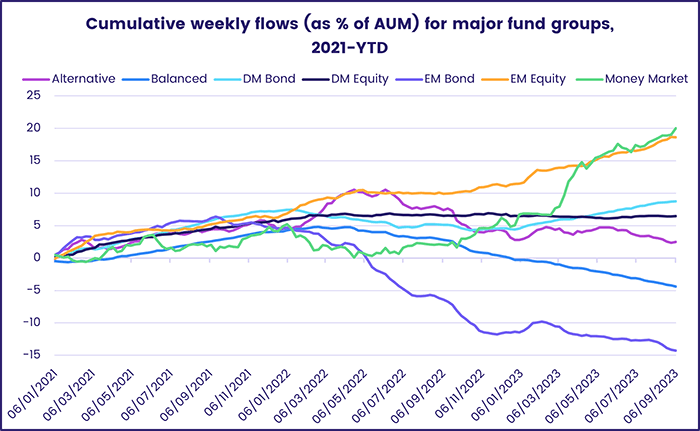

The first week of September saw EPFR-tracked Money Market Funds absorb over $65 billion as investors waited to see which way interest rate winds are blowing in the US and Eurozone. Also giving them pause for thought are the health of China’s economy, the durability of the latest bump in oil prices and the resilience of key real estate markets.

With US economic data a little too good, China’s latest export figures suggesting policymakers may be slipping behind the stimulus curve and cell phones falling afoul Sino-US trade tensions, China Equity Funds posted their second outflow of 3Q23, US Equity Funds recorded their fourth outflow in the past five weeks and Technology Sector Funds experienced net redemptions for the first time since the third week of June.

Overall, EPFR-tracked Equity Funds posted a collective inflow of $2.2 billion during the week ending Sept. 6 as flows into diversified Global Equity Funds hit their highest level in three months. Investors pulled $3 billion from Balanced Funds while steering $617 million into Alternative Funds, $4 billion into Bond Funds and $68 billion into Money Market Funds. In the case of the latter, flows into Japan, US and Europe Money Market Funds hit six, nine and 13-week highs, respectively.

At the asset class and single country fund level, Silver Funds extended their longest outflow streak since a 14-week run ended in early 3Q22, Bank Loan Funds posted their biggest weekly inflow in over 15 months and Inflation Protected Bond Funds chalked up their third inflow during the past year. Flows into Italy Equity Funds hit a nine-week high, Italy Bond Funds extended an inflow streak stretching back to late April and redemptions from China Bond Funds climbed to a 28-week high.

Emerging markets equity funds

Flows to China Funds finally cracked in early September ahead of export data showing global demand for Chinese exports continues to weaken. That, allied to further redemptions from retail share classes and the biggest outflow from Brazil Equity Funds since 2Q20, brought EPFR-tracked Emerging Markets Equity Funds’ eight-week inflow streak to an end.

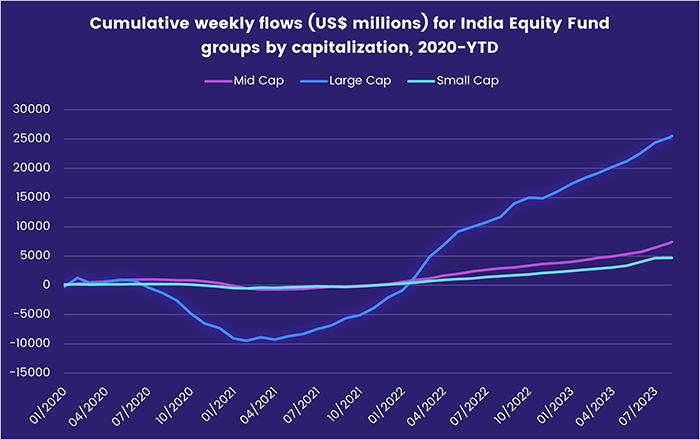

While China Equity Funds experienced a rare week of net outflows, investors continue to steer above-average sums into India Equity Funds which added to their longest run of inflows since a 30-week run ended in 2Q04. Flows into funds with mid cap mandates hit a five-week high and India Small Cap Funds, which recorded outflows one out of every two weeks during 5M23, posted their 13th consecutive inflow.

