With inflation falling on both sides of the Atlantic despite resilient job markets, investors dared during the third week of July to dream of ‘soft landings’ that will spare the US and UK the pain of recession. Sector Fund groups associated with growth reflected this bullish thinking, with Commodities Sector Funds snapping their longest redemption streaks since early 2020 and Energy Sector Funds since EPFR started tracking them in 2000 while Technology Sector Funds absorbed another $1.8 billion.

Hopes of lower interest rates in America and Europe also gave fund groups dedicated to emerging markets a boost. Emerging Markets Equity Funds attracted more fresh money than their developed market peers for the 10th time in the past 14 weeks as India Equity Funds took in over $350 million for the fifth week running and China Equity Funds added $1.3 million to their total inflows for 2023.

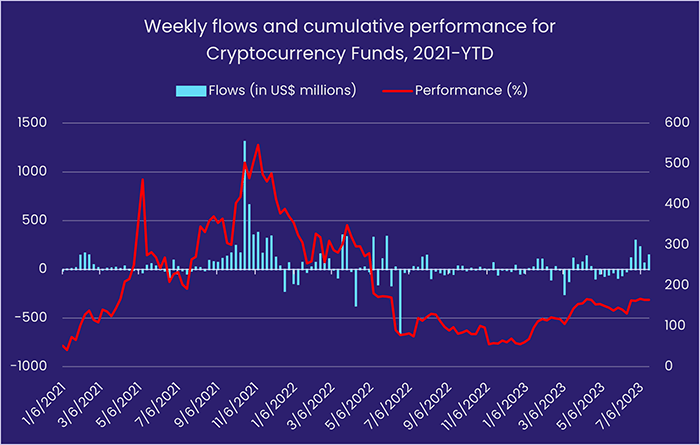

Elsewhere, investors steered over $1 billion into High Yield Bond Funds and extended Cryptocurrency Funds’ current inflow streak to five weeks and $825 million.

Overall, EPFR-tracked Bond Funds absorbed a net $1.3 billion during the week ending July 19 while Alternative Funds attracted $169 million and Money Market Funds $7.5 billion. Investors pulled $3.9 billion – a year-to-date high – from Balanced Funds and $4.5 billion from Equity Funds.

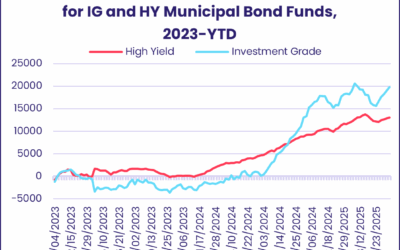

At the single country and asset class fund level, flows into France Equity, Austria Bond and Norway Equity Funds hit 16, 26 and 131-week highs, respectively, while Korea Bond Funds recorded their first outflow since early April and biggest since mid-March. Mortgage-Backed Bond Funds chalked up their 21st inflow in the past 25 weeks, flows into Municipal Bond Funds climbed to a 26-week high and Bank Loan Funds posted their biggest inflow since mid-2Q22.

Emerging markets equity funds

The week ending July 19 saw all four of the major regional Emerging Markets Equity Fund groups post inflows that ranged from $38 million for EMEA Equity Funds to $1.1 billion for Asia ex-Japan Equity Funds. The latest inflow took the year-to-date total for all EM Equity Funds past the $73 billion mark versus a collective outflow of $67 billion for all Developed Markets Equity Funds.

Both institutional and retail share classes attracted fresh money, with the latter posting their fourth inflow in the past five weeks. Flows into US-domiciled funds hit a 24-week high and Japan-domiciled funds extended an inflow streak stretching back to late October.

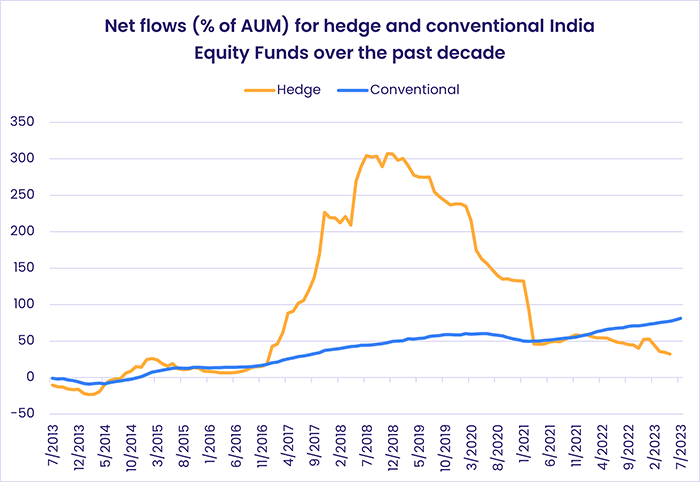

The headline number for Asia ex-Japan Equity Funds was underpinned by flows into China and India Equity Funds. In the case of funds dedicated to India, the latest inflows were the second largest since EPFR started tracking this group and came during when both of India’s benchmark indexes, the Sensex and Nifty, climbed to new record highs. While conventional funds are seeing plenty of fresh money, India Equity Hedge Funds continue to experience net redemptions.

