During WWII, civilians were constantly reminded that “loose lips sink ships.” In early 3Q24, it appeared that loose lips can also sink chips as Republican presidential candidate Donald Trump roiled already unsettled markets with his assertion that Taiwan (POC) should pay the US for the latter’s contribution to the island’s defense.

When combined with the uncertainty surrounding US President Joe Biden’s re-election bid, the attempted assassination of Trump on July 13, growing concerns about economic growth on both sides of the Atlantic and fears that Sino-US trade tensions are about to take another leg up, Trump’s remarks capped a tough week for several major indexes. America’s tech-heavy Nasdaq was down 3.5% during the latest reporting period, clocking up its biggest one-day drop since 2022 along the way, while the Nikkei-225 lost over 4%.

Mutual fund flows, however, suggested that investors are still sanguine about the recovery of China’s economy, the promise of artificial intelligence and the likelihood of lower US interest rates. During the week ending July 17, EPFR-tracked Technology Sector Funds pulled in over $2 billion and China Equity Funds over $3 billion, flows to US Bond Funds hit their highest weekly total since 2Q20 and Taiwan (POC) Equity Funds chalked up their 15th inflow over the past 16 weeks.

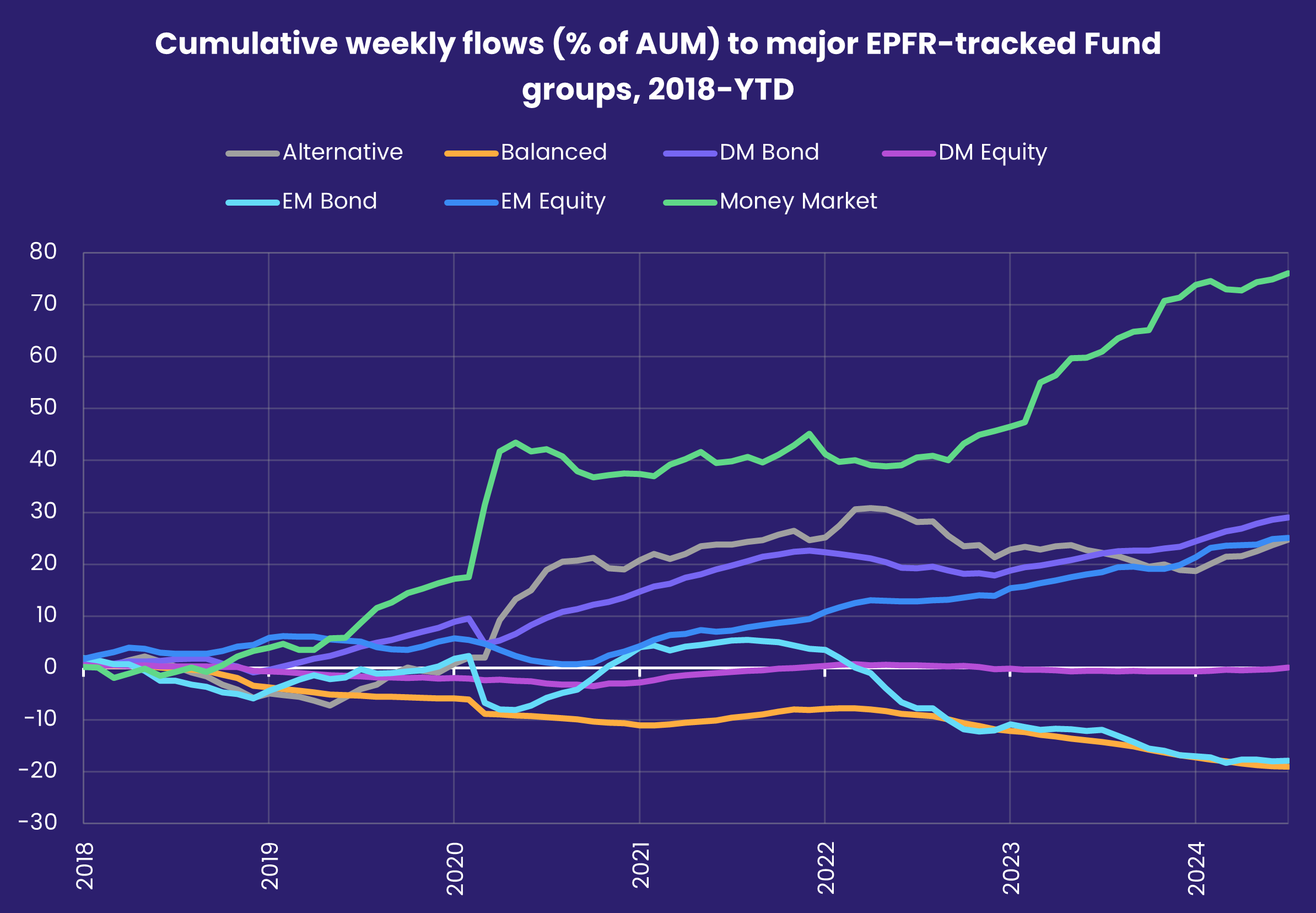

Overall, the week ending July 17 saw EPFR-tracked Equity Funds post their 18th consecutive inflow – and their biggest since the second week of March – while $4 billion flowed into Alternative Funds, $4.6 billion into Money Market Funds and $21.6 billion into Bond Funds.

At the single country and asset class fund level, Romania Equity Funds took in fresh money for the 37th straight week, Austria Equity Funds chalked up the 27th outflow year-to-date and flows into Vietnam Bond Funds climbed to a 16-week high. Cryptocurrency and Physical Gold Funds recorded their biggest inflows since mid-March and early 2Q22, respectively, while redemptions from Currency Funds hit a year-to-date high.

