Funds dedicated to the old world and conventional asset classes enjoyed a rare moment in the sun during the second week of February, which ended with the new US administration promising reciprocal tariffs on trading partners and a higher-than-expected February inflation number for the world’s largest economy.

The latest week saw Europe Equity Funds post their biggest inflow since the fourth week of 2023 and Inflation Protected Bond Funds post their biggest inflow since late 1Q22 while flows into Physical Gold and Silver Funds hit seven and 16-week highs, respectively. Meanwhile, US Equity Funds chalked up their first outflow of 2025, investors pulled over $4 billion out of Technology Sector Funds and Cryptocurrency Funds saw a three-week inflow streak come to an end.

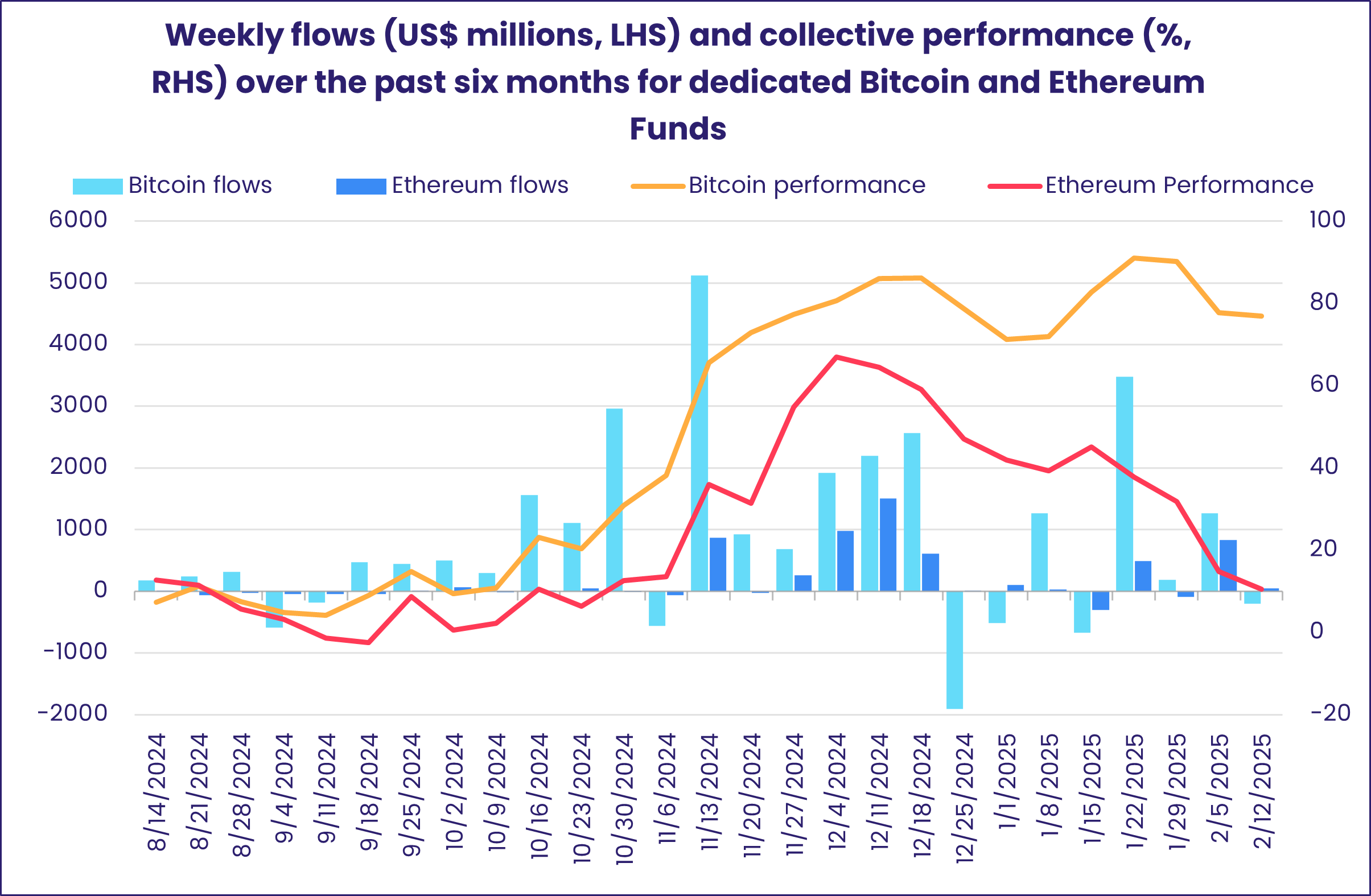

Among the Cryptocurrency Fund sub-groups, Ethereum Funds managed to eke out a modest collective inflow while Bitcoin Funds chalked up a modest outflow. Over the past six months the assets managed by Bitcoin Funds have more than doubled while those held by Ethereum Funds have more than tripled.

Overall, the week ending Feb. 12 saw all EPFR-tracked Equity Funds post a collective outflow of $655 million. Alternative Funds absorbed $4.8 billion, Balanced Funds recorded their second inflow year-to-date, Money Market Funds took in $9 billion with Europe-mandated funds accounting for the bulk of the headline number and $13.7 billion flowed into Bond Funds.

