The jury is still out on the impact of rising Covid caseloads triggered by the Omicron variant, but the latest round of inflation numbers delivered a verdict of “not transitory” that major central banks are expected to heed. The Bank of England was the first to respond, raising its key rate, and reinforcing the perception that the US Federal Reserve will accelerate its timetable to wrapping up its current quantitative earing program.

Those perceptions hit fixed income fund groups, Emerging Markets Equity Funds – ex-China – and Real Estate Sector Funds during the second week of December. With the European Central Bank (ECB) and Bank of Japan expected to be the last major central banks to tighten policy, Japan Equity and Europe Bond Funds posted solid inflows.

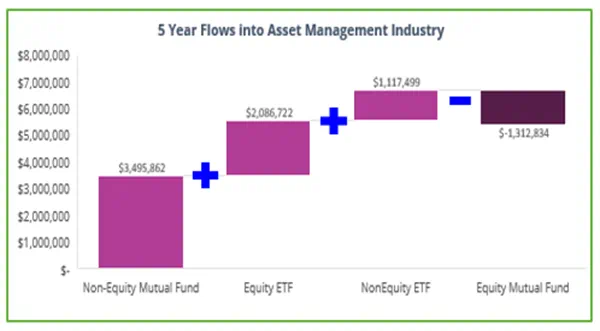

Investors remain committed to socially responsible (SRI) or environmental, social and governance (ESG) themes. Their appetite for exchange traded funds (ETFs) is also undiminished: after total AUM in ETFs hit this $10 trillion mark in November, those tracked by EPFR have taken in another $100 billion during the first two weeks of December.

Did you find this useful? Get our EPFR Insights delivered to your inbox.