The second quarter kicked off with US President Donald Trump mapping out a path to ‘liberation’ built on the foundation of higher tariffs for nearly all of America’s trading partners. Investors responded by pivoting towards the relative safety of gold, dividend paying stocks and gold while trimming their expectations for future economic growth and rotating (modestly) out of US equities and riskier fixed income asset classes.

Coming into April, EPFR-tracked Physical Gold Funds extended their longest inflow streak since 1Q22, flows into US and Europe Money Market Funds hit four and eight-week highs, respectively, and Dividend Equity Funds recorded their 11th inflow during the past 14 weeks. Meanwhile, US Equity Funds tallied consecutive weekly outflows for the first time in over six months, Energy Sector Funds posted their 12th outflow year to date and investors pulled money out of High Yield Bond Funds for the third time during the past month.

Expectations of a weaker dollar did give Emerging Markets Bond Funds a boost despite another tough week for Turkey-mandated funds, and Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates snapped their longest redemption streak since 4Q24.

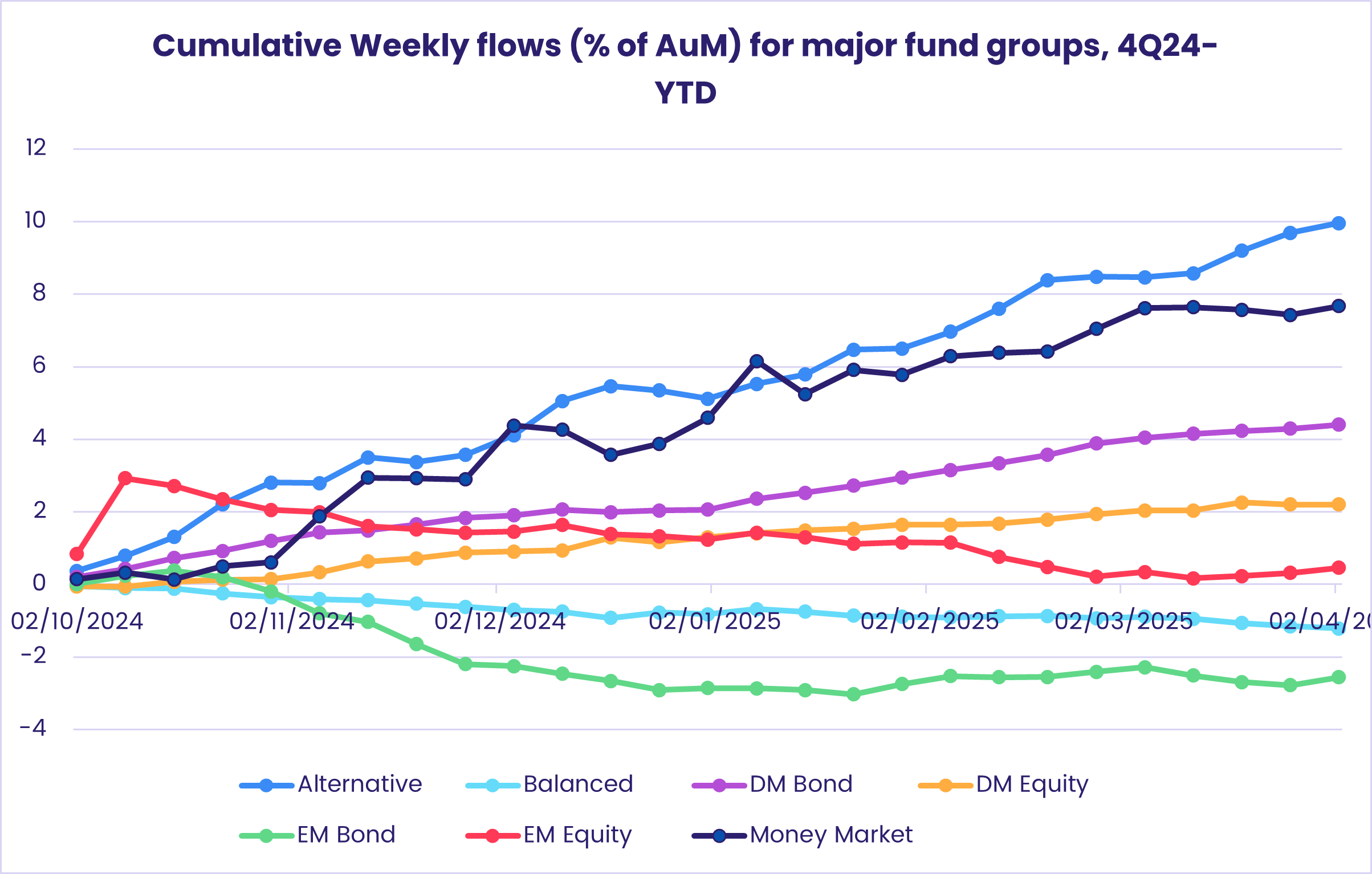

Overall, the week ending April 2 saw all EPFR-tracked Equity Funds post a collective inflow of $2.1 billion. Investors steered $2 billion into Alternative Funds, $9.3 billion into Bond Funds and $22.5 billion into Money Market Funds.