Emerging Markets Equity Funds

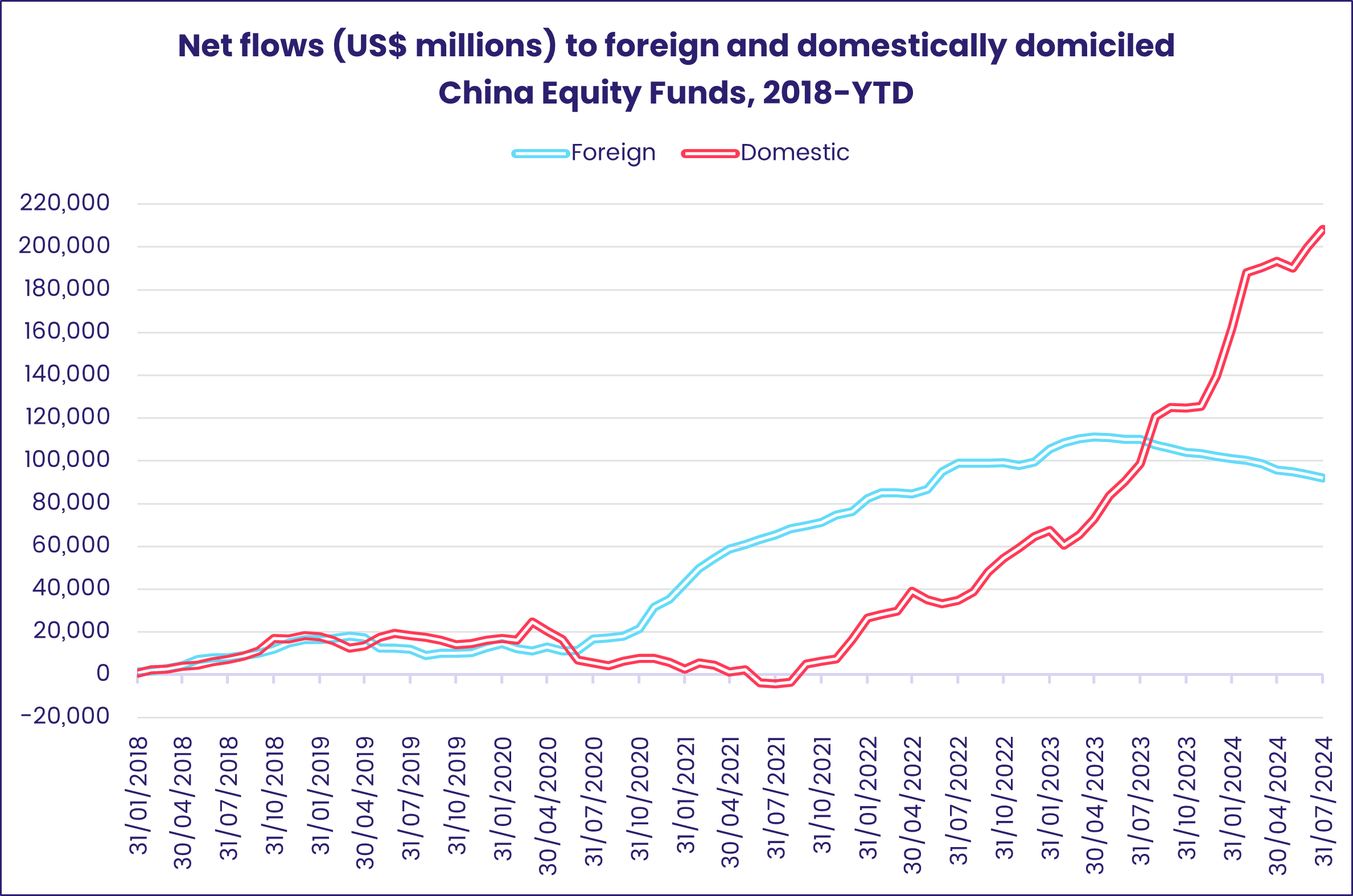

A surge of fresh money into China Equity Funds during the final day of the reporting period lifted EPFR-tracked Emerging Markets Equity Funds to their seventh consecutive inflow going into the second half of July. The flows into Asia ex-Japan Equity Fund groups offset further redemptions from Latin America and the diversified Global Emerging Markets (GEM) Funds.

The latest week also saw the first inflow of the current quarter for retail share classes, the end of Frontier Markets Equity Funds eight-week outflow streak and a seventh straight inflow for EM Dividend Funds.

The more than $3 billion that flowed into China Equity Funds arrived ahead of the conclusion of the Chinese Communist Party’s latest policy plenum. The official summation of the three-day meeting acknowledged the economic challenges faced by China but did not give investors any assurance that the policy shifts they are hoping for – stimulating consumer demand, supporting the property sector and encouraging private enterprise – are going to be fast-tracked.

Investors also steered over $800 million into Taiwan (POC) Equity Funds as a positive earnings report from global technology bellwether Taiwan Semiconductor (TSMC) buffered, at least for now, remarks by US presidential candidate Donald Trump about America’s willingness to protect the island.

