Among the groups that did receive noteworthy flows were Technology Sector Funds, Japan Equity Funds, Inflation Protected Bond Funds and some of the usual suspects dedicated to emerging Asian markets.

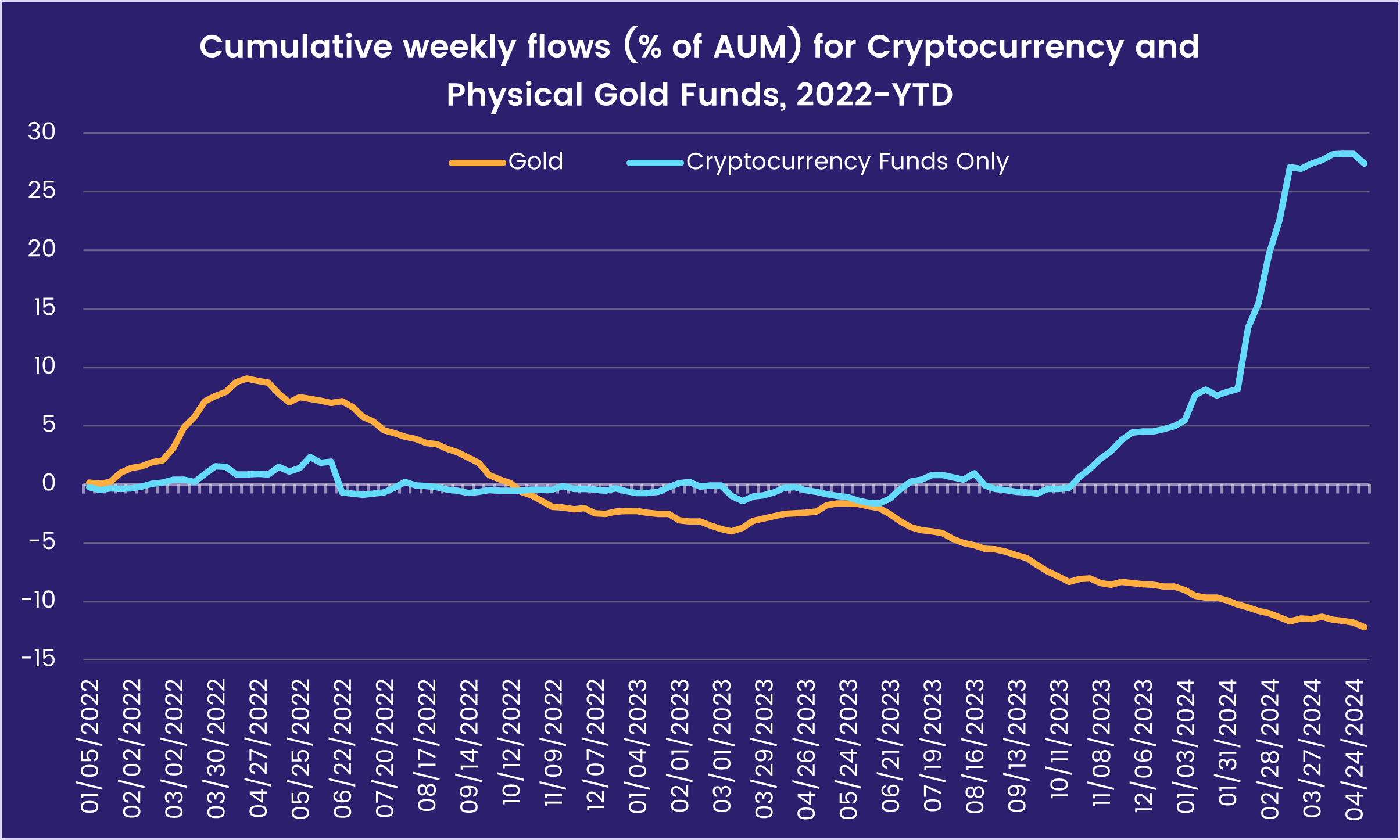

In the case of Inflation Protected Bond Funds, which posted only two weekly inflows during 2023, the latest inflow is the fifth year-to-date and the biggest since early 2Q22. But Physical Gold Funds saw over $900 million redeemed – a 16-week high – while flows into Cryptocurrency Funds were a modest $59 million.