At the asset class and single country fund levels, Cryptocurrency Funds chalked up their sixth outflow since early February, Inflation Protected Bond Funds attracted fresh money for the 12th straight week and flows into ESG Funds with SFDR Article 8 mandates climbed to a seven-week high. Turkey Money Market Funds saw another $9.9 billion flow out, redemptions from New Zealand Equity Funds hit a level last seen in 3Q21 and Thailand Equity Funds extended an outflow streak stretching back to early 1Q24.

Emerging Markets Equity Funds

EPFR-tracked Emerging Markets Equity Funds started April with their third straight inflow as investors, digesting the announcement of sweeping US tariff hikes, stepped up their investment in the Greater China theme and extended EMEA Equity Funds longest inflow streak since 1Q17.

Retail money continues to bypass this fund group and redemptions from EM Bear Funds hit a 34-week high. But Emerging Markets Dividend Funds recorded their biggest inflow in more than three months and flows into EM Leveraged Equity Funds climbed to their highest level in nearly six months.

Among the Asia ex-Japan Country Fund groups, Indonesia Equity Funds added to their longest run of inflows since 1Q12, India Equity Funds recorded consecutive weekly inflows for the first time in over five months, Korea Equity Funds chalked up their largest inflow since mid-2Q24 and flows into China Equity Funds topped $1 billion for only the fourth time so far this year.

