EPFR-tracked US Equity and Bond Funds absorbed a combined $22.2 billion during the second week of July. Of that total, $11 billion flowed in on the final day of the reporting period as investors and markets were digesting the better-than-expected headline number for US inflation during the previous month.

Although that number, a two-year low of 3%, was not enough to more than dent expectations of another 0.25% hike in US interest rates at the end of the month, it did rekindle hopes that the US Federal Reserve’s ‘pivot’ to a neutral or easing stance is just over the horizon. Risk appetite jumped appreciably. High Yield Bond Funds posted consecutive weekly inflows for the first time since early February, Emerging Markets Equity Funds chalked up their 21st inflow year-to-date and flows into Technology Sector Funds climbed to a four-week high.

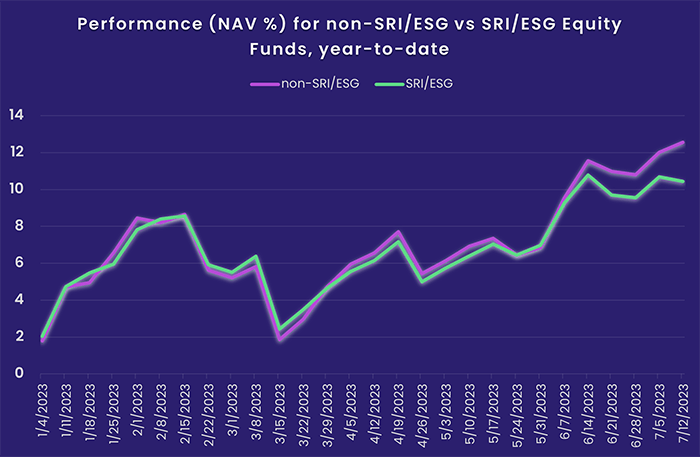

Flows into funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates continued their recent resurgence. SRI/ESG Equity Funds absorbed over $1 billion for the third week running while SRI/ESG Bond Funds extended an inflow streak stretching back to early April. Recent weeks have seen SRI/ESG Equity Funds regain a little of their edge when it comes to performance: YTD they have collectively outperformed non-SRI/ESG funds by around 125 basis points, with most of that separation coming since early June.

Overall, the week ending July 12 saw EPFR-tracked Equity Funds pull in a net $11.5 billion. Bond Funds collectively absorbed $12 billion while redemptions from Alternative, Balanced and Money Market Funds totaled $994 million, $2.3 billion and $17.6 billion, respectively.

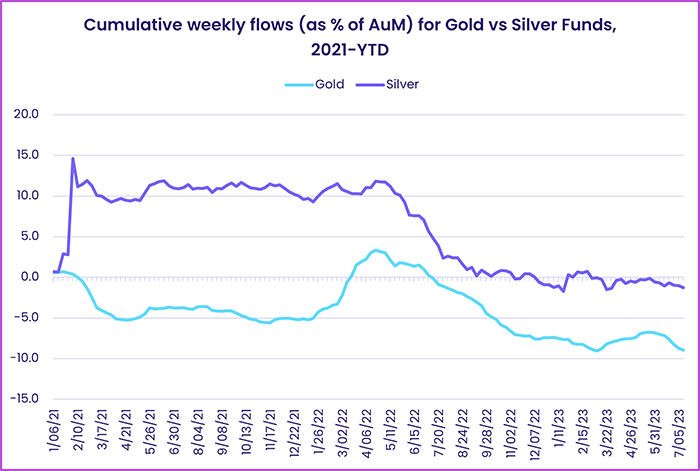

At the asset class and single country fund level, Total Return Funds posted their third outflow in the past four weeks, money flowed out of Inflation Protected Bond Funds for the 46th straight week and Gold Funds extended their longest redemption streak since 4Q22. Turkey Equity Funds posted their seventh straight outflow, India Bond Funds chalked up their biggest weekly inflow since mid-2Q18 and flows into Japan Bond Funds hit their highest level since late 4Q21.

Emerging markets equity funds

Data released in the second week of July shows inflation falling briskly in China and the US. For pessimists, this is fresh evidence that China is flirting with deflation, and the US with recession. For optimists, those threats increase the likelihood of more aggressive stimulus measures to bolster the Chinese economy and a ‘pivot’ on interest rates by the US Federal Reserve after its July meeting.

Flows to EPFR-tracked Emerging Markets Equity Funds during the week ending July 12 suggest that optimists outweigh pessimists. Asia ex-Japan, Latin America and the diversified Global Emerging Markets (GEM) Equity Funds all posted inflows that handily offset outflows from EMEA Equity Funds.

