With expectations for US and global economic growth being lowered in response to tariff-centric policies of the new American administration, Bear Funds posted their fourth straight inflow, and 13th year-to-date, while Leveraged Equity Funds extended their longest run of outflows since mid-2Q24.

Risk appetite among fixed income investors continued to recover during the first week of May. Bank Loan and High Yield Bond Funds both posted consecutive weekly inflows for the first time since early March and Emerging Markets Bond Funds recorded their third consecutive inflow.

Overall, EPFR-tracked Bond Funds attracted a net $14 billion – a 10-week high – while Equity Funds absorbed $2.2 billion and Alternative Funds $2.5 billion. Money Market Funds took in $51.3 billion as Europe-mandated funds chalked up their biggest inflow since the first week of the year.

At the asset class and single country fund levels, flows into Momentum Funds continued to accelerate, Convertible Bond Funds extended a redemption streak stretching back to the second week of February and outflows from Physical Silver Funds hit a nine-week high. Money flowed out of Romania Bond Funds for the 19th straight week, redemptions from Romania Equity Funds hit a 22-week high, Portugal Equity Funds recorded their biggest outflow since late December and UK Money Market Funds absorbed over $12 billion.

Emerging Markets Equity Funds

The first week of May saw EPFR-tracked Emerging Markets Equity Funds post their second straight collective outflow as redemptions from funds dedicated to mainland China more than offset flows into Latin America, EMEA and the diversified Global Emerging Markets (GEM) Equity Funds.

Market volatility triggered by shifts in US trade policies has yet to break the grip that passively managed funds have taken on this asset class. During the latest week, actively managed EM Equity Funds posted their 30th consecutive outflow and 96th over the past two years. Over the same period, passively managed funds have tallied only 23 weekly outflows.

