Redemptions from EPFR-tracked Equity Funds hit an 11-week high in early September as investors surveyed a sea of troubles, ranging from the complete shut-down of the Nord Stream 1 natural gas pipeline connecting Russia with European markets to the US Federal Reserve’s plan to double the pace of its balance sheet reduction.

With further 75 basis point interest rate hikes on the immediate horizon in Canada and the Eurozone, China’s zero-Covid-19 campaign resulting in fresh lockdowns and another major Ukrainian nuclear power plant in the line of Russian fire, risk reduction was the order of the day during the first week of September. Emerging Markets Bond and Equity Funds both recorded outflows, with the latter’s the biggest since early May, High Yield Bond Funds extended their current outflow streak to three weeks and $16 billion, redemptions from Technology Sector Funds hit a level last seen in 4Q18 and another $1.5 billion flowed out of Alternative Funds.

The week ending Sept. 7 also saw Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates post outflows for the third consecutive week, the first time that has happened since early 4Q16.

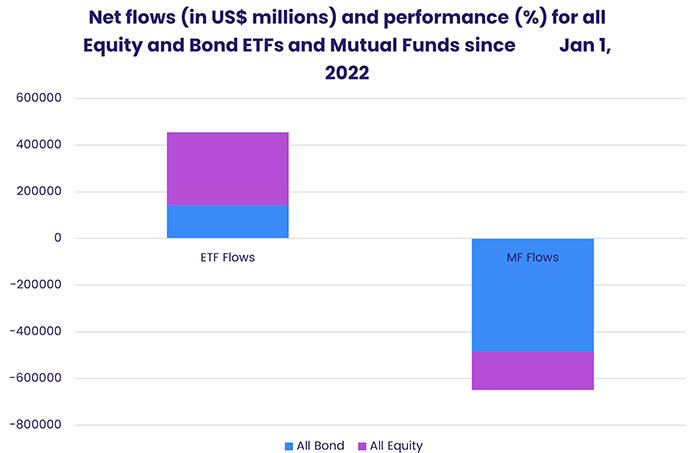

Year-to-date, flows to both Equity and Bond Exchange Traded Funds (ETFs) are still in positive territory. The opposite is true for actively managed mutual funds, with net redemptions from all Bond Funds so far this year now north of $470 billion.

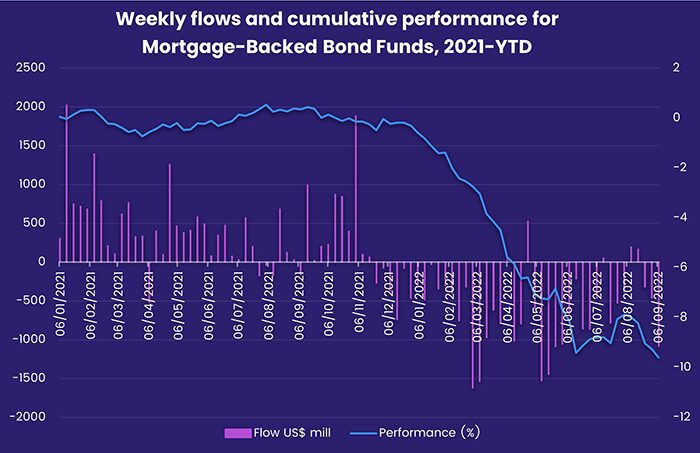

At the single country and asset class fund levels, outflows from Mortgage-Backed Bond Funds climbed to a 15-week high, Municipal Bond Funds saw over $1 billion flow out for the second straight week and Bank Loan Bond Funds extended their longest redemption streak since 1H20. South Africa and India Bond Funds posted their biggest inflows since 1Q22 and 2Q19, respectively, while flows into Chile Equity Funds hit a 24-week high and France Equity Funds recorded their biggest inflow since the third week of January.

Bond and other Fixed Income Funds

September kicked off with Canada’s central bank raising interest rates by 75 basis points on Sept. 7 and the European Central Bank (ECB) doing the same the following day. Against this backdrop, and with another US rate hike expected in two weeks, EPFR-tracked Bond Funds posted their third straight outflow.

Among the major groups by geographic focus, only US Bond Funds recorded an inflow. Redemptions from Europe Bond Funds hit a 10-week high, Global Bond Funds saw over $1 billion flow out and Emerging Markets Bond Funds racked up their 29th outflow in the 35 weeks year-to-date.

At the asset class level, investors pulled money out of Inflation Protected Bond Funds for the eighth time in the past nine weeks, YTD flows into Bank Loan Funds fell below $10 billion after peaking at $28 billion in April and net YTD redemptions from High Yield Bond Funds pushed over the $100 billion mark. Outflows from Mortgage-Backed Bond Funds climbed to a 15-week high as investors braced for a pick-up in the pace the US Federal reserve lets mortgage-backed securities run off its balance sheet.

Enthusiasm for European debt was sapped by Europe’s deteriorating energy picture and expectations of the biggest ECB rate hike since its creation in 2004. That hike was delivered the day after the latest reporting period and rekindled fears about the sustainability of Italy’s debt burden, with Italy Bond Funds posting their biggest weekly outflow since mid-2Q18.

Emerging Markets Bond Funds continue to struggle as higher interest rates in developed markets divert portfolio capital and skew exchange rates in a way that makes hard currency issues harder to service. At the country level, India Bond Funds recorded their biggest inflow in more than three years while China Bond Funds chalked up their 28th outflow since mid-February.

For the second week running all of the major US Sovereign Bond Fund groups posted inflows and all of the major Corporate Bond Fund groups recorded an outflow. Short Term US Sovereign Funds took in over $5 billion for the third time so far this year.

Both of the major multi-asset groups, Balanced and Total Return Bond Funds, experienced net redemptions. The two groups have seen a combined $117 billion flow out so far this year. Last year they took in $171 billion.

Did you find this useful? Get our EPFR Insights delivered to your inbox.