Taiwan (POC) Equity Funds also enjoyed strong inflows, which hit a 13-week high, as the island’s key semiconductor sector steps up its offshoring of chip production with stakes in new facilities being built in the US, Japan and Germany. Domestically domiciled funds have been the beneficiaries of recent inflows, with foreign domiciled Taiwan Equity Funds last posting an inflow during the third week of June.

China’s underwhelming economic performance also took a toll on Brazil Equity Funds, which saw over $400 million flow out as investors reassessed their forecasts for Brazilian commodity exports to the country’s biggest trading partner. August’s higher-than-expected inflation number has also hit expectations of a brisk rate-cutting cycle by Brazil’s central bank.

EMEA Equity Funds eked out a modest collective inflow, their biggest since mid-July, with South Africa Equity Funds the biggest contributor to the headline number. Inflation in Africa’s most developed economy has dropped back into the central bank’s target range, raising hopes that interest rates will remain at current levels and the central bank’s next move will be a rate cut.

Developed markets equity funds

EPFR-tracked Developed Markets Equity Funds started September with their second consecutive weekly inflow. Investors showed a marked preference for diversified exposure, with flows into Global Equity Funds offsetting modest redemptions from US, Japan, Europe and Canada Equity Funds.

The inflow recorded by Global Equity Funds was the biggest in 13 weeks, and funds with fully global mandates took in $7 for every $1 committed to their global ex-US counterparts. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates saw flows rebound to a nine-week high.

US SRI/ESG Equity Funds fared even better, with inflows hitting their highest level in just under a year. But record-setting outflows from US Technology Sector Funds, driven by fears that Sino-US trade tensions will hit US firms like Apple and doubts that US interest rates will actually drop this year, pulled the headline number for all funds into negative territory.

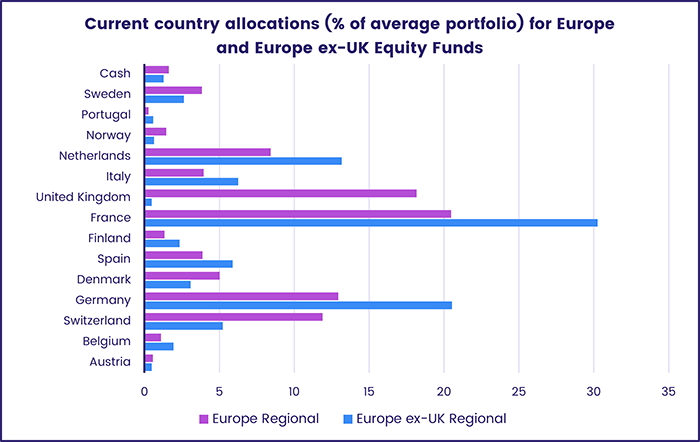

Doubts about Chinese appetite for European exports are among the headwinds that have dogged Europe Equity Funds since mid-March. During the latest week, however, the group did come within $70 million of snapping its 26-week outflow streak. Investors believe that, in the face of lackluster growth and weak leading indicators, the European Central Bank and the Bank of England may keep interest rates on hold at their next meetings.

At the country level, UK Equity Funds posted their first inflow since early January and their biggest since late 2Q22, Finland Equity Funds enjoyed another week of above average flows and Switzerland Equity Funds recorded their largest inflow since mid-July. Of the two major regional groups, however, it was Europe ex-UK Regional Funds that recorded inflows – which hit a 26-week high – while another $700 million flowed out of Europe Regional Equity Funds despite their bigger allocations to the UK and Switzerland.

