With only a few key data points standing between now and the Federal Reserve’s September meeting, expectations of a first cut in US interest rates since 1Q20 continue to harden.

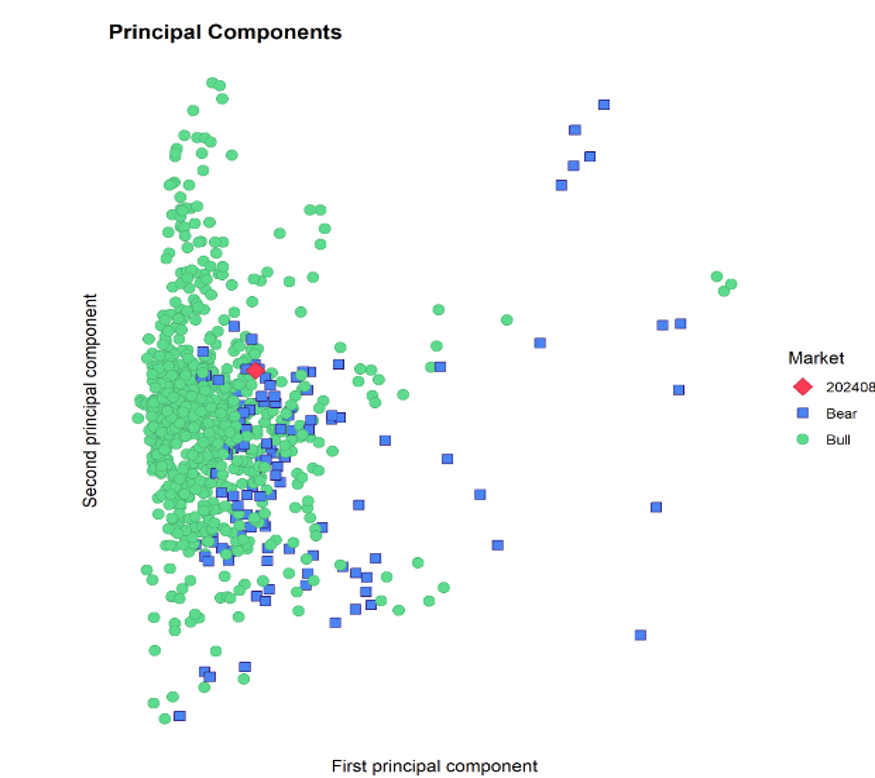

Underpinning those expectations is the conviction that the US economy – and by extension the global economy – risks stalling if rates remain restrictive. One of EPFR’s models, its Bear Detector, is pointing this way. The latest data point of the model, which uses principal component analysis of factors derived from the company’s databases, rests squarely in the bearish frontier.

During the week ending August 21, investors positioned themselves for lower interest rates, steering over $40 billion into major US-mandated fund groups for the second week running. US Money Market Funds have taken in $100 billion since the beginning of the month as investors take advantage of current yields. Physical Gold Funds, meanwhile, took in more than $1 billion for only the third time year-to-date and Technology Sector Funds recorded their eighth consecutive inflow and 26th of the year so far.

Overall, passively managed Equity Funds absorbed a net $22 billion during the third week while actively managed funds saw $1.8 billion flow out. Alternative Funds took in a five-week high of $3.5 billion, Bond Funds pulled in $15 billion and $37 billion flowed into Money Market Funds.

At the single country and asset class fund level, redemptions from Inflation Protected Bond Funds hit a 22-week high, Municipal Bond Funds posted their eighth consecutive inflow and Dividend Equity Funds added to their longest run of inflows since 2Q22. Turkey Money Market Funds took in fresh money for the 18th week running, Sweden Bond Funds posted their fourth weekly outflow year-to-date and flows into Colombia Equity Funds hit their highest level in over 11 months.

Emerging Markets Equity Funds

Buoyed by the prospect of lower US interest rates, which opens the door for emerging markets to cut their rates with less risk of triggering currency weakness, EPFR-tracked Emerging Markets Equity Funds tallied their 12th consecutive inflow during the third week of August. While fund groups with emerging Asian mandates continue to be the major driver of overall flows, the latest week saw the diversified Global Emerging Markets (GEM) Equity Funds post their biggest inflow since mid-May.

