Two major central bank interest rate decisions, more earnings reports from ‘Magnificent Seven’ companies and a spike in the violence wracking the Middle East marked the final week of July. The conviction that artificial intelligence (AI) is the wave of the future emerged largely intact, but investors showed less conviction about the outlook for economic growth as the US Federal Reserve kept interest rates at their current 23-year high and the Bank of Japan hiked its key rate.

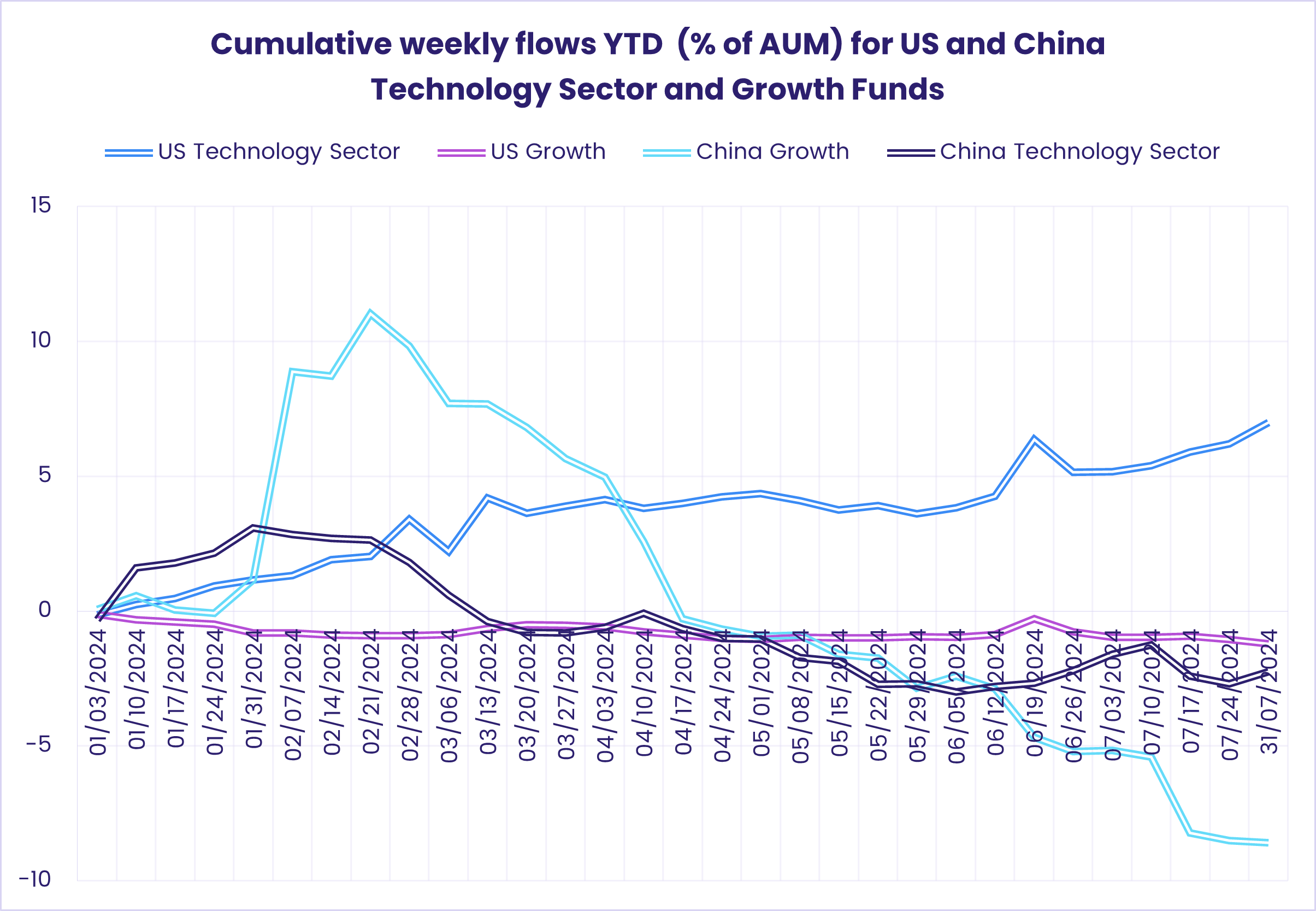

Both US and China Equity Funds absorbed over $4 billion during the latest week. But, while flows into China and US Technology Sector Funds hit four and six-week highs, respectively, US Equity Growth Funds posted their biggest outflow in five weeks and China Growth Funds their 22nd outflow since mid-February.