Latin America Equity Funds continue to struggle in the face of uncertainty about Chinese demand for their commodity exports, still high US interest rates and fears that Sino-US trade tensions will intensify. Brazil Equity Funds posted their fifth largest outflow so far this year and Mexico Equity Funds recorded their fourth consecutive outflow. Actively managed GEM Equity Funds remain overweight both Brazil and Mexico, but that overweight has shrunk in recent months.

The latest headline number for all EMEA Equity Funds was the biggest in over 15 months. It was underpinned by the over $100 million committed to Saudi Arabia Equity Funds and the extension of South Africa Equity Funds longest inflow streak since 3Q23. In the case of the flows to Saudi Arabia-mandated funds, a Hong Kong-domiciled fund accounted for the bulk of the latest inflows.

Developed Markets Equity Funds

While commentators fret that the political center in the US may not hold, that scenario was playing out with US Equity Fund flows during the week ending July 17. While more than $40 billion was committed to this group, US Mid Cap Funds posted a small outflow as US Large Cap Funds absorbed some $27 billion and US Small Cap Funds recorded their biggest inflow since late 2Q07.

The flows into US Equity Funds and, to a lesser extent, Global and Japan Equity Funds helped EPFR-tracked Developed Markets Equity Funds extend their longest run of inflows since 2021.

Despite the impressive headline number, US Equity Fund retail share classes posted their 28th outflow of the year so far and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their fourth outflow over the past five weeks. There has also been an easing of corporate support for their own share prices: the buy/sell ratio, which peaked at 11.5-to-1 in 2022, has fallen below 5-to-1.

