Despite China’s first steps away from the zero-Covid policies that have sapped its economy and some optimistic forecasts for 2023, investors tapped EPFR-tracked Emerging Markets Equity Funds for $2.4 billion – a 13-week high outflow – in early December. But Emerging Markets Bond Funds posted their first inflow since mid-August and their biggest since the first week of 2Q22.

As was the case during the final week of November, those investors pulled money out of US Equity and Bond Funds and pumped another $45 billion into US Money Market Funds. They also extended Europe Equity Funds’ longest redemption streak since EPFR started tracking them in 4Q00 while committing fresh money to Europe Bond Funds for the sixth time in the past seven weeks.

Overall numbers for the week ending Dec. 7 were qualified by technical issues with EPFR’s server which temporarily affected some 10% of the AUM tracked weekly. Equity, Balanced and Alternative Funds posted collective outflows for the week while Bond and Money Market Funds posted inflows. In the case of the latter, Europe Money Market Funds chalked up their eighth inflow quarter-to-date and China Money Market Funds extended their longest outflow streak since an 11-week run ended in early January.

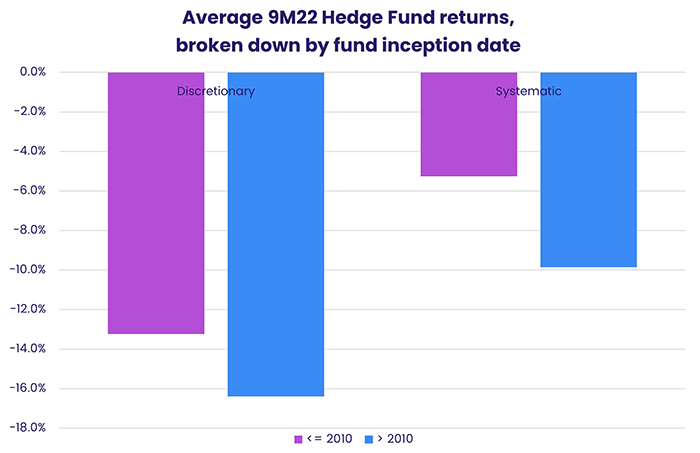

Hedge Funds with fixed income and equity strategies both experienced net redemptions, with the Equity Hedge Funds tracked by EPFR recording their 18th consecutive analysis. Analysis by Quantitative Research Director Sayad Baronyan of the more granular Hedge Fund Flows dataset produced in partnership with BarclayHedge shows that experience is counting in the current market, with funds established before 2010 collectively outperforming those launched after that date.

At the single country and asset class fund levels, Inflation Protected Bond Funds racked up their 15th straight outflow and Bank Loan Funds their 25th in the past 26 weeks while Convertible Bond Funds recorded consecutive weekly inflows for the first time since mid-August. Canada Bond Funds posted record-setting inflows and Portugal Equity Funds their biggest since 3Q14 while redemptions from Brazil, Korea and Indonesia Equity Funds hit 11, 26 and 28-week highs, respectively.

Emerging Markets Equity Funds

After bottoming out in late October, collective performance year-to-date for all EPFR-tracked Emerging Markets Equity Funds has climbed over 7%. Those funds have seen inflows 11 of the past 13 weeks, but December started with an outflow as the diversified Global Emerging Markets (GEM) Equity Funds saw a five-week inflow streak come to an end and redemptions from China Equity Funds touch a 17-week high.

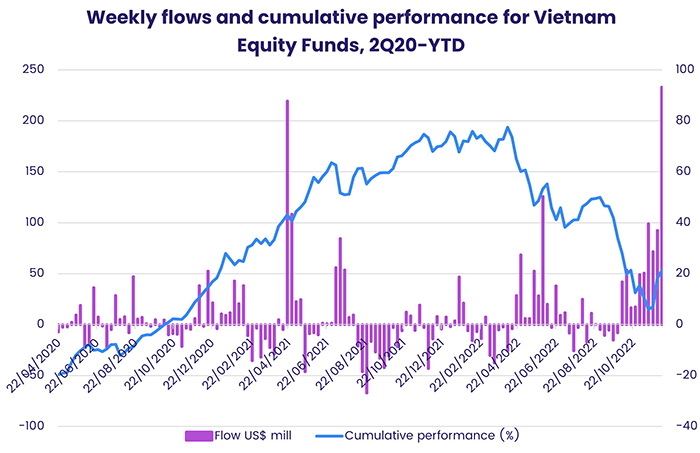

EMEA and Latin America Equity Funds also saw money flow out and dedicated BRIC (Brazil, Russia, India and China) Funds posted their 17th consecutive outflow. But frontier markets and supply chain relocation stories remained popular, with the two themes converging in Vietnam Equity Funds which recorded their biggest weekly inflow since 2Q21 and their second biggest on record as they added to their longest inflow streak since 1Q20.

China’s benchmark equity index made up some of the ground lost year-to-date as authorities started relaxing some of the zero-Covid measures that have shackled economic growth as well as the virus. China Equity Funds, which have seen big inflows in anticipation of this shift, recorded only their second outflow since mid-August.