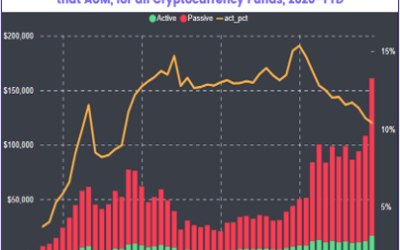

Elsewhere, two groups that have enjoyed robust flows in previous quarters experienced net redemptions. Cryptocurrency Funds recorded their sixth outflow of 2024 and Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates racked up their fourth straight outflow and 25th of the year so far.

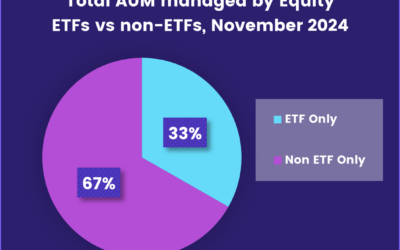

Overall, the week ending July 31 saw a net $8.8 billion flow into all EPFR-tracked Equity Funds, with Dividend Equity Funds posting their third-highest inflow since the beginning of the second quarter, while Bond Funds absorbed $14.6 billion. Redemptions from Balanced, Alternative and Money Market Funds totaled $847 million, $1 billion and $12.5 billion, respectively.

At the asset class and single country fund level, redemptions from Russia Equity Funds hit a 52-week high, Greece Bond Funds posted their biggest inflow since the second week of January and UK Money Market Funds recorded consecutive weekly outflows for the first time since late May. Convertible Bond Funds chalked up their biggest inflow in nearly two years, Bank Loan Funds tallied their fifth outflow year-to-date and Physical Gold Funds extended their longest run of inflows since mid-2Q23.

Emerging Markets Equity Funds

EPFR-tracked Emerging Markets Equity Funds ended July by posting their ninth consecutive outflow as dedicated China and Taiwan (POC) Equity Funds pulled in over $6 billion and EM Dividend Funds posted their biggest inflow since early June.

These inflows offset redemptions from Frontier Markets Funds and three of the four major regional groups, with the diversified Global Emerging Markets (GEM) Equity Funds seeing their biggest collective outflow in over three months and EMEA Equity Funds seeing their longest inflow streak since 1H22 come to an end.

