazil Bond Funds extended their longest inflow streak since mid-2Q24 and Thailand Equity Funds extended a run of redemptions that stretches back to the beginning of last year. Bank Loan Funds saw flows rebound to a 12-week high, Bear Funds took in fresh money for the fifth week running and Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded a fourth straight inflow for the first time since late 3Q24.

Emerging Markets Equity Funds

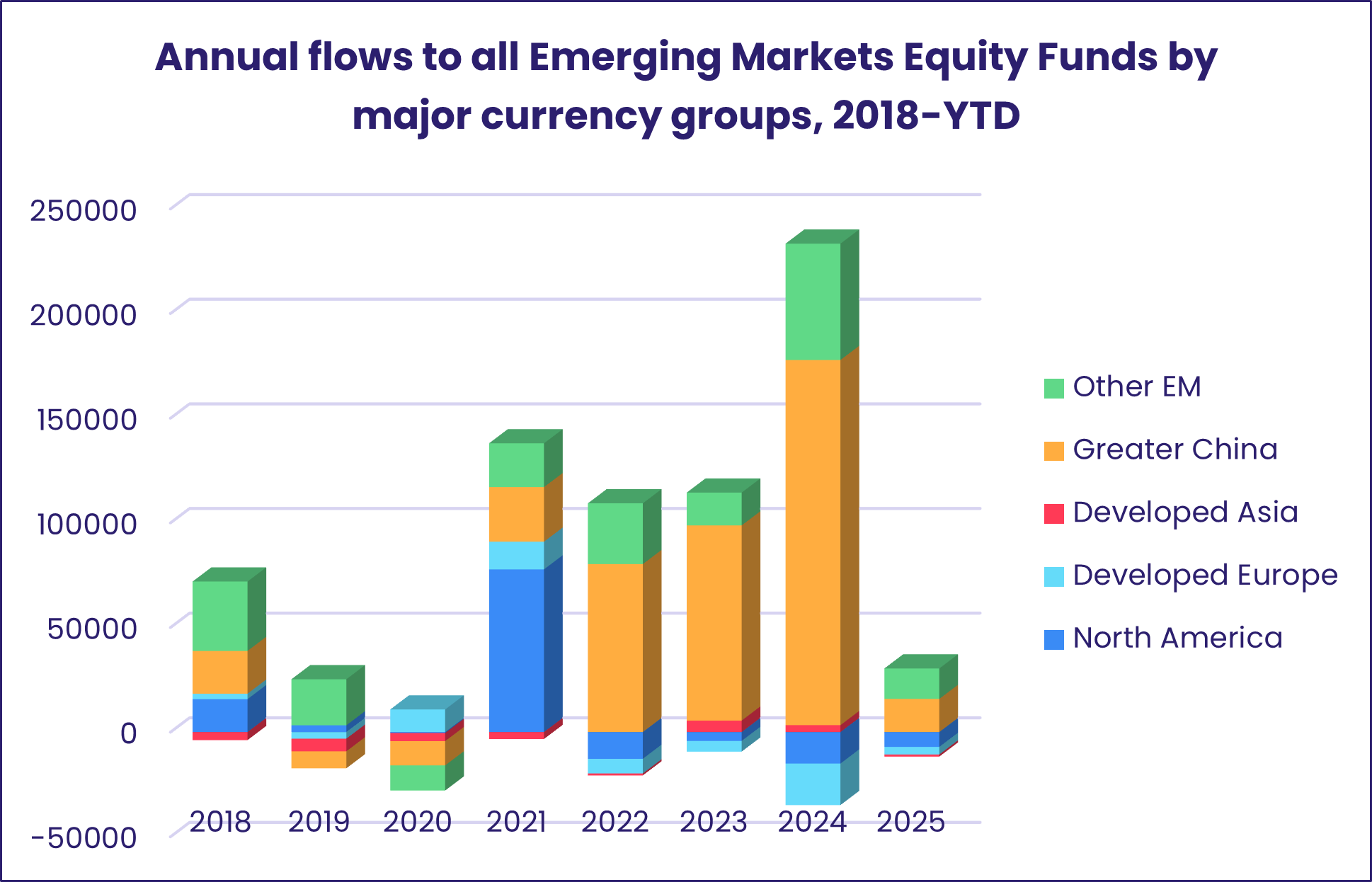

Investors continued warming to Latin America Equity Funds during the second week of May. But they capped Global Emerging Markets (GEM) Equity Funds’ latest inflow streak at three weeks, pulled another $3.3 billion out of funds dedicated to mainland China and hit EMEA Equity Funds with their biggest outflow since mid-April. Retail share classes suffered another week of net redemptions and EM Dividend Funds posted their biggest outflow in over seven months. The upshot was a third straight collective outflow for all EPFR-tracked Emerging Markets Equity Funds.

Utilizing EPFR’s currency filters, the strongest support for this fund group so far this year is coming from investors based in emerging markets. Flows in North American, Developed European and Developed Asian currencies have been negative.

Latin America Equity Funds absorbed fresh money for the third week running, with the latest week’s total being the largest since 3Q23. Argentina Equity Funds recorded their second biggest inflow year-to-date and Brazil Equity Funds their biggest inflow in over 18 months. Expectations that Brazilian interest rates are close to peaking, that next year’s election will open the door to more business-friendly economic policymaking and that investors will continue to diversify out of US assets recently propelled Brazil’s benchmark equities index to a new record high.

The forecasts for inflation, interest rate and positive political change are less bullish for key EMEA markets. The latest week saw redemptions from Russia Equity Funds climb to a 33-week high, Turkey Equity Funds tally their fourth outflow over the past five weeks and South Africa Funds post their second largest outflow since the beginning of 4Q24.

