US Money Market Funds started October with their biggest weekly inflow in six months as investors struggled to make sense of a market where interest rates are at a 22-year high, the unemployment rate is still below 4%, a key measure of American consumer sentiment is signaling recession, the yield on 10-year Treasuries hit a 16-year high and the idea of a ‘soft landing’ for the US economy still has currency.

Fixed income investors continued to rotate out of riskier asset classes, with over $4 billion flowing out of High Yield Bond Funds and redemptions from Emerging Markets Bond Funds hitting a 29-week high. However, appetite among equity investors for exposure to the major Asian markets remains high. Both China and Japan Equity Funds absorbed over $1 billion, flows into Thailand Equity Funds hit their highest level since mid-3Q20 and India Equity Funds extended their longest inflow streak since 1H04.

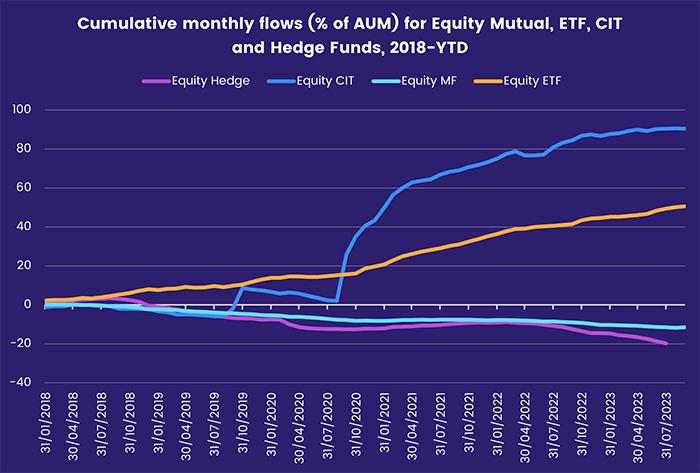

Overall, the week ending Oct. 4 saw all EPFR-tracked Bond Funds post consecutive weekly outflows for the first time since mid-March, Balanced Funds extend their current outflow streak to 26 weeks and $80.5 billion total, and Alternative Funds surrender a net $2.4 billion. Equity Funds posted a collective inflow of $3.2 billion as Dividend Equity Funds posted their fifth inflow since the beginning of September, flows into funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates climbed to a 12-week high, and Equity Collective Investment Trusts (CITs) recorded a modest inflow.

At the asset class and single country fund level, Cryptocurrency Funds snapped their six-week redemption streak, investors pulled another $1.2 billion out of Gold Funds, and Bank Loan Funds posted their biggest outflow in over four months. Australia Bond Funds posted their 25th straight inflow, Norway and Greece Equity Funds experienced their heaviest redemptions since 2Q22 and flows into Peru Equity Funds hit a 19-week high.

Emerging markets equity funds

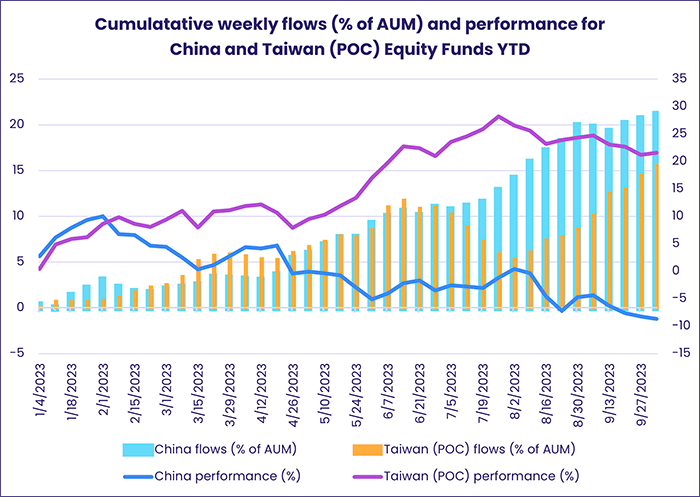

Investors steered a combined $2.4 billion into China, India, Korea and Taiwan (POC) Equity Funds during the week ending Oct. 4. Those inflows offset the 10th straight outflow from the diversified Global Emerging Markets (GEM) Equity Funds and allowed all EPFR-tracked Emerging Markets Equity Funds to post their 32nd inflow in the 40 weeks year-to-date.

The latest run of outflows for GEM Equity Funds is being driven by funds domiciled in Europe, which have recorded outflows of over $1 billion in seven of the past eight weeks versus four of eight for US-domiciled funds. Japan-domiciled GEM Funds, meanwhile, have posted inflows every week so far this year.

China Equity Funds have now absorbed fresh money in 12 of the past 15 weeks, despite a marked change for the worse in perceptions of its economic strength, while funds dedicated to Taiwan – which China deems a renegade province – have recorded inflows for nine straight weeks as investors continue to buy into the island’s technology story. Taiwan (POC) Dividend Funds have accounted for over a third of the inflows reported by all Taiwan-dedicated funds since the beginning of August.

