The toll on predictability taken by the idiosyncratic policymaking style of the new US administration hit fund flows during the second week of March. EPFR-tracked Equity Funds recorded their third, and biggest, outflow year-to-date and flows bypassed most of the fund groups associated with higher risk-reward ratios.

Among the groups to take a hit were Emerging Markets Equity and Bond Funds, with the latter posting their biggest outflow year-to-date, and High Yield Bond Funds which experienced their heaviest redemptions since early 3Q24. Cryptocurrency Funds extended their longest outflow streak in over 17 months, Bank Loan Funds saw an inflow streak that started last September come to an end and Technology Sector Funds chalked up their fifth outflow over the past six weeks.

With guns getting more attention than butter, Europe’s (presumed) rearmament story helped Europe Equity Funds pull in another $4.9 billion while redemptions from Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates hit a record high.

Overall, collective flows out of EPFR-tracked Equity Funds during the week ending March 12 totaled $2.8 billion. Investors pulled $1 billion out of Balanced Funds and steered $864 million into Alternative Funds, $1.7 billion into Money Market Funds and $7.2 billion into Bond Funds.

At the single country and asset class fund levels, Austria Equity Funds snapped their 39-week outflow streak, flows into New Zealand Equity Funds climbed to an 80-week high and over $5 billion flowed into UK Money Market Funds. Outflows from Momentum Funds hit their highest level in over seven months, Artificial Intelligence Funds extended an inflow streak stretching back to early November and Inflation Protected Bond Funds added to their longest run of inflows since 3Q21.

