After several weeks of shunning exposure to riskier asset classes in favor of cash, gold and US sovereign debt, investors shed some of their caution during the week ending November 8. EPFR-tracked High Yield Bond Funds posted their first inflow since the second week of September and their biggest since late 2Q20, flows into Cryptocurrency Funds climbed to a 75-week high and Global Emerging Markets (GEM) Bond Funds snapped a 14-week outflow streak.

Funds dedicated to US assets proved very popular in early November, with US Money Market, Equity and Bond Funds absorbing a combined $67.5 billion. Europe Money Market Funds also attracted significant amounts of fresh money, recording their biggest weekly inflow in 11 months.

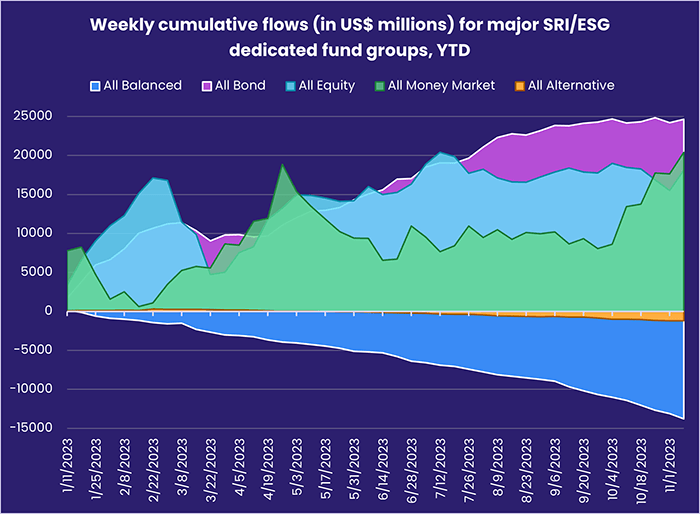

Among fund groups with socially responsible (SRI) or environmental, social and governance (ESG) mandates, SRI/ESG Equity Funds recorded their first inflow in four weeks and largest since the start of 3Q22 while SRI/ESG Money Market Funds chalked up their fifth inflow of the past six weeks and SRI/ESG Bond Funds recorded their 37th inflow of the 45 weeks year-to-date.

Overall, the week ending Nov. 8 saw flows into all EPFR-tracked Money Market Funds hit $77.7 billion and Bond Funds absorb $11.2 billion – twice the size of the previous week’s inflow. Equity and Alternative Funds recorded inflows of $8.8 billion and $906 million, respectively, while another $1.9 billion flowed out of Balanced Funds.

At the asset class and single country fund level, redemptions from Dividend Equity Funds climbed to a 17-week high, Municipal Bond Funds posted their biggest inflow since the first week of August and Agriculture Funds took in fresh money for the first time in seven weeks. Outflows from Denmark Bond Funds hit a 94-week high, Greece Equity Funds snapped an eight-week redemption streak and investors steered money into Taiwan (POC) Equity Funds for the 13th time in the past 14 weeks.

Emerging markets equity funds

Geopolitical tensions, concerns about the global impact of current US and European interest rates, and foreign investors steering clear of the world’s second largest economy weighed on EPFR-tracked Emerging Market Equity Funds during the first week of November. The fund group posted its fifth straight outflow, a run that seen nearly $9 billion redeemed, as the diversified Global Emerging Markets (GEM) Equity Funds extended their longest outflow streak since 1H20 and another $1 billion flowed out of China Equity Funds.

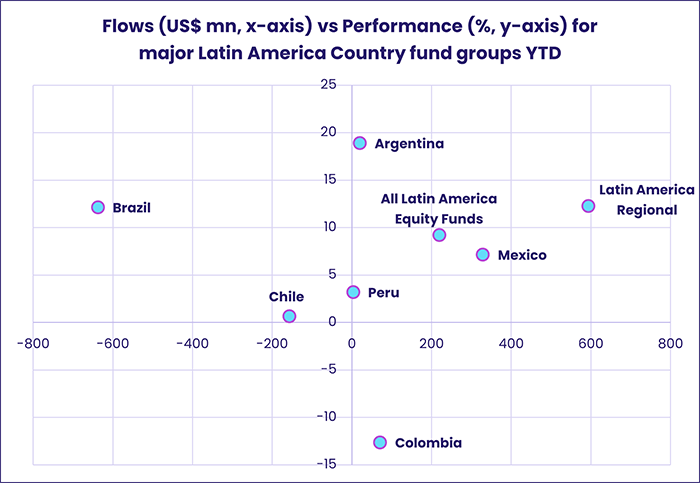

Among the major regional groups, only Latin America Equity Funds posted an inflow as Mexico’s proximity to the 4.9% growth recorded by the US in 3Q23 boosted flows into Mexico Equity Funds to a 51-week high. As the chart below illustrates, none of the Latin America Equity Fund groups are in the undesirable bottom left quadrant where year-to-date flows and performance are both negative.

