In mid-June investors got from the US Federal Reserve what they’d been hoping for since the beginning of the year: a pause in the Fed’s current rate-hiking cycle. Flows into US Equity Funds promptly surged to a 26-week high while US Money Market Funds recorded their second biggest outflow of the year.

The week ending June 14 also saw Technology Sector Funds pull in over $3 billion, Bank Loan Funds post consecutive weekly inflows for the first time in just over a year and flows into Emerging Markets Bond Funds climb to a seven-week high.

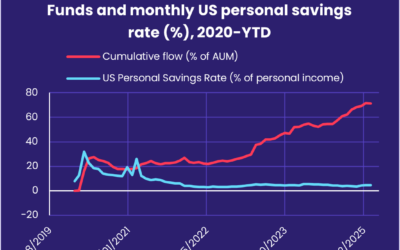

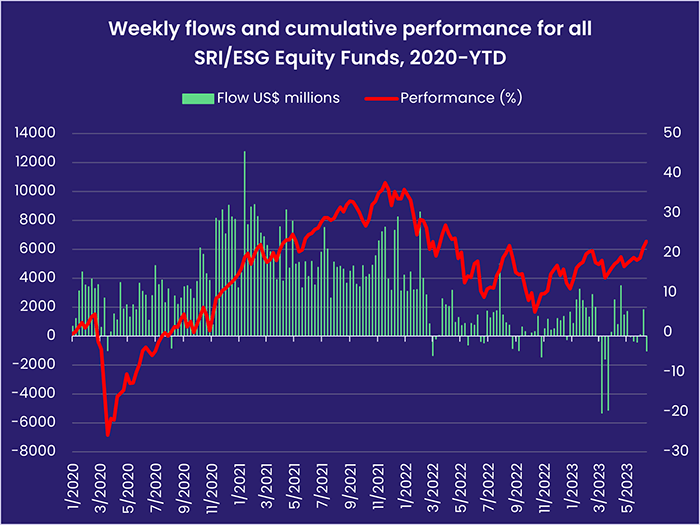

Not every boat was lifted by the rising tide of optimism that followed the Federal Open Markets Committee (FOMC) decision on June 13. Europe Equity Funds posted their 17th outflow in the past 20 weeks ahead of another rate hike by the European Central Bank (ECB) and Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates experienced net redemptions for the fourth time in the past six weeks. YTD flows into all SRI/ESG Equity Funds now stand at totaled $16 billion versus $45 billion for the same period in 2022 and $151 billion in 2021.

Overall, EPFR-tracked Equity Funds recorded a collective inflow of $22.3 billion during the second week of June while Alternative Funds attracted $303 million and Bond Funds $6.6 billion. Investors pulled $2.2 billion out of Balanced Funds and $37.8 billion from all Money Market Funds.

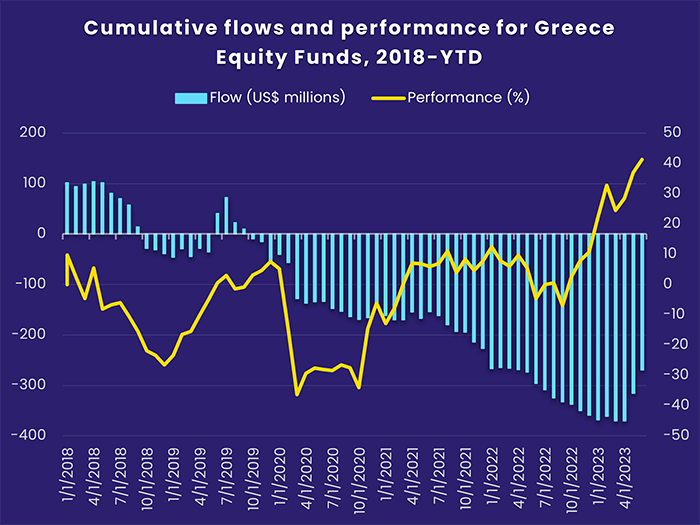

At the asset class and single country fund level, Inflation Protected Bond Funds absorbed fresh money for the 41st straight week, investors steered over $450 million into Mortgage-Backed Bond Funds and High Yield Bond Funds racked up their fifth outflow since early May. Flows into Italy Bond and Greece Equity Funds hit their highest level since 2Q21 and 2Q15 respectively while UK Equity Funds posted their 23rd consecutive outflow.

Emerging markets equity funds

China Equity Funds remain the locomotive dragging the headline flow number for all EPFR-tracked Emerging Markets Equity Funds into positive territory. During the second week of June, they absorbed another $1.8 billion, offsetting modest outflows from both EMEA and the diversified Global Emerging Markets (GEM) Equity Funds and more significant redemptions from Korea-dedicated funds.

Investors continue to favor ETFs, which took in more money than actively managed funds for the 10th week running, and collective redemptions from retail share classes hit their highest level since the second week of 4Q22.

The latest flows into China Equity Funds came as waning price pressures, high youth unemployment and below-consensus growth spurred China’s central bank to cut borrowing costs. The unemployment rate for people between 16 and 24 is running at 20% in urban areas and an estimated 11.5 million university graduates will join the workforce this summer.