Emerging Markets Equity Funds

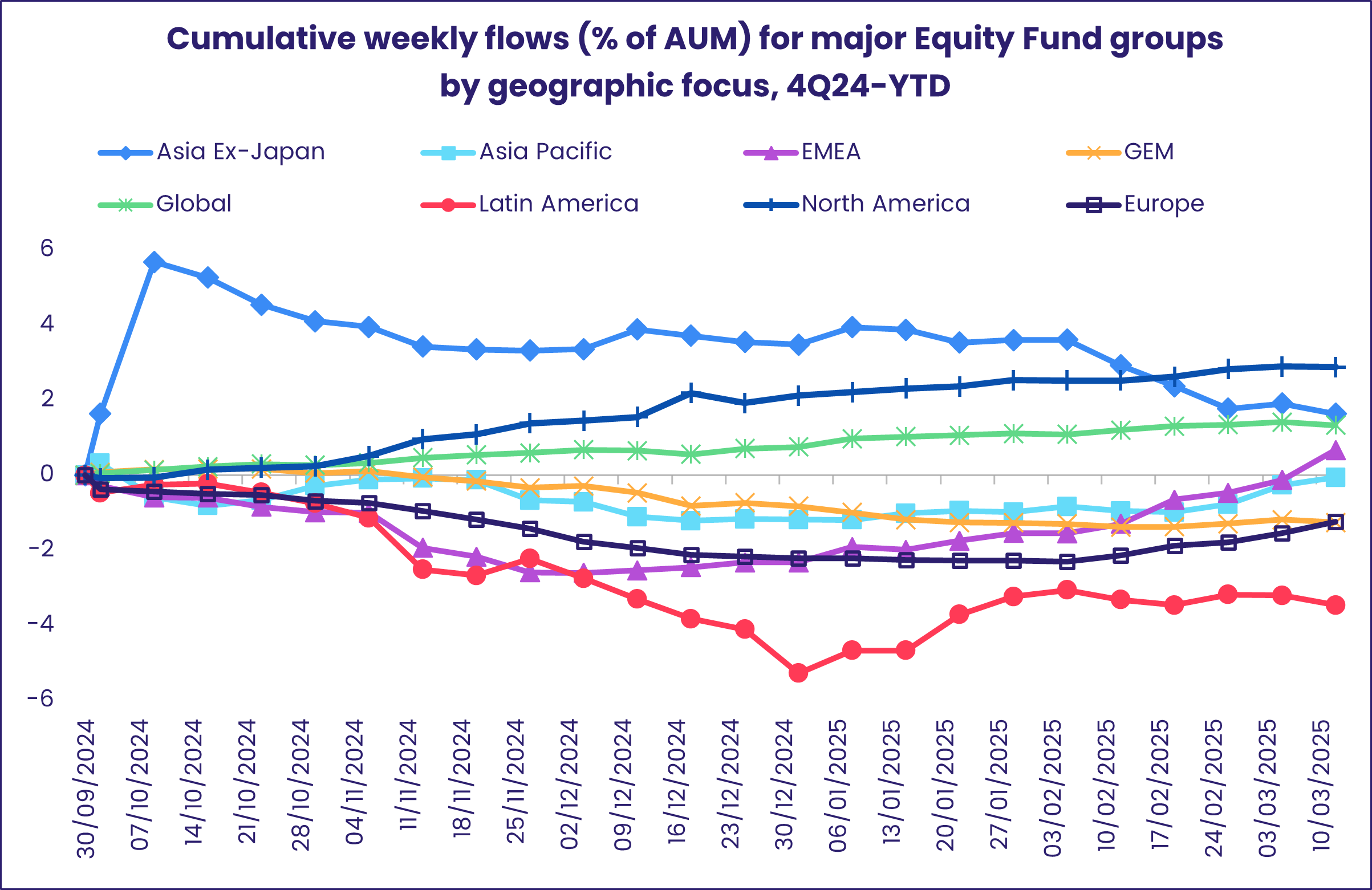

The latest week saw EPFR-tracked Emerging Markets Equity Funds posted their fifth collective outflow since the beginning of February as a combined $3.7 billion flowed out of China-mandated funds and the diversified Global Emerging Markets (GEM) Equity Funds.

Investors pulled money out of EM Fund retail share classes for the 34th week running and hit EM Collective Investment Trusts (CITs) with their biggest outflow since 2Q24. But, in contrast to the broader trend, funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates extended their longest runoff inflows since 2Q23.

February’s inflation numbers, showing a 0.7% year-on-year decline, added to the challenges facing China Equity Funds. But funds dedicated to the other Greater China markets, Hong Kong (SAR) and Taiwan (POC), both absorbed over $1 billion. There has been a shift in foreign domiciled China Equity Fund flows. Having posted outflows 14 times between late October and later January, these funds have posted collective inflows five of the past six weeks.

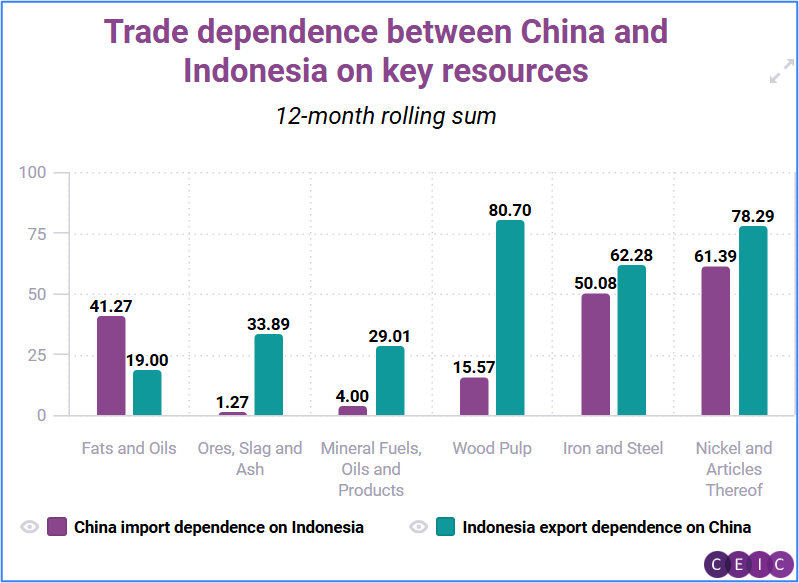

Elsewhere, Chinese investment in Indonesia and appetite for its raw material exports is an added tailwind for Indonesia Equity Funds whose current inflow streak is the longest since 1Q16. Analysis by EPFR sister company CEIC illustrates how the country’s bilateral trade has expanded since China stepped in to finance Indonesia’s domestic nickel smelting capacity a decade ago.

Among the Latin America Equity Country Fund groups, those dedicated to Argentina stood out in the second half of last year as investors bought into the country’s reform story and perceived alignment with US President Donald Trump’s economic philosophy. But, with Trump’s policies generating a significant market backlash, Argentina Equity Funds have now posted three straight outflows with the latest week’s the biggest since EPFR started tracking the group in 2000.

Flows into EMEA Equity Funds climbed to their highest level in over two years as investors positioned themselves for the possibilities of rearmament driven European growth and a ceasefire in Ukraine. Emerging Europe Regional Funds absorbed over $100 million and flows into Turkey and Poland Equity Funds hit 40-week and more than 11-year highs, respectively.

