With the opening weeks of the 1Q22 corporate earnings season raising more questions than it answers, US mortgage rates continuing to climb, global growth forecasts being trimmed and Russia’s invasion of Ukraine now in its third month, investors found a lot to like about the sidelines during the third week of April. Outflows from ERFR-tracked Equity Funds hit a year-to-date high for the second straight week while Bond Funds experienced net redemptions for the 14th time in the past 15 weeks.

Investors did show conviction at the sector level, with nine of the 11 major Sector Fund groups, recording inflows, and their appetite for direct exposure to China remains undimmed despite that country’s issues with Covid, indebted real estate developers and weaker GDP growth.

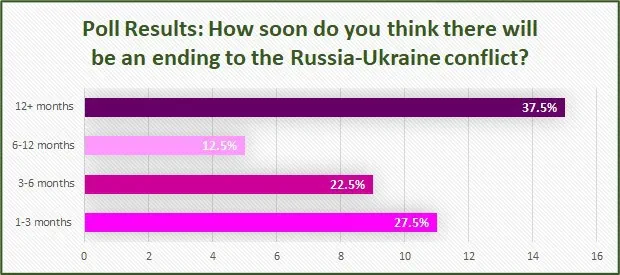

The Ukraine conflict continues to cast a shadow over Europe, with Europe Equity Funds chalking up their 10th straight outflow, and expectations of a 50 basis points increase in US interest rates next month is weighing on US Equity and Bond Funds. A poll of financial professionals following a recent EPFR-Macrobond webinar found that half of those responding expect Russia and Ukraine will still be fighting in 3Q22 and beyond, with a third expecting the conflict to stretch into 2023.

Overall, the week ending April 20 saw investors pull a net $3.8 billion out of all EPFR-tracked Balanced Funds, $8.6 billion from Bond Funds, $17.4 billion from Equity Funds and $55.4 billion from Money Market Funds. In the case of the latter, the April 18 deadline for 2021 tax and 2022 estimated tax payments in the US contributed to the spike in redemptions.

At the asset class and single country fund levels, flows into Spain Equity Funds climbed to a 19-week high, France Equity Funds posted only their fourth inflow since the beginning of 2021 and for the second week running Saudi Arabia Equity Funds chalked up their biggest inflow since early 3Q19. Investors pulled money out of Cryptocurrency Funds for the fourth time in the past seven weeks, Total Return Funds added to their longest outflow streak in over nine quarters and High Yield Bond Funds saw over $3 billion flow out for the 10th time year-to-date.

Did you find this useful? Get our EPFR Insights delivered to your inbox.