Among the other Asia ex-Japan Country Fund groups, Philippines Equity Funds extended their longest inflow streak since 1Q19 and India Equity Funds chalked up their sixth inflow in the past seven weeks while Thailand Equity Funds recorded their 18th inflow in the past 20 weeks. Redemptions from Korea Equity Funds climbed to a 26-week high as a truckers’ strike added to the headwinds facing Korea’s export-dependent economy.

Brazil Equity Funds were again the biggest factor in the headline number for all Latin America Equity Funds. Redemptions hit an 11-week high as investors responded to the fiscal challenges facing the left-of-center administration of new President Luis Inácio Lula da Silva. Peru Equity Funds also experienced significant redemptions, their biggest since mid-June, after the week ended with Peruvian President Pedro Castillo losing his office after a failed attempt to suspend the national legislature.

Turkey Equity Funds again fared best among the EMEA Equity Fund groups. Flows hit a 50-week high as cheap – in hard currency terms – valuations and “window dressing” demand for a market that is up over 160% year-to-date attracted fresh money.

Developed Markets Equity Funds

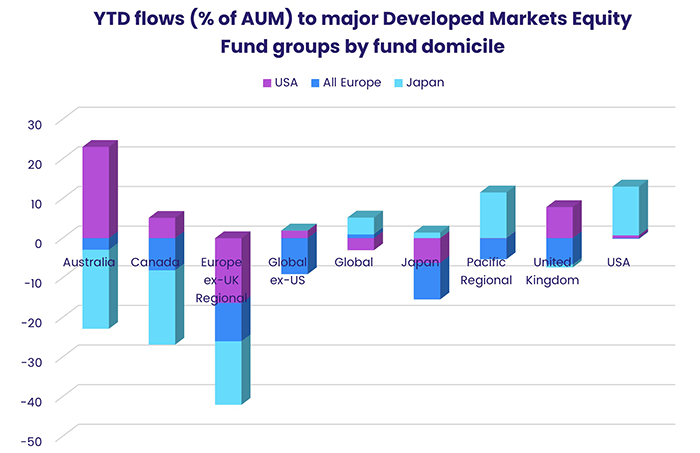

US-oriented investors continued to cash in on the recent market rally, with US Equity Funds surrendering another $11 billion during the first week of December as redemptions from EPFR-tracked Developed Markets Equity Funds climbed to a 24-week high. Australia, Canada, Global, Europe and Pacific Regional Funds also posted outflows.

December “is that time of year when US Equity Fund flow numbers can be skewed week-to-week by funds going ex-dividend,” notes Ian Wilson, EPFR’s Director of Data. “When funds pay out accumulated dividends –- of which there will certainly be less this year than last year — they appear as outflows. Most of those dividends are reinvested, showing up as inflows a few days later, so if a lot of funds go ex-dividend towards the end of a reporting period, you can end up with exaggeratedly large outflows one week and correspondingly outsized inflows the following week.”

The latest redemptions from US Equity Funds hit Large Cap Growth Funds the hardest, with outflows from that group climbing to a 45-week high, while US Dividend Funds posted consecutively weekly outflows for the first time since 1Q21 and retail redemptions from all funds hit their highest level in just under a year.

Japan Equity Funds posted their fifth inflow quarter-to-date, against five outflows, as investors struggle to get a fix on Japanese monetary policy and the likelihood the Bank of Japan will end its long-running quantitative easing program. Japanese investors continue to hedge their bets: Japan-domiciled Australia, US, Pacific Regional and Global Equity Funds have all attracted inflows year-to-date.

Europe Equity Funds of all domiciles remain under pressure as the energy squeeze triggered by Russia’s invasion of Ukraine and inflationary pressures narrow the options for regional policymakers. The latest week saw Sweden Equity Funds record their first outflow in over three months and UK Equity Funds extend a redemption streak stretching back to the third week of June while Portugal Equity Funds posted their biggest inflow since 3Q14.

Global Sector and Precious Metals Funds

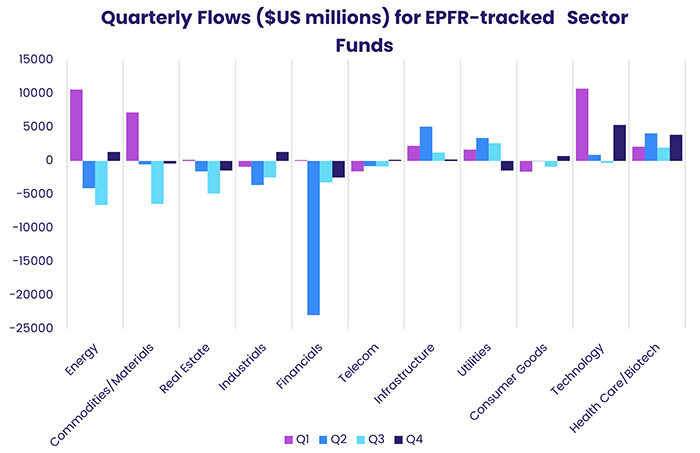

It was another uncomfortable week for sector-oriented investors in early December as the Russia-Ukraine war approached the 300-day mark, China started relaxing its zero-Covid policies and the EU and US imposed a $60 a barrel price cap on Russian oil. Only three of the EPFR-tracked Sector Fund groups – Consumer Goods, Industrials and Telecoms – recorded inflows while eight saw money flow out with Financials and Energy Sector Funds posting their biggest outflows in 13 and 24 weeks, respectively.