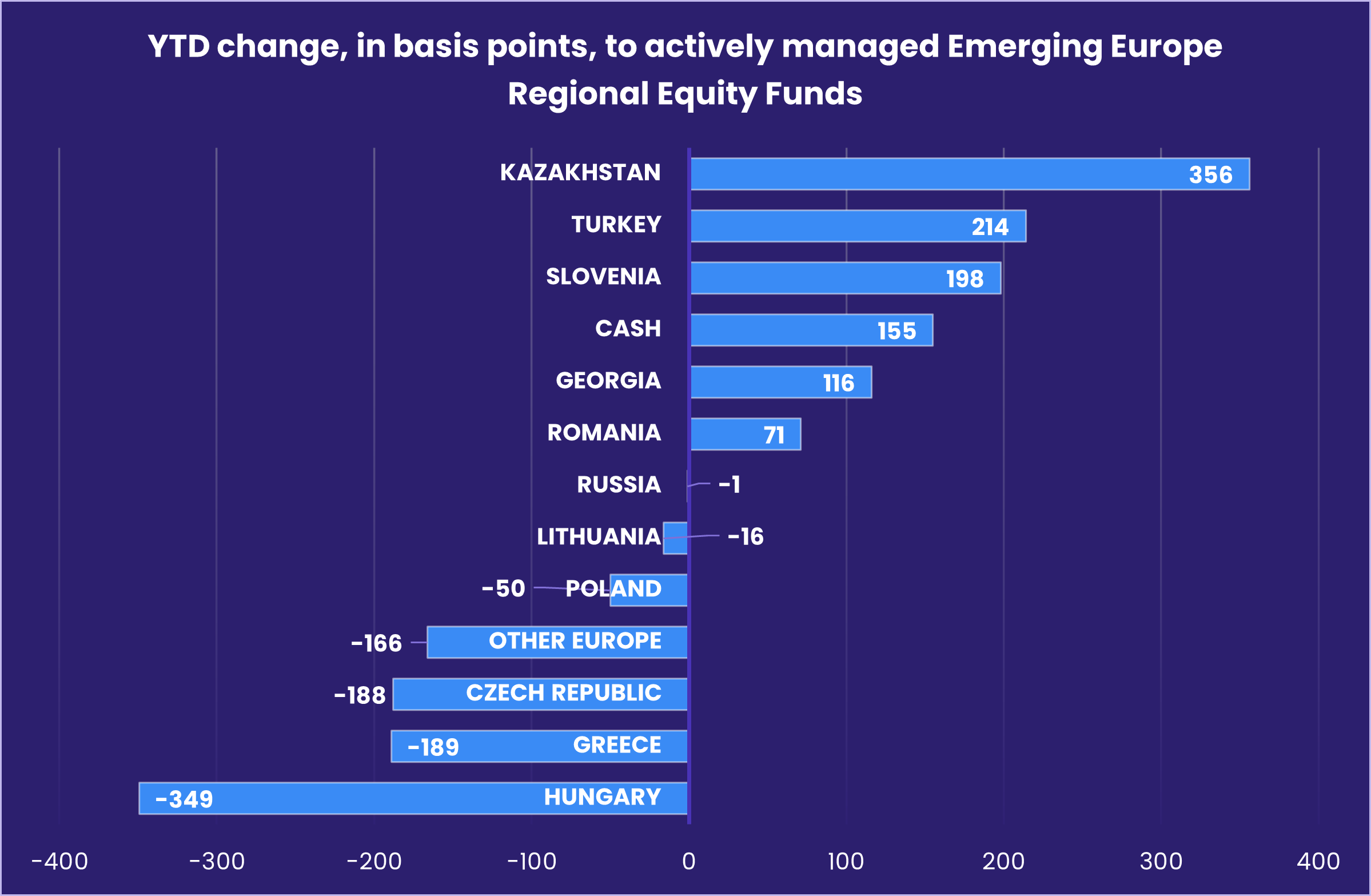

The recent flows into EMEA Equity Funds were driven by relief that South Africa has cobbled together a centrist coalition government, anticipation of increased Chinese investment in Saudi Arabia’s equity markets, appetite for Romania’s EU convergence story and a willingness to ride the latest rally in Turkey’s equity markets. Actively managed Emerging Europe Regional Equity Funds have increased their allocations to Turkey and Romania so far this year and rotated exposure from Hungary to Kazakhstan

Domestically domiciled China Equity Funds again accounted for all of the latest headline number as overseas-based funds posted their 10th straight collective outflow and their biggest since early 3Q15. Funds dedicated to Taiwan, which China views as a renegade province, continue to benefit from the island’s association with AI supply chains. Dedicated Taiwan (POC) Equity Funds have pulled in over $20 billion since the beginning of March.

Questions about Chinese demand for raw materials and the impact of the latest Sino-US trade tensions continue to weigh on Latin America Equity Funds. The latest sector allocations data for funds with regional mandates shows exposure to technology plays hitting a 20-month high coming into the third quarter.

Developed Markets Equity Funds

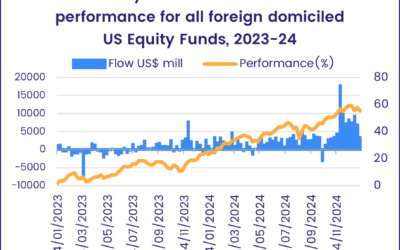

The final week of July saw EPFR-tracked Developed Markets Equity Funds extend their longest inflow streak since 2021. US Equity Funds were again the biggest contributor to the headline number, with Global Equity Funds also helping to offset redemptions from Japan, Canada and Europe Equity Funds.

