The third week of September began with investors buying US equities on the dip and Ukraine’s army rolling back Russian invaders around the city of Kharkiv. It ended with Russia mobilizing the first of 300,000 reservists and short-term US interest rates at their highest level since 2008.

With European, Emerging Asian and other central banks scrambling to match the Federal Reserve’s latest hike, EPFR-tracked Equity and Bond Funds both saw around $7 billion flow out as investors struggled to make sense of the latest macroeconomic, monetary and geopolitical developments. Balanced and Alternative Funds also experienced net redemptions during the week ending September 21. In the case of the latter, Alternative Commodities and Long Physical Commodities Funds extended outflow streaks stretching back to early June.

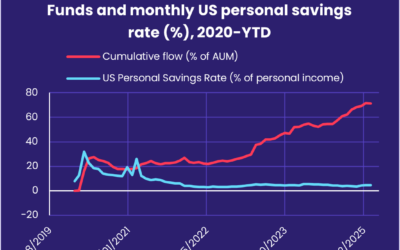

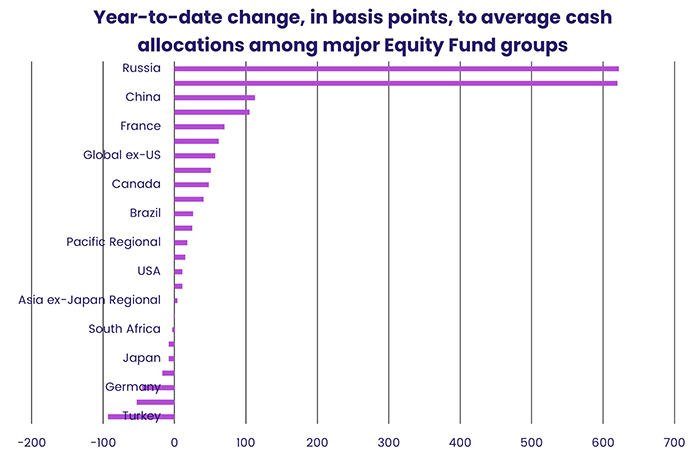

In this uncertain investment climate, income and liquidity proved attractive with Dividend Equity Funds seeing fresh money for the seventh straight week and flows into Money Market Funds hitting an 11-week high. Equity Fund managers are also gravitating to cash, although year-to-date increases in average allocations have been generally modest except for those funds with significant exposure to the Ukraine-Russia conflict.

At the single country and asset class fund levels, redemptions from Inflation Protected and Mortgage-Backed Bond Funds came in at nine and 14-week highs, respectively, Total Return Bond Funds saw over $1 billion flow out for the fourth time quarter-to-date and High Yield Bond Funds’ current outflow streak hit five weeks and $21.5 billion. Flows into Korea Equity Funds climbed to a 12-week high, Korea Bond Funds posted their biggest inflow since late 4Q20, Turkey Equity Funds recorded their biggest outflow year-to-date and redemptions from Germany Equity Funds jumped to levels last seen in late March.

Bond and other Fixed Income Funds

Another salvo of interest rate hikes kept the pressure on EPFR-tracked Bond Funds going into the final week of September, with overall redemptions hitting a nine-week high as the vast majority of groups saw money flow out.

Investors searching for points of light in the fixed income universe found them at the country level, with flows into Denmark, Spain and Austria Bond Funds hitting 13-week, 17-week and record highs, respectively, while Korea Bond Funds recorded their biggest inflow since late 4Q20.

At the asset class level, year-to-date redemptions passed the $75 billion mark for Municipal Bond Funds, $78 billion for Total Return Funds and $112 billion for High Yield Bond Funds. During the latest week, investors pulled money out of Mortgage-Backed Bond Funds for the eighth time in the past 10 weeks, outflows from Bank Loan Funds climbed to a 14-week high and Inflation Protected Bond Funds posted their sixth largest outflow so far this year.

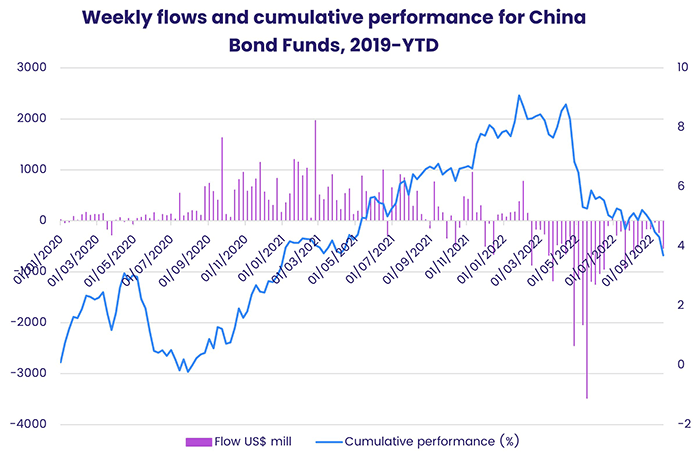

Among the Country Bond Fund groups that did not see inflows were China Bond Funds, whose 12th straight outflow – and 31st since mid-February – contributed to the fifth consecutive outflow recorded by all Emerging Markets Bond Funds. Redemptions from Global Emerging Markets (GEM) Bond Funds hit their highest total since late June and Asia ex-Japan Bond Funds extended an outflow streak stretching back to mid-April.

Asia Pacific Bond Funds chalked up their biggest outflow since the third week of last year as investors pulled over $500 million from Japan Bond Funds. The Bank of Japan is currently the last ultra-accommodative developed markets central bank standing, and speculation is mounting that currency weakness and the relative attractions of foreign sovereign debt will force the BOJ into some form of policy tightening.

That tightening is underway in Europe, with the National Bank of Switzerland taking its key rate out of negative territory and Sweden’s central bank opting for a 100-basis point hike. Europe Bond Funds posted a collective outflow, with retail redemptions hitting an eight-week high, but funds with sovereign debt mandates racked up their 13th straight inflow.

US Bond Funds also failed to attract retail support for the 39th week running. While over $6 billion found its way into Short Term US Sovereign Funds, those inflows were offset by redemptions from other groups with Municipal and High Yield Bond Funds again leading the way. Short Term US Treasuries are now the top-ranked asset in EPFR’s weekly Multi-Asset rankings, with European debt in the middle of the pack.

Did you find this useful? Get our EPFR Insights delivered to your inbox.