The aftershocks of the European Parliamentary elections continued to reverberate during the second week of June, with French leader Emmanuel Macron calling a snap election that falls either side of the July 4 vote called by British Prime Minister Rishi Sunak two weeks earlier.

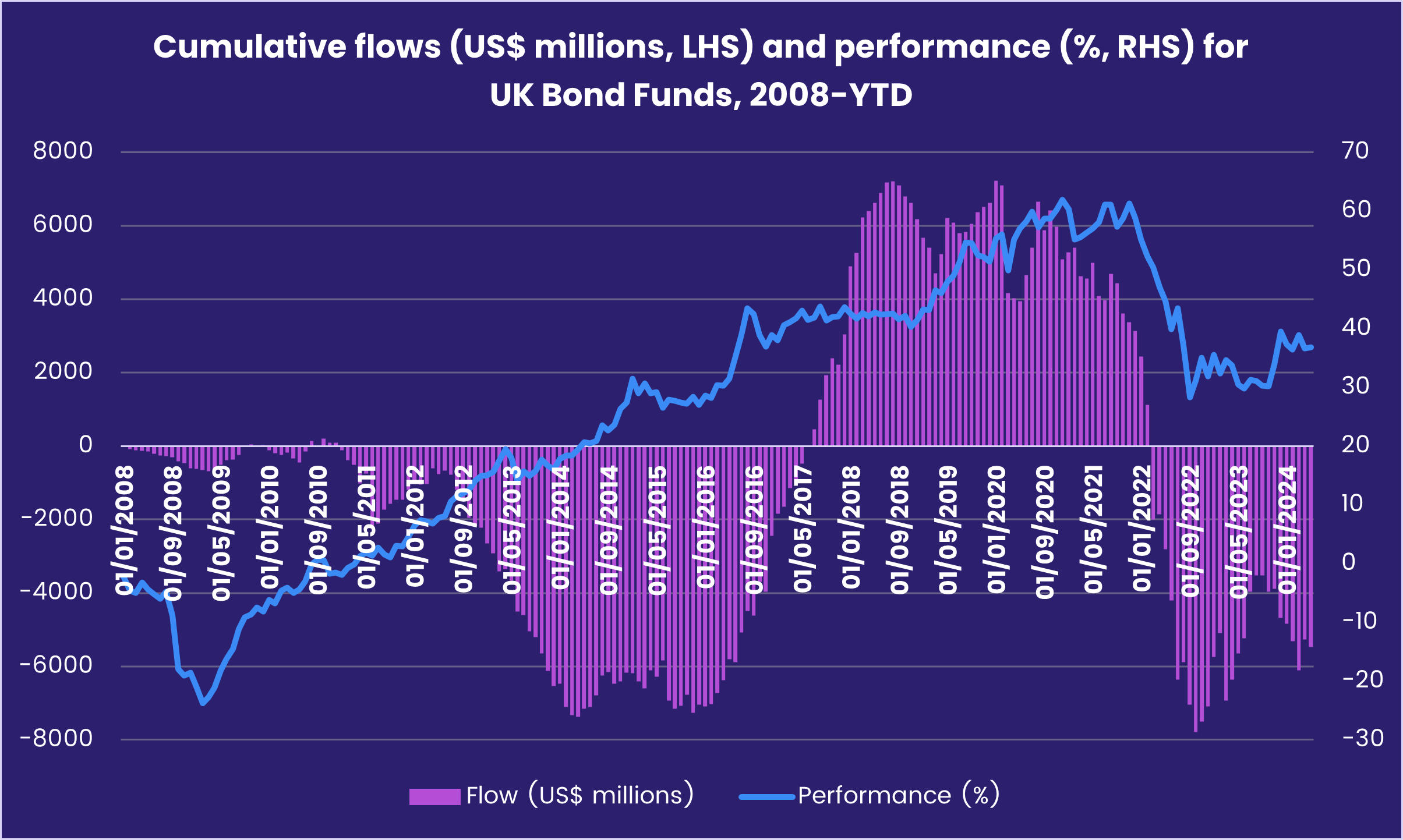

Although the French election carries the risk that populist Marine Le Pen’s populist National Rally Party will win control of the French legislature, the near certainty that the UK will soon be directed by a left-of-center Labour Party government with a hefty majority is drawing a stronger response from investors. While EPFR-tracked France Equity Funds posted their 20th outflow year-to-date, UK Equity Funds extended an outflow streak stretching back to late November and UK Bond Funds recorded their biggest outflow in over 22 months.