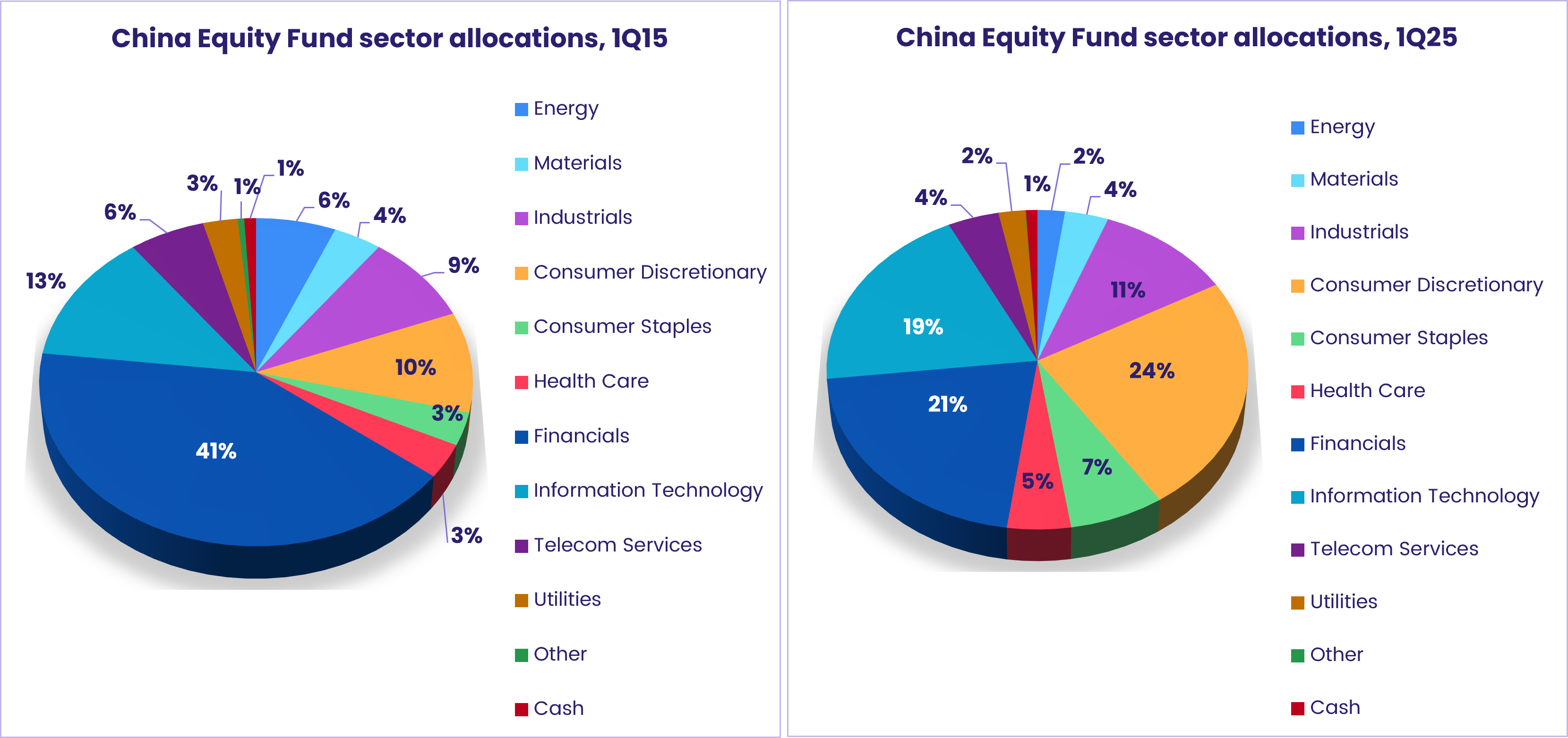

Investor sentiment towards China currently hinges, to a large degree, on perceptions of domestic demand and its capacity to offset any trade shocks stemming from the latest round of US tariffs. Managers of China Equity Funds appear optimistic: the latest sector allocations data shows those funds are, on average, allocating nearly a third of their portfolios to the consumer discretionary and consumer staples sectors compared to just 13% a decade ago.

The latest flows into EMEA Equity Funds were underpinned by another solid week for Turkey Equity Funds. For the second week running, investors dumped Turkish bonds and liquidity funds but opted to buy the dip in Turkish stock markets triggered by the arrest of opposition politician Ekrem Imamoglu.

Although Argentina Equity Funds continue to surrender a portion of the money that flowed in between mid-September and mid-February, when the AUM of this group trebled, Latin America Equity Funds overall posted an inflow on the back of fresh money flowing to Brazil and Mexico-mandated funds.

Developed Markets Equity Funds

The week ending April 2 saw EPFR-tracked Developed Markets Equity Funds post back-to-back outflows for the first time since early October as investors scrambled to reposition themselves ahead of US President Donald Trump’s latest salvo of tariff hikes. US Equity Funds accounted for the bulk of the redemptions, narrowly offsetting flows into Europe, Global, Japan and Australia Equity Funds.

