It was a mixed Christmas for the major EPFR-tracked fund groups as technical factors reversed a significant chunk of the previous week’s record-setting inflows to Equity Funds and the sell-off in primary debt markets crimped flows to Bond Funds while Money Market Funds added to their year-to-date total and Balanced Funds posted their biggest weekly inflow since mid 1Q22.

Funds tied to several of the major themes that have driven markets and fund flows over the past three years stumbled during the week ending Dec. 25. Redemptions from Cryptocurrency Funds hit a record high, Technology Sector Funds extended their longest outflow streak since the first week of 2023 and Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates eked out a collective inflow of $21 million.

Although the obituaries for 2024 have yet to be written, in flow terms it has been a very good year – albeit with a mediocre ending – for greater China and India-mandated Equity Funds, as well as for US, Canada, Europe and Total Return Bond Funds and US Money Market Funds. It was a great year for Cryptocurrency and Technology Sector Funds, the latest week notwithstanding, and for Mortgage-Backed Bond, dedicated Argentina Equity Funds and Equity ETFs overall.

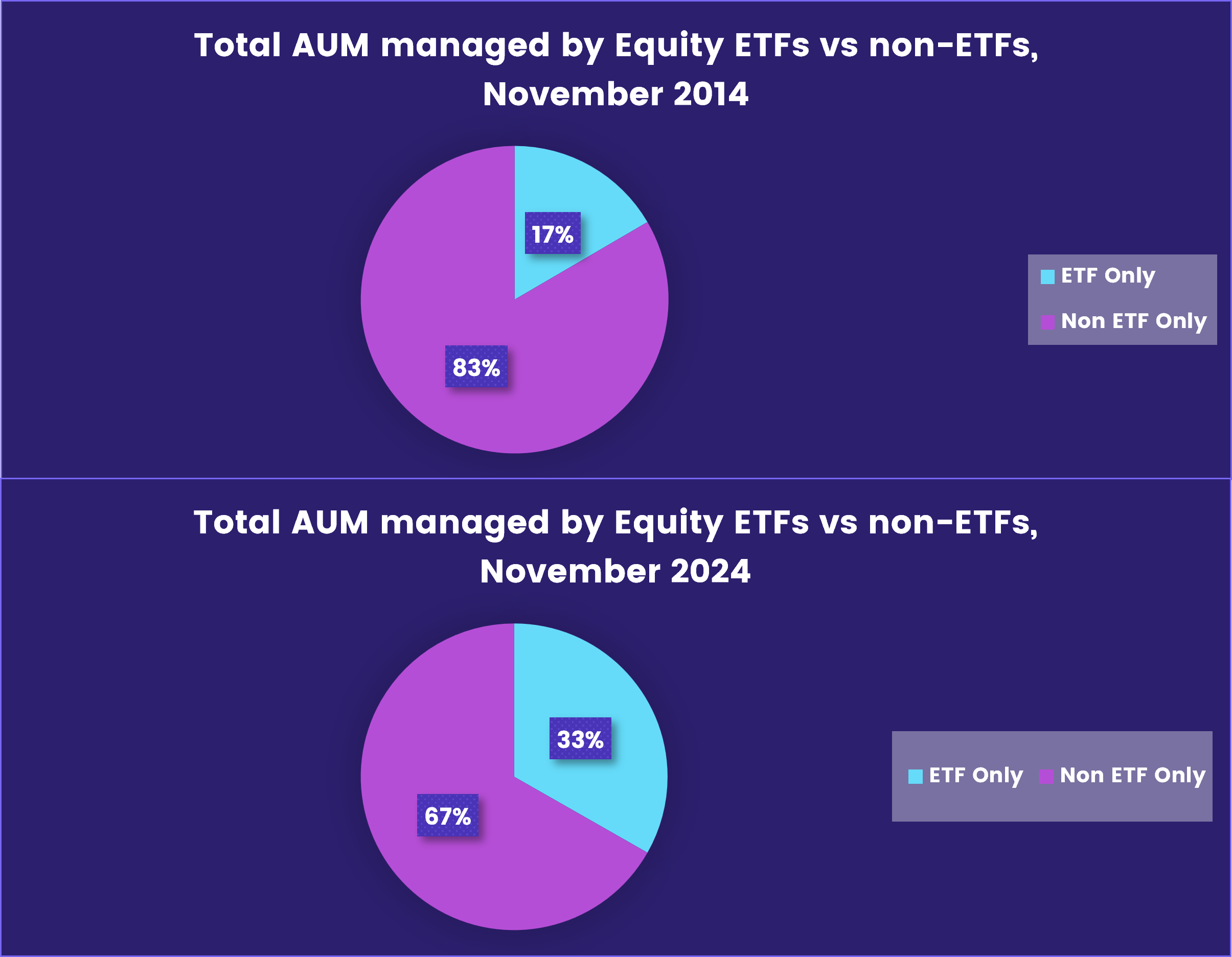

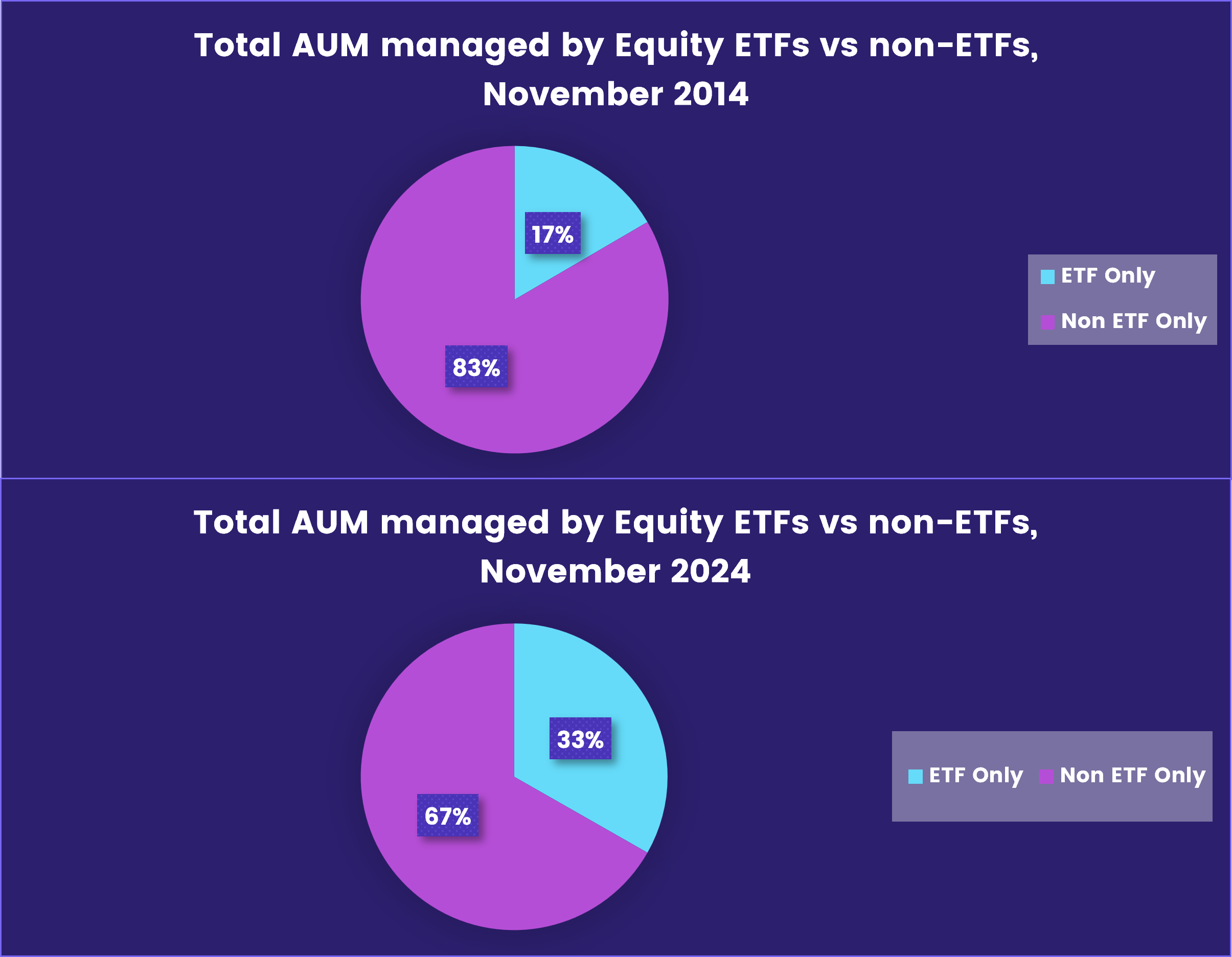

In the case of Equity ETFs, net inflows are on track to set a new full-year record. The group’s share of assets managed by all EPFR-tracked Equity Funds has doubled over the past decade to a third of the current total.

Overall, the latest week saw $26.5 billion flow out of all EPFR-tracked Equity Funds and $863 million from Alternative Funds. Investors steered a net $2.1 billion into Bond Funds, $3 billion into Balanced Funds and $28.7 billion into Money Market Funds.

Emerging Markets Equity Funds

Concerns about the outlook for global trade and US interest rates, cooling appetite for exposure to Asian heavyweights and mixed forecasts for key commodity prices weighed on EPFR-tracked Emerging Markets Equity Funds going into the final week of 2024. Redemptions from Asia ex-Japan, Latin America and Frontier Markets Funds offset modest flows into EMEA and the diversified Global Emerging Markets (GEM) Equity Funds.

Retail share classes saw money flow out for the 23rd straight week, Emerging Markets Collective Investment trusts (CITs) experienced net redemptions for the 17th time during the past 18 weeks and outflows from all Emerging Markets Leveraged Equity Funds hit a 12-week high.

Among the

Asia ex-Japan Country Fund groups,

China Equity Funds chalked up their 10th outflow since the beginning of the fourth quarter and

India Equity Funds their ninth,

Thailand Equity Funds extended an outflow streak stretching back to the first week of the year and

Taiwan (POC) Equity Funds posted only their third outflow during the past seven months.

