With US inflation behaving itself, French and British elections in the rearview mirror and another corporate earnings season that is expected to bolster the case for (most) current S&P 500 valuations kicking off in earnest next week, risk appetite climbed appreciably during the week ending July 10.

The latest week saw EPFR-tracked Alternative Funds post their biggest collective inflow since mid-March, Technology Sector Funds absorb over $1.5 billion for the fourth time over the past five weeks, flows into Cryptocurrency and High Yield Bond Funds climb to five-week highs and Emerging Markets Bond Funds record their 10th inflow year-to-date.

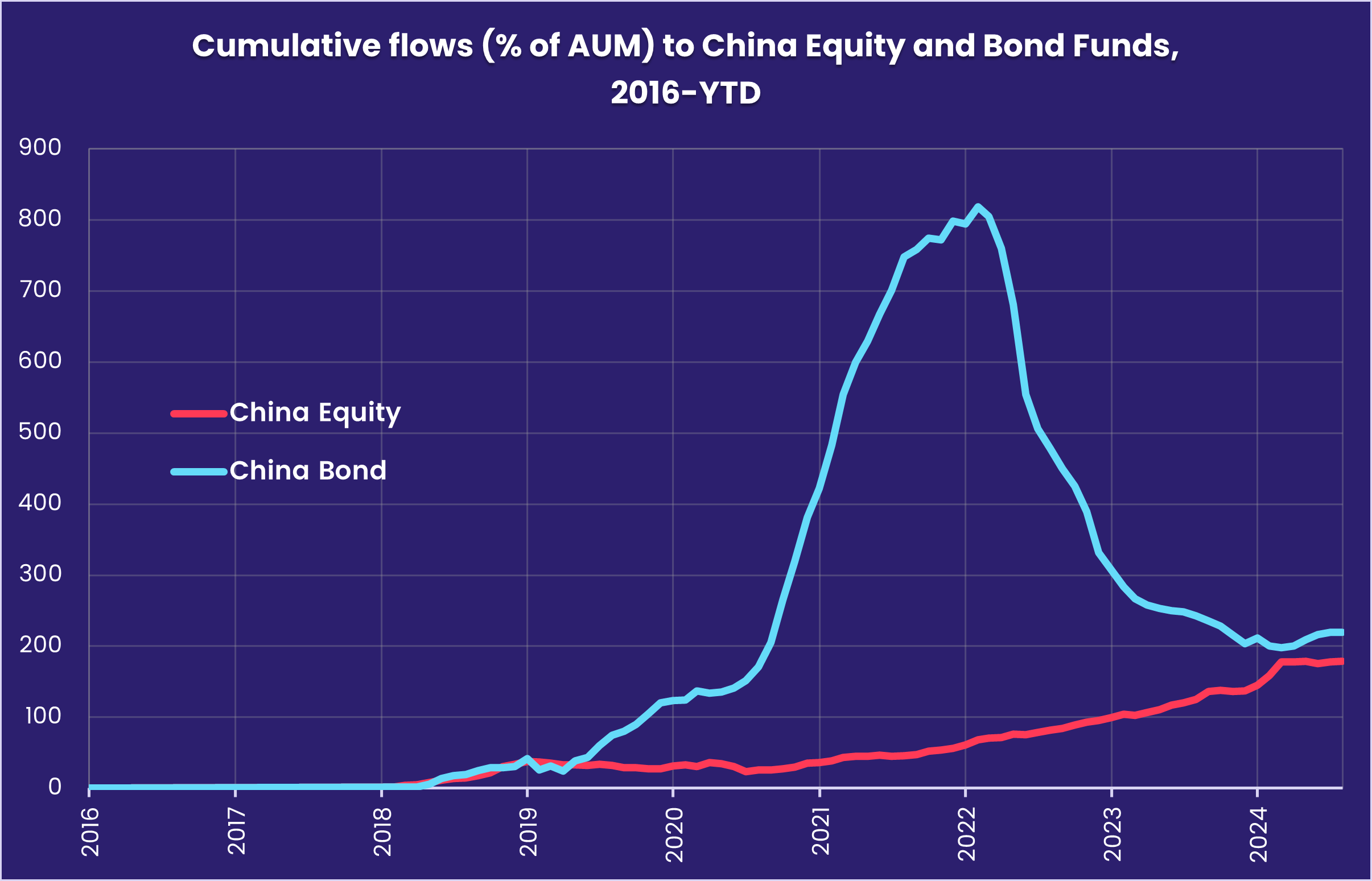

The US and Emerging Asia continue to soak up the bulk of the fresh money committed by equity investors. China Equity Funds extended their longest inflow streak since a 13-week run ended in mid-February and, for the third time since the beginning of June, India Equity Funds posted a new weekly inflow record. China Bond Funds, however, saw their longest inflow streak in over two years end as China’s central bank moved to cool surging demand for the country’s sovereign debt.