At the single country and asset class fund levels, flows into Synthetic Funds hit a nine-week high, Collateralized Loan Obligation (CLO) Funds extended a run of inflows stretching back to the first week of August and Dividend Equity Funds recorded their 17th inflow since the start of 4Q24. Finland Equity Funds posted their biggest outflow in nearly four months, Korea Bond Funds extended their longest inflow streak since 1Q24 and redemptions from Turkey Money Market Funds exceeded $1 billion for only the second time since EPFR started tracking them weekly.

Emerging Markets Equity Funds

Over $5 billion flowed out of China Equity Funds during the week ending Feb. 12 as US President Donald Trump’s administration banged the tariff drum loudly. That, allied to further redemptions from India, Korea and Brazil Equity Funds, dragged the headline number for all EPFR-tracked Emerging Markets Equity Funds down to a 13-week low.

Investors did show some appetite for thematic exposure. Frontier Markets Equity Funds recorded their biggest inflow in over 11 months and flows into funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates hit a 17-week high. But Emerging Markets Dividend Funds posted their first outflow since mid-November and their biggest since early October.

While there was plenty of uncertainty for investors contemplating their China exposure to digest, there were also gains to be enjoyed. Key Chinese equity indexes are up between 5% and 20% since mid-January and overseas domiciled China Equity Funds chalked up their biggest collective inflow in nearly four months.