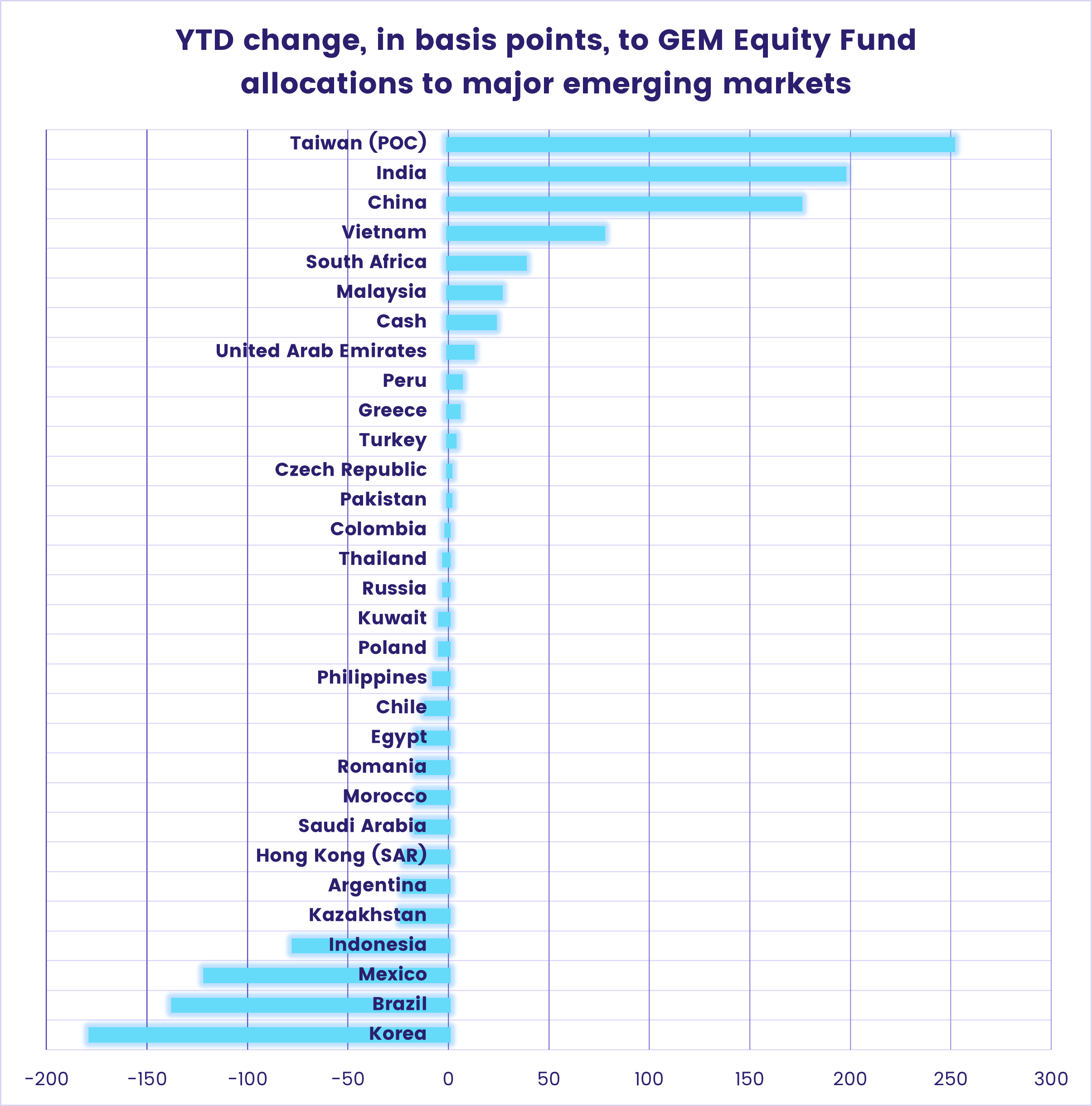

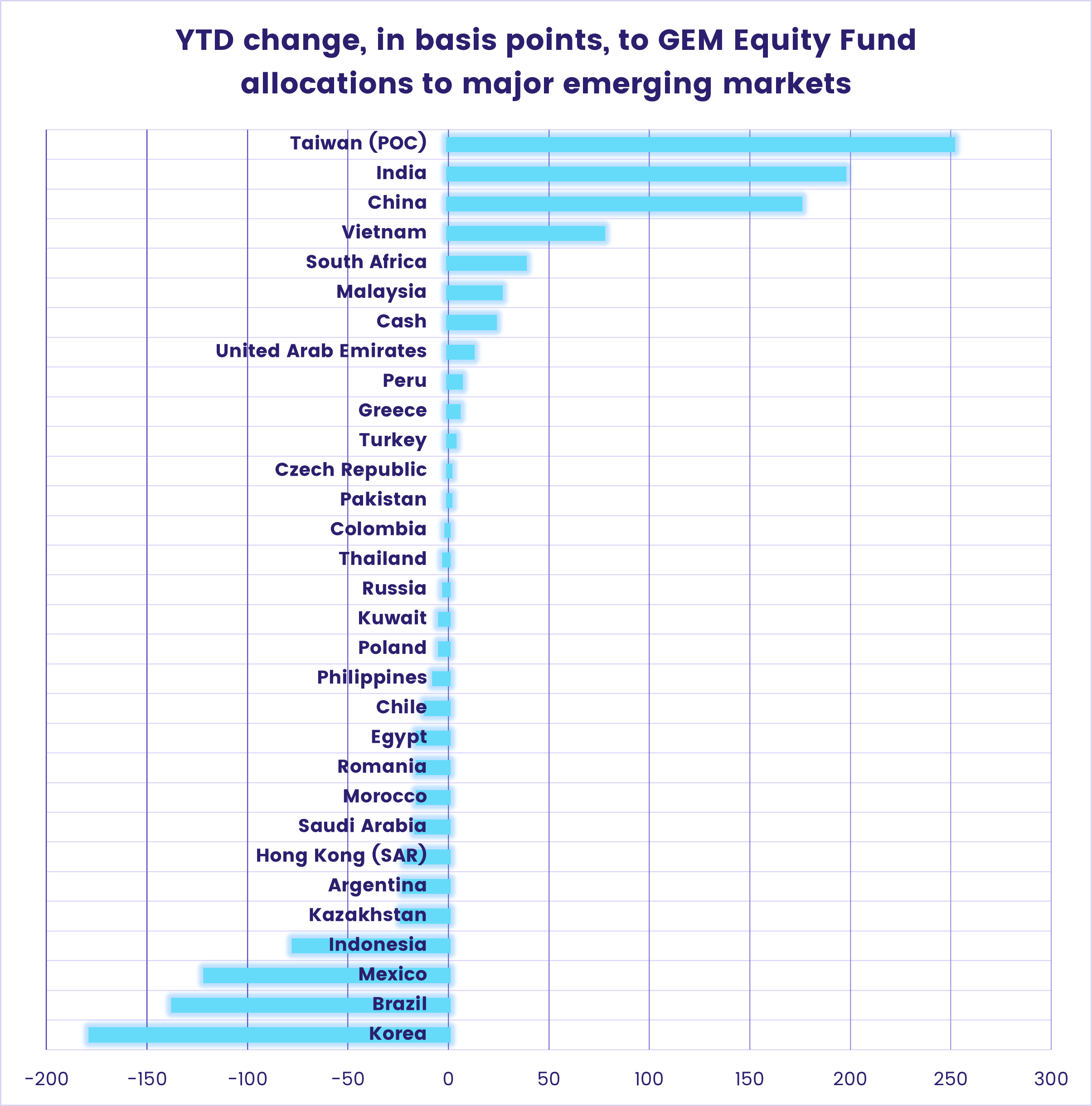

GEM Equity Fund managers have significantly boosted their exposure to several of these markets during 2024, largely at the expense of Latin America, although

Korea saw its average allocation slip even before this month’s political furor around President Yoon Suk Yeol’s short-lived effort to impose martial law.