Overall, Equity Funds pulled in a combined $10.2 billion during the first full week of July while Alternative Funds absorbed $2.9 billion and Bond Funds $13.7 billion. Investors steered $35 billion into Money Market Funds.

At the asset class and single country fund level, Total Return Funds chalked up their fourth outflow during the past five weeks, Mortgage-Backed Bond Funds absorbed fresh money for the 28th week running, and Physical Gold Funds posted a third consecutive inflow for the first time since mid-2Q23. Flows into UK and China Money Market Funds climbed to four and 24-week highs respectively, redemptions from Austria Bond Funds hit a record high and Russia Equity Funds posted their biggest outflow since the first week of the year.

Emerging Markets Equity Funds

Flows to EPFR-tracked Emerging Markets Equity Funds during the week ending July 10 hewed to their recent, Asia-centric pattern as dedicated China and India Equity Funds absorbed over $5 billion between them while the diversified Global Emerging Markets (GEM) Funds added to their longest outflow streak since 2H23 and Latin America Equity Funds saw over $200 million redeemed for the third straight week.

Investors pulled money out of Emerging Markets Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates for the 21st time so far this year. Sentiment towards Collective Investment Trusts (CITs) with EM mandates also remains cool, with these vehicles posting their 12th consecutive outflow.

The latest flows into India Equity Funds took their year-to-date total to north of $35 billion and 95% of last year’s record-setting total. Most of this money has gone to India Large Cap Equity Funds with mixed growth/value portfolios. Enthusiasm for India’s story has spread to the investor class who utilize hedge funds. Dedicated India Equity Hedge Funds have recorded six consecutive monthly inflows, their longest run since 2017.

Overseas domiciled China Equity Funds saw money flow out for the seventh straight week, but those redemptions were handily offset by flows into domestically based funds. That included the first inflow for China State Owned Enterprise (SOE) Funds since late April.

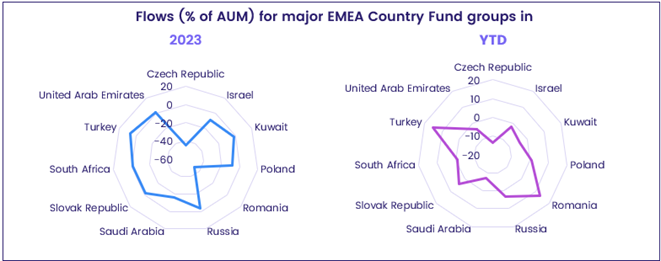

EMEA Equity Funds were the other major regional group to post a collective inflow for the week as Romania Equity Funds continue to soak up fresh money and flows into Saudi Arabia Equity Funds hit their highest level since the third week of 2Q22. Slowing growth and a relatively large fiscal deficit may sap enthusiasm for Romania in the months ahead.

Weaker commodity prices, policy concerns, the shadow cast by higher-for-longer US interest rates and the underperformance of regional currencies and equity markets continue to sap demand for Latin America Equity Funds. Through the end of June, the MSCI EM Latin America Index was down nearly 6% year-to-date versus a 4% gain for the MSCI Emerging Markets Index.

Developed Markets Equity Funds

With US stock indexes hitting yet more record highs during the week ending July 10, the money kept flowing into US and Global Equity Funds. That kept EPFR-tracked Developed Markets Equity Funds’ current inflow streak alive despite further redemptions from Japan, Pacific Regional and Europe Equity Funds.

The investment case for American equity got a further shot in the arm from the latest inflation data, showing year-on-year growth in the Consumer Price Index falling to a 37-month low of 3%. That suggests the Federal Reserve may have scope to cut interest rates twice during 2H24. US Equity Funds pulled in fresh money for the 11th time during the past 12 weeks despite the continued absence of retail support, with Large Cap ETFs again absorbing the bulk of the new money.