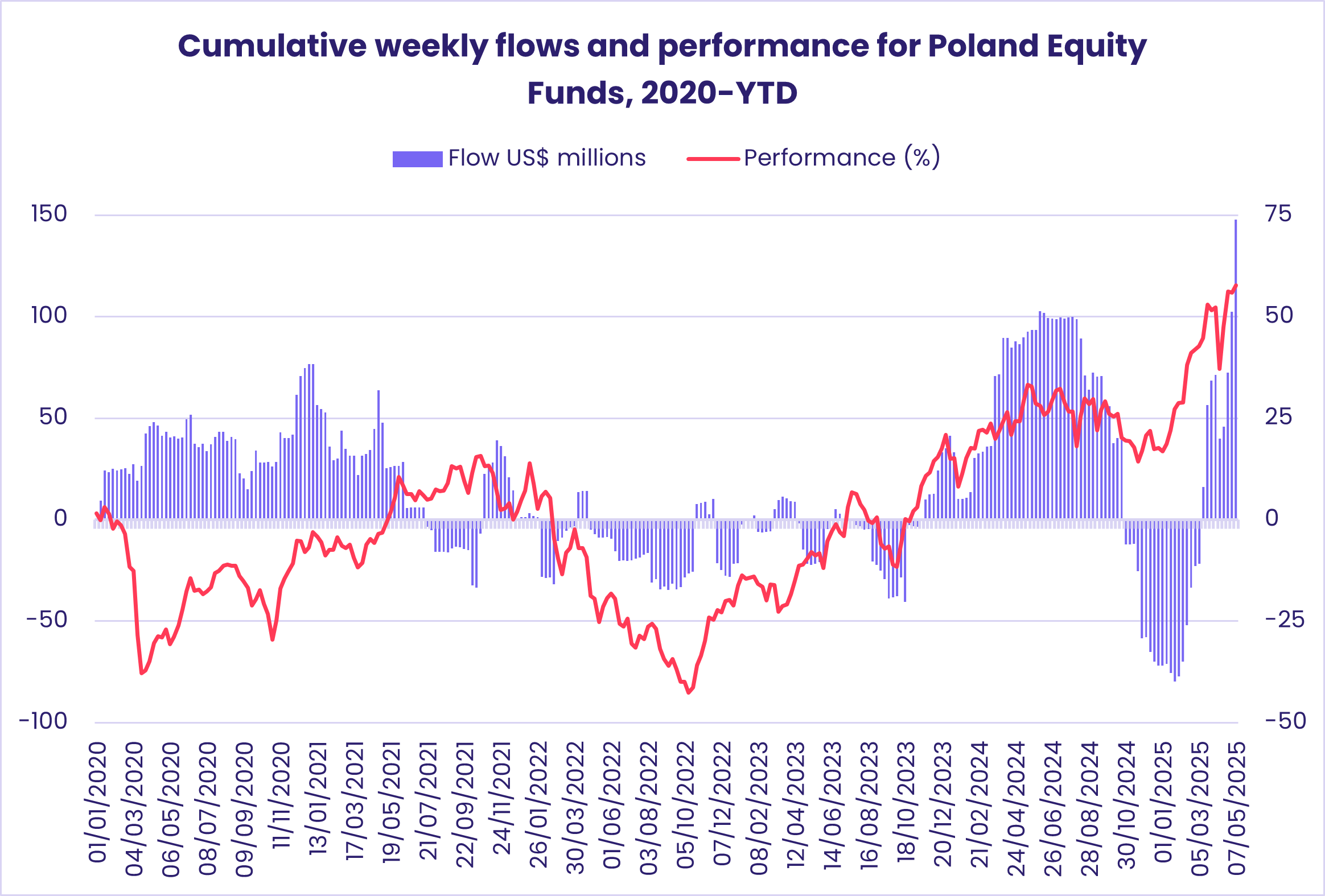

Among the major regional groups, EMEA Equity Funds posted their third straight inflow, and their biggest since late March, as flows into Turkey Equity Funds rebounded to a five-week high and Poland Equity Funds chalked up their biggest weekly inflow since mid-2Q13 when investors expected the liquidity generated by quantitative easing in the US, Japan and Europe to spill over into emerging markets. In the case of Poland, market performance so far this year and rising dividend yields have attracted the attention of investors.

China Equity Funds posted a modest collective outflow, their 10th of the year so far, with redemptions from domestically domiciled funds canceling out positive flows for funds based outside the mainland. Meanwhile, GEM ex-China Equity Funds tallied their biggest inflow since early February. Funds dedicated to Emerging Asia’s other heavyweight, India, fared better as investors placed greater weight on the benefits of lower oil prices than the latest spike in tensions with Pakistan.

The headline number for all Latin America Equity Funds was again underpinned by strong flows into Brazil Equity Funds ahead of another interest rate hike that lifted the benchmark rate for Latin America’s largest economy to a 19-year high. Elsewhere, flows into Argentina Equity Funds continued to rebound while Mexico Equity Funds recorded their biggest outflow since late December.

Developed Markets Equity Funds

May started with US Equity Funds extending their longest run of outflows since 2Q23. But, for the fourth straight week, flows into Europe, Global and Europe Equity Funds outweighed the redemptions from US-mandated funds, allowing EPFR-tracked Developed Markets Equity Funds to keep their current inflow streak alive.

The latest outflow posted by US Equity Funds came at the end of a week when benchmark indexes continued to make up the ground lost during the week following US President Donald Trump’s ‘Liberation Day.’ American equity markets are also getting plenty of support in the form of listed companies shrinking their free float. Since the beginning of the current earnings season, the average daily value of announced share buybacks has been running at over $20 billion.