Developed Markets Equity Funds

The second week of March was another good one for Europe Equity Funds, with the group extending its longest inflow streak since 2Q21. Combined with solid flows into Japan and Canada Equity Funds, they were just enough to offset redemptions from US and globally mandated funds and allow all EPFR-tracked Developed Markets Equity Funds to post their fifth straight inflow and ninth year-to-date.

Once again, the headline number for Europe Equity Funds – the biggest since early 4Q17 – was pulled down by large redemptions from dedicated UK Equity Funds. While Europe ex-UK Regional Equity Funds were posting their biggest inflow since mid-1Q22, UK-mandated funds saw over $2 billion flow out. The redemptions from UK Equity Funds were broadly based, with 21 funds seeing over $20 billion flow out and 12 of those funds surrendering over $50 million.

Among the drivers of these redemptions is the perception that the UK will be on the outside looking in when Europe rearms and Germany takes off its so-called debt brake. Those assumptions helped Austria Equity Funds snap a nine-month run of outflows and Germany Equity Funds rack up their biggest weekly inflow since 3Q12.

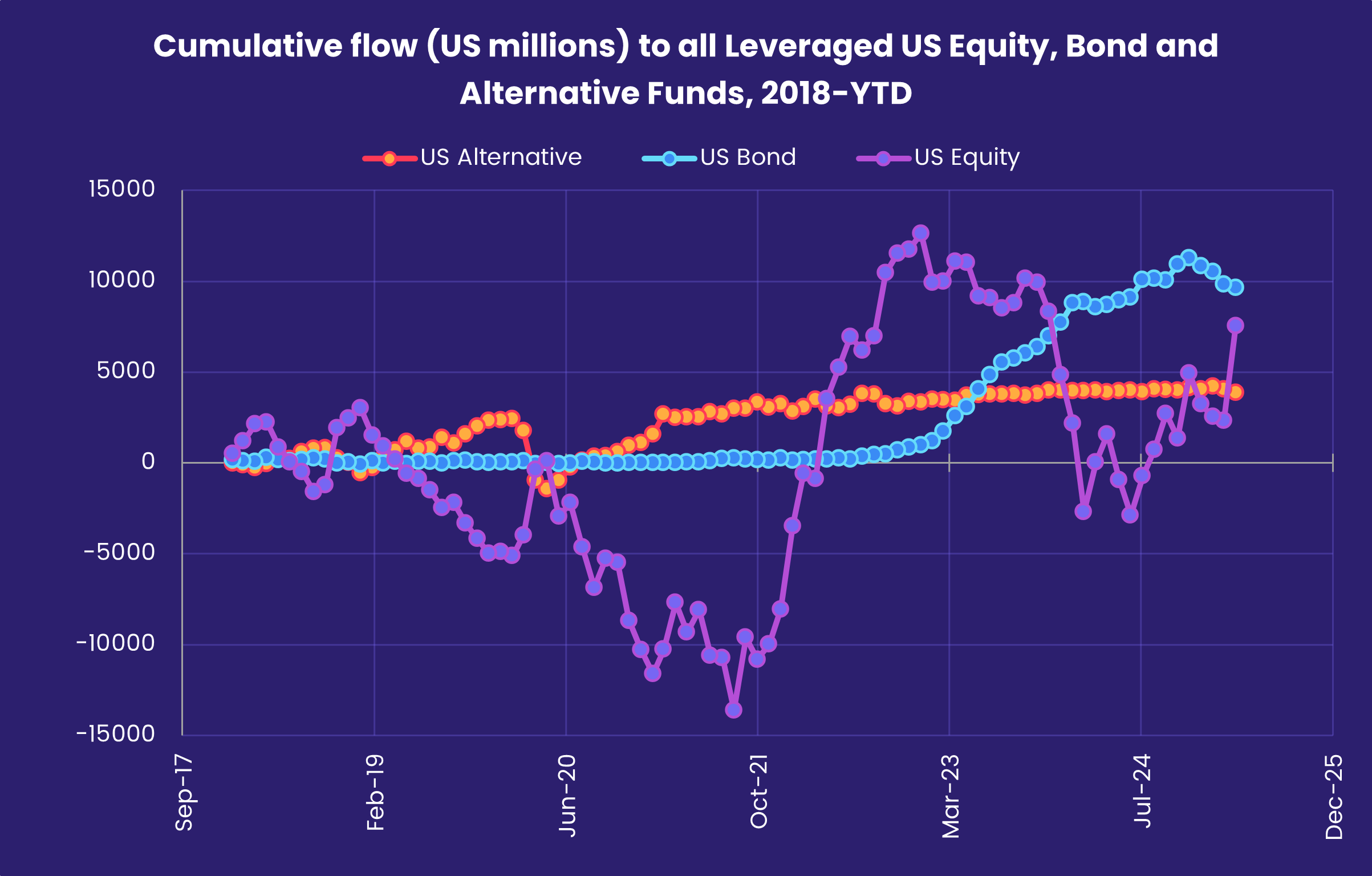

US Equity Fund retail share classes saw over $4 billion flow out during a week when Large Cap Growth Funds recorded their biggest outflow year-to-date. Leveraged funds, however, pulled in over $4 billion for the first time since mid-November. Flows to this group have been trending higher since late 2Q24.

Flows to Japan Equity Funds fell to less than a third of the previous week’s total, which came in at a 17-week high, as investors look ahead to the Bank of Japan’s next policy meeting later this month. Foreign domiciled funds saw flows drop for the third straight week, although those based in China recorded modest inflows for the 12th week running.

The largest of the diversified Developed Markets Equity Funds groups, Global Equity Funds, posted their biggest outflow of 2025 as redemptions from funds with fully global mandates hit a level last seen in 1Q20.

