The twin specters of inflation and the planet running hotter occupied investors going into November as the UN climate summit, COP26, got underway and central bankers in the US and UK met. SFlows to EPFR-tracked funds during the week ending Nov. 3 reflected the general focus on these themes.

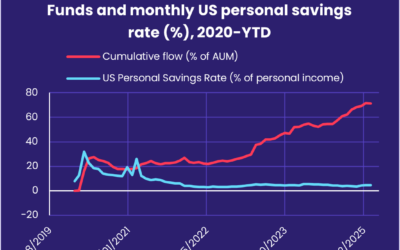

Ahead of the US Federal Reserve spelling out the tapering of its current asset purchasing program, at the rate of $15 billion a month, and the Bank of England’s Nov. 4 policy meeting, flows continued to rotate from fixed income to Equity Fund groups. During 3Q21, Bond Funds recorded an average weekly inflow of $16 billion versus $14 billion for Equity Funds. So far this quarter, flows into Equity Funds have averaged $20.5 billion versus $5 billion for Bond Funds.

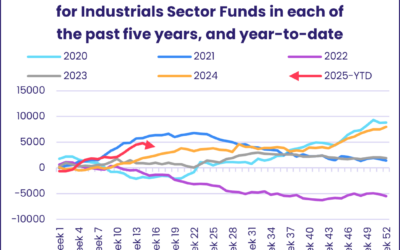

Investors looking for protection from inflation, or ways to keep ahead of its effects, also steered over $2 billion into Inflation Protected Bond Funds for the third time in the past four weeks, extended the current inflow streaks of Bank Loan, High Yield and Cryptocurrency Funds and boosted flows into Commodities Sector Funds to a 20-week high.

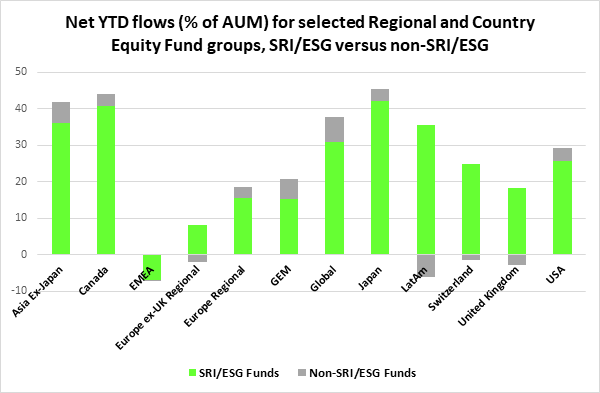

Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates, meanwhile, chalked up their 65th consecutive inflow and largest since the second week of July. Year-to-date they have taken in twice as much money, in dollar terms, compared to their non-SRI/ESG counterparts. In % of AUM terms the gap is even more pronounced.

Did you find this useful? Get our EPFR Insights delivered to your inbox.