Although the US Federal Reserve kept short term interest rates on hold at their latest policy meeting, expectations of a cut in September hardened. US Small Cap Funds attracted more money than their mid and large cap peers and flows into US Leveraged Equity Funds climbed to a 20-week high. Senior Liquidity Analyst Winston Chua noted that the gap between present reality and future expectations is also reflected in the latest Texas Manufacturing Survey, with the current business index at a six-month low and the future business condition reading at a 29-month high.

While US Equity Funds attracted fresh money for the 15th time since the beginning of the second quarter, the other major North American group continues to struggle. Canada Equity Funds posted their third consecutive outflow as a deflationary narrative and weaker demand for commodities sap investor confidence.

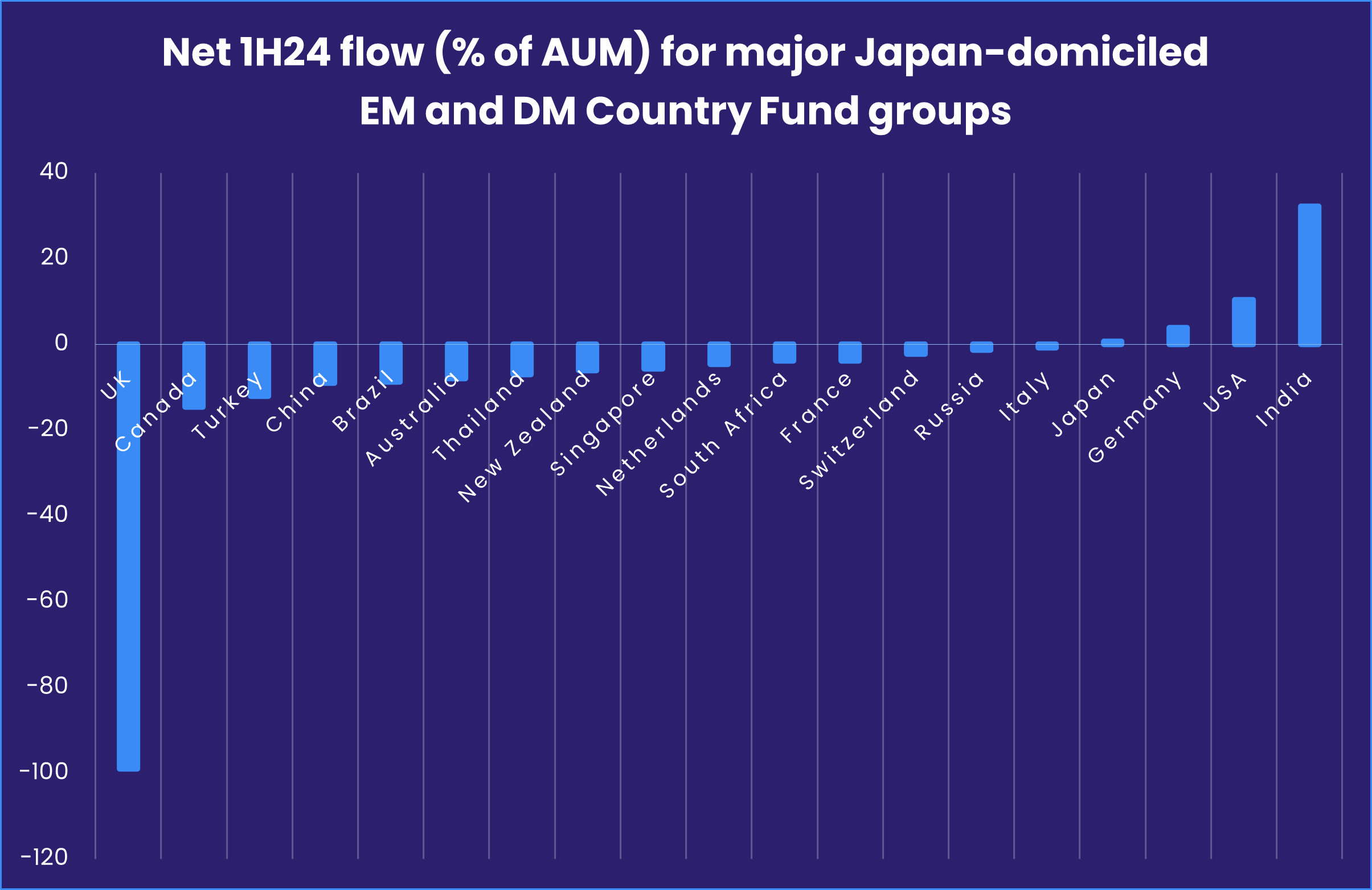

A week after flows rebounded to a three-month high, Japan Equity Funds saw flows reverse ahead of the Bank of Japan’s decision to implement a second interest rate hike and cut its government bond purchases. Among domestically domiciled Country Fund groups, Japan Equity Funds rank fourth in relative terms when it comes to attracting fresh money.

Europe Equity Funds added to their latest outflow streak as the stickiness of core inflation, France’s unsettled political state, weak manufacturing data from Germany and looming “excessive deficit procedures” gave investors reasons to sell. Dedicated France Equity Funds did, however, post their sixth straight inflow, the longest such run since 2H17, when enthusiasm for current President Emmanuel Macron’s reform agenda was at its height.

For the second week running, flows into Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, favored those with ex-US mandates.

Global sector, Industry and Precious Metals Funds

The week ending July 31 saw more major earnings reports, greater optimism about the chances of US and European interest rate cuts in September and inflows for six of the 11 major EPFR-tracked Sector Fund groups.

Despite some more critical assessments of the realistic return on current investment in artificial intelligence, flows into Technology Sector Funds climbed to a six-week high. Of the top 10 funds ranked by inflows for the week, five have semiconductor mandates.

Financial Sector Funds also recorded an inflow, their seventh over the past nine weeks, with US-mandated funds accounting for the bulk of the headline number. Regional Bank Funds posted a third consecutive inflow for the first time this year. Redemptions from China Financial Sector Funds, meanwhile, hit their highest level since early November after China’s central bank cut its one-year policy rate to a level last seen in 2020.