Global sector, Industry and Precious Metals Funds

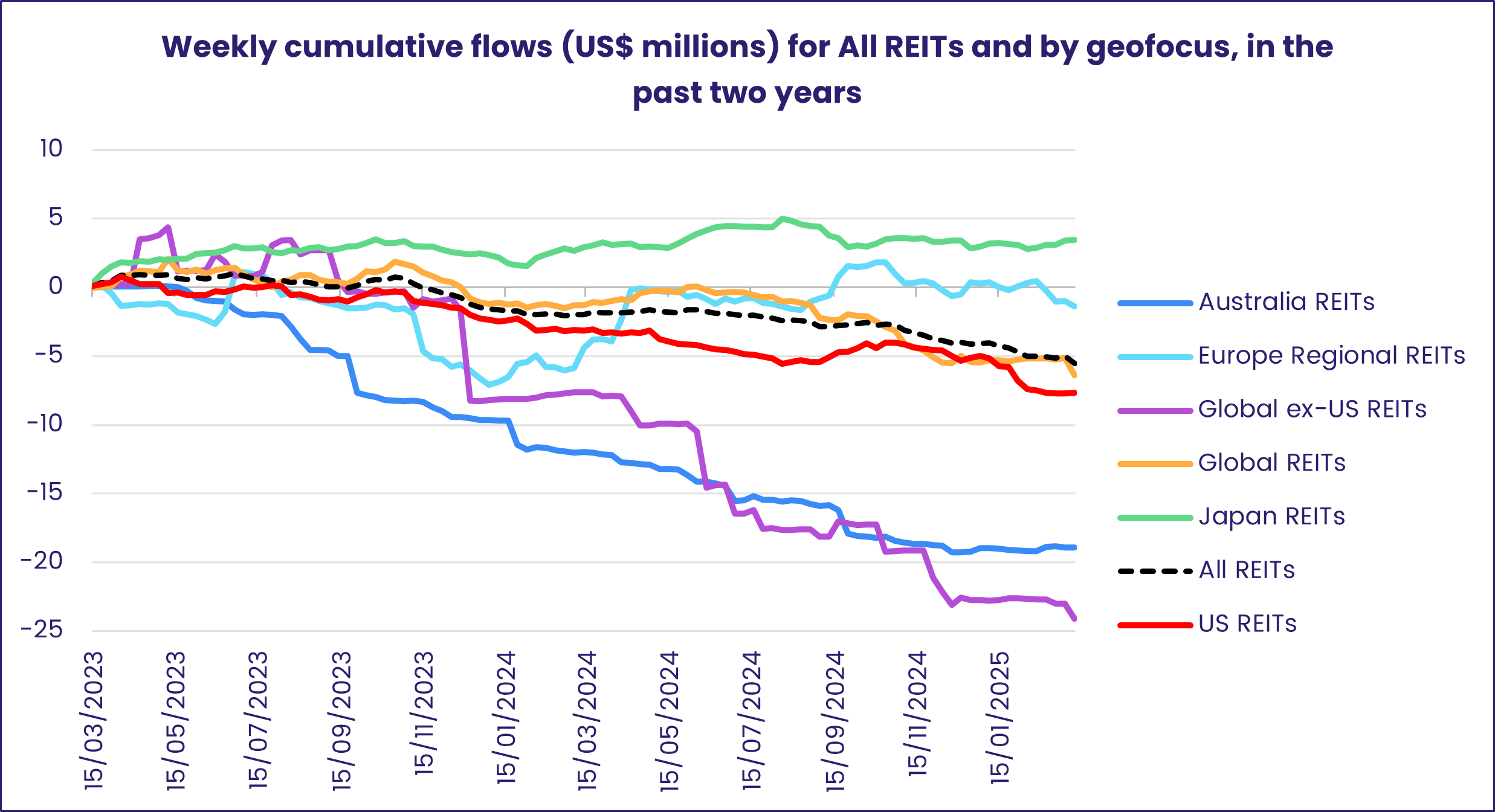

The number of EPFR-tracked Sector Fund groups reporting inflows during the second week of March dropped to just three – Industrials, Financials and Consumer Goods Sector Funds – as US President Donald Trump’s will he, won’t he style of policymaking roiled asset markets and created the kind of uncertainty investors prefer to avoid. Redemptions for the remaining eight groups averaged $480 million this week, with Real Estate Sector Funds the heaviest hit at $1.2 billion.

Nearly 70% of the Real Estate Sector Fund universe – by number of funds – is closely associated with Real Estate Investment Trusts (REITs). This week’s headline number was clouded by a single UK-domiciled mutual fund benchmarked to FTSE EPRA/NAREIT. Of the following top 15 funds with the heaviest outflows this week, nine were benchmarked to REITs, and more specifically tied to those two major industry associations in the real estate investment sector: European Public Real Estate Association (EPRA) and the National Association of Real Estate Investment Trusts (NAREIT).

REIT Funds have seen just four weekly inflows over the past 20 weeks, and this week’s redemptions were the heaviest since mid-December 2021. The overall Real Estate Sector Fund group has not fared much better, with just six inflows over the past 22 weeks. Japan REIT Funds have been the only regional group to attract net inflows over the past year, two years, and five years.

Industrials Sector Funds experienced their biggest inflow in six weeks as Aerospace & Defense Funds enjoyed record-setting weekly inflows that were just shy of $1 billion. A single Defense ETF contributed to roughly half of that headline number. Over the past 10 weeks, this subgroup has attracted over $3.4 billion in total inflows, bolstered by developments in the Ukraine conflict and news of increased private investment in new capacity.

Outflows resumed for Healthcare/Biotechnology Sector Funds after a brief two-week inflow streak, and redemptions from Telecoms and Utilities Sector Funds climbed to eight and 17-week highs, respectively. For the latter group, sentiment was broadly based but water-related funds did appear four times in the top 10 with the heaviest outflows this week.

Meanwhile, a group that has seen consistent interest throughout the year – Financials Sector Funds – absorbed their 10th inflow of the past 11 weeks, bringing their year-to-date total to an impressive $8.3 billion.