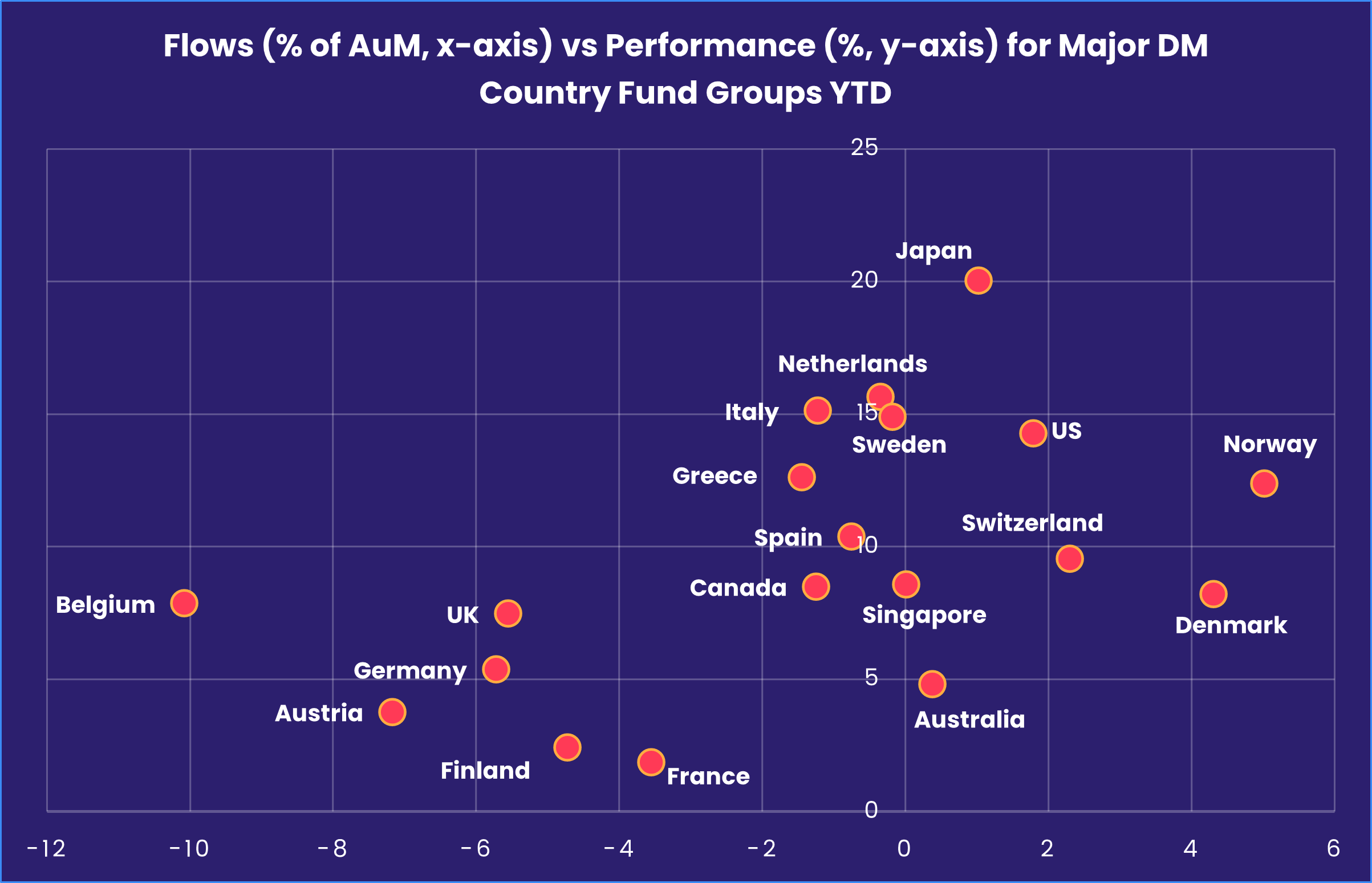

With the dust still settling from general elections in France and the UK, more weak manufacturing data from Germany and the European Central Bank keeping rates on hold at its latest policy meeting, investors pulled more money out of Europe Equity Funds. At the country level, France Equity Funds extended their longest inflow streak since 3Q20 and redemptions from Greece Equity Funds climbed to a 13-week high.

Japan Equity Funds posted only their second inflow during the past 10 weeks as the yen’s persistent weakness versus the US dollar raises questions about the durability of the domestic consumption that Japanese policymakers have worked so hard to stoke. The Bank of Japan meets at the end of the month and may take steps to bolster the purchasing power of the yen.

Investors steered fresh money into Global Equity Funds for the 12th week running. Funds with fully global mandates attracted more money than their ex-US counterparts for the 10th time in the past 12 weeks.