Among the Asia ex-Japan Equity Fund groups, flows into India Equity Funds hit their highest level since 2Q15, Korea Equity Funds recorded their fourth consecutive inflow and China Equity Funds took in over $1 billion for the 16th time year-to-date. The range between the best and worst performers so far this year among funds reporting weekly is significantly wider for China Equity Funds than the other groups. For China Equity Funds, the range between best and worst is -10.8% to +30.9% compared to -4.8% to +9.1% for Korea Equity Funds and -7.7% to +3% for India Equity Funds.

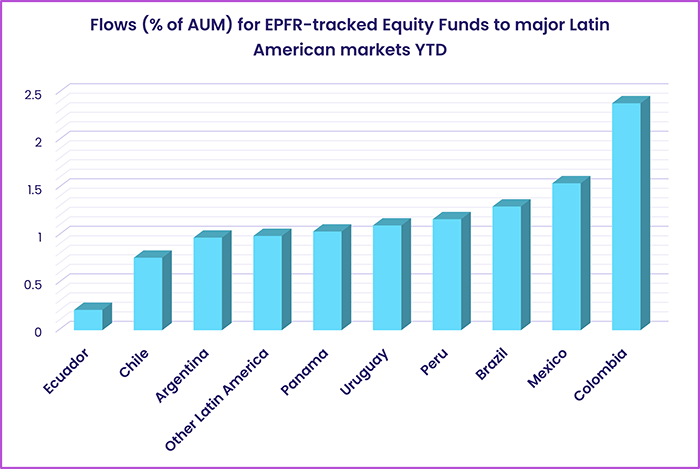

Appetite for exposure to Latin America remains high, with Latin America Equity Funds posting their ninth inflow in the past 10 weeks and their biggest since late 2Q22. Brazil Funds were again the biggest contributors to the headline number, with domestically domiciled funds taking in more money than those domiciled overseas for the third week running. While investors favor Brazil, in relative terms Colombia has attracted the strongest flows YTD from EPFR-tracked Equity Funds (dedicated, regional and diversified global).

After a brief thaw, flows for EMEA Equity Funds turned negative again. Turkey Equity Funds extended their current outflow streak, South Africa Equity Funds saw a three-week run of inflows come to an end, redemptions from Slovak Republic Equity Funds came in at a record high and Israel Equity Funds posted their third outflow in the past five weeks.

Developed markets equity funds

A week that began with an unexpectedly strong US jobs report and ended with the lowest US inflation number since March 2021 saw EPFR-tracked Developed Markets Equity Funds post their fifth-largest weekly inflow so far this year. Flows into US Equity Funds again underpinned the headline number for all DM Funds, with Japan and Global Equity Funds absorbing over $1 billion apiece and Europe Equity Funds racking up their 18th consecutive outflow.

Flows into US Equity Funds were again broadly distributed, with over 40 funds posting inflows of $100 million or more, and biased towards Large Cap Blend Funds. Redemptions from US Dividend Equity Funds hit a 16-week high while funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their seventh inflow of the past nine weeks.

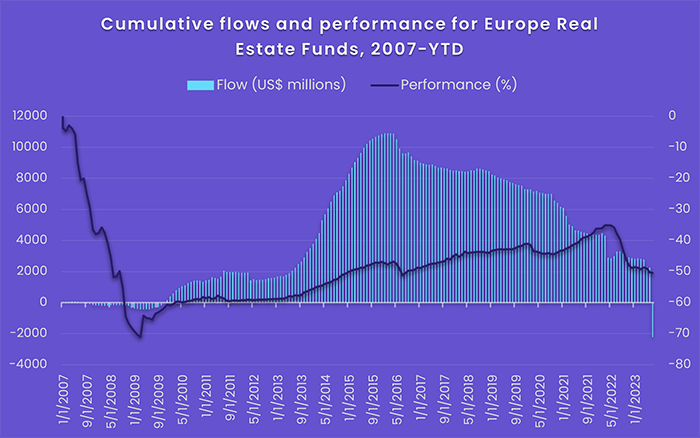

The certainty of more interest rate hikes, the impact of a major heatwaves on tourism and agriculture, Germany’s spluttering economy, and the political unrest in France kept the pressure on Europe Equity Funds during the second week of July. Investors pulled over $3 billion from this group despite the strong performance of key European equity indexes so far this year. France Equity Funds posted their 10th straight outflow, and 20th in the past 23 weeks, while redemptions from Italy Equity Funds hit their highest level since late 2Q22,

Investors are turning particularly sour on the UK. The current outflow streak for dedicated UK Equity Funds stretches back to the first week of the year. Much of the current angst is focused on the impact of higher interest rates on British homeowners, few of which have long-term, fixed-rate mortgages and face sharply higher servicing costs.

Another $1.3 billion found its way into Japan Equity Funds during the latest week. Flows into retail share classes hit a 16-week high, and domestically domiciled funds absorbed more fresh money than their foreign domiciled peers for the third straight week.