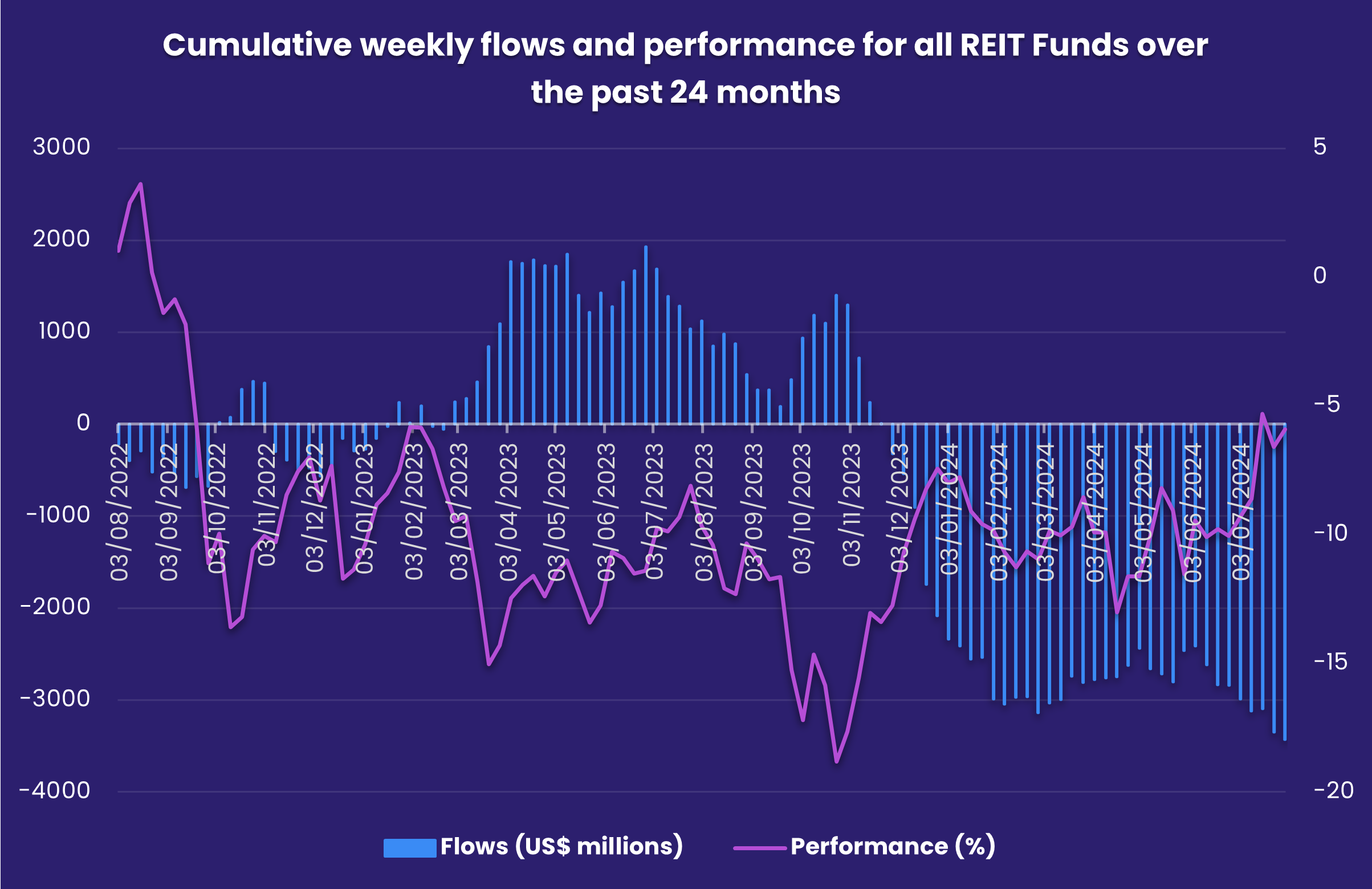

Hopes for lower US interest rates helped Real Estate Sector Funds to post their second inflow during the past three weeks. But Real Estate Investment Trust (REIT) Funds experienced further redemptions. In the face of further tightening by the Bank of Japan, JREIT Funds – which carried a seven-week inflow streak into July – posted their third outflow over the past four weeks.

With short term expectations for job security and consumer demand cooling, especially in the US, both Telecoms and Consumer Goods Sector Funds saw over $400 million flow out. Fund managers are, however, still buying. Industry flow data shows that, year-to-date, EPFR-tracked Equity Funds have steered some $8 billion into consumer durable stocks and over $15 billion into food, beverage and tobacco plays.

Bond and other Fixed Income Funds

A year of deeply held but quickly abandoned consensuses about the timing and pace of interest rate cuts has a new focal point: the US Federal Reserve’s September policy meeting where the debate has shifted from ‘if’ to the size of the cut. Against this backdrop, the yield on the US 10-year Treasury fell below 4%, Bank Loan Funds posted their fifth outflow of the year and overall flows to all EPFR-tracked Bond Funds climbed by another $14 billion to a net $475 billion year-to-date.

Among the major geographic groups, only Emerging Markets Bond Funds posted an outflow. Global, Canada and US Bond Funds extended inflow streaks stretching back to March, January and December, respectively, while Europe Bond Funds posted their 38th inflow since the beginning of November.

At the asset class level, High Yield Bond Funds posted their 25th inflow so far this year versus 24 weekly inflows for all of 2023. Redemptions from Inflation Protected Bond Funds climbed to a five-week high and Mortgage-Backed Bond Funds extended an inflow streak stretching back to late December.