When it came to the major Asian markets, investors opted to ignore China’s latest stimulus measures, the risk that India’s standoff with Pakistan will morph into a more serious conflict and the prospect that Korea’s June 3 snap election will draw a line under recent domestic volatility. Despite a second consecutive week of flows into overseas domiciled funds, China Equity Funds posted their third consecutive outflow while India Equity Funds recorded their fifth straight inflow and Korea Equity Funds posted consecutive weekly outflows for the first time since mid-March.

Developed Markets Equity Funds

EPFR-tracked Developed Markets Equity carried a seven-week run of inflows into the second half of May as US Equity Funds attracted fresh money for the first time since the first week of April and investors steered a combined $8.7 billion into Global, Europe and Japan Equity Funds. A scaling back of the new US administration’s tariff plans soothed markets, which also started to price in further rate cuts in American and European interest rates.

Flows into US Equity Funds during the week ending May 14 included the first weekly inflow for Small Cap Equity Funds since late January and the biggest since mid-December. Foreign domiciled funds recorded their fifth straight inflow and US Dividend Equity Funds their seventh but retail share classes extended an outflow streak stretching back over three months.

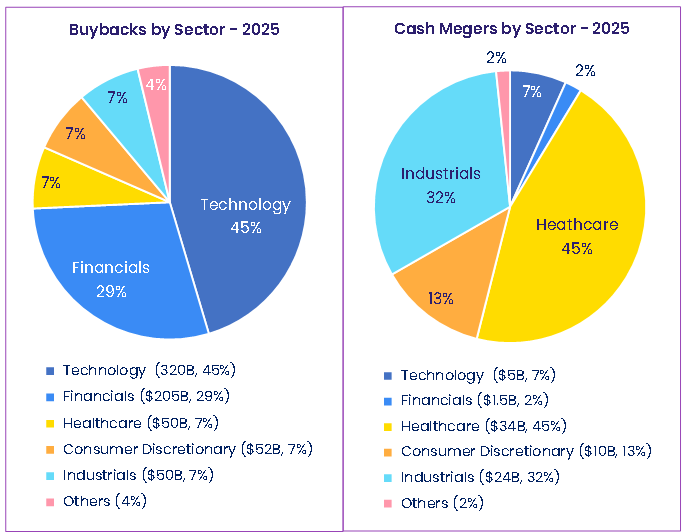

Research by Winston Chua, EPFR’s senior liquidity analysts, suggest that US corporate share buybacks are making a run at another full-year record. In a recent report, he noted that, “announced corporate buying (new cash takeovers + new stock buybacks) has soared to $785 billion year-to-date, down 5% from the same period a year ago. Stock buybacks have accounted for 90% of the total, the largest percentage in two decades.”