Energy Sector Funds’ $1.3 billion outflow during the first week of December was largely driven by US-dedicated funds, which experienced net redemptions for the fourth straight week. Having boosted their exposure to Energy Sector Funds between 4Q20 and 2Q22, investors have been pulling back as the efforts to curb Russia’s energy exports unleash uncertainty and unintended consequences on global energy markets.

After a run of seven straight inflows, Healthcare Sector Funds posted their largest weekly outflow since mid-1Q22. But they remain on track for their fourth straight quarterly inflow, a feat only Infrastructure Sector Funds seem likely to match.

At the country level, funds dedicated to China are faring well in flow terms despite the disruption caused by that country’s zero-Covid policies. In early December, flows into China Healthcare Sector Funds rose to a five-week high and China Technology Sector Funds took in their 18th straight inflow and 45th of the 49 weeks YTD. China Financial Sector Funds did chalk up their sixth outflow in the past nine weeks but remain the top country fund group in terms of year-to-date flows.

Bond and other Fixed Income Funds

The debate over the US Federal Reserve’s pivot point, and the terminal rate for its current tightening cycle, kept fixed income investors on edge during the first week of December. The latest flows to EPFR-tracked Bond Funds, however, suggested the scales tipping towards those for whom the answer to those questions is “sooner and lower”.

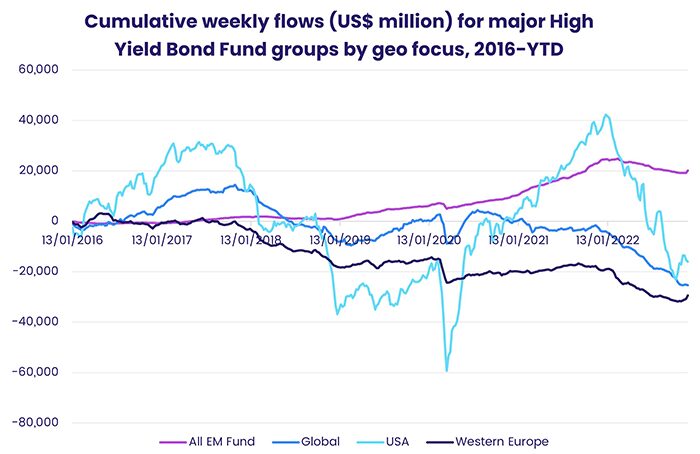

Although US Bond Funds posted consecutive weekly outflows for the first time since mid-October, Inflation Protected Bond Funds extended their longest run of outflows since 4Q18, High Yield Bond Funds chalked up their fifth inflow in the past seven weeks and Emerging Markets Bond Funds snapped a 15-week redemption streak.

Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates continued their recent run, pulling in another $1.4 billion as their year-to-date total moved north of the $15 billion mark. That is still well short of the full-year total of $102 billion in 2021.

In the high yield space, the modest collective inflow for all High Yield Bond Funds was underpinned by ones with a European or emerging markets focus. Flows into Emerging Markets High Yield Bond Funds hit a 36-week high while Europe HY Funds recorded their sixth inflow in the past seven weeks.

In the case of EM High Yield Funds, the inflows were broadly based with 41 funds pulling in over $20 million and 12 of those absorbing over $50 million. Those flows were a significant contributor to the first inflow posted by all Emerging Markets Bond Funds since mid-3Q22. China Bond Funds again subtracted from the headline number and retail investors were net redeemers for the 44th time in the 48 weeks YTD.

For US Bond Funds, retail inflows are something last seen late last year. The latest week did see solid flows into Long Term Treasury, Intermediate Term Corporate and Municipal Bond Funds that were offset by redemptions from High Yield, Short Term Treasury and Inflation Protected Funds.

Funds dedicated to the US were overshadowed by Canada Bond Funds, which posted a record inflow that saw 25 funds pull in more than $10 million.

The latest inflation data from Europe suggest prices grew at a 10% rate in November, down from the previous month but still a number that keeps the pressure on the European Central Bank to tighten further. The expectation that the ECB will pivot as soon as it can to avoid stresses in national bond markets saw another $1.1 billion flow into Europe Bond Funds. However, redemptions from Italy Bond Funds climbed to a 13-week high and Spain Bond Funds posted their 14th outflow in the past 16 weeks.

Did you find this useful? Get our EPFR Insights delivered to your inbox.