Investors also ended the week assessing the impact of new tariffs on Chinese electric vehicle exports to Europe, a move by the European Commission which heaped further pressure on trade-dependent markets such as Germany, Korea and Japan. During the latest week, Korea Equity Funds posted their biggest outflow since 2Q22, Japan Equity Funds added to their longest run of outflows so far this year and money flowed out of Germany Equity Funds for the 43rd time since the beginning of 3Q23.

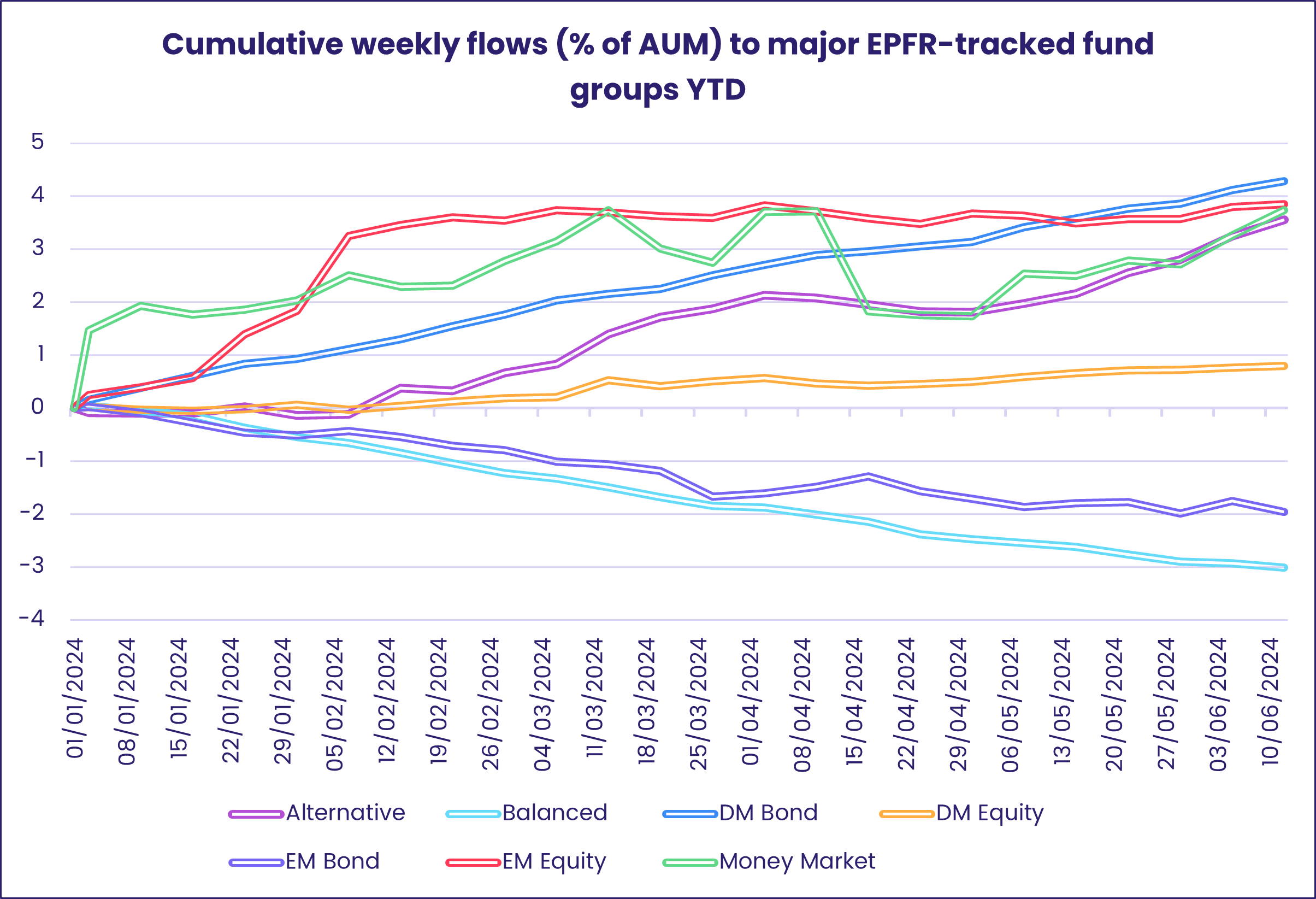

Overall, the week ending June 12 saw EPFR-tracked Equity Funds pull in $6.2 billion. A net $2 billion found its way into Alternative Funds, $10.2 billion into Bond Funds and $40.3 billion into Money Market Funds while Balanced Funds surrendered another $1.5 billion.