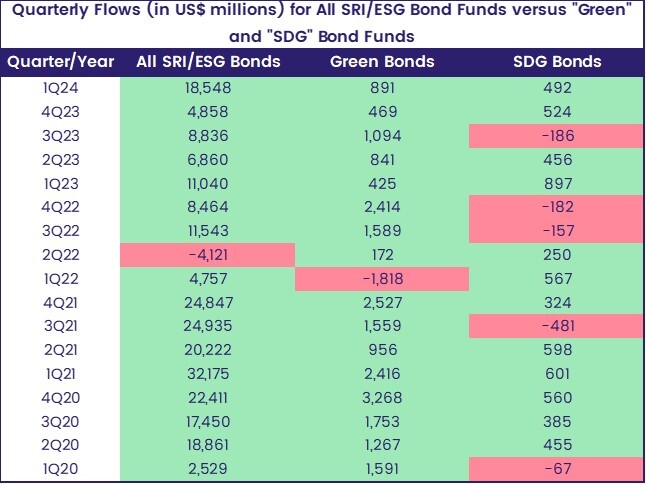

The week ending May 1 did see a shift in flows for funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates, with SRI/ESG Equity Funds snapping their longest outflow since 2012 while SRI/ESG Bond Funds posted only their second outflow of 2024 and their biggest in over a year.

Overall, the week ending May 1 saw a net $9.8 billion flow into Equity Funds and $4.8 billion into Bond Funds. Investors pulled $91 million out of Alternative Funds, $1.5 billion from Money Market Funds and $1.8 billion from Balanced Funds.

Emerging Markets Equity Funds

Flows to China Equity Funds rebounded coming into May, lifting the headline number for all EPFR-tracked Emerging Markets Equity Funds to a four-week high despite further outflows from Latin America and the diversified Global Emerging Markets (GEM) Equity Funds.

