China and cash were by far and away the most popular asset classes during the fourth week of April as investors and markets braced for another round of rate hikes in early May. EPFR-tracked Money Market Funds pulled in over $50 billion for the seventh time in the past nine weeks while funds dedicated to China and its rebounding economy chalked up their biggest inflow since mid-1Q21.

Both the US Federal Reserve and European Central Bank (ECB) hold policy meetings next week, and both are expected to hike interest rates by at least 25 basis points. Investors fear this increases the odds of economic ‘hard landings’ on both sides of the Atlantic. They also fear that it will put more pressure on fault lines, such as real estate bubbles and interest rate mismatches, that could trigger new market shocks. US, Global and Europe Equity Funds all posted outflows, with the latter experiencing their heaviest redemptions in over four months.

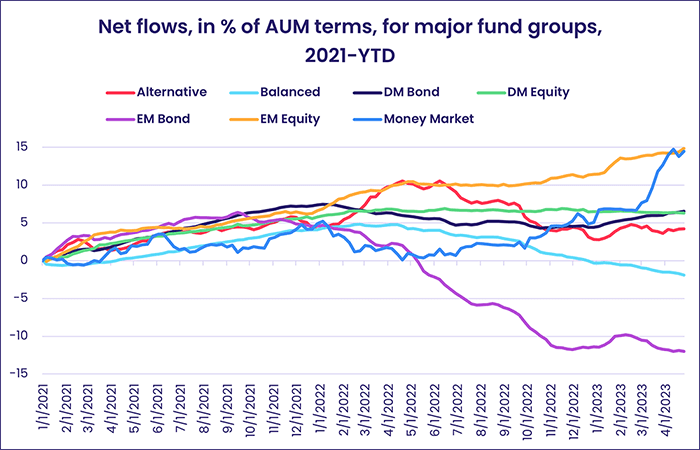

Overall, the week ending April 26 saw EPFR-tracked Equity Funds eke out a collective inflow of $24 million while Alternative Funds absorbed $177 million and Bond Funds $7.3 billion. A net $52.2 billion flowed into Money Market Funds, with Japan Money Market Funds recording their biggest inflow since mid-December and Europe Money Market Funds posting their seventh inflow in the past eight weeks.

At the asset class and single country fund level, Gold Funds extended their longest run of inflows since 4M22, Cryptocurrency Funds saw their five-week inflow streak come to an end, Mortgage-Backed Bond Funds attracted fresh money for the 14th time in the past 16 weeks and Municipal Bond Funds posted their second biggest outflow year-to-date. Thailand Bond Funds chalked up their biggest outflow since mid-2Q22 and Vietnam Equity Funds since mid-3Q22 while Hong Kong Equity Funds recorded their 13th consecutive inflow.

Emerging markets equity funds

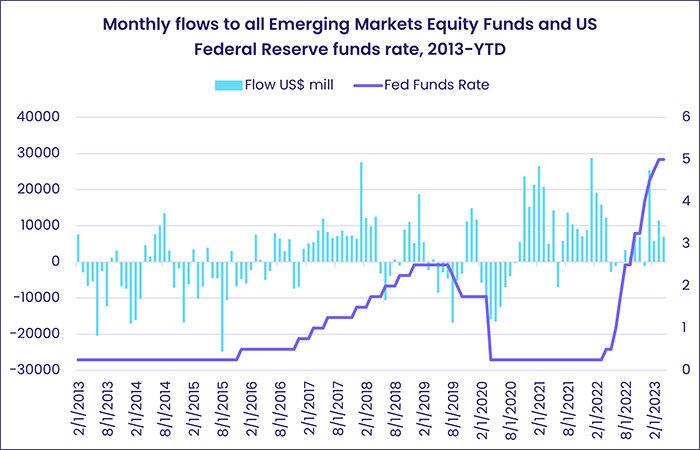

The rush to increase exposure to a recovering Chinese economy lifted flows to all EPFR-tracked Emerging Markets Equity Funds to a 12-week high going into the final days of April. Flows to this group have proved much more resilient in the face of rising US interest rates than they did in the run-up to the US Federal Reserve’s pre-pandemic tightening cycle when the so-called ‘taper tantrum’ held sway from 2013 to 2015.

While flows into China Equity Funds accounted for the bulk of the latest week’s headline number, fresh money also flowed into Latin America and the diversified Global Emerging Markets (GEM) Equity Funds. Flows into EM Dividend Funds hit a six-week high and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates extended an inflow streak that started in mid-November. Retail flows were negative for the fifth time in the past seven weeks.

In addition to the more than $6 billion that flowed into China Equity Funds, investors committed a combined $470 million to Taiwan (POC) and Hong Kong (SAR) Equity Funds while redemptions from Greater China Equity Funds hit a 21-week high. China’s share of the average GEM Equity Fund portfolio remains slightly above 26%, while India’s has fallen to a 20-month low.