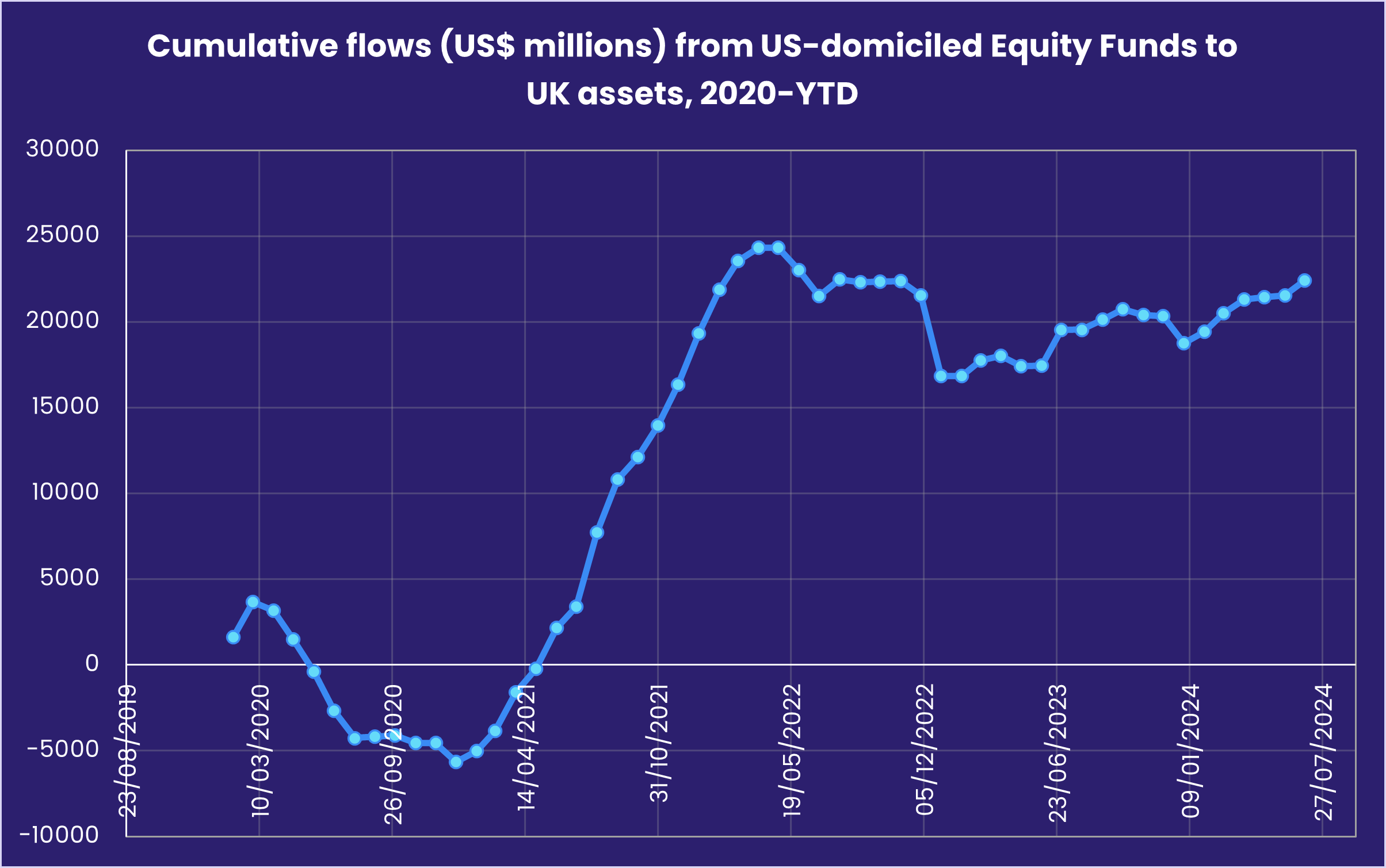

Europe Equity Funds racked up their eighth consecutive outflow as the dust continues to settle from general elections in France and the UK. Contrary to the general narrative of orderly transition in the UK versus confusion and uncertainty in France, investors steered money into France Equity Funds for the third straight week – the first time that has happened since early 4Q23 – and redeemed another $834 million from UK Equity Funds. British stocks are getting some support from Global Equity Funds, principally those domiciled in the US.

While the UK and France are claiming the lion’s share of market attention, the latest week saw Spain Equity Funds snap their longest redemption streak since 3Q18 and Norway Equity Funds take in fresh money for the ninth straight week.

Equity markets in Japan are also testing – and breaching – record highs. But Japan Equity Funds are not benefiting, with the latest week’s redemptions the eighth during the past nine weeks. Flows to foreign-domiciled Japan Equity Funds did climb to a 13-week high, but retail share classes posted their biggest collective outflow since late 2Q23.