Funds dedicated to the major Asian markets all recorded inflows that ranged from $159 million for Korea Equity Funds to $4.87 billion for China Equity Funds. There was less appetite for exposure to smaller regional markets, with Pakistan, Philippines, Vietnam and Thailand Equity Funds all recording outflows.

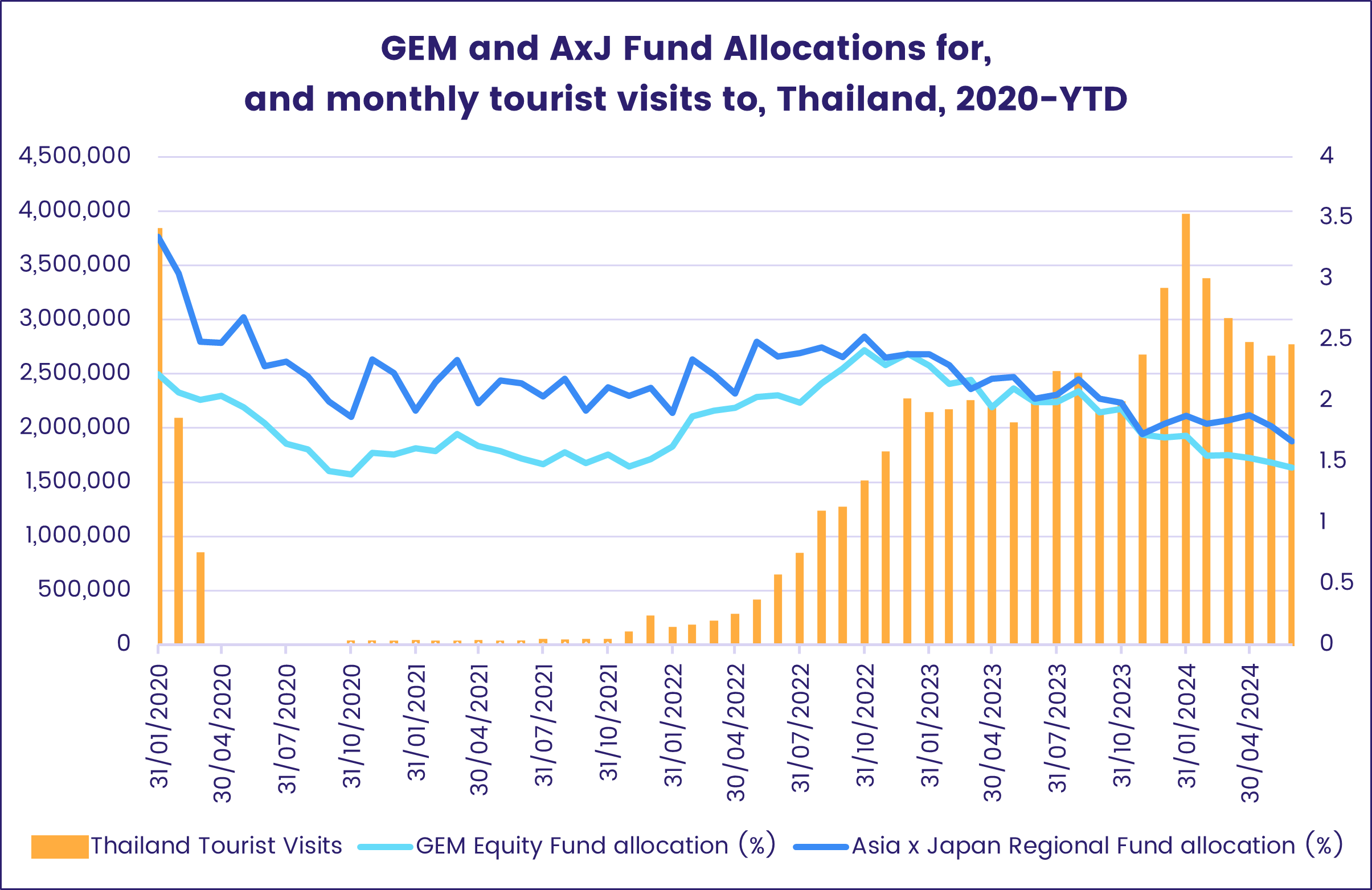

In the case of Thailand Equity Funds, the latest redemptions marked the 33rd straight week that investors have pulled money out of the group. Although tourism, historically a key marker of Thailand’s economic health, has recovered after the hit it took from the Covid-19 pandemic, political uncertainty and global trade tensions have undermined the country’s appeal with both investors and fund managers.