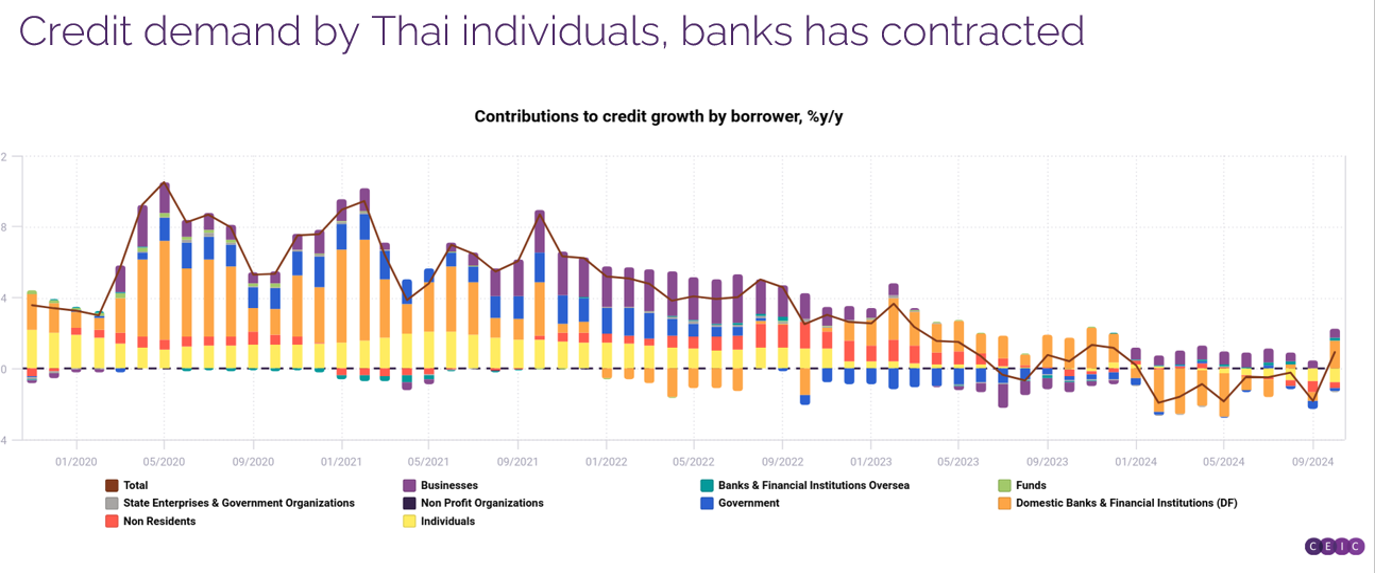

Among fund groups dedicated to smaller Emerging Asian markets, Thailand Equity Funds extended a redemption streak that started over a year ago. Although the country has escaped – for now – the threat of deflation, its growth is lagging most of its regional peers and bank lending data from EPFR’s sister company CEIC suggests this underperformance will persist.

With access to, and demand from, two of the region’s biggest markets threatened by the possibility of an all-out Sino-US trade war, a majority of the Latin America Equity Fund groups experienced net redemptions. That included Argentina Equity Funds, which posted their first outflow since the third week of October, and Colombia Equity Funds which racked up their biggest weekly outflow since early 4Q22.

EMEA Equity Funds recorded their eighth inflow over the past 10 weeks, with dedicated South Africa and Emerging Europe Regional Funds the biggest contributors to this week’s headline number.

Developed Markets Equity Funds

A rapidly changing economic policy environment that promises more trade barriers and higher-for-longer US interest rates weighed on investor sentiment during the second week of February. But they responded by reassessing the investment case for Europe and taking on more diversified exposure through Global Equity Funds. As a result, EPFR-tracked Developed Markets Equity Funds posted their sixth inflow since the final week of last year.