Global sector, Industry and Precious Metals Funds

In the first full week of July, with investors making their final dispositions prior to the 2Q24 US corporate earnings season kicking off, more money flooded into Technology Sector Funds. Outside this group, however, flows in both directions were modest, ranging from an outflow of $334 million for Industrial Sector Funds to an inflow of $226 million for Telecoms Sector Funds.

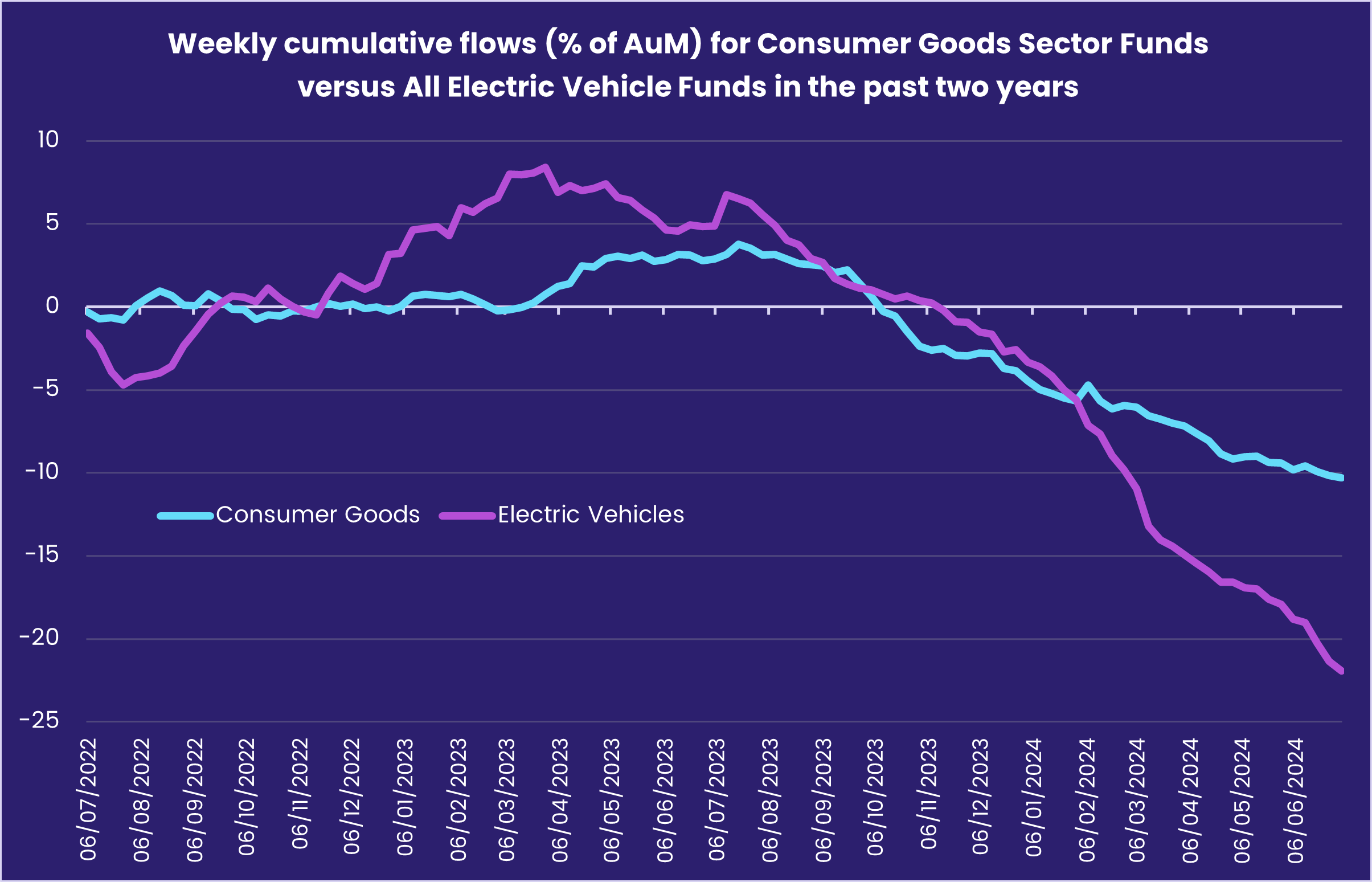

Consumer Goods and Energy Sector Funds did see their first inflow in three and two weeks, respectively, but they were at or below the $10 million mark. For the former group, the top money magnet at the fund level was tied to home construction, while four funds with Tesla in their name or relating to EVs pulled the headline number down.