Among the major Asia ex-Japan Country Fund groups, China Equity Funds recorded their fourth outflow of the past five weeks as funds with small cap mandates experienced net redemptions for the sixth consecutive week. Foreign-domiciled funds saw money flow out for the 14th time in the past 15 weeks as China grapples with deflationary forces and direct foreign investment turning negative during the third quarter for the first time in 25 years.

Investors kept faith with other regional markets. Flows into India Equity Funds climbed to a three-week high, Korea Equity Funds extended their current inflow streak to 15 weeks and Vietnam Equity Funds recorded their largest inflow since early February.

With two conflicts within its universe, EMEA Equity Funds remain a hard sell for investors. During the latest week, redemptions from Turkey Equity Funds hit a five-week high, flows for Russia Equity Funds were under 0.002% of AUM for the 12th week running and Africa Regional Funds posted their biggest outflow since late February.

Developed markets equity funds

With US growth during 3Q23 coming in at an eye-popping 4.9%, flows into US Equity Funds hit an eight-week high during early November and Global Equity Funds snapping a five-week outflow streak. That helped all EPFR-tracked Developed Markets Equity Funds snap a four-week redemption streak despite the $3 billion that investors pulled out of Europe and Japan Equity Funds.

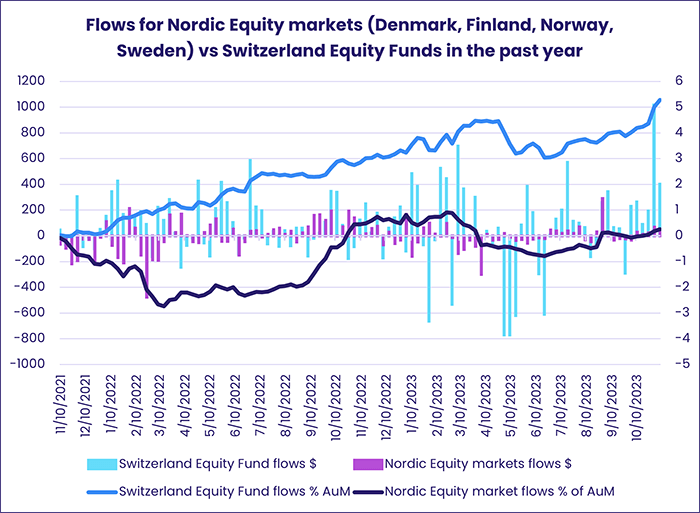

With European Central Bank (ECB) policymakers still talking up the dangers of inflation and the need to “wait-and-see” before cutting rates, investors continued to pull money out of Europe Equity Funds during the first week of November. What enthusiasm investors did express at the country level was reserved for Switzerland Equity Funds and groups dedicated to the four major Nordic markets – Sweden, Norway, Finland and Denmark Equity Funds – which collectively recorded a sixth straight week of inflows. Over the past year, these two groups along with Portugal Equity Funds are the only European dedicated country groups to post inflows.

The week ending Nov. 8 saw flows into domestically and foreign domiciled US Equity Funds hit six and 84-week highs, respectively, with over three-quarters of the headline number going to Large Cap Blend Funds.

Japan Equity Funds snapped a two-week inflow streak with their biggest outflow in 35 weeks as the country’s central bank continues to lay the groundwork for policy normalization.

Despite flows into ETFs, Global ex-US Equity Funds posted their third straight outflow, the longest since an eight-week run that started in mid-4Q22.

Global sector, industry and precious metals funds

After a week where not a single EPFR-tracked Sector Fund group experienced inflows, investors returned – cautiously – during the first week of November. They gravitated to the promise of artificial intelligence plays while remaining leery of other major risk factors that include high oil prices, empty office buildings and tighter credit conditions.

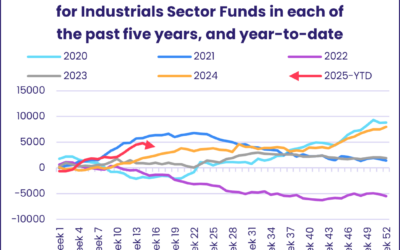

While $1 billion flowed into Technology Sector Funds, another $1 billion flowed out of Real Estate Sector Funds while Financials, Energy, Consumer Goods, Industrials and Utilities Sector Funds posted outflows ranging from $184 million to $521 million.

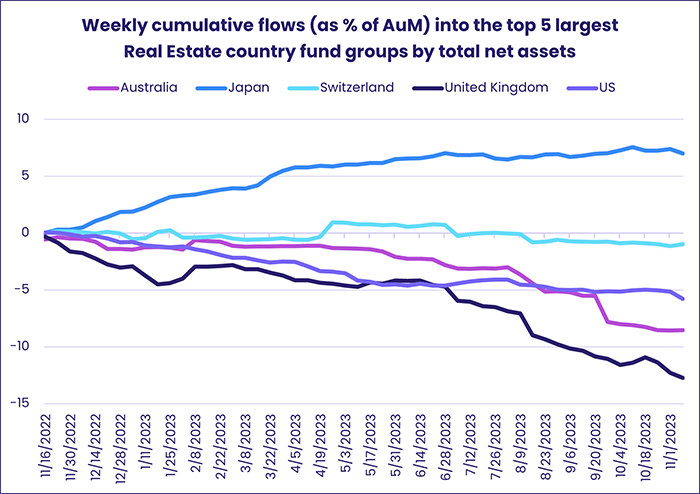

Real Estate Sector Funds recorded their heaviest outflow since mid-2Q22, with US-dedicated funds accounting for the bulk of the headline number and Japan Real Estate Sector Funds experiencing their second largest outflow year-to-date. Switzerland Equity Funds, which are the fourth largest EPFR-tracked Real Estate Sector Country Fund group by total net assets, chalked up their biggest inflow in over two months.