For investors, Argentina and its reform story remains the exception to the rule that a fiscally undisciplined, commodity export dependent and politically left-leaning region should be treated with caution. While Latin America Regional Equity Funds recorded their eighth straight outflow, and 42nd so far this year, Argentina Equity Funds extended their current inflow streak to nine weeks and $370 million.

Hopes that fragile ceasefires in Syria and Lebanon will hold came under pressure around Christmas, and Turkey Equity Funds posted their biggest outflow in 15 weeks as Turkish President Recep Erdogan ramped up his threats against Syria’s Kurdish minority. But, with many of its strategic goals apparently within reach after many months of fighting, Israel-mandated funds posted their biggest inflow since late 1Q24.

Developed Markets Equity Funds

EPFR-tracked Developed Markets Equity Funds followed up the previous week’s record-setting inflows with their biggest outflow since late 4Q22, with day-to-day flows whipsawed by funds going ex-dividend, the reinvestment of those dividends and the year’s final major options and futures rollover date.

Once again, it was the headline number for US Equity Funds which dominated, with over a third of the previous week’s inflow heading out the door. Retail share classes attracted fresh money for the third time quarter-to-date, the first time that has occurred since 1Q23, and foreign domiciled US Equity Funds posted their 12th consecutive inflow.

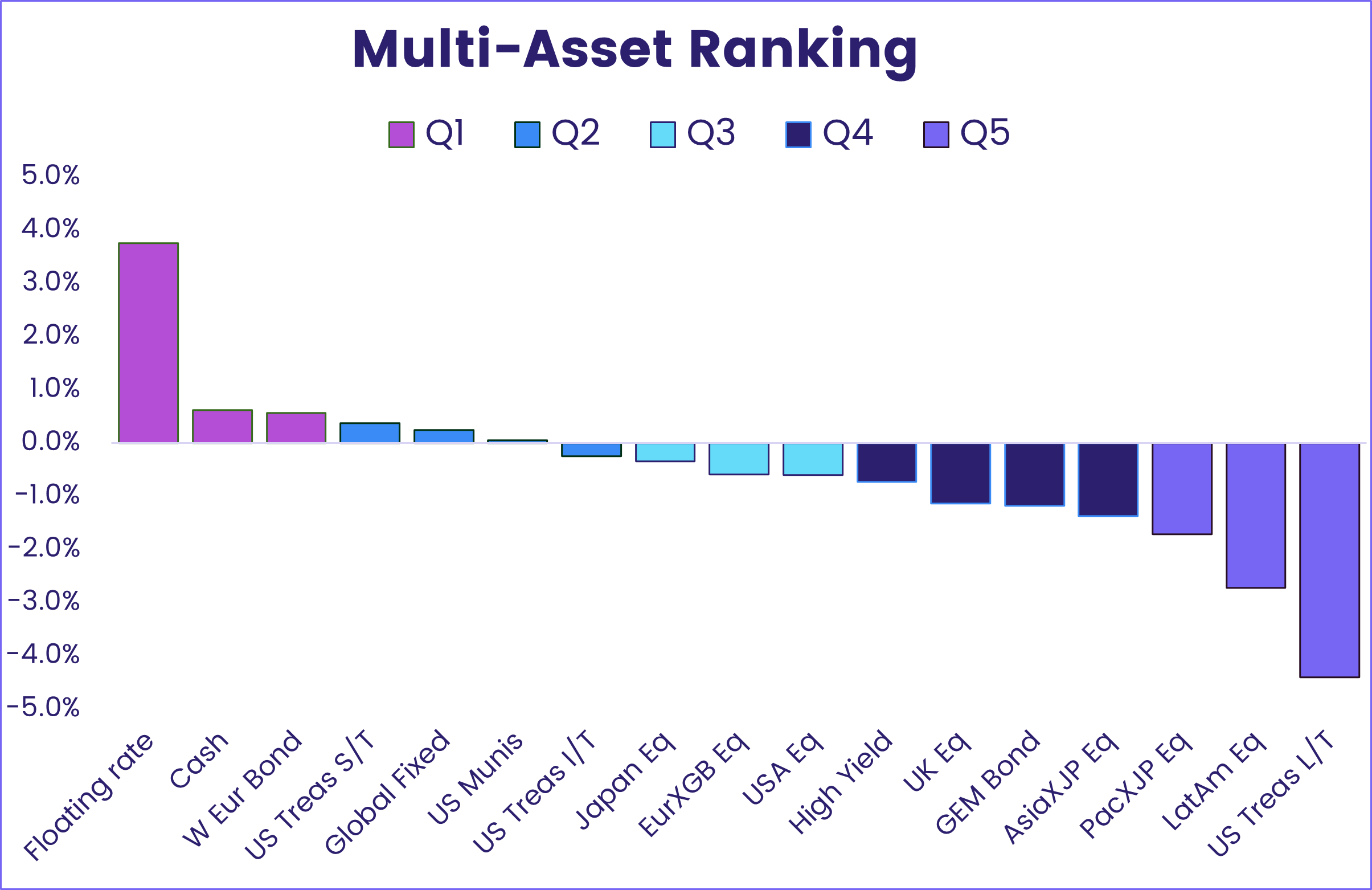

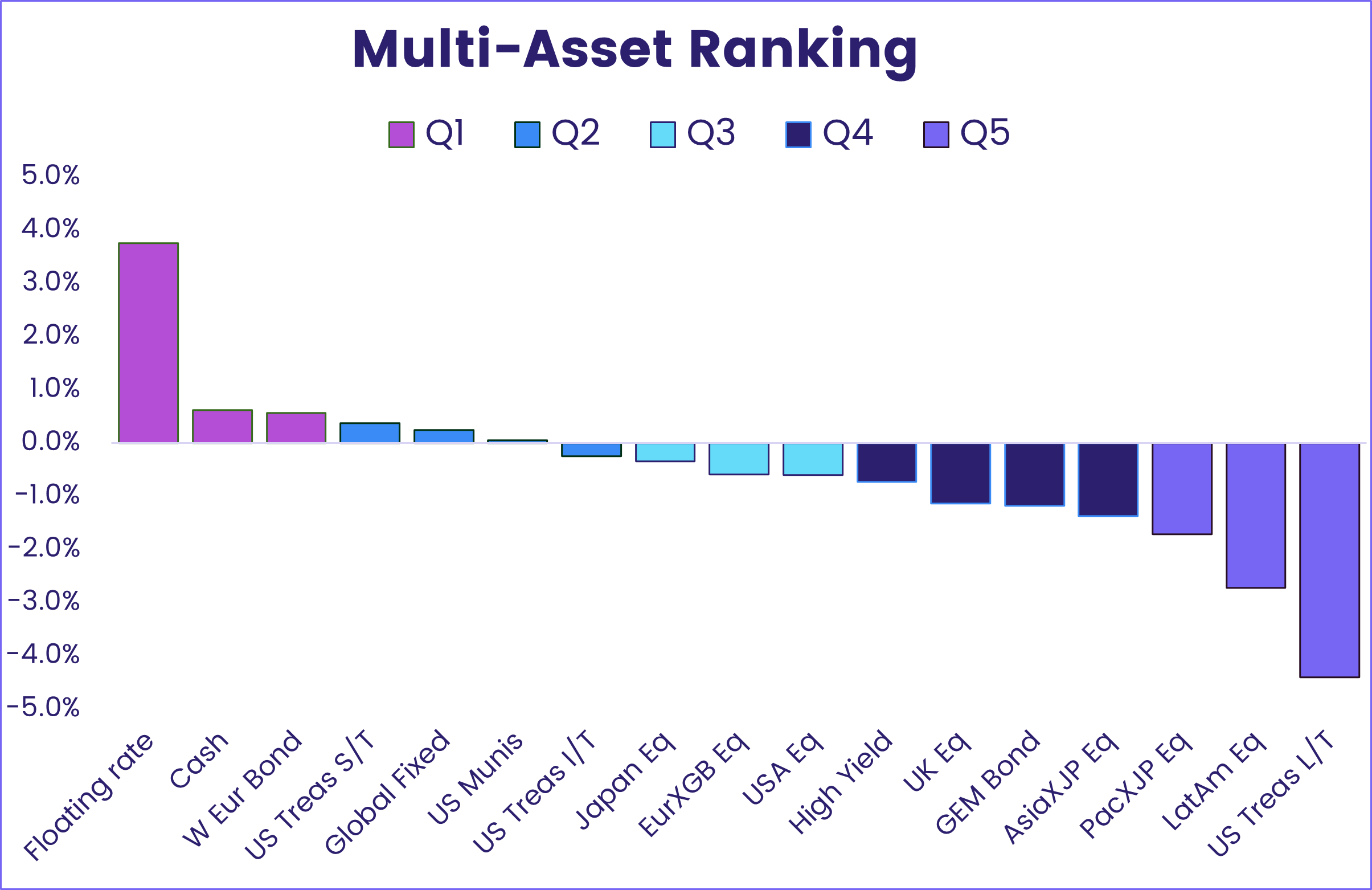

EPFR’s weekly multi asset rankings, which utilize data from funds which can invest in multiple asset classes, suggest that managers are leery of just how far and how high US equity markets have soared in anticipation of lower domestic interest rates. American stocks rank in the middle of the pack, with Japanese equities currently ahead with modest momentum.