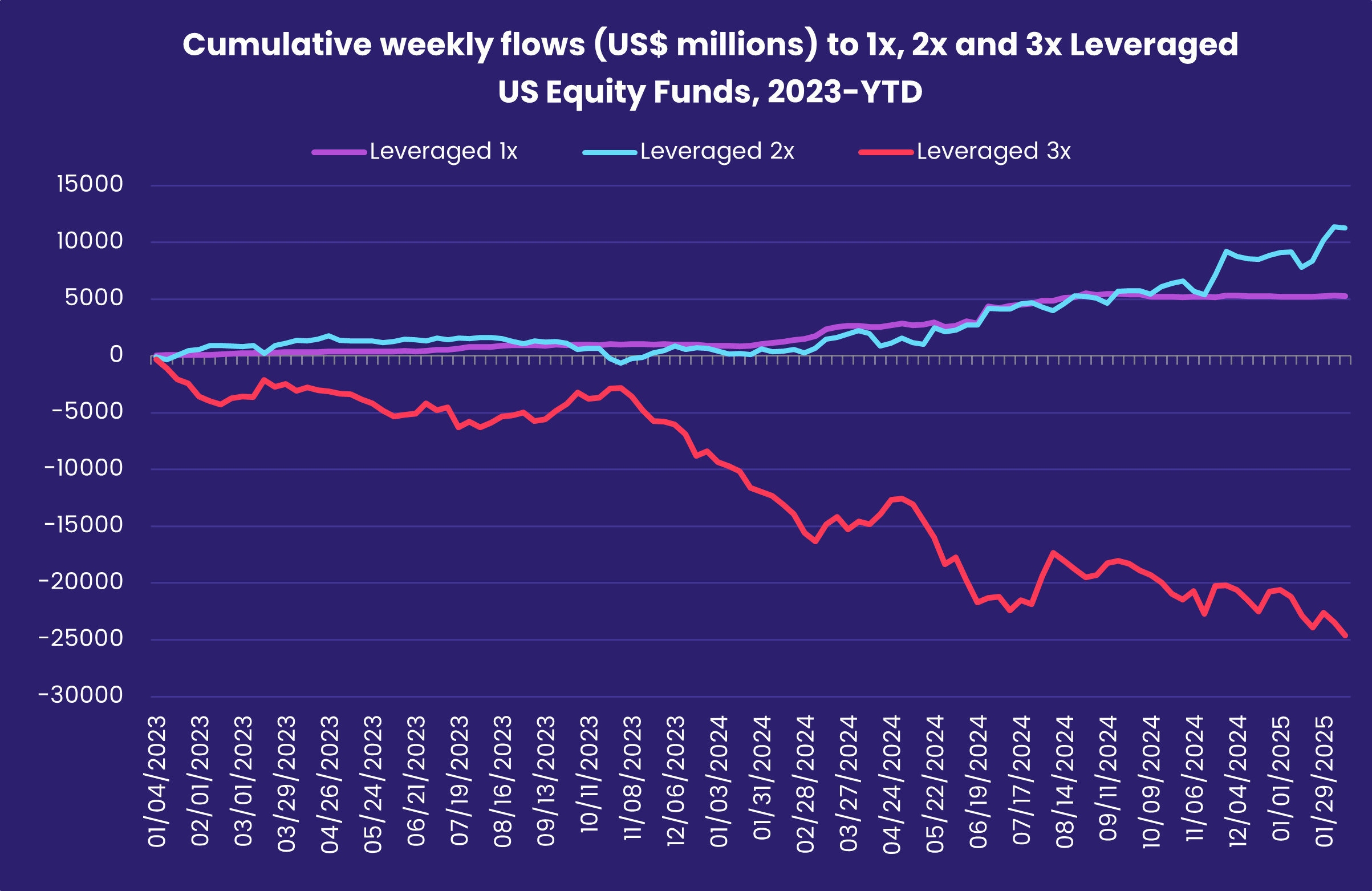

With the narrative for US interest rates tightened, US Equity Funds experienced net redemptions for the first time this year and only the ninth time over the past 12 months. Funds managed for growth posted their fifth straight outflow while their value counterparts snapped a five-week run of outflows and investors pulled over $1 billion from Leveraged US Equity Funds.

Europe Equity Funds finally shrugged off the drag exerted by UK-mandated funds, chalking up their first collective inflow since late September and their biggest since early 1Q23. Flows were broadly distributed, with 32 funds taking in over $40 million, as investors responded to differing expectations for US and Eurozone monetary policy and positioned themselves for the possibility of a ceasefire in Ukraine. At the country level, flows into Germany Equity Funds climbed to a 41-week high while UK Equity Funds tallied their 13th consecutive outflow.

With the country’s central bank raising interest rates and exporters braced for higher US tariffs, sentiment towards Japanese equity continues to shift from week-to-week. Flows to Japan Equity Funds switched direction for the third week running. Outflows from foreign-domiciled funds climbed to a 10-week high.

Global Equity Funds domiciled in Japan keep pulling in fresh money, with their current inflow streak stretching back to late 2023, and the overall number for the largest of the diversified Developed Markets Equity Funds groups exceeded $5 billion. Funds with fully global mandates pulled in $7 for every $1 committed to funds with ex-US mandates.

Global sector, Industry and Precious Metals Funds

The number of EPFR-tracked Sector Fund groups reporting inflows fell from six to just three – Telecoms, Financials and Infrastructure Sector Funds – during the week ending Feb. 12 as investors weighed the implications of President Trump’s push for higher tariffs on Canadian, Mexican and Chinese exports to the US.