Leading the buyback charge are technology firms. “Tech firms alone have constituted 45% of all buybacks ($310 billion) across 120 companies — an average of $2.6 billion per company (the largest dollar volume per company in history),” says Chua. “This year’s buyback activity is not only outsized in magnitude but also in concentration —Tech’s 45% share is the highest for any sector since 2005.”

Investors steered fresh money into Japan Equity Funds for the 11th time over the past 12 weeks. Flows into funds managed for value climbed to a 68-week high while Japan Growth Funds posted their biggest inflow since the first week of March. Japan-mandated Leveraged and Bear Funds saw flows head in opposite directions, with redemptions from the former hitting a 14-week high and Japan Bear Funds racking up their biggest inflow since the third week of 2024.

Europe Equity Funds recorded another solid inflow that was driven by diversified rather than single country funds and was restrained by the biggest outflow from UK Equity Funds since mid-March. The rearmament and fiscal accommodation stories that have supported recent inflows came into sharper focus during the latest week as Germany’s new government unveiled a $1.1 trillion plan for new weapons and infrastructure over the next decade.

The largest of the diversified Developed Markets Equity Funds groups, Global Equity Funds, pulled in another $5.2 billion. Flows were evenly divided between Global ex-US Funds and those with fully global mandates.

Global sector, Industry and Precious Metals Funds

With many companies couching their earnings forecasts, or not giving them at all, in the face of rapidly shifting US trade policies, sector oriented investors continued to feel their way in mid-May. But the number of the 11 major EPFR-tracked groups recording inflows crept up again to six, the highest number since the first week of March.

Inflows during the latest week ranged from $1 million for Telecoms Sector Funds to $1 billion for Financial Sectors Funds while Energy Sector Funds experienced the heaviest redemptions.