Both Global and Global ex-US Equity Funds increased their exposure to Japan in mid-2Q23, with the latter lifting their average allocation to a five-month high while exposure to Japan among Global Equity Funds climbed to its highest level since early 4Q21.

Global sector, industry and precious metals funds

The week ending July 12 closed out with the 2Q23 corporate earnings season in the US about to kick off and several financial heavyweights leading the charge. Despite expectations of a bumpy season, for the second week running six of the 11 major EPFR-tracked Sector Fund groups posted inflows.

Topping the list of groups attracting fresh money was Technology Sector Funds, which pulled in nearly $2 billion. US-mandated funds were the biggest contributors to the headline number, followed by China Technology Sector Funds. Investors shied away from diversified exposure, with Global, Global EM, Europe and Pacific Regional Funds all posting outflows. Drilling down to the industry level, Anime, Comic and Gaming Funds extended their inflow streak to five weeks – the longest since a 14-week one ended mid-1Q21 – and Semiconductors Funds recorded their third inflow of the past four weeks.

In addition to five major Sector Fund groups, investors pulled money out of both Gold and Silver Funds during the second week of July. The former’s seven-week outflow streak has seen over $5 billion flow out and, despite its correlation to industrial and technology sector demand, Silver Funds posted their third consecutive outflow.

Of the major groups posting outflows, Healthcare/Biotechnology Sector Funds were hit the hardest with redemptions hitting a 22-week high. A single fund accounted for $739 million of the headline number. Over the past nine weeks, the group has suffered net outflows of $2.9 billion. China Healthcare/Biotechnology Sector Funds have, however, posted inflows for seven straight weeks.

Energy Sector Funds extended their current outflow streak into record-setting territory. The previous record was for a 12-week stretch starting in mid-2002, just over a year after EPFR started tracking these funds, and totaled only $30 million compared to this year’s 13-week, $9.6 billion run. Of the top 10 funds ranked by outflows for the week, three have “clean energy” mandates while one is focused on uranium and one on coal.

Bond and other fixed income funds

Investors steered fresh money into EPFR-tracked Bond Funds for the 16th straight week as inflation data from China and the US showed price pressures declining in the world’s two largest economies. Leveraged Bond Funds posted their 14th consecutive inflow and 32nd since mid-November, Bond Collective Investment Trusts (CITs) recorded their 38th outflow since the beginning of 4Q22 and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates extended an inflow streak stretching back to mid-April.

Among the major country and regional groups, US Bond Funds recorded the biggest inflows in US dollar terms and Asia Pacific Bond Funds in % of AUM terms.

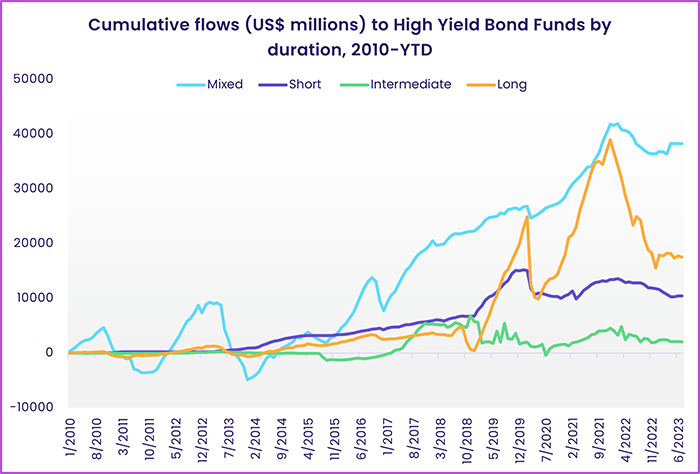

At the asset class level, Inflation Protected Bond Funds added to their record outflow streak, Bank Loan Funds extended their longest run of inflows since 2Q22, Municipal Bond Funds racked up their fifth inflow in the past six weeks and High Yield Bond Funds took in over $1 billion for the seventh time year-to-date.

Flows into Asia Pacific Bond Funds were underpinned by the biggest inflow recorded by Japan Bond Funds in over 18 months. Speculation is again mounting that the Bank of Japan (BOJ) will tweak its yield control policy when it meets later this month.

While investors are wondering if the BOJ will tighten, their expectations for China’s central bank tend in the opposite direction as policymakers move to prevent deflation getting a grip on the world’s second-largest economy. China Bond Funds posted their 20th outflow in the past 26 weeks, with emerging markets investors looking to Korean and Indian debt funds instead. Korea Bond Funds chalked up their 28th inflow since the beginning of November and India Bond Funds set a new weekly inflow record.

Europe Bond Funds posted modest inflows that hinged on investor appetite for several country fund groups. Flows into Germany Bond Funds climbed to a 24-week high, Italy Bond Funds extended their longest run of inflows since 1Q13 and UK Bond Funds posted their third-largest inflow of the year.

Did you find this useful? Get our EPFR Insights delivered to your inbox.