The week ending Dec. 25 saw Japan Equity Funds snap a five-week run of outflows as a weaker currency versus the US dollar bolstered the case for major Japanese export plays. The latest allocations data shows the average allocation among actively managed Japan Equity Funds to technology plays has fallen to a 55-month low while exposure to financials is at its highest level since 1Q18. The average weighting for industrial stocks is just off October’s record high.

Pacific Regional Equity Funds, which on average allocate over a third of their portfolios to Japanese assets, posted their first inflow since the second week of October and the biggest since late June.

Redemptions from

Europe Equity Funds moderated going into the Christmas holiday, but the group still racked up their 45th outflow of 2024 as growth in the UK and Germany slowed to a crawl in the current quarter, the struggle to form an effective French government ground on and

US President-elect Donald Trump spelled out parts of his economic agenda. Flows at the country level were quieter, with the exception of

Portugal Equity Funds which posted their biggest outflow in nearly two years.

Global sector, Industry and Precious Metals Funds

With the new year a week away and the next corporate earnings season only three weeks out, flows to EPFR-tracked Sector Fund groups ranged widely during the latest week. Four groups recorded inflows while seven experienced net redemptions, with two of those groups – Technology and Consumer Goods Sector Funds – seeing over $1.5 billion flow out.

After a banner year for inflows driven by optimism about the artificial intelligence (AI) story and the direction of US interest rates, Technology Sector Funds have struggled in late 2024 for a variety of reasons. Slower monetary easing by the US Federal Reserve and stiffer competition for capital with sovereign borrowers, regulatory challenges, discomfort with the current valuations of key AI stocks and the uncertainties surrounding global trade in 2025 have all taken a toll.