Hopes for stronger Chinese demand for raw materials helped Brazil Equity Funds snap a five-week run of outflows. Data showing inflation at a 30-month low also bolstered sentiment towards Latin America’s biggest economy ahead of next week’s central bank policy meeting. Brazil’s benchmark interest rate currently stands at 13.75%

Investors were net redeemers from EMEA Equity Funds for the fifth week running as Poland Equity Funds posted their biggest outflow since late November and South Africa Equity Funds recorded their 13th outflow year-to-date. The latest Sector Allocations data show that EMEA Regional Fund managers are still, on average, allocating over a third of their portfolios to financial stocks. Exposure to energy plays is less than a third of its last peak in 4Q19 and the weighting for technology is at its lowest level since 3Q14.

Developed markets equity funds

Going into the final days of April, benchmark equity indexes for the US, Japan and Europe were up 6.1%, 10.6% and 14.8% year-to-date. But investors are cashing in these gains rather than chasing future performance. Redemptions from EPFR-tracked Developed Markets Equity Funds during the week ending April 26 hit an eight-week high as US Equity Funds posted their 10th outflow in the past 12 weeks and Japan Equity Funds their 11th in the past 14, Global Equity Funds posted consecutive weekly outflows for only the second time this year and Europe Equity Funds chalked up their biggest outflow since the first week of December.

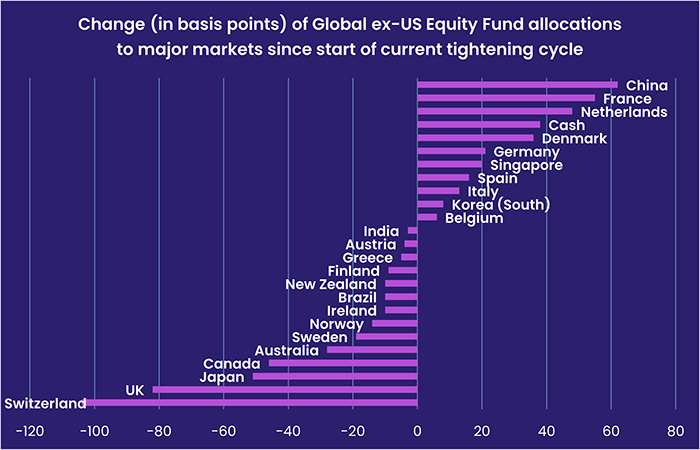

Funds with fully global mandates drove the headline number for all Global Equity Funds while flows into Global ex-US Equity Funds climbed to a six-week high. Since the latest US tightening cycle began last year, Global ex-US Funds have outperformed their fully global peers as they rotated exposure from developed Asian and non-EU markets to China and core Eurozone countries.

Investors are currently cool to markets both inside and outside the Eurozone. Redemptions from France, Germany and UK Equity Funds accounted for roughly half of the week’s headline number for all Europe Equity Funds. Investors, who pulled a record-setting sum out of UK Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates the previous week, redeemed over $1 billion this week.

Japan Equity Funds extended their current outflow streak to four weeks and $3.3 billion ahead of the Bank of Japan’s first policy meeting under new governor Kazuo Ueda. Markets believe the BOJ will start tightening its current monetary program, which includes direct purchases of domestic ETFs and REITs, but are unsure of when and to what degree.

Markets are more certain about the immediate future for US monetary policy – another 0.25% hike early next month – but expect rate cuts before the end of the year. That consensus is likely to harden after first-quarter GDP growth slipped from an annualized rate of 2.6% in 4Q22 to just 1.1%. Although US Large and Small Cap Mixed Funds both posted modest inflows, those were more than offset by redemptions from other groups.

Global sector, industry and precious metals funds

Major US technology plays were on deck during the fourth week of April as the 1Q23 corporate earnings season headed toward its peak. Although Technology Sector Funds attracted over $1 billion, it was one of only four major EPFR-tracked Sector Fund groups to record an inflow while seven were hit with redemptions ranging from $12 million to $1.09 billion.

The bulk of the latest inflow for Technology Sector Funds went to funds dedicated to China. After a record-breaking outflow two weeks ago, China Technology Sector Funds flipped the switch by posting their second largest inflow on record (the biggest inflow happened in mid-Feb 2020). Drilling down, funds with semiconductor mandates posted their biggest inflow in over six months despite US bellwether Intel’s less than stellar earnings report.