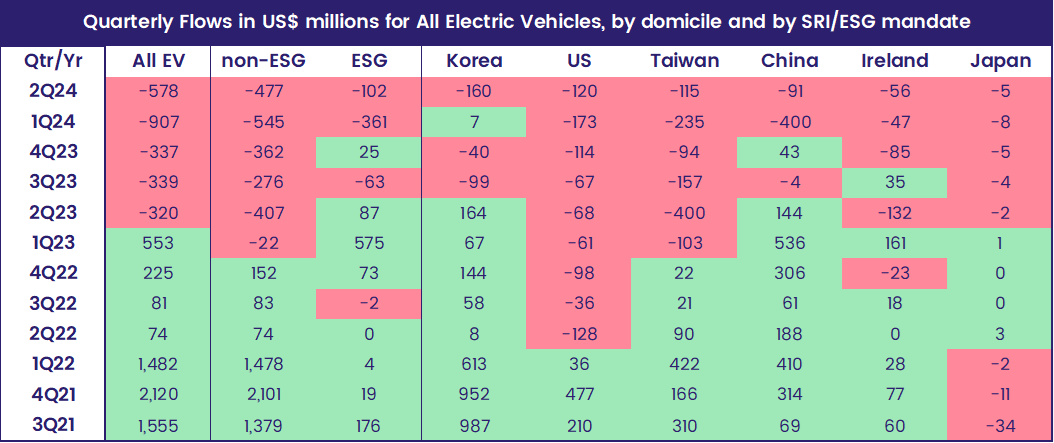

There are roughly 80 funds within Consumer Goods Sector Funds tied to the general automotive industry and of those, nearly 60 funds that have significant exposure to companies developing EVs or autonomous driving. The redemptions for EVs have contributed to the overall trend of outflows from Consumer Goods Sector Funds.

These Electric Vehicle Funds track $6.57 billion in AuM, with China and Korea-domiciled funds equally representing roughly 60% of this group and US-domiciled accounting for 15% of the AuM. Korea-domiciled EV Funds were the hardest hit among the groups in the latest quarter. But when looking at year-to-date flows, China-domiciled EV Funds have seen nearly half a billion flow out and Taiwan-domiciled EV Funds have seen another $350 million redeemed

First off the earnings report grid are some of the major US banks – JPMorgan, Wells Fargo, Citigroup, Goldman Sachs, BlackRock – and investors pumped over $420 million into Financials Sector Funds on the final two days of the reporting period, offsetting redemptions at the beginning of the week. The group has seen over $1.4 billion flow in over the past three weeks, and a net $2.5 billion added over the past six weeks.

Infrastructure Sector Funds have posted just a single outflow in the past 10 weeks, pulling in a net $1.12 billion in that time. The group pushed its inflow streak to six weeks, the longest since a 10-week stretch in late 3Q22. Construction Funds snapped a three-week outflow run with their biggest inflow in six weeks while Transportation/Shipping Funds racked up their sixth straight week of outflows.

As gold touched over $2,400 per ounce, EPFR-tracked Gold Funds saw the pace of inflows drop compared to the previous two weeks. The group tallied its seventh inflow of the past nine weeks. Silver Funds, meanwhile, snapped a four-week run of inflows.

Bond and other Fixed Income Funds

Hopes for higher-for-not-as-long US interest rates and further rate cuts in Europe during the second half of the year kept the money flowing into EPFR-tracked Bond Funds during the week ending July 10. The latest influx lifted the year-to-date total over the $400 billion mark, with US, Global, Asia Pacific, Emerging Markets and Europe Bond Funds all posting inflows.

At the asset class level, Inflation Protected Bond Funds posted their fifth outflow over the past six weeks, Convertible Bond Funds racked up their 22nd outflow of the year so far and Mortgage-Backed Bond Funds posted their 28th consecutive inflow. Expectations of more than one US rate cut this year provided a tailwind for Municipal Bond Funds, with inflows climbing to a nine-week high.