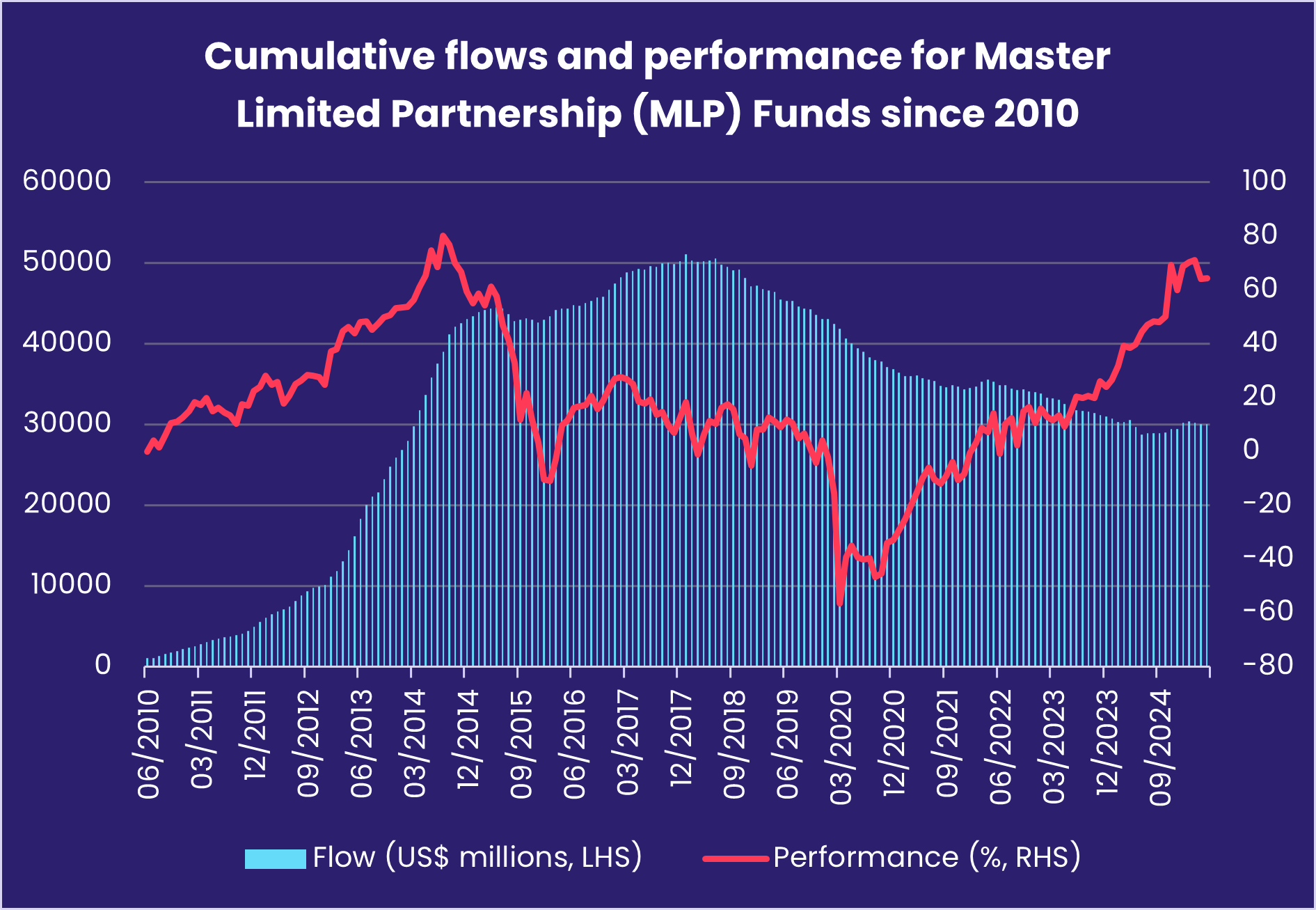

Among the subgroups hit by the cooling sentiment towards energy plays, driven in part by Saudi Arabia’s plans to keep a lid on oil prices by pumping more crude, were Master Limited Partnership (MLP) Funds. Immensely popular between 2012 and 2018, these funds invest in a tax advantaged vehicle for funding US mid-stream assets such as pipelines and tank farms. The latest week saw outflows hit their highest level since mid-December.

Industrial Sector Funds continue to enjoy a tailwind from expectations of higher military spending by Europe and Japan. The overall group chalked up its fifth straight inflow and 22nd since the beginning of November. Drilling down, flows into Aerospace and Defense Funds climbed to an eight-week high.

Investors are also gravitating to Infrastructure Sector Funds, which posted their third straight inflow and biggest since mid-February. The asset class appeals to investors looking for businesses that own and operate assets that have pricing power during uncertain, inflationary periods.

Bond and other Fixed Income Funds

Risk, both credit and duration, for reward continued to regain its appeal for fixed income investors during the second week of May as EPFR-tracked Bond Funds saw year-to-date inflows push back over the $170 billion mark.