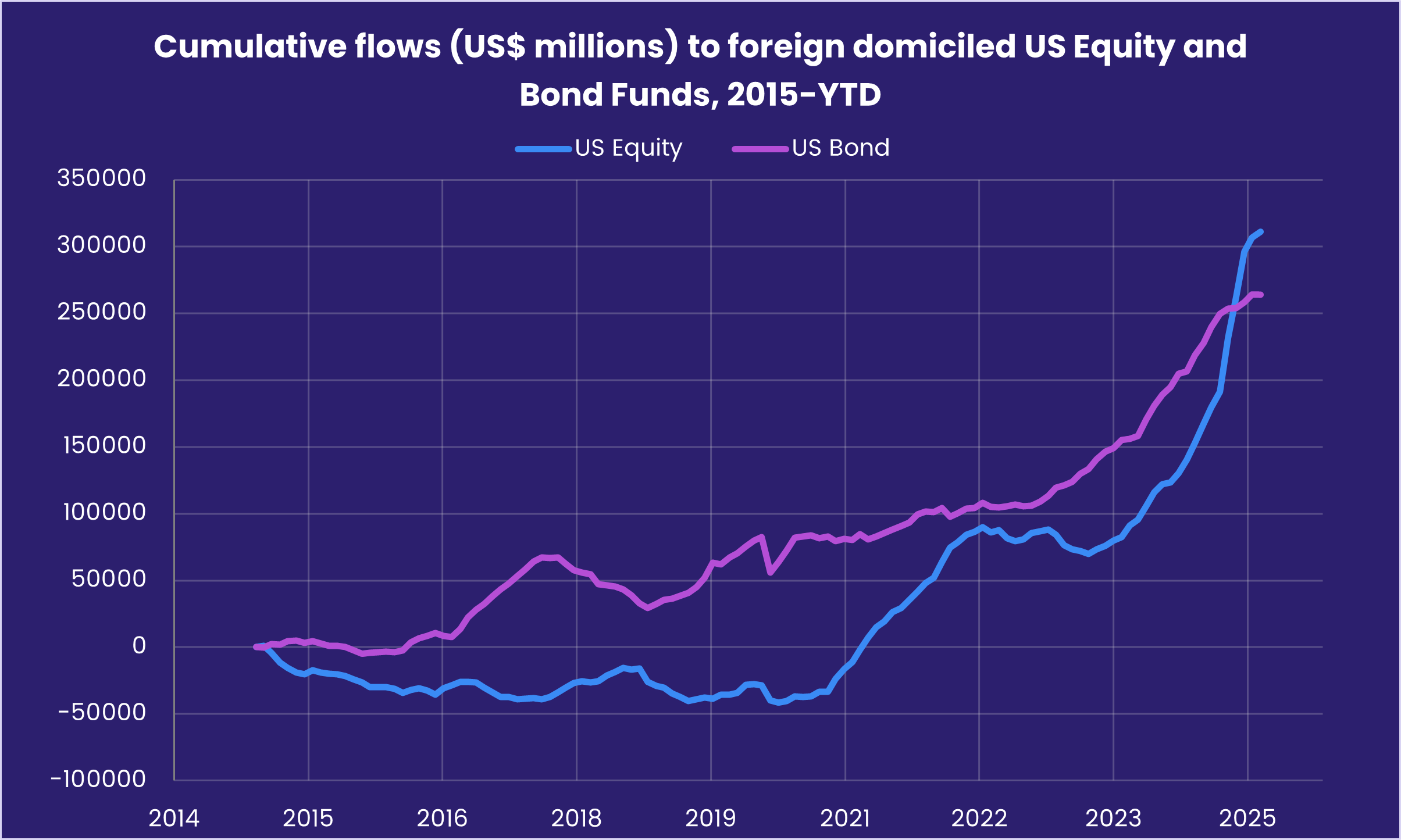

Among the US Equity Fund groups, Mid Cap Value and Small Cap Blend Funds took the biggest hits, while Large Cap Growth, Large Cap Blend and Mid Cap Blend Funds posted small inflows. But overseas support held up, with foreign domiciled US Equity Funds chalking up their 23rd inflow since the beginning of October and their biggest since late January.

Fresh money flowed into Europe Equity Funds for the eighth consecutive week, the longest such run in over three years, with investors again favoring funds tied to core European Union markets as the pulled a combined $1.2 billion out of Switzerland and UK Equity Funds. But the headline number was the smallest since the current run began as investors weighed the impact of new US tariffs on European exporters.

Japan and Australia Equity Funds benefited from the perception that the region has enough combined economic heft to blunt the impact of the latest US policies. In the case of Japan, hefty wage increases suggest that domestic demand will enjoy additional support this year. Retail share classes have recorded a collective inflow four of the past six weeks, and flows into foreign domiciled Japan Equity Funds jumped to a nine-week high.

Global Equity Funds, the largest of the diversified Developed Markets Equity Funds groups, recorded another inflow that favored funds with fully global mandates over their ex-US counterparts.

Global sector, Industry and Precious Metals Funds

On the eve of the 1Q25 corporate earnings season, forecasts for the average year-on-year earnings growth among the S&P 500 companies are running between 6% and 7.5%. But looking back to the quarter just ended may be superseded by the need to look forward as companies scramble to navigate a business landscape reshaped by US tariffs.

During the latest week, flows favored funds offering exposure to precious metals, European rearmament, Chinese technology and diversified utilities. Five of the 11 major EPFR-tracked Sector Fund groups recorded inflows while six posted collective outflows ranging from $8 million to $951 million.