Money also continues to flow out of Latin America Equity Funds. Questions about Chinese and US demand for raw materials, the developed world’s commitment to renewable energy and the outlook for Sino-US trade are all sapping investor appetite for regional exposure. Brazil Equity Funds have been hit by the return of price pressures that are fueling expectations of at least one rate hike before the end of the year.

EMEA Equity Funds posted their biggest collective outflow since mid-2Q22 as the previous week’s record-setting flows into South Africa Equity Funds reversed and redemptions from Saudi Arabia Equity Funds climbed to a 10-week high.

Developed Markets Equity Funds

The week ending August 21 saw EPFR-tracked Developed Markets Equity Funds take in fresh money for the 18th week running as investors started penciling in lower US interest rates by the end of next month. US and Global Equity Funds were again the major drivers of the week’s headline number, which was also supported by further flows into Europe Equity Funds, while Japan, Canada and Pacific Regional Funds experienced net redemptions.

The latest flows into Global Equity Funds favored those with fully global mandates over their ex-US counterparts by a 7-to-1 margin. Flows into retail share classes hit a seven-week high and Global Dividend Funds posted their second-biggest inflow year-to-date.

US Equity Funds have not attracted retail money since the final week of April. But, helped by expectations of lower interest rates and a ‘soft landing’, enthusiasm for the artificial intelligence story and robust repurchasing of their own shares by US companies, overall inflows year-to-date now exceed $160 billion. During July, US Small Cap Funds posted their biggest monthly inflow since EPFR started tracking them in 2Q03.