Bond and other Fixed Income Funds

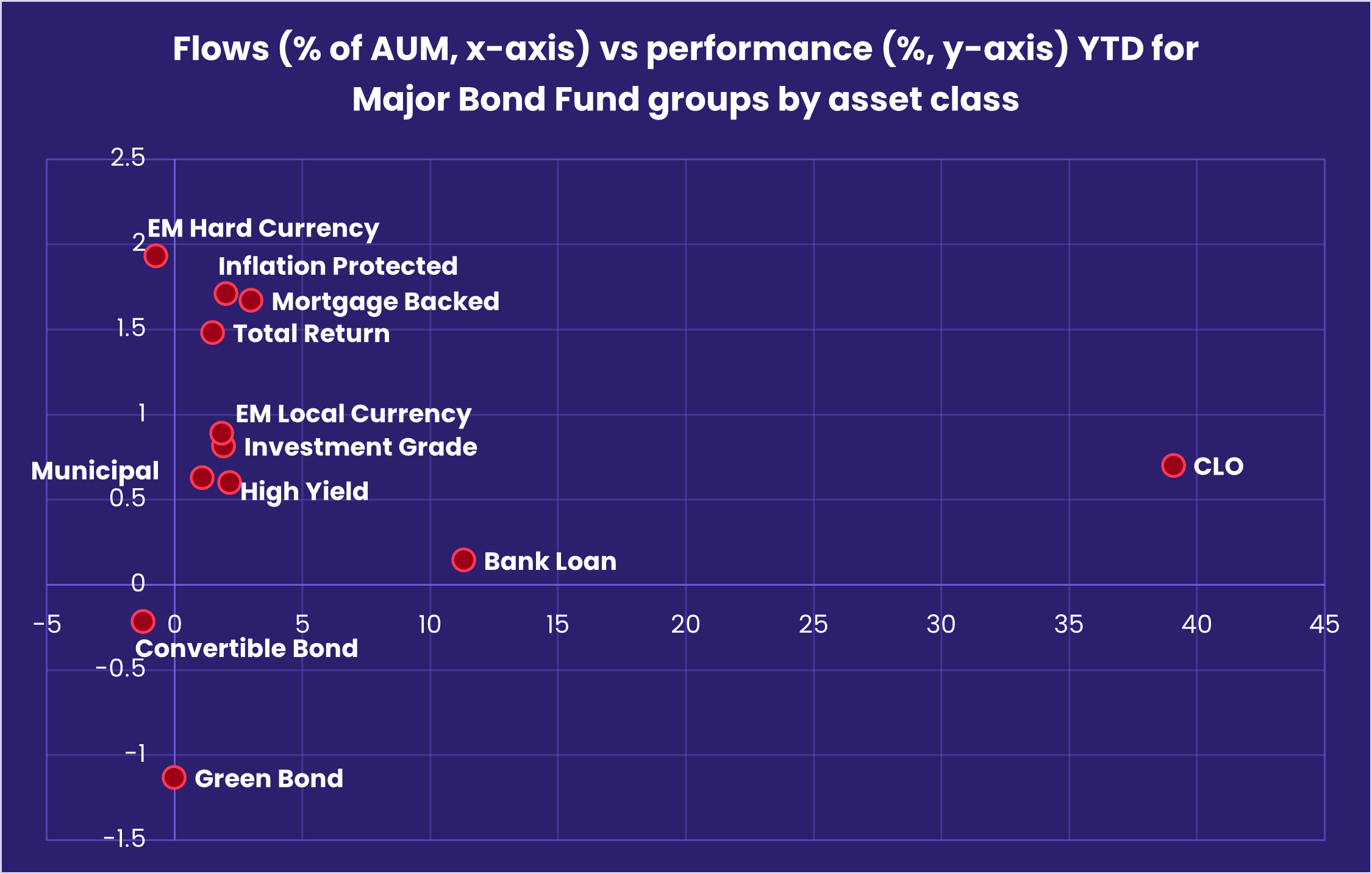

EPFR-tracked Bond Funds maintained their year-to-date inflow streak going into mid-March, although the latest week’s total was the lowest since the week ending January 1. Risk appetite fell several notches in the face of erratic US policymaking, inflationary concerns and expectations of another surge in sovereign debt issues to finance European rearmament, the US deficit and Chinese stimulus measures.

The week ending March 12 saw redemptions from High Yield Bond Funds hit their highest level in over six months while outflows from Bank Loan Funds jumped to a 22-week high and Emerging Markets Bond Funds recorded their biggest outflow of the year so far. The asset class group that stood out was the one dedicated to inflation protected debt. It expended its longest inflow streak in over three years while posting its second biggest inflow since 1Q22.

Redemptions from Hard Currency Emerging Markets Bond Funds jumped to an 11-week high as expectations for US inflation and interest rates hardened around the higher-for-longer narrative. Flows at the country level were subdued, with Thailand Bond Funds posting the week’s biggest inflow and Korea Bond Funds the biggest outflow.

US Bond Funds continue to pull in fresh money, albeit at a slower pace than was the case in January and February. There was a sharp drop-off in appetite for overseas domiciled US Bond Funds which posted their biggest outflow since mid-4Q22. There was also a pronounced shift towards US Sovereign Bond Funds, especially those with short duration mandates, and investors looked north with Canada Bond Funds absorbing over $1 billion.

Investors looking to Europe again favored fund groups offering exposure to corporate debt. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their third outflow of the year, matching the number of weekly outflows they posted during all last year. At the country level, flows into Germany Bond Funds climbed to a 20-week high as that group extended its longest inflow streak since 1Q24.

Did you find this useful? Get our EPFR Insights delivered to your inbox.