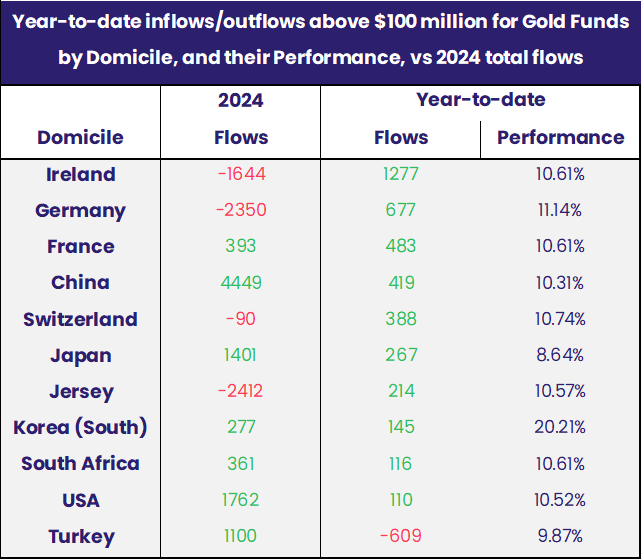

The uncertainty generated by Trump’s pronouncements, and their implications for interest rates and inflation, boosted the appetite for precious metal funds. Investors committed fresh money to Physical Gold Funds for a fifth consecutive week, the longest run of inflows since 3Q24. The latest inflow came during the week when the price of gold broke the $2,900 per ounce mark and climbed another $42 to a record high on Tuesday.

Among the top 15 funds ranked by inflows during the latest week, seven were tied to the LBMA (London Bullion Market Association) Gold Price and five were tracking the gold price in China. Another two were following the South African and US Gold Price. Europe-domiciled Gold Funds have, overall, fared better than the previous year, while Turkey-domiciled funds are being dumped after a record-high yearly inflow during 2024 of $1.1 billion.

EPFR’s Liquidity Analyst Winston Chua did note that speculative traders are dialing back their expectations on gold, with “the long-short ratio on gold futures plunging to an eight-week low of 6.7-to-1 during the latest week. That ratio is down 27% this month but, historically speaking, remains at an elevated level.”

Among the other major precious metals groups, Physical Silver Funds snapped a three-week run of outflows with their biggest inflow since late October (16 weeks) and Silver Mining Funds extended their run of inflows to six weeks, the longest since mid-June.

Elsewhere, Technology Sector Funds suffered their heaviest outflow in nearly a year, climbing past the $4 billion mark this week. Underpinning the headline number were over 20 funds with redemptions that exceeded $100 million, two of which – a US-dedicated tech growth mutual fund and a China-domiciled science & tech innovation ETF – each saw roughly $1 billion flow out.

Flows into Infrastructure Sector Funds have kept the current pace since early 2022, when the group enjoyed a 20-week inflow streak ending in early July. The group has now seen four straight weeks of inflows that total over $850 million.

Industrials Sector Funds, on the other hand, posted their first outflow in four weeks, as a ninth consecutive redemption from Transportation & Logistics Funds – and biggest in over six months – outweighed inflows to Aerospace & Defense Funds and Shipbuilding Funds, which have been uninterrupted for seven and 13 weeks straight, respectively.