Global sector, Industry and Precious Metals Funds

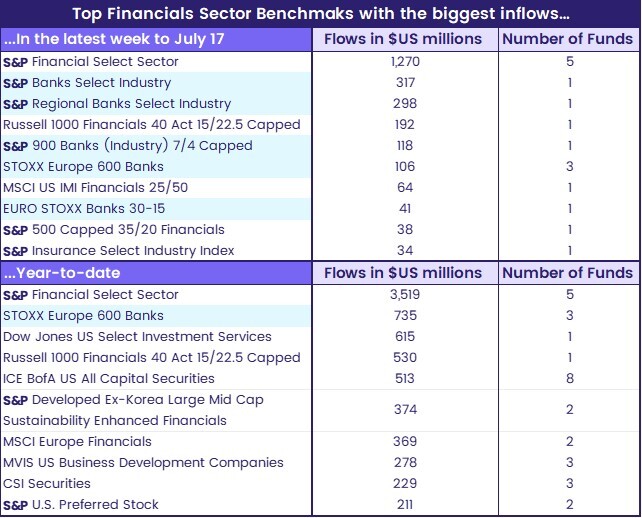

The second quarter corporate earnings season kicked off during the third week of July, starting with reports from bulge-bracket and regional banks and followed by Netflix and Tesla at the end of the week. Investors responded optimistically to the mixed results that were delivered, steering fresh money into nine of the 11 major EPFR-tracked Sector Fund groups. The last time the inflow-to-outflow ratio reached that high was exactly a year ago.

Last year, investors shied away from infrastructure and real estate plays during the first weeks of the US corporate earnings season kicking off. This year, investors bailed out of Telecoms and Healthcare/Biotechnology Sector Funds, with the latter seeing their four-week outflow streak surpass $1 billion total. The usual suspects – Financials, Industrials, and Technology Sector Funds – racked up inflows ranging from $1.28 billion to $2.41 billion.

Financials Sector Funds pulled in a 33-week high of $1.28 billion as major bellwether banks – Bank of America, JPM, Citi, Wells Fargo – started the earnings seasons on a high note by meeting or topping expectations. Six of the top 10 funds with the biggest inflows had ties to an S&P financials benchmark, collectively pulling in over $2 billion, though a single fund accounted for over 60% of that. US Bank Funds enjoyed their biggest inflows year-to-date but appetite for Regional Bank Funds was more subdued.

Positive remarks in bank earnings reports about the outlook for the commercial real estate market also helped Real Estate Sector Funds snap their three-week outflow streak.

Investors ended Industrials Sector Funds’ longest outflow streak since mid-4Q23 at three weeks and $732 million with the group’s biggest inflow since mid-2020, a purely institutional story. Again, the headline number was dominated by a single US-domiciled ETF benchmarked to the S&P.

The inflows for Technology Sector Funds were more broadly spread across the top 10 funds pulling in money, Leveraged 3x Technology Sector ETFs have now recorded inflows three of the past four weeks, and overall flows to all Leverage Tech ETFs so far this year stand at $4.8 billion, nearly half of the 2022’s record total.

During the latest week, the price of gold surpassed the previous record high, set in May, of $2,450 per ounce. Flows into EPFR-tracked Gold Funds climbed to $1.74 billion, the largest since early 2Q22, as the group extended its four-week inflow streak. Silver Funds also posted their fifth inflow of the past six weeks.

Bond and other Fixed Income Funds

The week ending July 17 saw year-to-date flows into EPFR-tracked Bond Funds exceed last year’s total and hit 57% of the full-year inflow record set in 2021. For the second week running, all of the major groups by geographic mandate posted inflows that ranged from $60 million for Global Bond Funds to $17.7 billion for US Bond Funds.

At the asset class level, risk appetite continues to run hot, with flows into High Yield Bond Funds jumping to a 36-week high, Mortgage-Backed Bond Funds extending their 29-week inflow streak that now totals $20.5 billion and CDO Funds posting their second-largest weekly inflow since EPFR started tracking them in mid-2018.