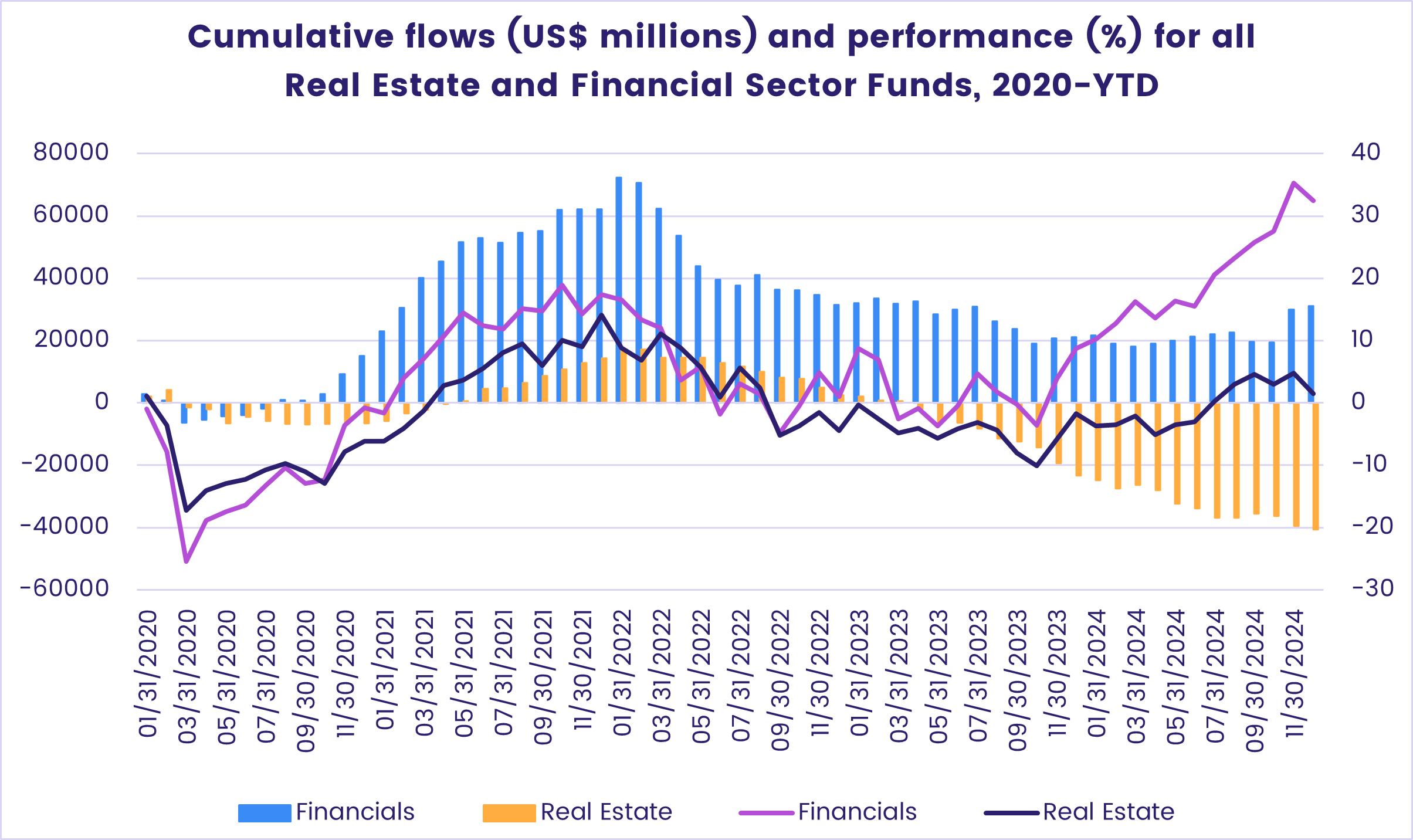

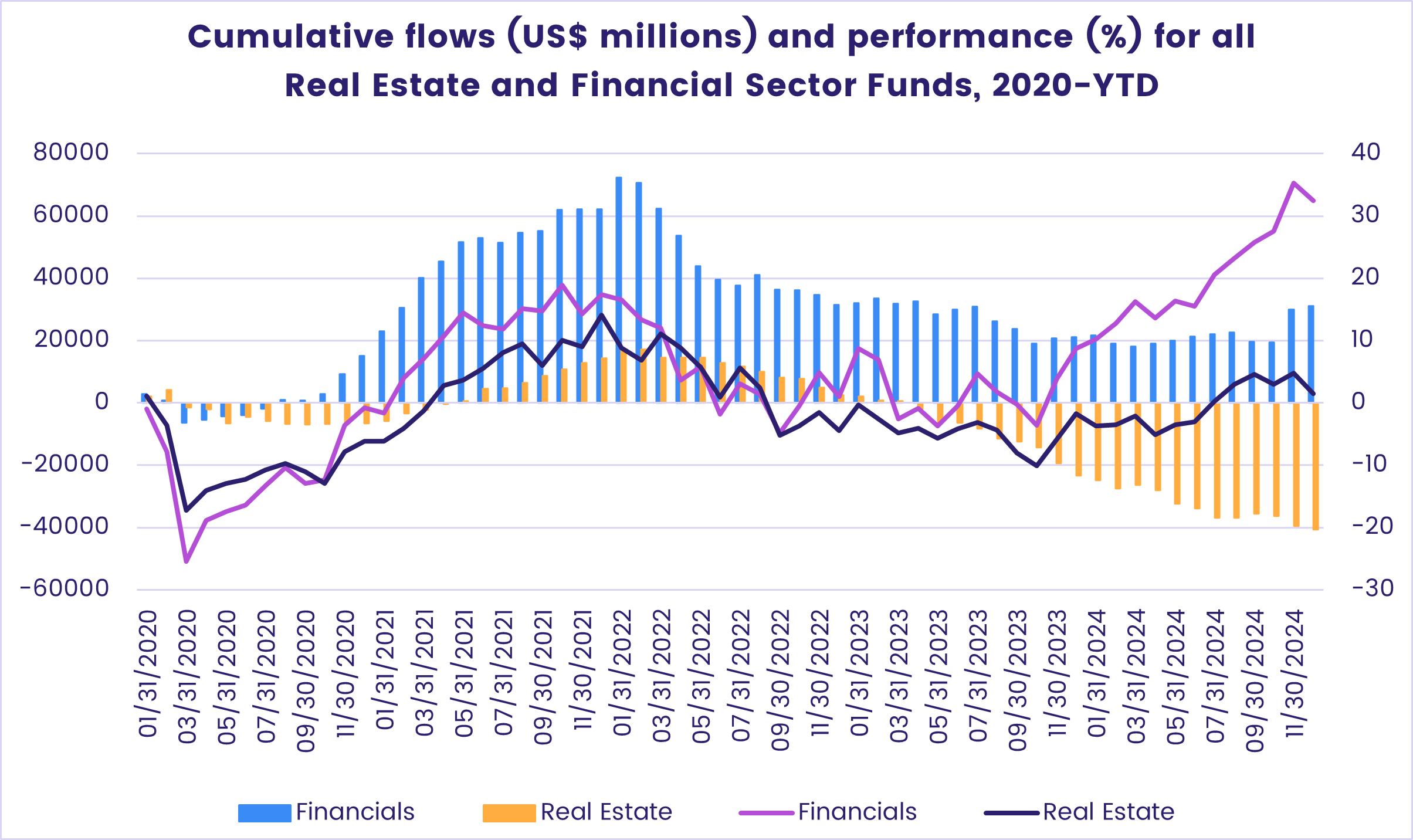

Investors remain optimistic that

the lighter regulatory touch promised by incoming US President Donald Trump will bolster the bottom lines of major players in the financial sector, a belief reflected in recent flows to

Financial Sector Funds. But they are less bullish about the outlook for real estate, with dedicated

Real Estate Sector Funds chalking up their ninth outflow over the past 11 weeks as US 30-year mortgage rates remain north of 6.7%. Commercial real estate still accounts for a significant portion of bank lending in all regions.

Flows into Energy Sector Funds climbed to their highest level since the final week of July, with investors reassessing European demand in light of a colder than expected start to the winter.

Among the precious metals’ groups, Physical Gold Funds attracted over $2 billion for only the second time in 2024. The price of gold has climbed past the $2,600 per ounce level in the face of geopolitical tensions and heavy government borrowing.

Bond and other Fixed Income Funds

Through the first 10 months of 2024, the average weekly inflow for all EPFR-tracked Bond Funds was $17 billion. Since the beginning of November, that weekly average has fallen to $6 billion as investors revisit their assumptions about sovereign borrowing requirements, the success of the fight against inflation and the ability of weaker corporate borrowers to keep servicing their debts.

Despite this marked loss of momentum, flows into all Bond Funds remain on track to surpass the full-year record set in 2021. During that year, flows into Europe, Global and US Bond Funds accounted for 8%, 10% and 76%, respectively, of the overall total. So far this year, a quarter of the headline number is attributable to flows into Europe Bond Funds.

During the week ending Dec. 25, High Yield Bond Funds extended their longest run of outflows in over 13 months, redemptions from Inflation Protected Bond Funds hit a 10-week high, Municipal Bond Funds posted consecutive weekly outflows for the first time since late May and Mortgage-Backed Bond Funds recorded their smallest weekly inflow since the second week of August.