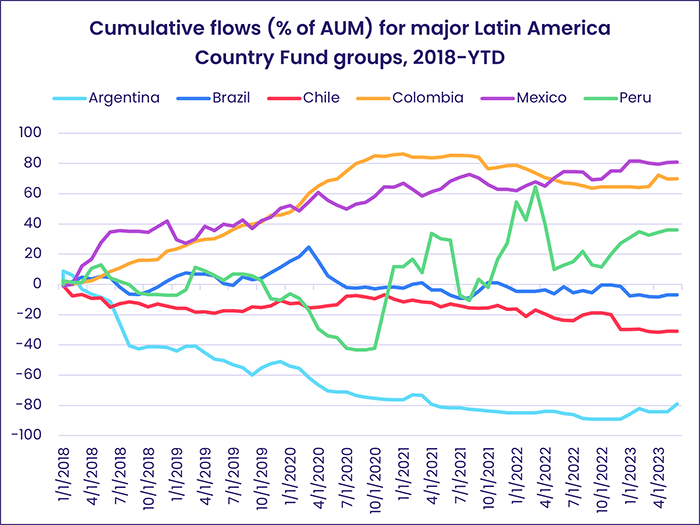

China’s initial steps to stimulate its economy, the pause in the US tightening cycle and Brazil’s improving outlook helped Latin America Equity Funds attract over $100 million for the fourth time in the past five weeks. The latest inflow was the biggest since the final week of February. Brazil’s first quarter growth exceeded expectations, and inflation in the region’s biggest economy continues to fall in the face of strong domestic harvests, which keep a lid on food prices, and high interest rates.

EMEA Equity Funds recorded their 10th outflow in the past 11 weeks as the outlook for major markets in this universe remains dour. Redemptions from South Africa Equity Funds hit an 18-week high, Israel Equity Funds posted their biggest outflow since mid-2Q18 and Turkey Equity Funds chalked up their third straight inflow. In the case of South Africa, interest rates at a 13-year high, routine power cuts, drought and high unemployment have dragged full-year GDP growth forecasts below 0.5%.

Developed markets equity funds

Flows for EPFR-tracked Developed Markets Equity Funds followed the doves during the second week of June. With the US Federal Reserve and Bank of Japan keeping rates on hold at their June policy meetings, US Equity Funds racked up their biggest inflow since mid-December and flows into Japan Equity Funds hit an 11-week high. Europe Equity Funds, meanwhile, posted their 14th consecutive outflow ahead of the latest rate hike by the European Central Bank (ECB).

A hawkish ECB is not the only headwind facing Europe Equity Funds. The weaker than hoped for rebound – so far – in China, the threat to transportation, food production and industry from persistent drought, drops in bank lending and the ongoing war in Ukraine are all sapping investor appetite for the region. At the country level, redemptions from Spain Equity Funds climbed to a nine-week high, Switzerland Equity Funds saw their longest inflow streak of the year come to an end and money flowed out of UK Equity Funds for the 23rd straight week while Greece Equity Funds recorded their biggest inflow in over seven years.

US Equity Funds saw over $20 billion flow in during the latest week, with over half of that coming in on the day the Fed announced it was holding its key interest rate at 5%. Retail share classes recorded a collective inflow for the fourth time so far this year. Overall flows were broadly distributed, with all the major groups by capitalization and style pulling in fresh money. Most of those inflows were multi-week highs ranging from 13 weeks for Mid-Cap Value Funds to 78 weeks for Small Cap Growth Funds.

With Japanese equity indexes marching higher, investors are faced with a choice: go along for the ride or side-step another false dawn? During the latest week, they steered over $2 billion into Japan Equity Funds, with domestically domiciled funds attracting for money than their overseas-based counterparts for the first time in a month.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, posted their biggest outflow year-to-date. Redemptions from funds with fully global mandates hit a level last seen in the first week of 4Q22.

Global sector, industry and precious metals funds

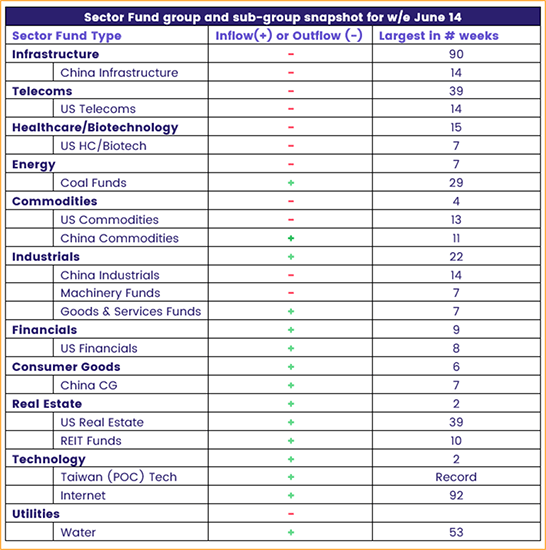

There was more conviction about the flows into and out of EPFR-tracked Sector Fund groups during the week ending June 14 as a pause in the US tightening cycle and the approaching 2Q23 earnings season spurred investors to shuffle their sector-level exposure.