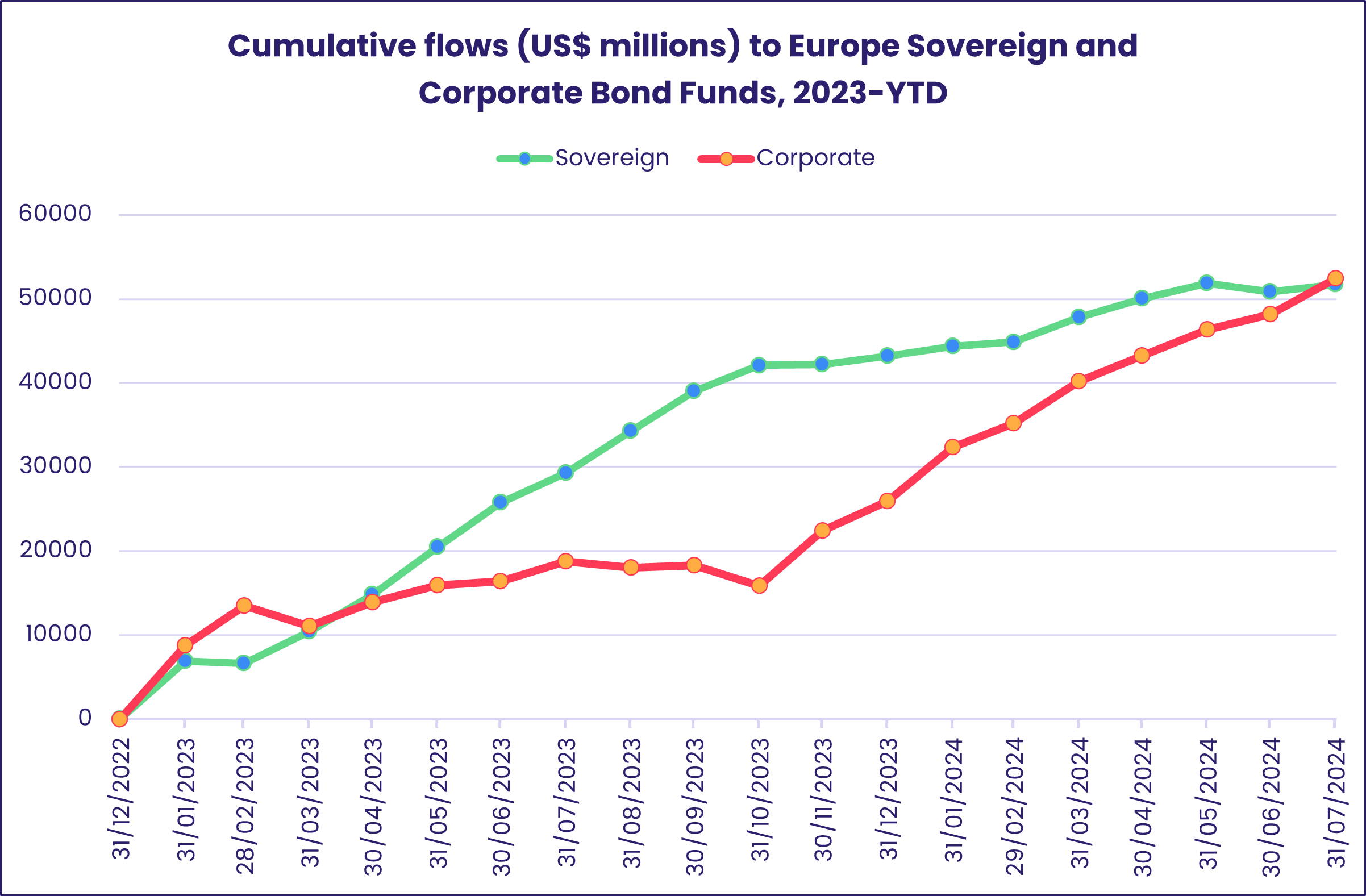

Flows to Europe Bond Funds again favored funds with corporate mandates as investors wait to see what kind of government emerges in France and what that will mean for the country’s already high fiscal deficit. UK Bond Funds were a major exception, with Sovereign Funds shading their corporate counterparts as overall flows climbed to an eight-week high.

US Bond Funds benefited from the perception that Federal Reserve policymakers could start cutting rates by the end of the quarter, with the latest inflow the biggest since June 2020. US bonds are also getting significant support from Global Bond Funds, which have taken in fresh money for 17 straight weeks. Although down nearly 9% from its peak in 4Q21, the average Global Bond Fund allocation to the US is still north of 40%.

Emerging Markets Bond Funds posted a modest inflow as funds with hard and mixed currency mandates offset redemptions from EM Local Currency Funds. Japan-domiciled funds posted their biggest collective outflow since early 2Q18

Did you find this useful? Get our EPFR Insights delivered to your inbox.