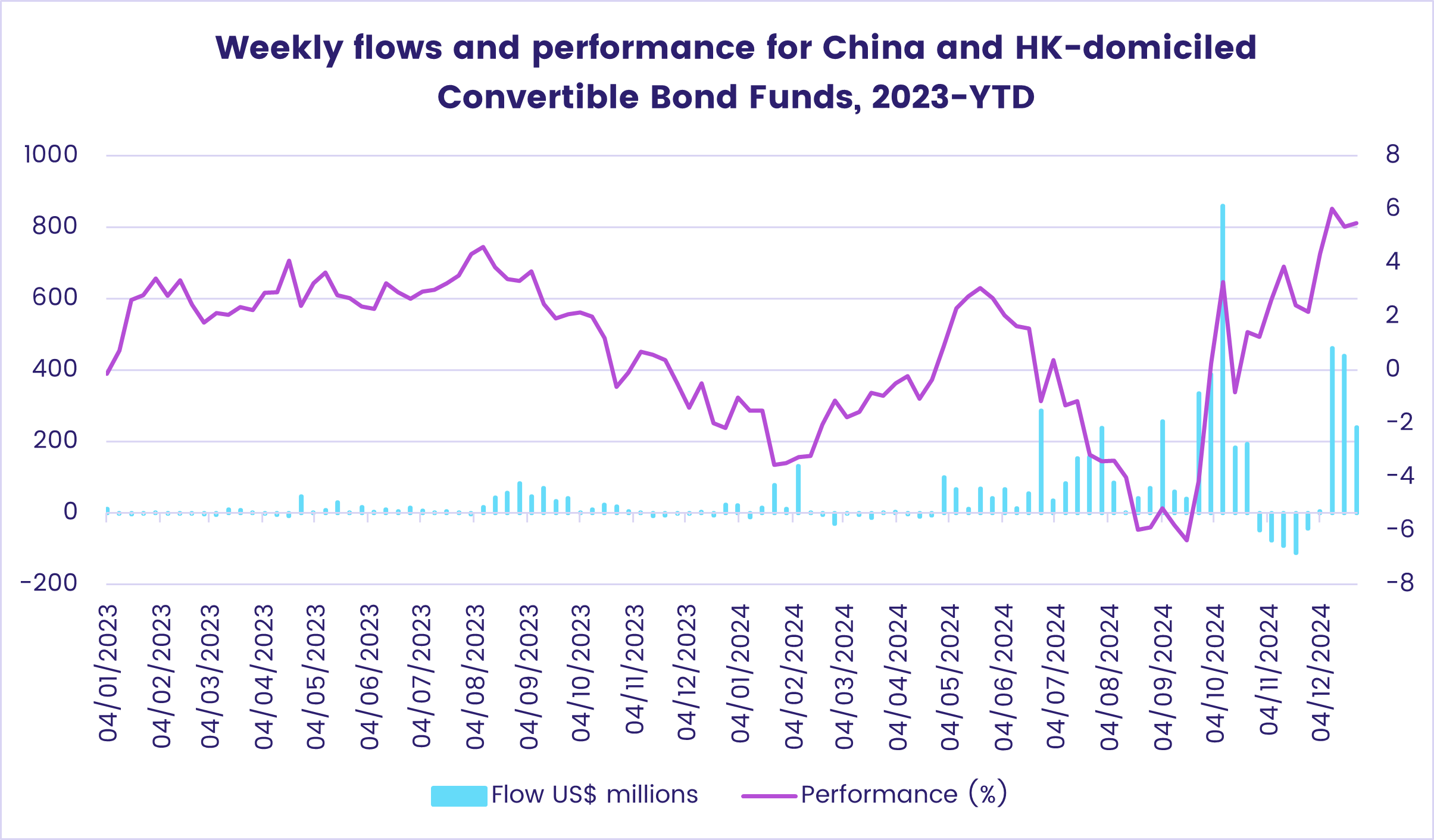

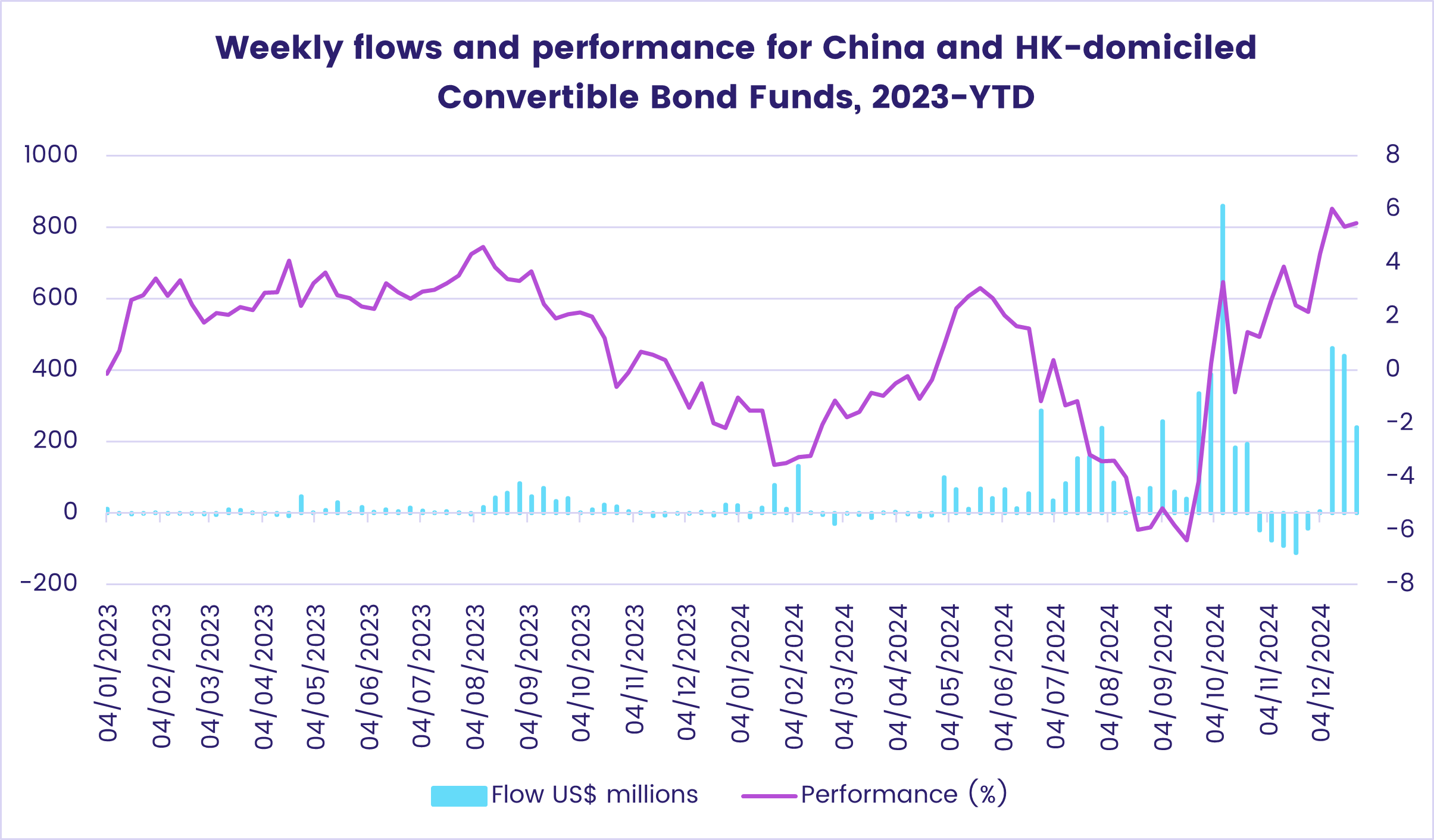

Convertible Bond Funds did add to their longest inflow streak in over two years, helped by renewed interest from investors in the growing volume of Chinese issues.

Emerging Markets Bond Funds with mandates that encompass conventional bonds continue to struggle with subdued commodity prices, stubborn price pressures in the US that has crimped the Federal Reserve’s appetite for further interest rate cuts, statist policymaking in key markets and geopolitical uncertainties. At the country level, flows into Korea Bond Funds hit a 54-week high, China Bond Funds saw their latest run of inflows come to an end and redemptions from Russia Bond Funds climbed to their highest level in over 21 months.

Did you find this useful? Get our EPFR Insights delivered to your inbox.