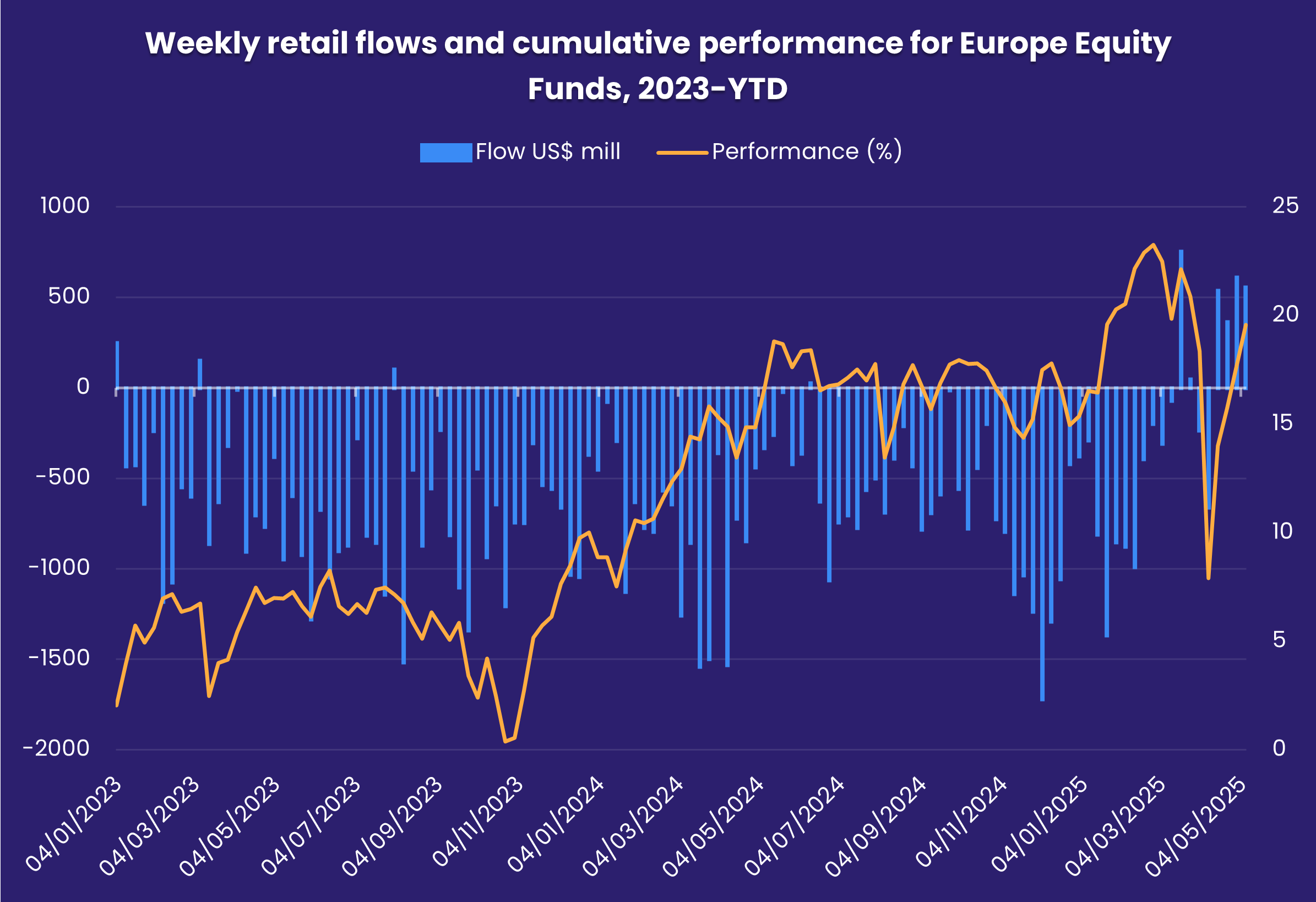

Europe Equity Funds, meanwhile, enjoyed another solid week with Germany and Europe Regional Funds again leading the way. Retail investors have started to join the party, committing fresh money to Europe Equity Funds for the fourth week running. The last time that happened was early 1Q22.