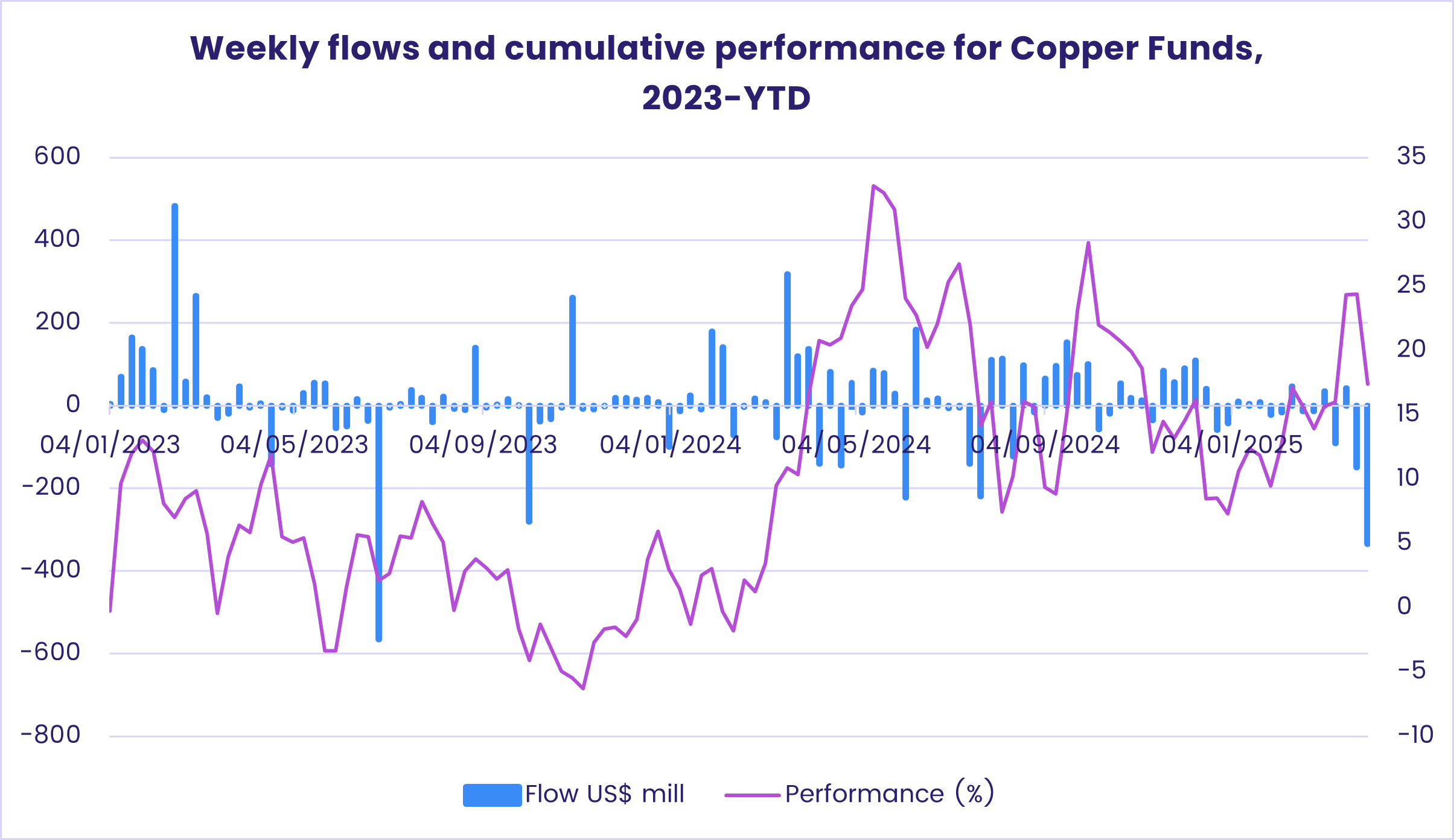

Among the groups posting an inflow were Commodities Sector Funds, whose headline number was the biggest since mid-November. Of the 10 individual funds ranking by inflows for the week, seven has gold or other precious metals mandates. Investors showed far less interest in more prosaic commodities, with Copper Funds chalking up their biggest outflow since 3Q23.

Technology Sector Funds were one of two groups to pull in over $1 billion during the week ending April 2. China and Hong Kong-mandated funds accounted for three-quarters of the headline number and eight of the top 10 by inflows.

European industrial and defense funds were heavily represented among the top money magnets as Industrial Sector Funds added to their current inflow streak.

Bond and other Fixed Income Funds

Having ground lower for most of March, flows to EPFR-tracked Bond Funds picked up coming into April with the latest total more than double the previous week’s headline number. US, Europe, Canada and Emerging Markets Bond Funds attracted solid inflows that more than offset redemptions from Asia Pacific and Global Bond Funds.