At the single country fund and asset class fund level, flows into China Money Market Funds climbed to a 20-week high, flows into Portugal and Norway Equity Funds hit levels last seen in late 4Q23 and early 3Q23, respectively, and Israel Equity Funds posted their biggest outflow since mid-April. Cryptocurrency Funds absorbed fresh money for the sixth straight week, Mortgage-Backed Bond Funds added to their longest inflow streak since 2019 and Physical Gold Funds chalked up their fourth inflow during the past five weeks.

Emerging Markets Equity Funds

Flows to China Equity Funds bounced back during the second week of June and India Equity Funds posted another record inflow as Asia ex-Japan Country Fund groups again drove the headline number for all EPFR-tracked Emerging Markets Equity Funds.

Investors continued to position themselves in response to the gloomier outlook for global trade. Funds dedicated to markets with strong – or potentially strong – domestic demand stories attracted significant inflows, as did Mexico-mandated funds thanks to the country’s proximity to the US consumer.

It was another tough week for EMEA Equity Funds as investors waited to see what kind of government emerges in the aftermath of South Africa’s recent election – which deprived the corrupt but centrist African National Congress of its long-standing majority – and adjusted their outlooks for oil producers in light of rising supply. Turkey Equity Funds did extend their longest inflow streak since a 12-week run ended in early 3Q16.