Japan Equity Funds chalked up only their second outflow over the past three months during a week when the Topix index hit a 33-year high. Policymakers at the Bank of Japan have been challenging expectations that the process of normalizing the BOJ’s ultra-accommodative policies will start any time soon despite recent wage and price growth. Exporters are under pressure from weaker global demand.

Global sector, industry and precious metals funds

Heading into the final third of 2023, investors were still trying to get a fix on interest rate trajectories in Europe and North America, interpret an increasingly complex energy picture, sift hype from reality in the Artificial Intelligence space and handicap the odds of a soft landing for the US and global economies. Although four of the 11 EPFR-tracked Sector Fund groups attracted inflows during the first week of September, the totals were nowhere near the levels seen in previous weeks, ranging from a shy $2 million for Infrastructure Sector Funds to $272 million for Energy Sector Funds.

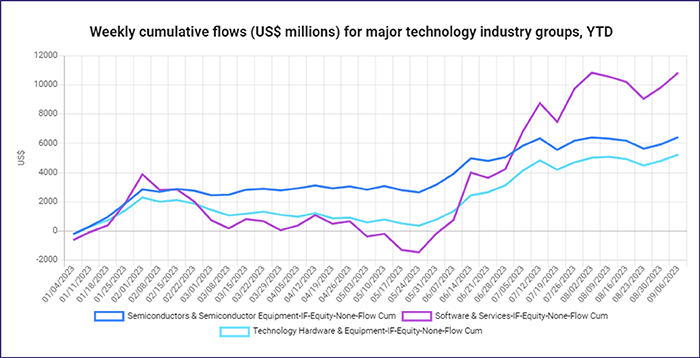

There was a notable absentee from the latest inflow list. Technology Sector Funds snapped a 10-week inflow streak that saw $18 billion (3.5% of assets) flow in, with the $2.2 billion redeemed from a single US-based ETF driving the group’s headline number and the new outflow record for all US Technology Sector Funds.

Drilling down, redemptions for Semiconductor Funds were the largest since the first week of June while Artificial Intelligence Funds recorded their sixth straight inflow. EPFR’s Industry Flows dataset shows that year-to-date, $10.8 billion has been committed to Software & Services firms versus $5.2 billion for Hardware & Equipment producers and $6.4 billion for Semiconductor-related businesses.

Elsewhere, Energy Sector Funds posted their first inflow in two weeks and fourth in the past eight weeks as oil prices camped around the $90 a barrel mark. A grouping of nine funds with solar mandates enjoyed a second straight week of collective inflows. The previous week this group chalked up their largest inflow since the first week of this year.

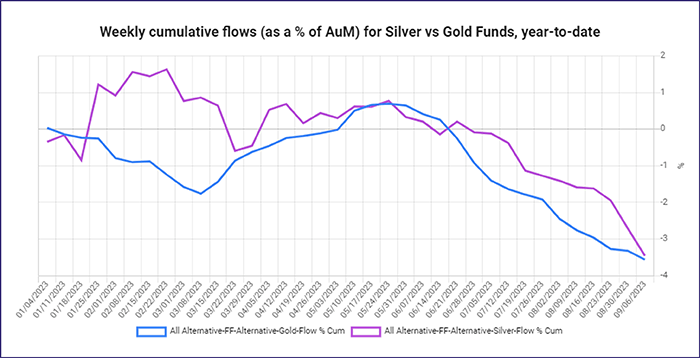

Silver Funds suffered their 11th straight week of outflows, the longest run since a 14-week ended in April. With the past two weeks seeing over $400 million flow out, investors have pulled a collective $1 billion (or 3.5% of assets) from this group since the last week of June. The other major precious metals group, Gold Funds, recorded their 15th consecutive outflow.