At the country level, Italy Equity Funds extended their longest run of inflows since 2Q24, Spain Equity Funds pulled in fresh money for the ninth time during the past 10 weeks and Switzerland Equity Funds chalked up their fifth straight inflow while investors pulled money out of UK Equity Funds for the 17th time year-to-date and redemptions from Portugal Equity Funds hit a YTD high.

Japan Equity Funds eked out a modest collective inflow despite the first outflow from retail share classes since the third week of March, a third straight outflow from Leveraged Japan Equity Funds and the sixth week of net redemptions over the past two months for funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates.

Flows into Global Equity Funds, the largest of the diversified Developed Markets Equity Funds groups, favored those with fully global mandates over their ex-US counterpart. Another diversified group, Pacific Regional Equity Funds, posted their biggest inflow since late 3Q23.

Global sector, Industry and Precious Metals Funds

For the second straight week, five of the 11 major EPFR-tracked Sector Fund groups reported inflows and six posted outflows. But the first week of May did see flows for Technology Sector Funds move to negative territory. Overall, inflows to the groups that received them averaged roughly $250 million – with Industrials Sector Funds topping the list – while outflows from the other six ranged from nearly $100 million for Healthcare/Biotechnology Sector Funds to $1.2 billion for Technology Sector Funds.

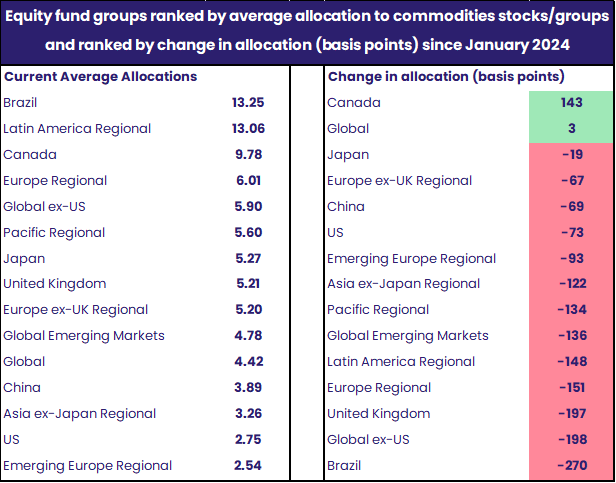

Commodities/Materials Sector Funds extended their outflow streak to five weeks and $3.5 billion. Flows by benchmark over the past five weeks show 11 with redemptions hitting above $100 million. That included four benchmarks focused on gold mining racking up a net $1.5 billion in outflows, over $550 million exiting a single copper mining benchmark, $400 million being collectively pulled from three other metal & mining focused benchmarks, and an upstream natural resources benchmark redeeming over $200 million.

Brazil Equity Funds, which have the highest average allocation currently to commodities among other major country funds groups, have decreased their exposure by roughly 270 basis points since the start of last year. Canada Equity Funds, which rank third highest, however, have taken a contrarian stance on commodities exposure so far this year – increasing average allocations by roughly 143 basis points since Jan 2024 – but have also embraced their position in the energy space.

Technology Sector Funds saw their seven-week inflow streak, the longest since a nine-week run starting in 3Q24, come to an end. Investors – who have a growing pile of earnings reports to digest – pulled a collective $750 million from two semiconductor ETFs this week and another $500 million total from two Leveraged 2x ETFs tracking Nvidia and Microsoft.

Although the Magnificent 7 companies that have reported first quarter earnings have highlighted the uncertainty created by recent tariff proposals, that was partially offset by improvements in their AI models. Microsoft, buoyed by strong AI-driven revenue growth, is planning to invest $80 billion in data centers to support its expanding AI infrastructure. The rollout of Gemini 2.5 highlighted Alphabet’s continued commitment to advancing AI, positively impacting the company’s Q1 growth.

Bond and other Fixed Income Funds

Having recovered some of their appetite for credit risk in late April, investors ventured further out along the yield curve in early May. Flows into all Long and Intermediate Term Bond Funds climbed to six and nine-week highs, respectively, as EPFR-tracked Bond Funds posted their biggest inflow in over two months.

