Expectations for economic growth, US job creation and the transitory nature of inflation all took a knock during the second week of October as supply chain issues and rising energy prices continue to bite. Headline inflation for the US in September exceeded 5% for the third month running while new job creation was less than half of the expected total while the IMF trimmed another 0.1% off its global growth forecast.

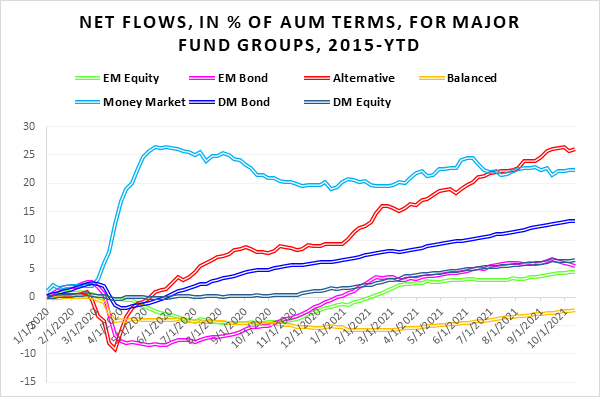

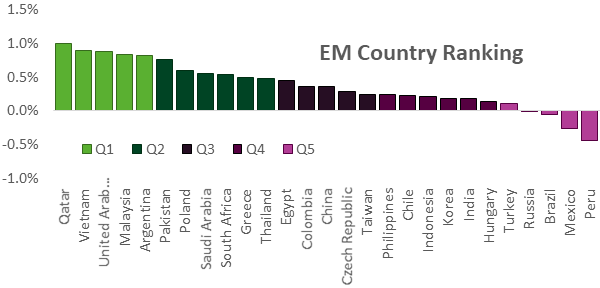

Investors responded by beefing up their exposure to inflation protected securities, pulling money out of the riskier fixed income fund groups and positioning themselves for short-term gains driven by the latest corporate earnings season. Both High Yield and Emerging Markets Bond Funds saw over $1.5 billion redeemed during a week when commitments to Inflation Protected Bond Funds hit an 11-week high.

Overall, the week ending Oct. 13 saw EPFR-tracked Bond Funds post a collective net inflow of just $77 million. Equity Funds took in $11.8 billion, with a third of that total going to funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates, and Balanced Funds absorbed $1.4 billion.

Did you find this useful? Get our EPFR Insights delivered to your inbox.