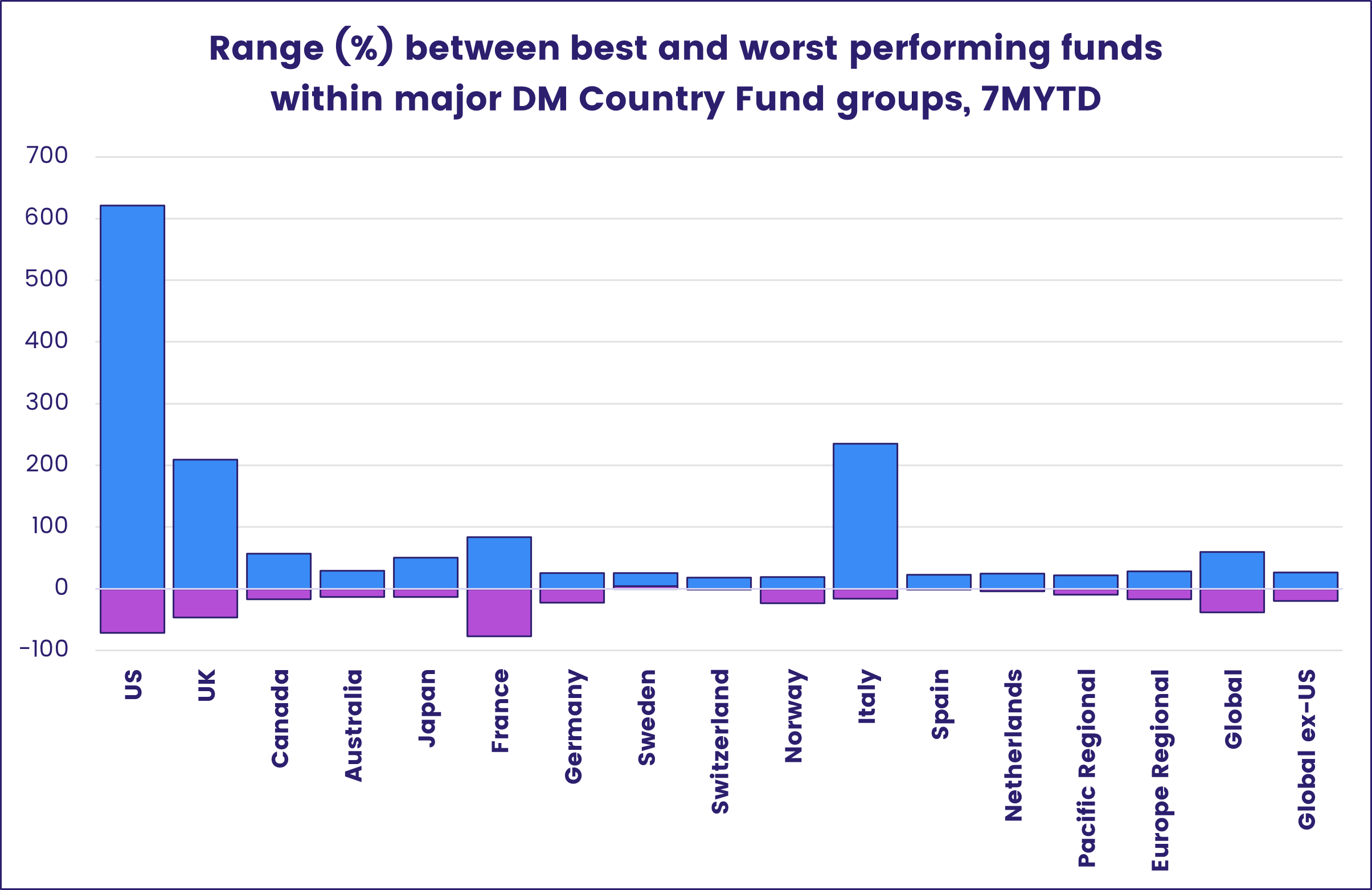

The universe of US Equity Funds has seen the greatest divergence in individual fund performance over the first seven months of 2024, followed by UK and Italy-mandated funds.

Canada Equity Funds did not fare as well as their US counterparts ahead of a major strike by the country’s rail workers, posting their sixth consecutive outflow and 21st of the year so far.

The latest flows into Europe Equity Funds again favored those offering regional rather than single country exposure. Appetite for fiscal rectitude also appears to be at a low ebb: all of the fund groups dedicated to the so-called ‘frugal five’ markets – Austria, the Netherlands, Finland, Denmark and Sweden – posted outflows, with redemptions from Sweden Equity Funds hitting a 72-week high.

Japan Equity Funds saw their latest inflow streak stop at two weeks as retail flows slipped into negative territory. Export data for July was underwhelming and, with the yen’s recent appreciation, investors fear there is more pain ahead for Japanese exporters.

Global sector, Industry and Precious Metals Funds

With recent US retail sales data boosting confidence in consumer demand, only to run into concerns over a weaker American labor market, sector focused investors showed some uneasiness during the week ending August 21. The number of major EPFR-tracked Sector Fund groups reporting inflows did climb to seven, but trading volume (the absolute value of outflows + inflows) among all Sector Fund groups was the smallest since the first week of 2023. Inflows ranged from $6 million for Industrials Sector Funds to $471 million for Technology Sector Funds.

Consumer Goods Sector Funds saw their four-week, $2.85 billion outflow streak come to an end, with analysis at the fund-level showing sentiment leaning towards staples rather discretionary. The latest Inflow was the biggest in over six months and the second-largest since early 3Q23. US-dedicated funds drove the headline number this week as inflows reached nearly $1 billion, while those with China and Europe mandates snapped eight and 10-week outflow runs, respectively.