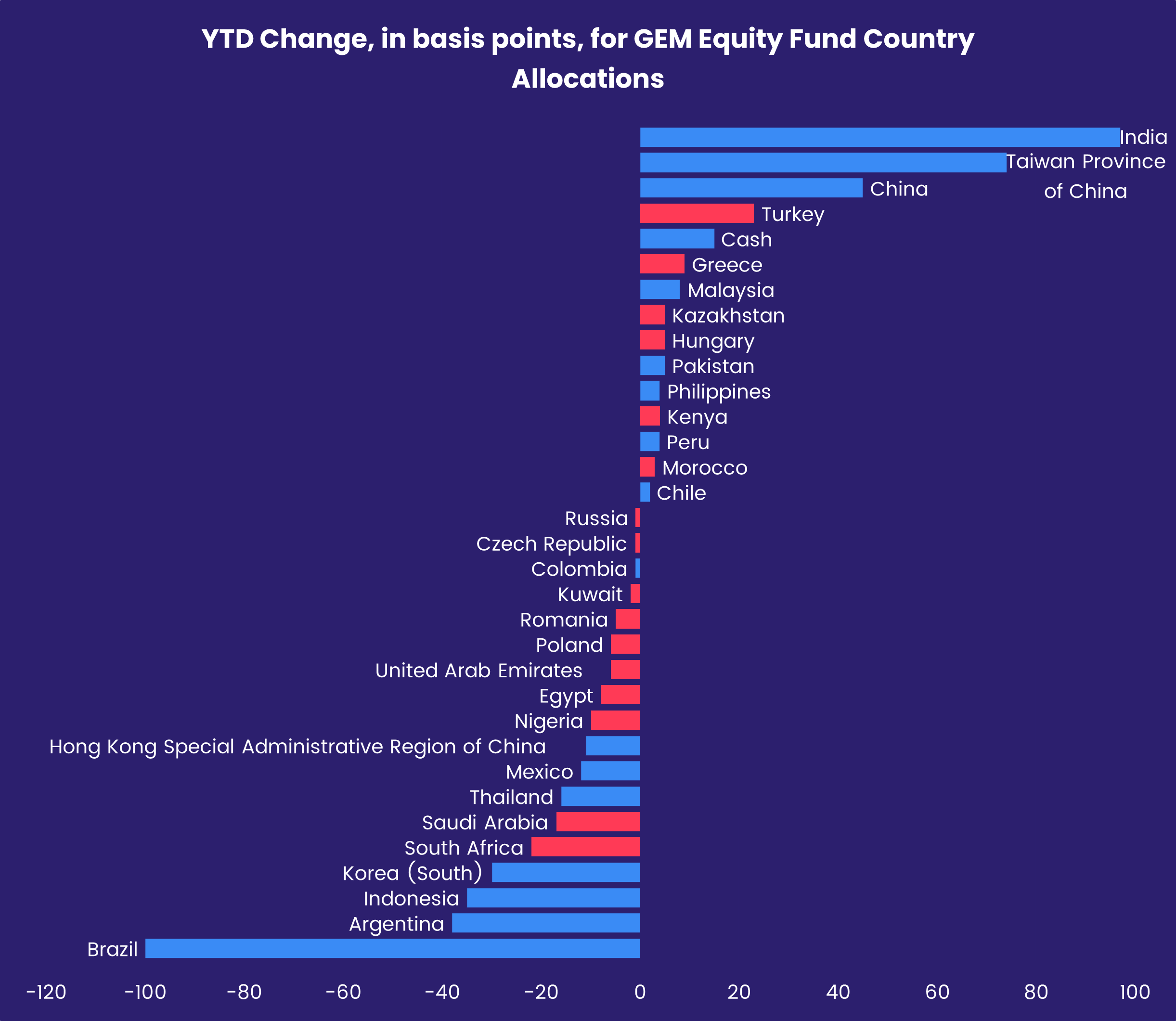

So far this year, managers of the diversified Global Emerging Markets (GEM) Equity Funds have cut their exposure to a majority of the major EMEA markets. Turkey, Greece, Hungary and Kazakhstan are among the exceptions.

GEM Equity Funds have also trimmed allocations to both of the biggest Latin American economies. But the lack of drama surrounding Mexico’s recent general election and its proximity to the US economy have triggered a flood of fresh money into Mexico Equity Funds, with the latest week’s total the largest since 4Q16.

Redemptions from Frontier Markets Equity Funds, which invest in the riskiest developing markets, hit a year-to-date high. But Africa Regional Equity Funds chalked up their biggest inflow in more than two years.

Developed Markets Equity Funds

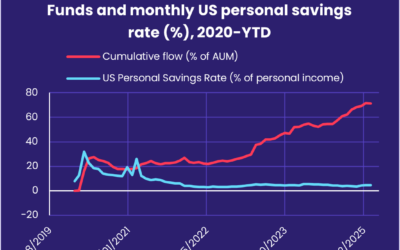

Impressive levels of share repurchases and its consumption story helped US Equity Funds post inflows in mid-June despite the US Federal Reserve’s reluctance to start cutting rates. Those flows underpinned the latest headline number for EPFR-tracked Developed Markets Equity Funds, more than offsetting further redemptions from Europe and Japan Equity Funds.

With trade tensions climbing on the back of US and European efforts to shield their domestic car industries from a flood of cheap Chinese-made electric vehicles, flows to Global Equity Funds lost momentum. Investors opted instead to boost their exposure to North American Free Trade Agreement (NAFTA) members, with Canada Equity Funds absorbing fresh money for the third straight week and US Equity Funds extending their longest inflow streak since a nine-week run ended in mid-December.

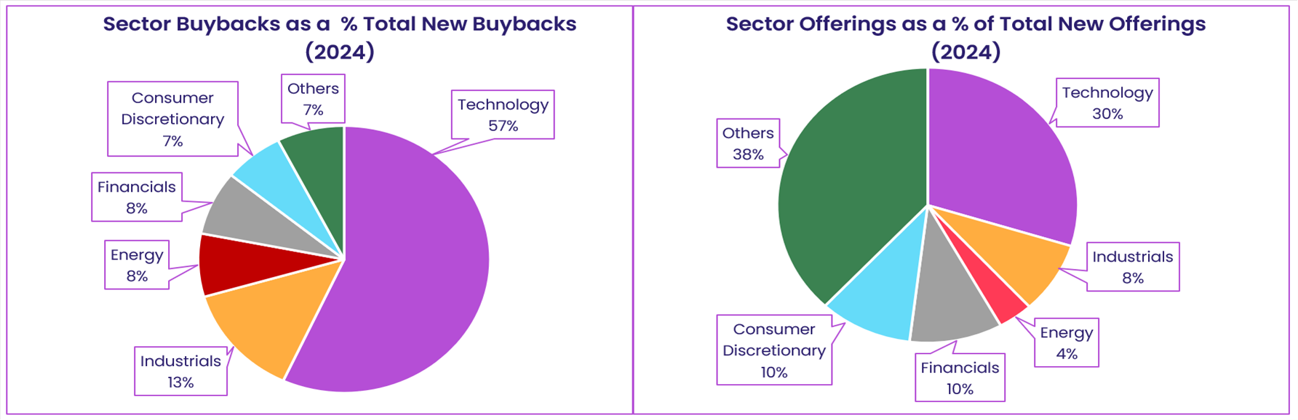

Investor appetite for US Equity Funds is picking up tailwinds from the record-setting performance of key indexes and the raft of share buybacks announced by major US companies. “US companies have announced a record $708 billion in buybacks so far this year, a 12% increase through the same period in 2023,” notes EPFR Senior Liquidity Analyst Winston Chua. “Tech companies account for more than half ($402 billion) of this total, led by announcements from the Magnificent 7. During the previous five years, tech accounted for an average of one-third of all buybacks.”

