Mixed earnings reports from the closely watched American technology sector, the European Central Bank (ECB) starting to talk the anti-inflation talk and oil prices hitting levels last seen in 2004 gave investors additional pause for thought going into February. Those investors, already staring down the barrel of multiple US interest rate hikes this year, stepped up their redemptions from Bond Funds and looked for alternatives to US equity without completely abandoning that asset class.

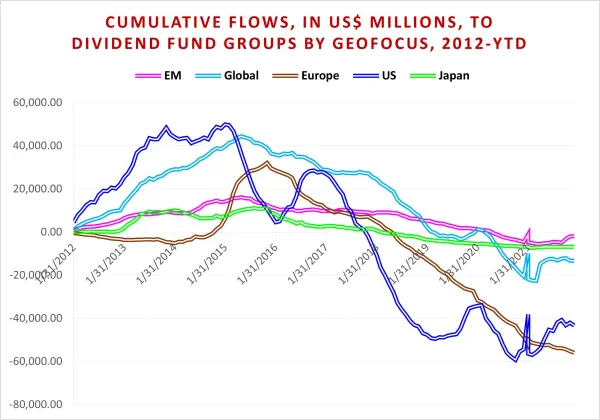

Overall, the week ending Feb. 2 saw a net $11.6 billion flow out of EPFR-tracked Bond Funds, the biggest weekly total since early March of last year, while Balanced Funds absorbed $850 million, Alternative Funds $3.1 billion and Equity Funds $21.8 billion. Dividend Equity Funds posted their sixth straight inflow and 16th in the past 18 weeks while Equity Funds with socially responsible (SRI) and environmental, social and governance (ESG) mandates extended an inflow streak stretching back to mid-3Q20.

When it came to risk appetite, the signals were mixed. The prospect of Russian attacking the Ukraine did not stop Europe Regional, Russia Equity or Energy Sector Funds from recording inflows. But interest rate risk, or the perception of that risk, chased another $4.9 billion out of High Yield Bond Funds and contributed to the biggest outflow from Europe Bond Funds in exactly 11 months.

At the single country and asset class fund levels, flows into China Bond Funds hit a 12-week high and China Equity Funds extended their longest inflow streak since 1Q21. Redemptions from UK and Canada Bond Funds hit levels last seen in 4Q20 and 1Q20, respectively, while Italy Equity Funds recorded their biggest inflow in over three months. Bank Loan Funds absorbed more than $1 billion for the fifth time in the past eight weeks, flows to Total Return Bond Funds rebounded from the previous week’s outflow and redemptions from Inflation Protected Bond Funds climbed to a 98-week high.

Did you find this useful? Get our EPFR Insights delivered to your inbox.