Bond and other fixed income funds

Another $4 billion flowed into EPFR-tracked Bond Funds during early September as investors seek exposure to higher yielding developed market investment grade debt that was off the table for much of the decade following the financial crises of 2008-10. US Bond Funds kept their year-to-date inflow streak intact and Europe Bond Funds recorded their 31st inflow since the beginning of 2023.

Those higher yields continue to dull investor appetite for riskier fixed income asset classes. Net flows into High Yield Bond Funds came in at only $38 million while Emerging Markets Bond Funds chalked up their sixth consecutive outflow.

At the asset class level, flows into Inflation Protected Bond Funds hit a six-week high with US-mandated funds providing most of the impetus. Bank Loan Funds recorded their biggest inflow since mid-2Q22, Convertible Bond Funds posted their 32nd outflow of the year and flows into Total Return Funds climbed to a nine-week high.

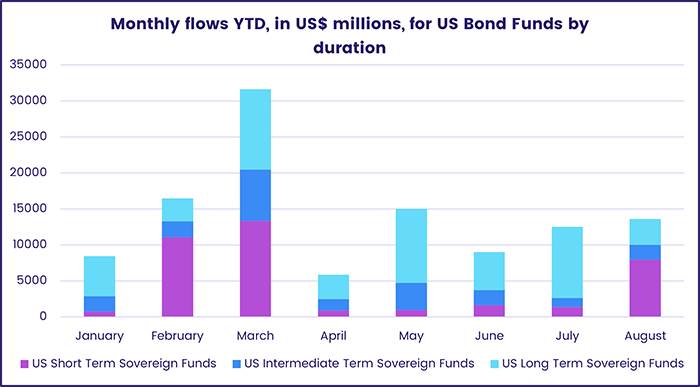

The latest flows into US Bond Funds saw funds with sovereign mandates outgain their corporate counterparts for the seventh week running. So far this year, US Sovereign Bond Funds have absorbed nearly 25 times the amount of fresh money that US Corporate Bond Funds have received. Municipal Bond Funds are also feeling the chill as investors gravitate to Treasuries: flows have been negative four of the past six weeks.

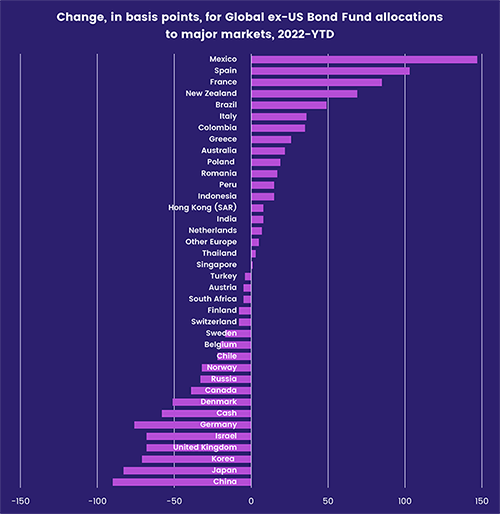

Global Bond Funds did not attract the same kind of attention – and flows – that Global Equity Funds did during the first week of September. Redemptions from Global Bond Funds edged up to a six-week high as modest flows into funds with ex-US mandates were offset by the outflows from funds with fully global mandates. Country Allocations data shows that, over the past 19 months, managers of Global ex-US Bond Funds have rotated exposure for Asian and core European markets to Latin markets on both sides of the Atlantic.

The latest Emerging Markets Bond Fund flows reflected, to a degree, that pattern with China, India, Japan, Malaysia and Thailand Bond Funds posting outflows while Brazil and Colombia Bond Funds both recorded solid inflows. Flows into retail share classes rebounded to a 20-week high and US-domiciled funds recorded their first collective inflow since mid-July.

Flows into Europe Bond Funds in early September favored those with corporate mandates while mixed funds racked up their 11th outflow over the past 13 weeks and Europe Sovereign Bond Funds pulled in fresh money for the 30th consecutive week.

Did you find this useful? Get our EPFR Insights delivered to your inbox.