Japanese companies are also picking up the pace of share buybacks and other ways of returning cash to shareholders. But the prospect of a global trade war centered on the automotive industry continues to dull investor appetite for Japan Equity Funds. Those with socially responsible (SRI) or environmental, social and governance (ESG) mandates extended their longest outflow streak since 1Q16, but Japan Dividend Funds did post a collective inflow for the 11th time since the final week of March.

In addition to the threat posed by Chinese EVs and the risks associated with raising tariffs on them, sentiment towards Europe is taking a beating from the snap election campaigns on either side of the English Channel. Europe Equity Funds chalked up their 21st outflow year to date. The group would have, however, posted inflows for two consecutive weeks if redemptions from UK Equity Funds were not included in the overall number.

Global sector, Industry and Precious Metals Funds

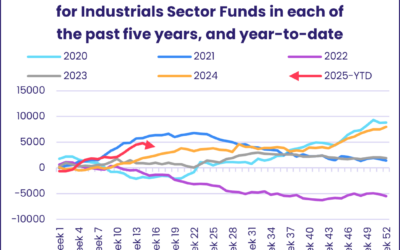

Sector-oriented investors continued to demonstrate a degree of confidence in the second week of June as seven of the 11 major EPFR-tracked Sector Funds groups attracted fresh money. Inflows ranged from almost $6 million for Infrastructure Funds to over $2 billion for Technology Sector Funds.

Consumer Goods Sector Funds saw their three-week, $1.2 billion outflow streak come to an end. At the fund level, flows into two funds benchmarked to S&P Consumer Discretionary and Staples indices pulled in $580 million between them, while a homebuilding-themed ETF dragged the headline number down by $120 million. Another $58 million was committed to a fund benchmarked to the CSI Liquor index, tracking the performance of major liquor producers and distributors listed on Chinese stock exchanges.