Elsewhere, the combination of geopolitical tensions and gloomy forecasts for semiconductor demand hit Taiwan (POC) Equity Funds, which suffered their biggest outflow since late 3Q19 as they posted their fourth outflow in the past five weeks.

It was another good week for Latin America Equity Funds which racked up their sixth straight inflow as Brazil and Chile Equity Funds enjoyed strong investor support. Flows into the latter hit a 45-week high as the price of copper, a key Chilean export, hit an eight-week high.

EMEA Equity Funds recorded a modest inflow that was, nevertheless, the biggest in two months, as Emerging Europe Regional Funds posted their biggest inflow since the third week of February and Turkey Equity Funds snapped their longest redemption streak since 2019.

Developed markets equity funds

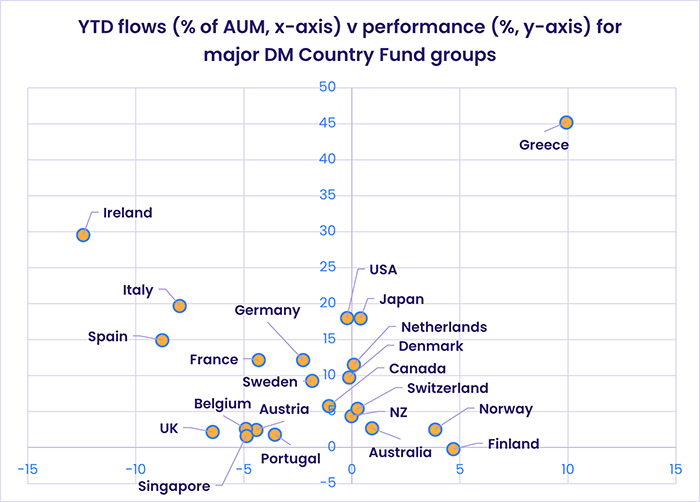

Bullish sentiment unleashed by the recent drop in US inflation hit a wall of mixed earnings reports from US technology plays in mid-July. EPFR-tracked Developed Markets Equity Funds recorded their first outflow of the third quarter as US, Europe, Global and Canada Equity Funds experienced net redemptions.

Year-to-date, Developed Markets Equity Funds have seen a net $67 billion flow out. During the comparable periods in 2021 and 2022, they absorbed $494 billion and $73 billion, respectively. Redemptions from retail share classes are running well ahead of last year, which ended with the smallest collective retail outflow since 2013.

Japan Equity Funds were one of only two major DM Country Fund groups to attract over $500 million during the week ending July 19. The latest inflow was the smallest since their current seven-week run began in early June. Domestically domiciled funds pulled in more money than their overseas-based counterparts for the fourth week running and Japan Dividend Funds recorded an inflow for the 17th time in the past 19 weeks.

US Dividend Equity Funds also recorded an inflow – only their third since the first week of April – and US Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their fifth inflow in the past six weeks. But overall flows were negative as redemptions from retail share classes hit their highest level in seven months. Mid Cap Blend and Small Cap Growth and Value Funds did attract some fresh money, but these inflows were swamped by redemptions from Large Cap Blend Funds.

Investors pulled money out of Europe Equity Funds for the 19th consecutive week as the continent grappled with a major heatwave, cluster munitions and a suspension of a grain export deal were factored into the Ukraine-Russia conflict, the European Central Bank (ECB) set the stage for another rate hike at month’s end and China restricted the export of two minerals seen as key for some ‘green’ technologies.

At the country level, another $1.3 billion flowed out of UK Equity Funds while Switzerland Equity Funds pulled in over $500 million, flows into France and Norway Equity Funds hit multi-week highs and Greece Equity Funds attracted fresh money for the 14th straight week.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, posted a modest outflow as funds with ex-US mandates experienced net redemptions for the first time since early April.

Global sector, industry and precious metals funds

The second quarter corporate earnings season kicked off during the third week of July with reports from bulge-bracket and regional banks to start and Netflix and Tesla weighing in at the end of the week. Investors took a glass-half-full approach to the mixed results that were delivered, steering fresh money into nine of the 11 major EPFR-tracked Sector Fund groups. The last time the inflow-to-outflow ratio was that high was early March.