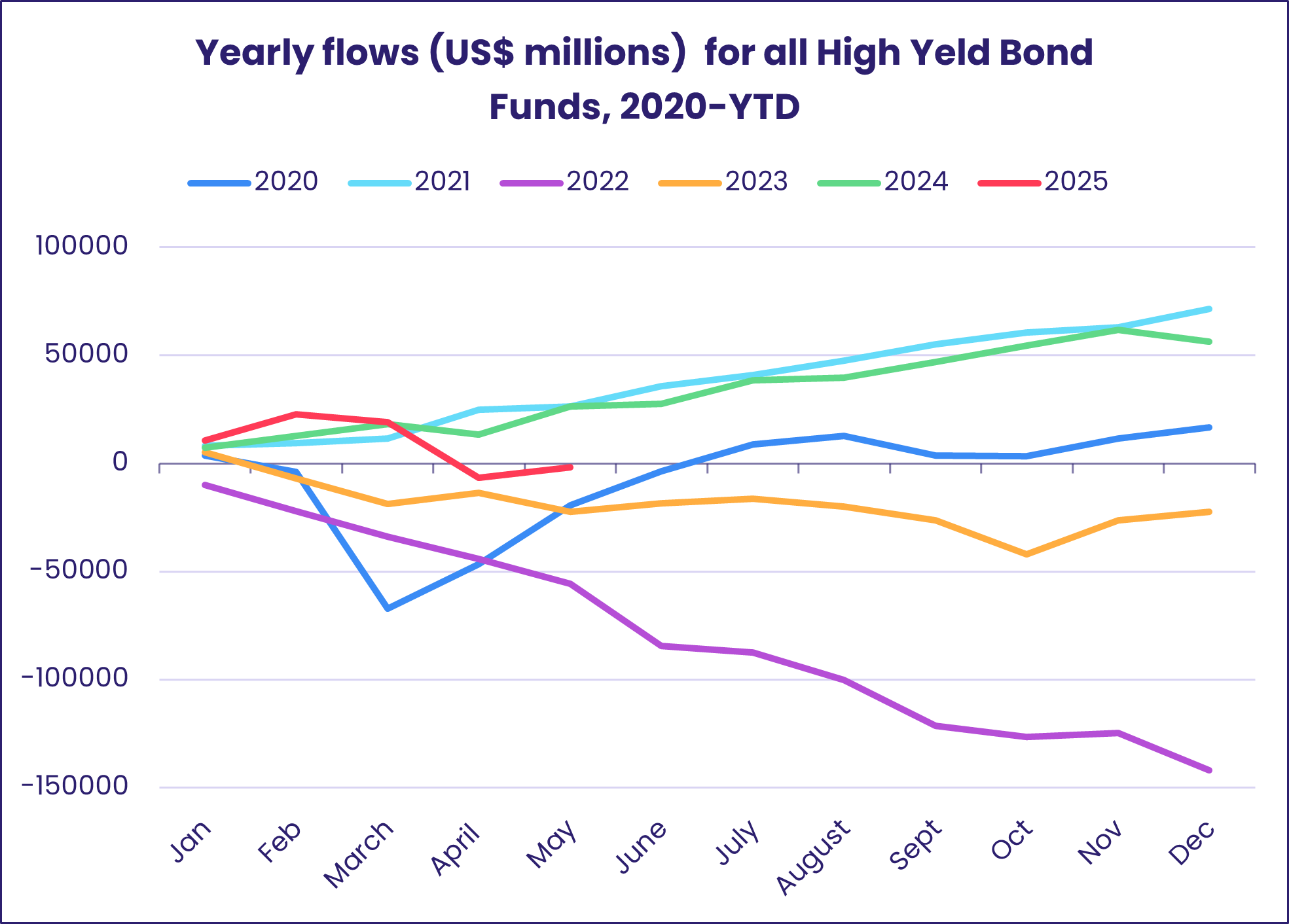

Flows into Long Term Bond Funds climbed to a seven-week high while Short Term Bond Funds recorded their biggest outflow since mid-December. At the geographic and asset class levels, High Yield Bond Funds posted their biggest weekly inflow in 10 months and Emerging Markets Bond Funds in more than two years.

Flows for the big groups by geographic focus followed the previous week’s pattern, with Asia Pacific Bond Funds again the only one to tally an outflow. Canada and US Bond Funds both recorded their third consecutive inflows, Europe Bond Funds their fourth in a row while Global Bond Funds chalked up their biggest inflow since mid-3Q24.

China Bond Funds were a major driver of the headline number for all Emerging Markets Bond Funds as they extended their longest inflow streak since 3Q21. Flows to domestically domiciled China Bond Funds hit a record high. Overall, flows to all EM Corporate Bond Funds were the biggest in over four years, funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their largest inflow since late February and redemptions from Sharia Bond Funds jumped to a 76-week high.

While the prospect of looser fiscal policy has accelerated flows into Germany Equity Funds, it has had the opposite effect on Germany Bond Funds. The latest week saw redemptions from the latter come in at a 46-week high. But flows to regional groups allowed Europe Bond Funds collectively to post another solid inflow that went, by a nearly 3-to-1 margin, to funds with corporate debt mandates.

Among US Bond Fund asset class groups, flows into Bank Loan, Total Return and High Yield Funds came in at 12, 13 and 43-week highs, respectively. But foreign domiciled US Bond Funds posted their fifth outflow during the past six weeks.

Did you find this useful? Get our EPFR Insights delivered to your inbox.