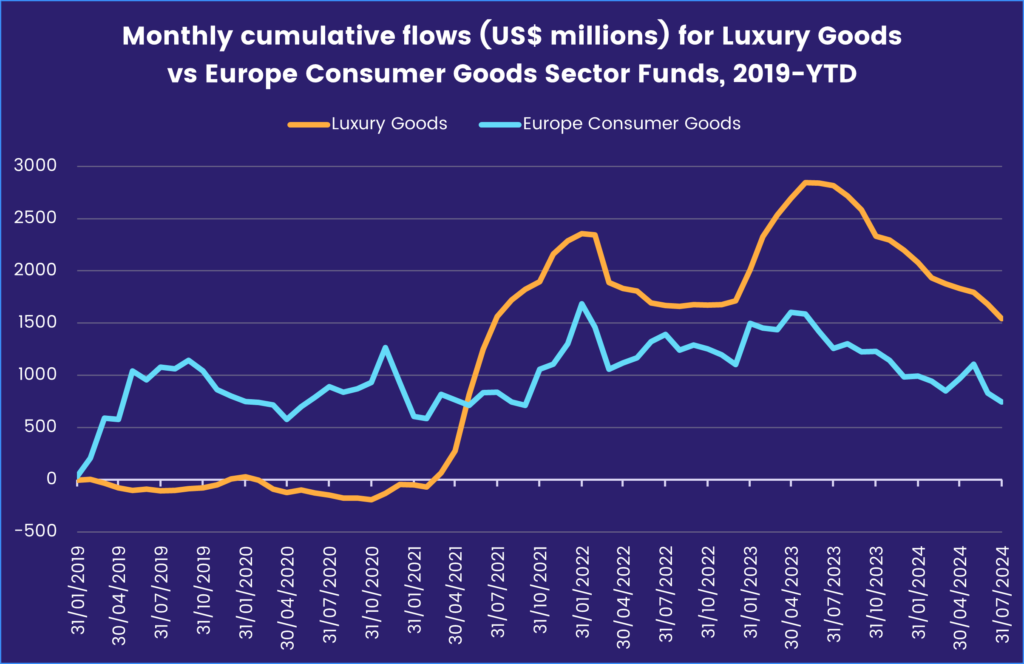

The escalating tariffs on Chinese-made goods and further investigations on EV subsidies from both the US and EU have put pressure on another segment of the industry. Looking at a custom grouping of 14 unique Consumer Goods Sector Funds with “luxury” or “premium brands” in their fund-level or benchmark name, illustrates the collateral damage caused by these broader trade tensions.

Investor enthusiasm for Luxury Goods Funds grew rapidly starting in late 2020. The group racked up inflows of over $2.5 billion from mid-4Q20 until early 2022, but flows wavered until dropping off significantly since the middle of 2023. In the past 14 months, redemptions for Luxury Goods Funds have totaled $1.3 billion with year-to-date outflows accounting for roughly half of that (16% of assets), surpassing previous yearly records set in 2014 and 2022 at $415 and $575 million, respectively.

Elsewhere, the price of gold hit a record high of $2,531 per ounce on Tuesday ahead of the latest Federal Reserve meeting minutes which did add to the market’s certainty around a September rate cut. EPFR-tracked Gold Funds posted their 12th inflow of the past 15 weeks, with this week’s total running at a five-week high.

Two of the top three funds with the biggest inflows this week were benchmarked to LMBA Gold Price (global benchmark prices for unallocated gold and silver delivered in London) attracting $1.2 billion alone. Another fund tracking the Gold Bullion Price Index (tracks the price changes of gold bars, market value of physical gold bullion) added $353 million to the total, while three funds domiciled in China saw over $400 million flow out.

The $11.5 billion absorbed by Technology Sector Funds in July was the second-largest monthly inflow behind the record $18.4 billion they absorbed in February of 2021. A single US Leveraged 3x ETF focused on semiconductors accounted for nearly $3 billion (27% of the fund’s assets). At the country level, Taiwan (POC) Technology Sector Funds pulled in a record high of $1.6 billion during July.

Bond and other Fixed Income Funds

Although US Bond Funds again attracted the largest slice of fresh money, flows to EPFR-tracked Bond Funds broadened during the third week of August as year-to-date flows for all funds climbed past the $500 billion mark. Flows into Global Bond Funds hit a 14-week high and Europe Bond Funds bounced back from their biggest outflow in over 19 months.

Flows to funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates also bounced back despite the cooler response from some companies and fund providers to key ESG themes. Flows into Green Bond Funds climbed to a 12-week high.

At the asset class level, Bank Loan Funds extended their longest outflow streak since a 19-week run ended in mid-2Q23. But High Yield and Mortgage-Backed Bond Funds snapped their two-week outflow streaks as investors debated whether the Federal Reserve will cut US interest rates by 25 or 50 basis points at its September meeting.