Of the major groups by geographic focus, only Asia Pacific Bond Funds recorded an outflow. US Bond Funds tallied their biggest inflow since late February, Europe Bond Funds chalked up their 15th inflow year-to-date and flows into Global Bond Funds climbed to a 16-week high.

At the asset class level, flows into Mortgage-Backed Bond Funds hit their highest level so far this year, Municipal Bond Funds chalked up their biggest inflow since late February and High Yield Bond Funds tallied consecutive weekly inflows for the first time since early March as investors adjusted their expectations for US interest rates.

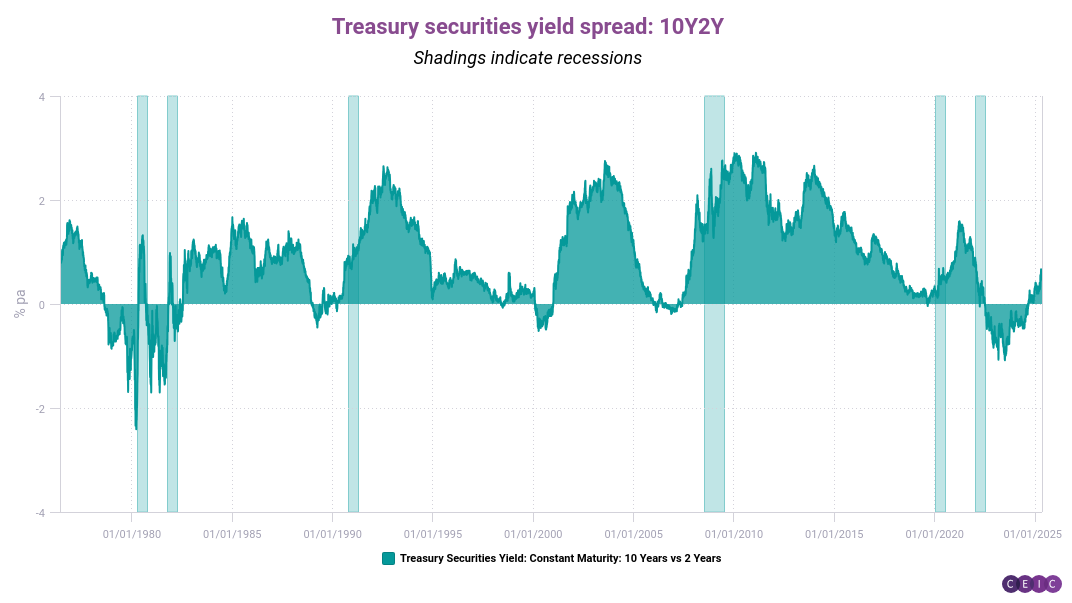

Short Term Mixed, Intermediate Term Sovereign, Municipal and Mortgage-Backed Funds were the biggest contributors to the headline for all US Bond Funds. Having lived with an inverted yield curve between 2022 and late last year, investors in US Treasuries are working with a positive curve.

Europe Bond Funds with corporate mandates took in more money than their sovereign counterparts for the first time since the second week of March. But retail share classes, which took in fresh money 18 of the 20 weeks between mid-November and early April, posted their third outflow over the past four weeks. At the country level, investors favored diversified over single country exposure, with Germany Bond Funds chalking up their biggest outflow since late 2Q24.

This preference for diversified exposure was also reflected in flows to Emerging Markets Bond Funds. For the second week running, Global Emerging Markets (GEM) Equity Funds recorded the biggest inflow among regional and single country groups.

Among the Asia Pacific Country Fund groups, both Japan and Australia Bond Funds posted significant outflows. In the case of the latter, the redemptions were the biggest since late 2023 and snapped an inflow streak stretching back over a year.

Did you find this useful? Get our EPFR Insights delivered to your inbox.