Among the other Asia ex-Japan Country Fund groups, Thailand Equity Funds posted their biggest inflow in over 37 months as investors positioned themselves for expansionary measures promised by the country’s government.

Latin America Equity Funds, which racked up 11 weekly inflows between mid-June and late August, posted their fourth outflow of the past five weeks as higher-for-longer US interest rates and an underwhelming Chinese economy sapped investor sentiment. The latest sector allocations data shows that Latin America Regional Equity Fund managers have lifted their exposure to energy stocks to a 12-month high now and have started to reverse the rotation from consumer discretionary to consumer staples plays that began in 3Q22.

With clouds over all of the major markets in the EMEA universe, EMEA Equity Funds posted their eighth collective outflow in the past 10 weeks. South Africa Equity Funds did post their sixth inflow since mid-August.

Developed markets equity funds

Uncertainty about the pivot points for interest rates in the US and Europe, and the softness of any landing for their economies, dampened – but did not extinguish – investor appetite for exposure to developed markets equity in early October. US, Japan, Canada and Australia Equity Funds all posted inflows that offset redemptions from Europe, Global and Pacific Regional Equity Funds.

US Equity Funds pulled in nearly $4 billion as institutional investors tuned out the political circus in Washington, DC, and rising bond yields. The bulk of the fresh money went to Large Cap Blend Funds. Also seeing inflows were US Dividend Funds, which snapped a four-week outflow streak, and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates absorbed a five-week high inflow.

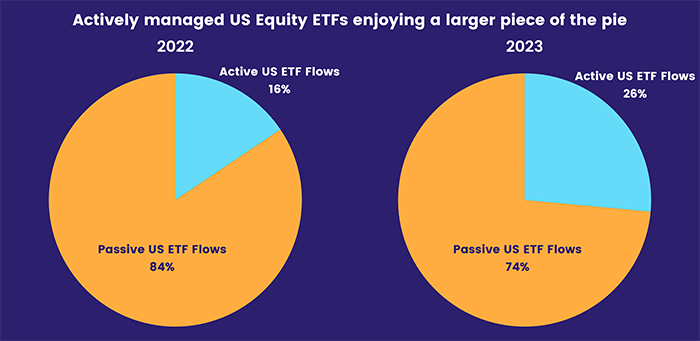

Research by EPFR Senior Liquidity Analyst Winston Chua highlights the growing footprint of actively managed ETFs in the US Equity Fund space. EPFR tracked 300 of these funds in 1Q22 and now tracks 437 which have absorbed over a quarter of the net flows to all US Equity ETFs so far this year.

Europe Equity Funds extended an outflow streak stretching back to mid-March as Italy joined Germany on many investors’ watch lists. Inflation in the Eurozone continues to grind lower, hitting a 23-month low of 4.2% in September, but leading indicators suggest more economic pain ahead for the currency union and broader EU. Italy Equity Funds have posted outflows in nine of the past 10 weeks as investors fret that rising bond yields and ad hoc fiscal policymaking put continental Europe’s third-largest economy at risk of another debt crisis.

Investors committed fresh money to Japan Equity Funds for the 16th time since the beginning of June, with flows to retail share classes just shy of the previous week’s one-year high. Flows to foreign domiciled funds rebounded, as did flows into Japan SRI/ESG Equity Funds which climbed to their highest level in nearly four months.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, saw a five-week inflow streak end as redemptions from Europe-domiciled funds hit an eight-week high.

Global sector, industry and precious metals funds

October kicked off with five of the 11 major EPFR-tracked Sector Fund groups posting an inflow. In a departure from the pattern since early 2Q23, it was not the usual suspect – Technology Sector Funds – that was the week’s biggest money magnet. Both Energy and Utilities Sector Funds posted bigger inflows.

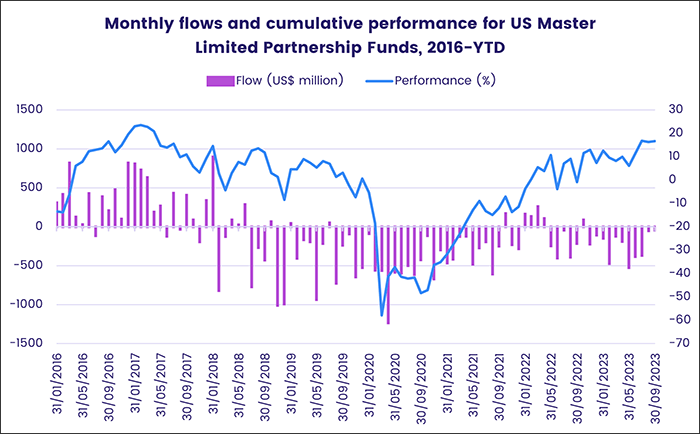

For the fifth week running, Energy Sector Funds have seen positive flows as oil prices remain elevated and driving season gives way to heating season in the Northern Hemisphere. Nuclear & Uranium Funds enjoyed a 12th straight week of inflows while outflows from Solar Energy Funds hit a six-week high. The week ending Oct. 4 also saw Master Limited Partnership (MLP) Funds, which provide tax-advantaged exposure to US mid-stream energy assets and have struggled since their heyday between 2012 and 2014, post their biggest inflow in over 15 months.