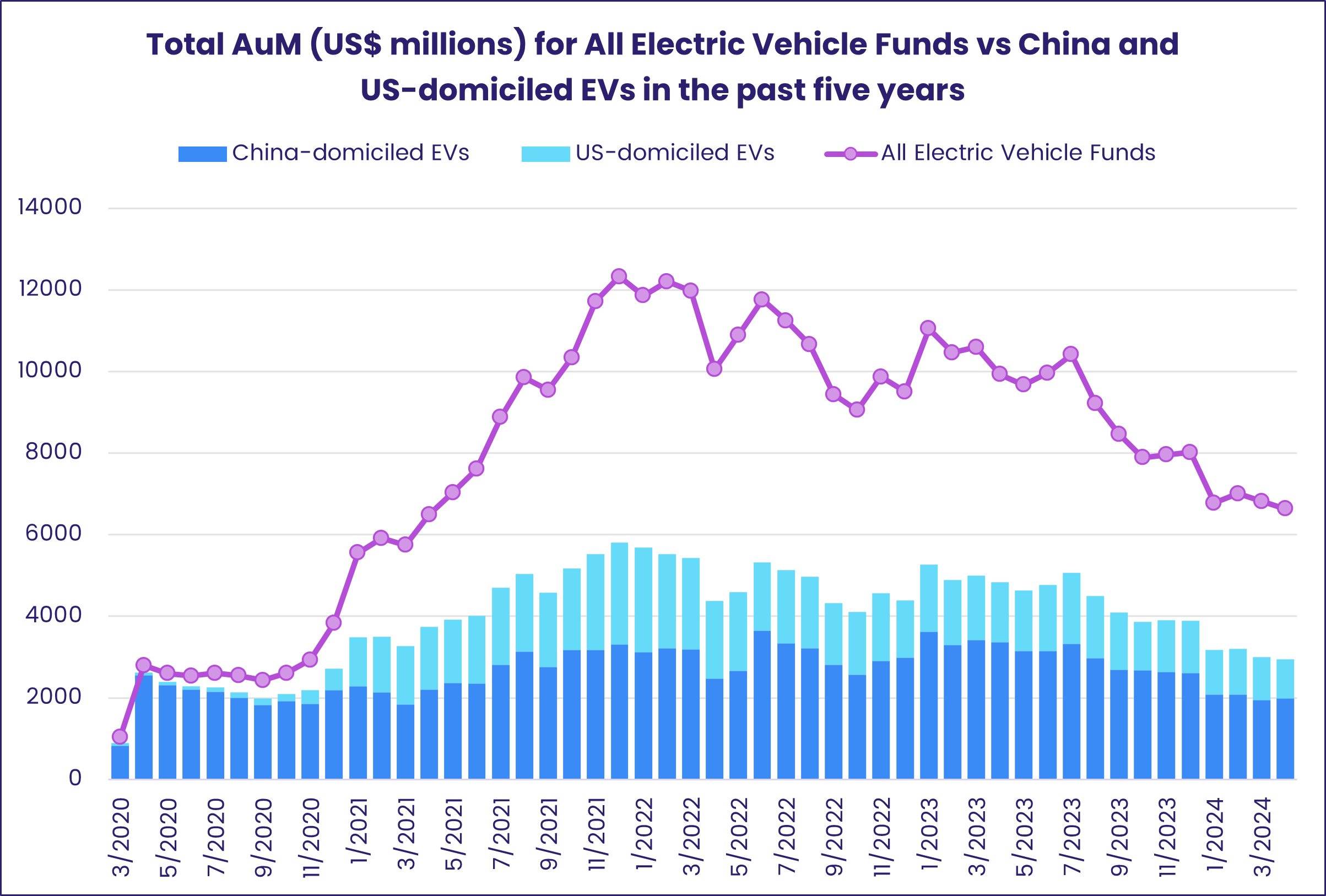

During a week when the EU made the decision to increase tariffs on Chinese EVs, following the Biden administration’s decision a month ago, no funds with ties to electric vehicles appeared in the top 10 funds receiving inflows/outflows. But Electric Vehicle Funds – especially those domiciled in the US – have been reinforcing the downward trend for all Consumer Goods Sector Funds over the past year.

Inflows for Technology Sector Funds were more than double the previous week’s total, hitting a 13-week high. Artificial Intelligence Funds rebounded from the heavy redemptions seen the previous week and Software Funds chalked up their biggest inflow since mid-4Q23. Technology Sector Funds would have enjoyed inflows at the $3 billion mark if it wasn’t for a US Leveraged 3x Semiconductor ETF pulling the headline number down by $1 billion.

Bond and other Fixed Income Funds

Emerging Markets Bond Funds were the only major group by geographic mandate to post an outflow during the week ending June 12 as EPFR-tracked Bond Funds shrugged off fresh worries about future policymaking in France and the UK. Year-to-date inflows to all funds are now north of $340 billion.

Of that total, less than 10% has been absorbed by funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates which, despite taking in fresh money 22 of the 24 weeks YTD, are well off the pace seen in 2021 when the current full-year inflow record was set.

For the first time since 2021 flows favor actively managed Bond Funds, and actively managed exchange traded funds (ETFs) are on course to eclipse the full year inflow record they set last year. Meanwhile, retail share classes are on track for their biggest collective inflow since 2012.

During the latest week, attention was split between the run-up to the US Federal Reserve’s latest policy meeting and the prospect of French and UK legislatures – and fiscal policymaking – being controlled, respectively, by right-of-center populists and tax-and-spend socialists. Although Europe Bond Funds overall added to an inflow streak stretching back to the final week of October, redemptions from UK Bond Funds jumped to a 99-week high.

US Bond Funds also added to a lengthy run of inflows despite the biggest retail redemptions since mid-December. Sovereign US Bond Funds attracted $2 for every $1 committed to funds with corporate mandates. Demand for US sovereign debt in the primary market remains solid despite high levels of issuance, with a reopened auction of 10-year notes attracting over 2.5 times the bids needed to cover.

Redemptions from Hard Currency Emerging Markets Bond Funds jumped to a 12-week high ahead of the Fed’s decision on June 12 to keep US short term interest rates at their current levels. At the country level, China Bond Funds, which posted only 15 weekly inflows during 2022 and 2023, took in fresh money for the ninth time during the past 11 weeks as they extended their longest inflow streak since 1Q22.

Did you find this useful? Get our EPFR Insights delivered to your inbox.