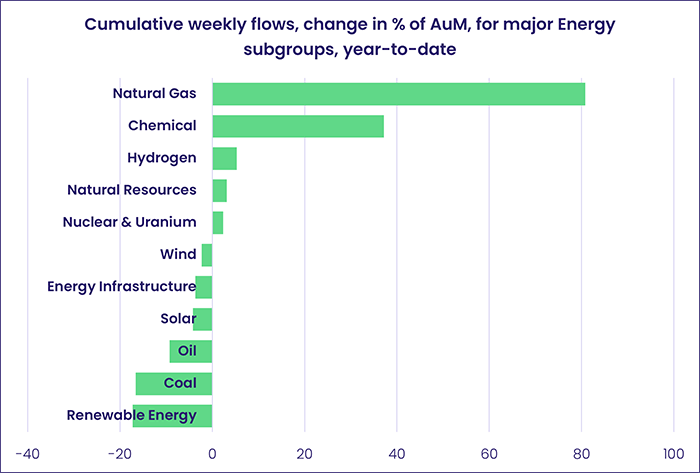

Energy Sector Funds continue to struggle as fears about a recession in the second half of the year nullified the potential benefits – from a profit perspective – of tight supplies. Outflows from the overall group exceeded $1 billion for the fifth time year-to-date, with Oil Funds racking up their fifth straight outflow. The ongoing conflict between Ukraine and Russia, and that conflict’s impact on supplies of natural gas to Europe, has kept the spotlight on renewable energy sources. But diversified Renewable Energy and Hydrogen Funds were the only two subgroups that saw fresh money flow in this week.

Although US bank First Republic’s first quarter earnings rekindled fears about the health of other regional banks and their ability to lend, Financial and Real Estate Sector Funds both posted an inflow for the week. Behind the headline number for the latter group was the largest weekly inflow on record for Switzerland Real Estate Sector Funds which have taken in fresh money for three straight weeks and 12 of the past 16.

Bond and other fixed income funds

The fourth week of April saw EPFR-tracked Bond Funds absorb fresh money for the 15th time in the past 17 weeks as retail commitments climbed to an eight-week high. But the risk appetite seen the previous week flickered out, with High Yield and Emerging Markets Bond Funds experiencing net redemptions while over $7 billion flowed into funds with investment grade mandates.

At the asset class level, flows into Municipal Bond Funds hit a 14-week high and Mortgage Backed Bond Funds recorded their 14th inflow so far this year while investors pulled money out of Bank Loan Funds for the 14th consecutive week and Inflation Protected Bond Funds extended their second longest outflow streak on record.

US Bond Funds continue to shrug off the risk that the latest debt ceiling standoff in the world’s largest economy will end badly, maintaining their record of posting an inflow every week of the year so far. Retail share classes, however, have only seen fresh money five of those 17 weeks. US Bond Funds with intermediate term mandates have seen the biggest inflows in cash terms and long term funds in % of AUM terms.

Funds dedicated to North America’s other major market, Canada, remain popular. Canada Bond Funds posted their fifth straight inflow and 12th since mid-January.

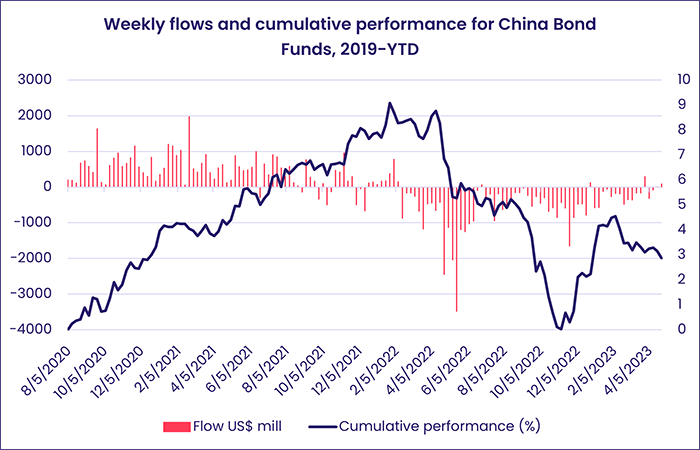

Both Hard and Local Currency Emerging Markets Bond Funds recorded outflows during a week when inflationary pressures forced Argentina to raise domestic interest rates to over 80% and Standard & Poor’s cut its outlook on Egypt’s debt to negative. Sharia Bond Funds posted their biggest outflow since late November and money also flowed out of Frontier Markets Bond Funds the week after they set a new inflow mark. But China Bond Funds have seen investor sentiment slowly thaw in recent months and Korea Bond Funds continue to soak up fresh money.

Europe Bond Funds recorded another solid inflow as funds with sovereign mandates absorbed more money than corporate funds for the fifth time in the past six weeks and retail share classes absorbed fresh money for the 12th time in the past 13 weeks.

Flows into the two major multi-asset groups diverged sharply, with Total Return Funds posting their third inflow in the past four weeks while redemptions from Balanced Funds hit a YTD high.

Did you find this useful? Get our EPFR Insights delivered to your inbox.