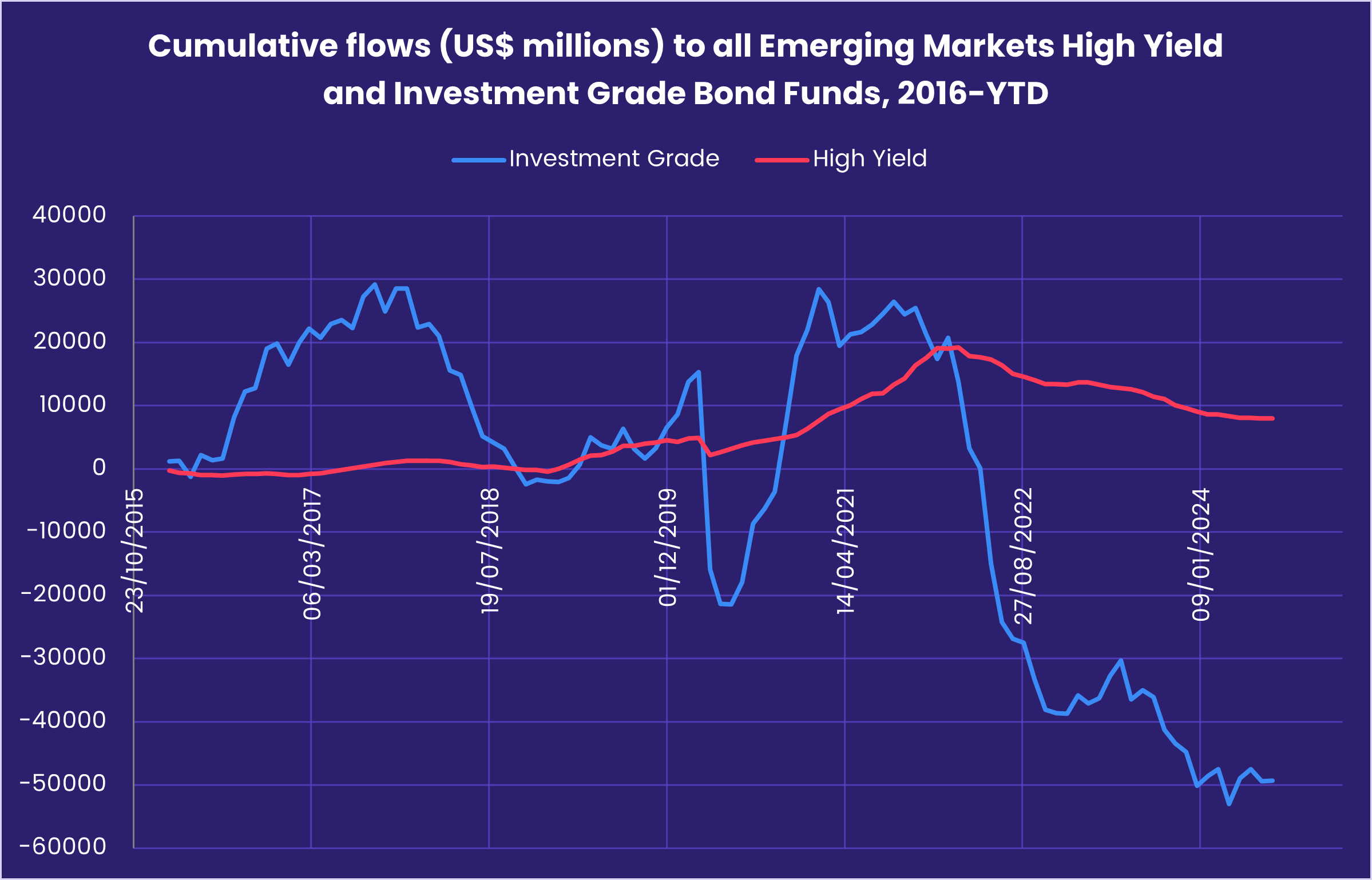

The latest redemptions from Emerging Markets Bond Funds again hit funds with hard currency mandates. Investors also favored high yield over investment grade, corporate over sovereign, country specific over diversified and long term over the other standard durations. At the country level, China Bond Funds posted their 10th inflow over the past three months.

While Chinese central bankers were easing monetary policy, their Japanese counterparts were tightening it. Flows into Japan Bond Funds climbed to an 18-week high as they posted their sixth straight inflow.

Europe Bond Funds continue to attract fresh money, with Europe ex-UK Regional Bond Funds making the biggest contribution to the week’s headline number.

US Corporate Bond Funds pulled in more money than their sovereign counterparts for the third week running and Short Term US Bond Funds posted their smallest collective inflow since the second week of June.

Did you find this useful? Get our EPFR Insights delivered to your inbox.