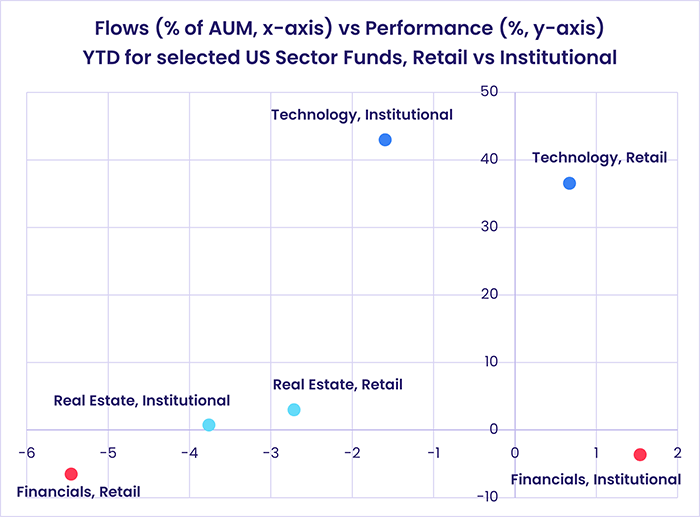

Financials Sector Funds pulled in a 14-week high of $1.2 billion, which included the biggest flows into retail share classes since the first week of March, as major bellwether banks – Bank of America, JPM, Citigroup, Wells Fargo – started the earnings seasons on a high note by meeting or topping expectations. Updates from regional banks were not as bullish, but Regional Bank Funds did eke out their third consecutive inflow.

Commodities/Materials and Energy Sector Funds both saw 13-week outflow streaks come to an end that cost them close to $5 billion (4.2% of assets) and over $9.5 billion (5.9% of assets), respectively. The first day of the reporting period – July 13th – saw the largest daily inflow for Energy Sector Funds since late April 2022.

With the buzz around artificial intelligence picking up and electric vehicle major Tesla continuing to show strong growth on the back of solid 2Q delivery figures boosted by price cuts, Technology Sector Funds absorbed their fourth straight inflow and their 19th in the past 24 weeks.

Elsewhere, Consumer Goods Sector Funds recorded their biggest weekly inflow in 13 weeks which was driven by the largest daily inflow – $915 million – since late 2021. Industrials Sector Funds recorded the largest inflow of their three-week streak, which now totals $1.4 billion, while flows into Utilities Sector Funds hit a seven-week high and Infrastructure Sector Funds snapped a two-week, $143 million run of inflows.

Bond and other fixed income funds

Going into the second half of July, EPFR-tracked Bond Funds extended an inflow streak that started during the final week of March. But, despite some signs of increased risk appetite, with both Emerging Markets and High Yield Bond Funds taking in fresh money, overall flows were subdued with retail share classes experiencing net redemptions for the fourth time in the past five weeks.

Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their first outflow since mid-April, Leveraged Bond Funds saw a 14-week inflow streak come to an end and redemptions from Frontier Markets Bond Funds hit a six-week high.

At the asset class level, Bank Loan Funds recorded their biggest weekly inflow since 2Q22, Convertible Bond Funds racked up their 22nd outflow in the past 26 weeks and flows into Municipal Bond Funds hit their highest level in six months. In the case of Municipal Bond Funds, flows into funds with short-term mandates were negative for the 12th consecutive week despite the current inversion of the municipal yield curve with AAA-rated one-year bonds offering higher yields all the way out to 14 years.

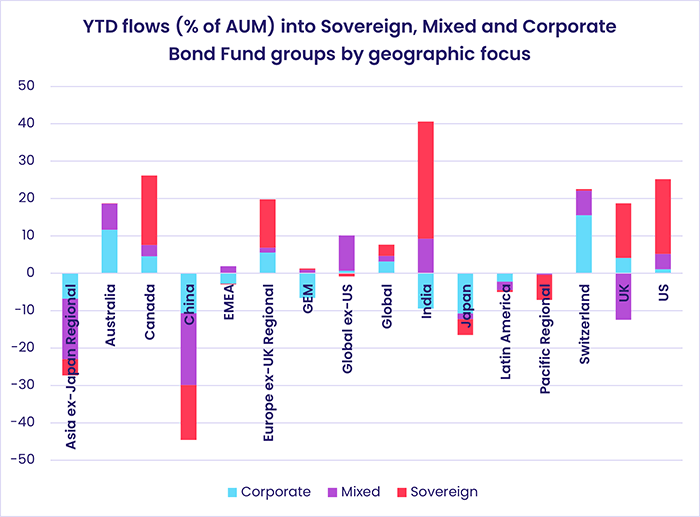

Emerging Markets Bond Funds recorded their second inflow of 2Q23 as funds with hard currency mandates posted their first collective inflow since the first week of February and retail share classes attracted fresh money for the first time since early May. At the country level, flows into Turkey Bond Funds climbed to a 16-week high, China Bond Funds saw money flow out the 23rd time in the 29 weeks year-to-date and India Bond Funds posted their ninth straight inflow.

Investors steered another $250 million into Europe Bond Funds ahead of the European Central Bank’s next policy meeting on July 27. Funds with corporate mandates outgained their sovereign counterparts for the first time since early June.

US Bond Funds, which have yet to post a weekly outflow in 2023, maintained that record despite the biggest outflow from Short Term Mixed Funds in over 15 months. Domestically-domiciled funds posted their first outflow since late May while foreign domiciled funds recorded their 11th consecutive inflow.

Did you find this useful? Get our EPFR Insights delivered to your inbox.