Bond and other Fixed Income Funds

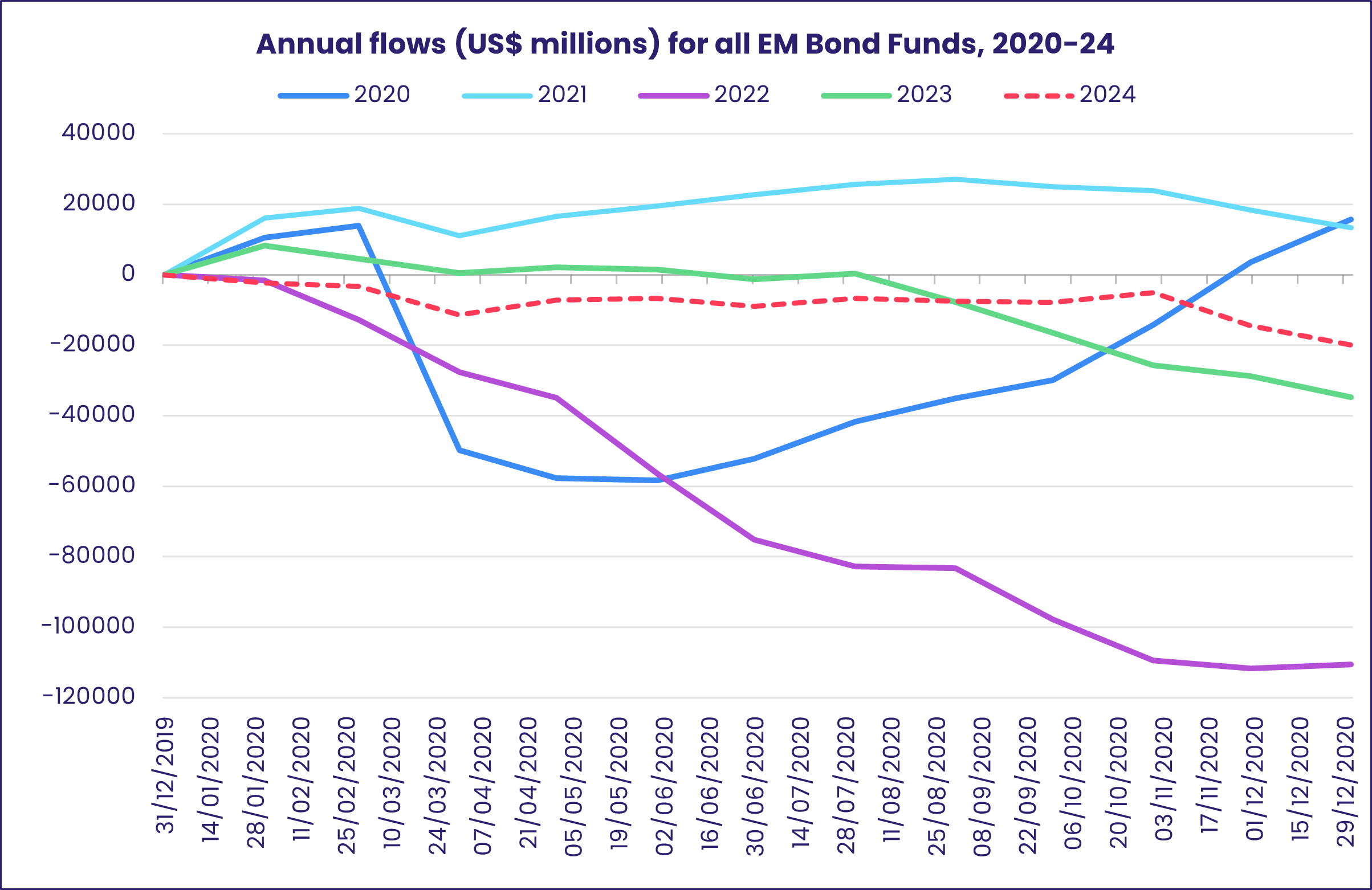

Having broadened during the first five weeks of 2025, flows to EPFR-tracked Bond Funds narrowed during the second week of February as Emerging Markets Bond Funds saw their two-week inflow streak come to an end and Global Bond Funds posted their biggest outflow in over 15 months.

While their geographic focus tightened, investors retained much of their risk appetite, with both Bank Loan and High Yield Bond Funds absorbing over $1 billion and fresh money flowing into Contingent Convertible (CoCo) and Catastrophe Bond Funds.

Doubts that the US Federal Reserve will be able to cut rates at all this year did leave their mark on several groups, with flows into Municipal Bond Funds coming in at a quarter of the $1.1 billion they averaged during 2H24 and Inflation Protected Bond Funds recording their biggest inflow in nearly three years.

Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded a modest inflow. But, for the first time since December, both Green and ESG Transition Bond Funds posted an outflow.

During the past three weeks, flows to Turkey Bond Funds have shaped the headline number for all Emerging Markets Bond Funds. That was again the case, with the biggest outflow from Turkey Bond Funds on record more than offsetting flows into Korea and South Africa-mandated funds. Sharia Bond Funds did post their 10th inflow over the past 11 weeks, and Frontier Markets Bond Funds extended their longest inflow streak since a 13-week run ended in mid-1Q21.

Investors looking to Europe opted for regional exposure going into the second half of February. Strong flows into Europe ex-UK Regional Bond Funds offset redemptions from UK Bond Funds, which hit a 26-week high, and Italy Bond Funds. Overall flows continue to favor funds with corporate mandates over those dedicated to sovereign debt.

US Corporate Bond Funds also outgained their sovereign peers, in their case for the fourth week running, as investors keep a weather eye on US Treasury issuance and the constraints imposed by the federal debt ceiling that came back into force earlier this year.

Did you find this useful? Get our EPFR Insights delivered to your inbox.