At the asset class level, investors remain cautious. High Yield Bond Funds saw over $800 million redeemed, Bank Loan Funds extended their longest run of outflows since mid-3Q24 and Collateralized Loan Obligation (CLO) Funds posted consecutive weekly outflows for the first time in over 30 months.

Inflation Protected Bond Funds did extend their current inflow streak, but the latest total was the smallest since the second week of January. With many investors translating increased US tariffs into slower growth in both Europe and North America, major central banks are expected to step up the pace of their easing as growth replaces inflation as their primary concern.

If, as is now projected, the US Federal Reserve cuts interest rates three or four times this year, emerging markets debt will pick up a tailwind from more attractive rate differentials and better currency dynamics. Local Currency Emerging Markets Bond Funds posted their biggest inflow since 1Q21 as China Bond Funds took in over $1.5 billion.

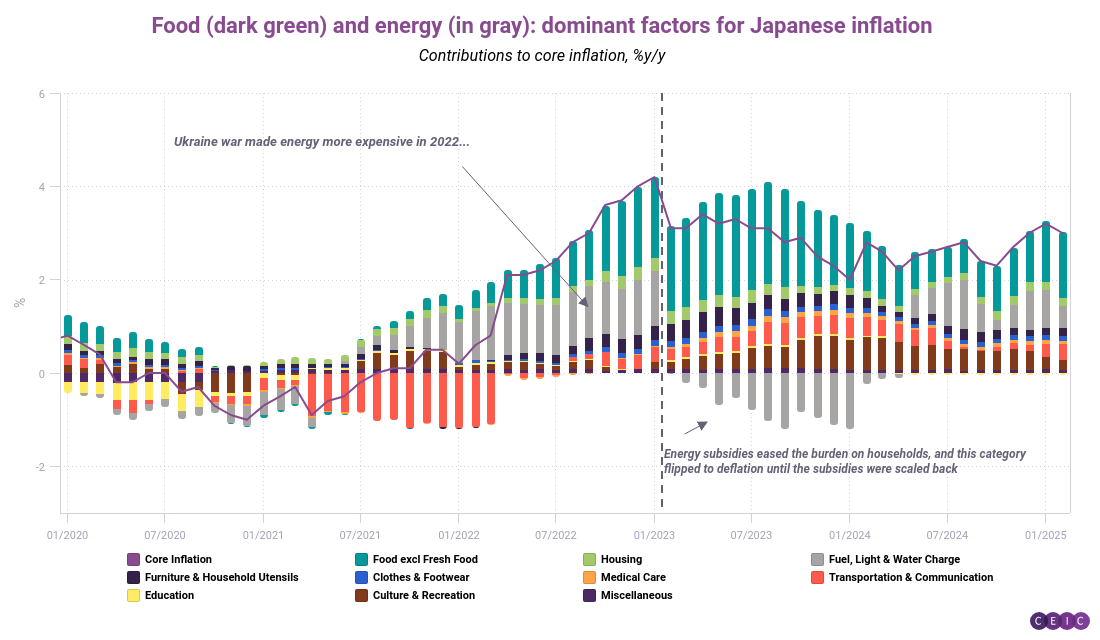

One market, Japan, continues to swim against the general tide with inflation and interest rates expected to climb higher on the back of rising wages and the removal to temporary food and fuel subsidies. Japan Bond Funds have posted significant outflows three of the past five weeks.

In a recent note to clients, EPFR’s sister company CEIC notes that, “sticky food and fuel-price pressures are raising doubts about expectations that cost-push inflation [will] ease …. prices for rice have been soaring in Japan since last summer, reaching a 71% annualized pace in January; prices for this key staple are expected to stay high for the rest of 2025.”

For the third week running, Europe Sovereign Bond Funds fared better – in flow terms – than their corporate counterparts, the first time that has happened since 2Q24. A single fund with an environmental, social and governance (ESG) mandate accounted for roughly half of the group’s overall total for the week.

Short Term Sovereign Bond Funds were the biggest contributors to the headline number for all US Bond Funds in early April. Year-to-date, US Bond Funds have absorbed a net $146 billion. During the first three months of 2024 they pulled in $166 billion.

The major multi-asset groups, Balanced and Total Return Bond Funds, continue to pull in opposite directions when it comes to flows. The former ended the first quarter with their ninth outflow of the year while Total Return Funds tallied their 12th consecutive inflow.

Did you find this useful? Get our EPFR Insights delivered to your inbox.