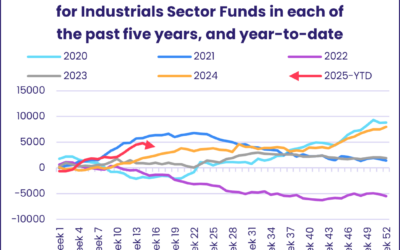

Flows this week into Real Estate, Consumer Goods, Financials, and Industrials Sector Funds reached two, six, nine, and 14-week highs, respectively, while Technology Sector Funds topped the group in cash terms with a nearly $4 billion inflow. The headline numbers for all these groups were underpinned by flows into US-dedicated funds. The remaining six groups posted outflows ranging from $7 million for Utilities Sector Funds to $936 million for Energy Sector Funds.

In the case of Energy Sector Funds, inflows for Coal Funds this week that reached a 29-week high were offset by the largest outflow since early April from Oil Funds, and the eighth and sixth consecutive week of redemptions for Natural Resources and Electric Vehicles Funds.

The latest inflow for Technology Sector Funds was double the previous week’s outflow, bringing the total for the last past nine weeks to $19 billion. The top 10 funds ranked by inflows for the week were a mixed bag of internet, software, semiconductor, automation and information funds. Among the sub-groups, Internet Funds recorded their largest inflows since early September 2021. Although US-dedicated funds pulled the most weight overall, Global and China Technology Sector Funds posted their fourth and ninth straight inflow this week and flows into Taiwan (POC) Technology Sector Funds rocketed to an all-time high of $217 million.

Despite expectations that mortgage rates will remain high even with the Fed pausing its rate-hiking cycle, the inflow for Real Estate Sector Funds this week was underpinned by US-dedicated funds and the largest inflow for REIT Funds in 10 weeks which accounted for 70% of the $285 million flowing into the overall group.

Bond and other fixed income funds

EPFR-tracked Bond Funds saw total inflows year-to-date push past the $225 billion mark during the second week of June as the US Federal Reserve’s decision to keep interest rates on hold gave risk appetite another modest boost. Flows into Emerging Markets Bond Funds climbed to a seven-week high and Bank Loan Bond Funds posted consecutive weekly inflows for the first time since 2Q22.

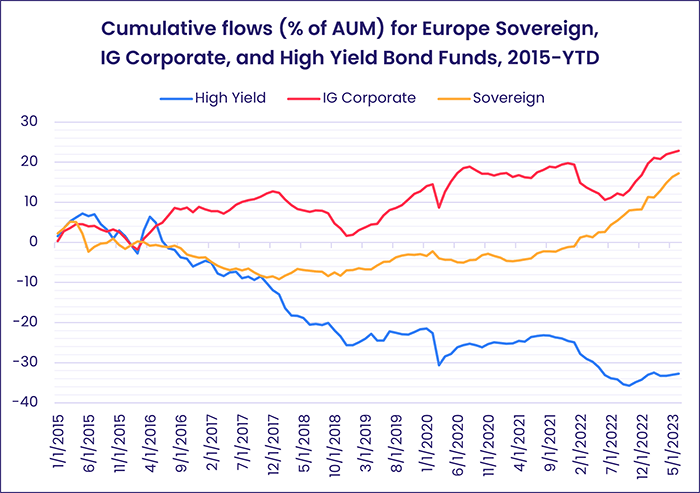

Among groups by geographic mandate, US Bond Funds kept their year-to-date inflow streak intact, Europe Bond Funds took in fresh money for the 12th straight week – their longest inflow streak since a 16-week run ended in late 3Q21 – and Global Bond Funds recorded their biggest inflow in six weeks.

Europe Bond Funds with sovereign debt mandates outgained their corporate counterparts during the latest week. Redemptions from retail share classes hit their highest level since the second week of 4Q22 and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their first outflow since mid-April and biggest in 10 weeks.

At the country level, redemptions from Switzerland Bond Funds climbed to a 30-week high and Sweden Bond Funds posted their biggest outflow since 4Q21 while Spain Bond Funds saw $200 million flow in and Italy Bond Funds recorded their biggest inflow in nearly two years.

Emerging Markets Local Currency Bond Funds posted their fifth inflow in the past seven weeks, lifting the headline number for all funds into positive territory. Short-term was the preferred duration, although Long-Term EM Bond Funds did post their ninth straight inflow.

Among US Bond Fund groups, Intermediate-Term Mixed Funds recorded the biggest inflows and Short-Term Mixed Funds the largest outflows. Short-Term Sovereign Bond Funds posted their largest inflow since late March.

Australia Bond Funds continued to pull in fresh money despite the latest interest hike. Sovereign funds have taken in the bulk of the fresh money during this nine-week run and investors have committed fresh money to Australia Inflation Protected Bond Funds six of the past seven weeks.

Did you find this useful? Get our EPFR Insights delivered to your inbox.