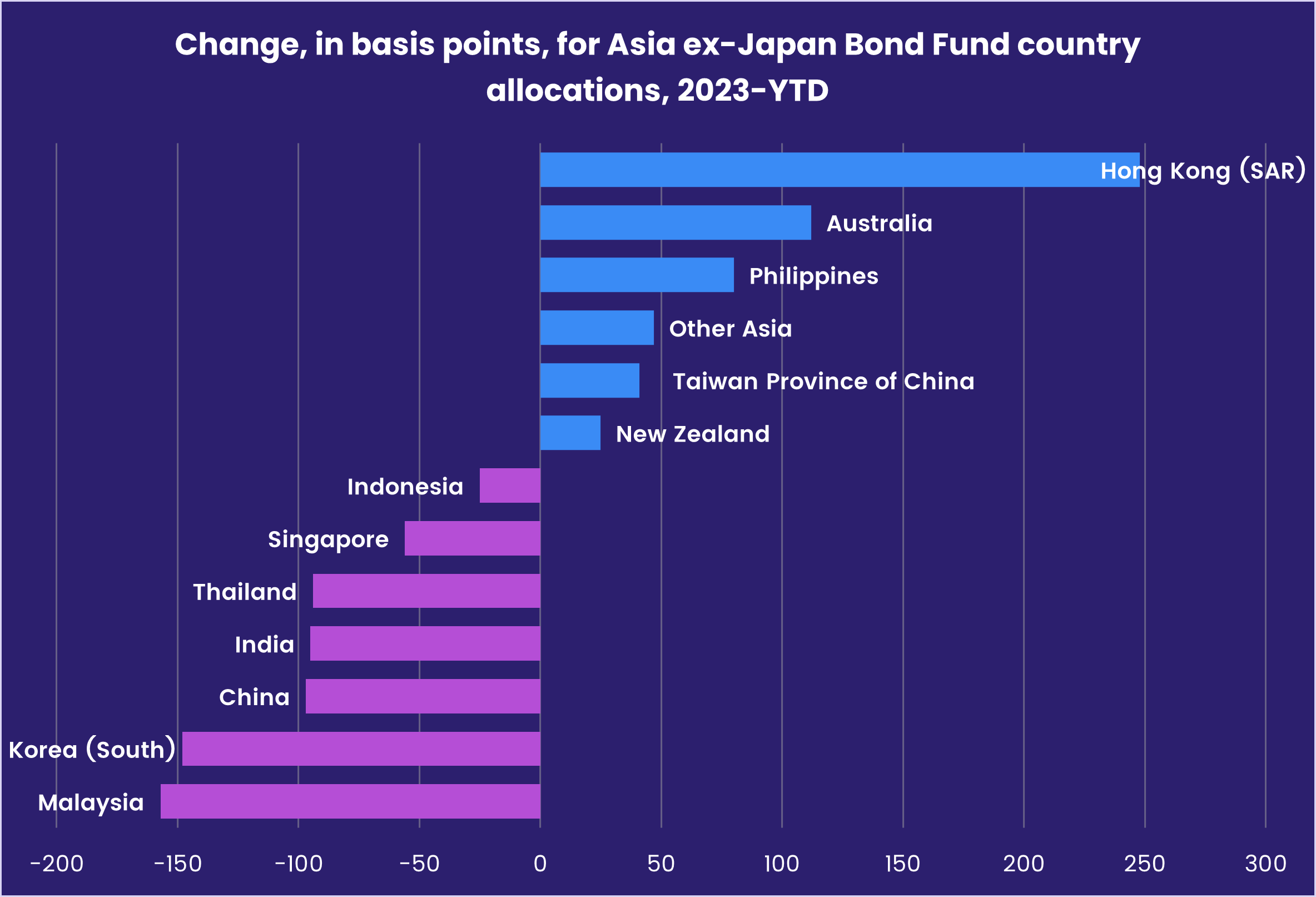

Flows into Emerging Markets Hard and Local Currency Bond Funds were largely even as flows into South Africa Bond Funds jumped to a 26-week high and the renaissance in flows to China Bond Funds hit a wall. Over the past 18 months, Asia ex-Japan Bond Fund managers have rotated exposure from China, India, Korea and Malaysia to Taiwan (POC), the Philippines and several developed markets.

Europe Bond Funds added to their year-to-date total despite concerns about the appetite of new governments in France and the UK for fiscal discipline. But overall flows favored funds with corporate mandate over their sovereign counterparts by a 100-to-1 margin. At the country level, UK Bond Funds snapped a seven-week outflow streak while funds dedicated to one of the ‘Frugal Five’ markets, Austria, posted a record outflow.

Foreign-domiciled US Bond Funds posted their 27th weekly inflow of the year so far as, for the second week running, flows were spread relatively evenly across the major durations.

Did you find this useful? Get our EPFR Insights delivered to your inbox.