Over the past 15 weeks, Technology Sector Funds have recorded a single week of outflows while racking up 10 weeks of inflows above the $1 billion mark. This week, inflows for the group dipped below the $500 million mark as Internet Funds snapped a 14-week inflow streak with their heaviest outflow since mid-3Q22. Meanwhile, Cybersecurity Funds saw their first inflow in 14 weeks and Artificial Intelligence Funds, which recorded their fifth-largest inflow last week, posted their ninth inflow of the past 10 weeks.

Consumer Goods Sector Funds suffered another week of outflows at the $1 billion mark, but it was Global-mandated funds that accounted for most of the headline number this week. US Consumer Goods Sector Funds posted an outflow half that of last week’s figure, while investors pulled an all-time weekly high of $657 million from Global Consumer Goods Sector Funds.

Investors put money into Silver Funds for the third time in the past four weeks and, with over 50% of annual silver consumption going to industry purposes, flows for Industrials Sector Funds inched closer to positive territory.

Bond and other fixed income funds

Coming into October, EPFR-tracked Bond Funds posted consecutive weekly outflows for the first time, and only the third time over the past 11 months, as global bond markets adjusted – painfully – to the prospect of interest rates in the US and Europe staying at current levels for some time.

While still in the market for sovereign debt yielding over 4%, fixed income investors continued to cut their exposure to riskier asset classes. Both High Yield and Emerging Bond Funds posted their biggest weekly outflow in over six months, redemptions from Bank Loan Funds hit a 20-week high and Europe Bond Funds recorded only their sixth outflow in the 40 weeks year-to-date.

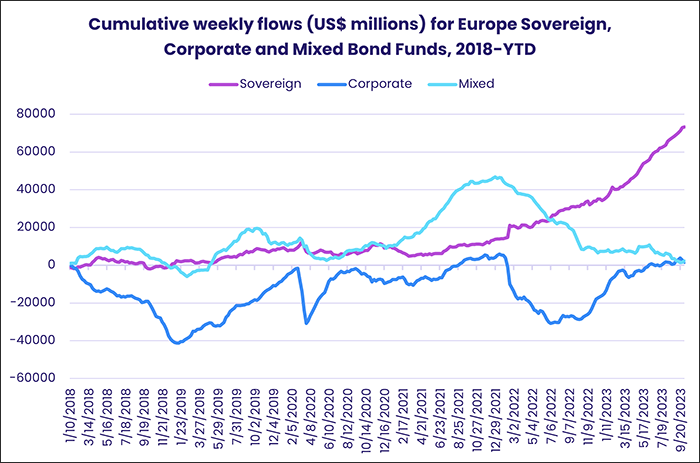

The latest week saw Europe Sovereign Bonds extend an inflow streak stretching back to early February while Europe Corporate Bond Funds recorded their third-largest outflow YTD. At the country level, Italy Bond Funds posted their first outflow since late April and biggest since mid-February as the yield on 10-year Italian government bond funds pushed towards 5% and the spread with comparable German debt touched 2%.

Emerging Markets Bond Funds extended their longest outflow streak since a 15-week run ended in early December as investors pulled over $1 billion from both hard and local currency-mandated funds. Redemptions from Frontier Markets Bond Funds jumped to a 50-week high while, and at the country level, over $300 million was redeemed from Thailand Equity Funds as the Thai government’s expansive fiscal plans drew warnings from ratings agencies.

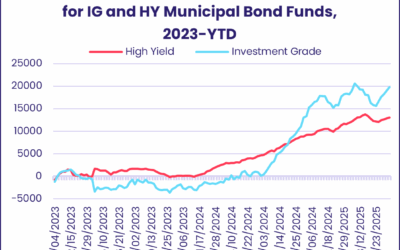

US Bond Funds recorded their 39th inflow year-to-date as flows into US Sovereign Bond Funds hit a 12-week high. Municipal and Corporate Funds remain under pressure from the rising yields on Treasuries. Funds with mixed corporate sovereign mandates attracted solid retail flows.

Investors looking to Developed Asia steered another $136 million into Australia Bond Funds while Japan Bond Funds posted modest outflows. The Bank of Japan, which meets at the end of the month, faces a currency that recently fell, in part due to interest rate differentials, to a 32-year low against the US dollar.

Did you find this useful? Get our EPFR Insights delivered to your inbox.