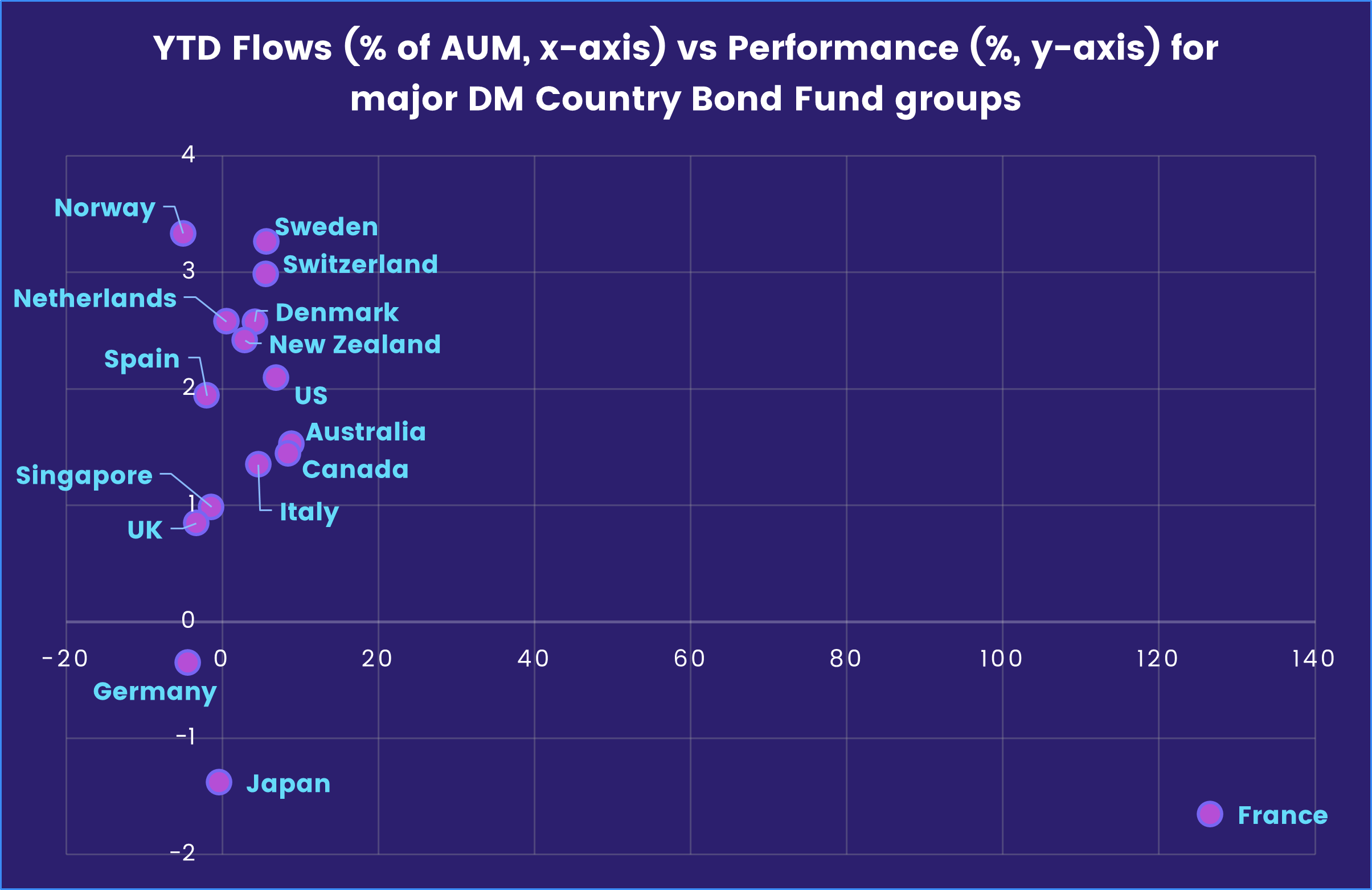

As with their equity counterparts, flows into Europe Bond Funds favored funds with regional mandates. At the country level France Bond Funds, which have been an outlier in relative terms this year, posted their biggest outflow since late November as the glow from the Paris Olympics faded and efforts to form a new government resume.

US Bond Funds pulled in another $9.6 billion, with Sovereign and Corporate Funds attracting roughly equal sums overall and Long Term Sovereign Funds recorded the biggest inflow when those groups were filtered by duration. Foreign domiciled US Bond Funds have posted inflows eight of the past nine weeks and 23 of the past 26.

Redemptions from both Hard and Local Currency Emerging Markets Bond Funds moderated during the third week of August, but the overall group extended their longest run of outflows since the first quarter. At the country level, flows to Russia Bond Funds have picked up in recent weeks with the latest total the biggest since mid-3Q21.

Did you find this useful? Get our EPFR Insights delivered to your inbox.