Commodities/Materials Sector Funds saw the curtain come down on their six-week, $1.1 billion outflow streak with a single gold mining-focused ETF driving the latest inflow. The money absorbed by this fund also helped Equity Gold Funds post their second inflow of the past three weeks. Physical Gold & Derivative Funds, meanwhile, snapped a two-week inflow streak with Gold Bear Funds experiencing their heaviest outflow since the start of pandemic in 1Q20 and Gold Leveraged Funds suffering their second largest outflow on record.

When it comes to energy, investors continue to try and square a circle that includes questions about future Chinese demand, the onset of the Northern hemisphere’s heating season and clouds over Russian and Middle Eastern oil and gas production. Energy Sector Funds posted a second consecutive outflow above $500 million. US-dedicated funds accounted for over 50% of the headline number versus 25% for globally mandated funds and 5% for China Energy Sector Funds.

Bond and other fixed income funds

Collective flows into EPFR-tracked Bond Funds during the week to November 8 were the largest in three months, and reflected a significantly higher risk appetite on the part of fixed income investors. Those investors embraced High Yield Bond Funds as they boosted their exposure to the US, Europe, Canada and Developed Asia while exiting funds associated with diversified exposure and emerging Asian markets.

Collective Investment Trusts (CITs) dedicated to bonds recorded a second consecutive week of inflows for the first time since mid-2022. In the previous week, Bond CITs posted their fourth largest inflow since EPFR started tracking them in 2014. This week’s inflow was only a third of the size.

At the asset class level, High Yield Bond Funds and Bank Loan Bond Funds saw flows climb to their highest level since June of 2020 and mid-2Q22, respectively, while Municipal Bond Funds posted their biggest inflow in three months. For both HY and Municipal Bonds it was the first inflow in roughly 10 weeks.

The larger of the North American Bond Fund groups, US Bonds Funds, saw inflows hit a 17-week high and top $10 billion in the first week of November. Retail share classes saw fresh money for the first time since early September but redemptions from funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates climbed to an 11-week high. Canada Bond Funds, meanwhile, recorded an inflow for the fifth time in the past six weeks, and seventh of the past nine.

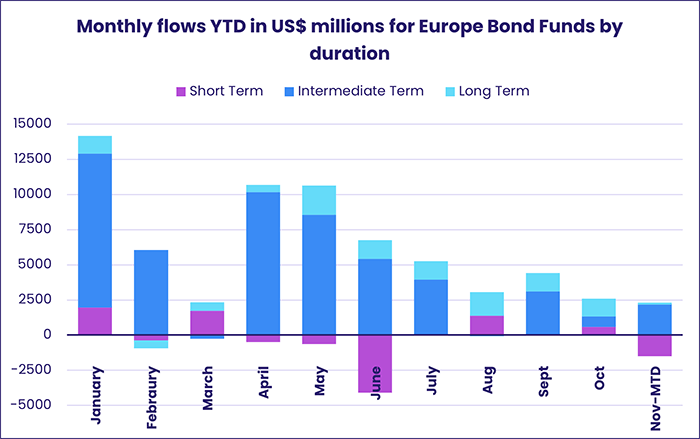

Flows into Europe Bond Funds were positive for the third time in the past four weeks with Europe ex-UK Regional Bond Funds the biggest contributor to the headline number. Investors favored funds with corporate mandates over their sovereign counterparts, though the latter group added to an inflow streak that now stands at 39 weeks. At the country level, flows into UK and France Bond Funds were the largest in 10 and 11 weeks, respectively, while Denmark Bond Funds racked up their biggest outflow since early 1Q22.

Looking at redemptions from Emerging Markets Bond Funds over the past three and a half months, the latest weeks’ outflow was by far the smallest during that run. In contrast to other regional groups, EM Sovereign Bond Funds saw some positive investor sentiment, while those with corporate mandates showed a 37th outflow spanning the past 39 weeks. If it was not for the $300 million flowing out of China Bond Funds this week, emerging markets would have posted an inflow thanks to the almost $200 million combined flowing into EMEA, GEM and Latin America Bond Funds.

Australia Bond Funds extended an inflow streak stretching back to mid-April. But the momentum of flows slowed appreciably in the first week of November as investors digested the latest 25 basis point rate hike from The Reserve Bank of Australia, and the RBA’s emphasis on risks that could trigger further hikes.

Did you find this useful? Get our EPFR Insights delivered to your inbox.