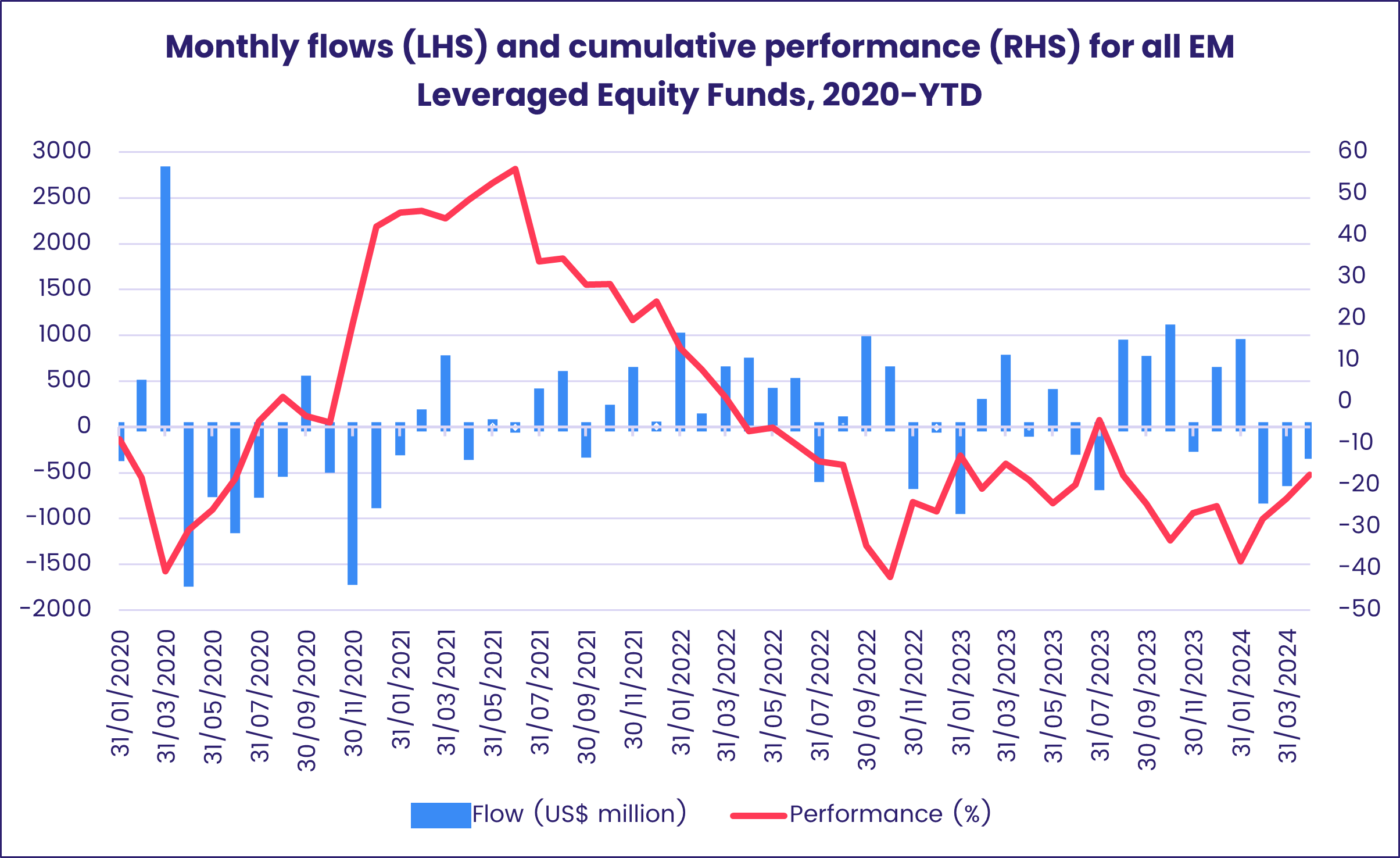

Money continued to flow into Emerging Markets Dividend Funds, which recorded their 39th inflow since the beginning of August, and out of retail share classes which chalked up their 17th outflow year-to-date. Frontier Markets Equity Funds enjoyed a better week, posting their biggest inflow in two months, but redemptions from Leveraged EM Equity Funds climbed to their highest level since early 3Q23.

The latest flows to China Equity Funds went predominately to domestically domiciled funds as China’s leaders signaled – not for the first time over the past year – their willingness to consider new measures to bolster an economy struggling with a deflating property bubble. Those funds based overseas posted their 10th collective outflow over the past 11 weeks.

Fresh money found its way into other major Asia ex-Japan Country Fund groups, with India Equity Funds extending their record-setting run of inflows and Korea Equity Funds posting their biggest weekly total since the first week of the year. Korean investors are also looking to the US, with Korean-domiciled US Equity Funds absorbing over $3.5 billion during the past eight months.

While Latin America is closer to the US growth story, funds dedicated to the region are seeing little benefit. Latin America Regional Equity Funds have posted inflows only twice since mid-December, and funds dedicated to Mexico are experiencing consistent redemptions ahead of the country’s general election on June 2. Investors are still intrigued by Argentina’s latest reform story: the latest inflows recorded by Argentina Equity Funds were the biggest since 2Q14.

One of the EMEA universe’s key markets, South Africa, is also heading into a general election that takes place at the end of May. Investors have now pulled money out of South Africa Equity Funds during six of the past eight weeks. But overall flows into all EMEA Equity Funds hit their highest level in over a year, with Turkey Equity Funds accounting for a significant share of the headline number.

Developed Markets Equity Funds

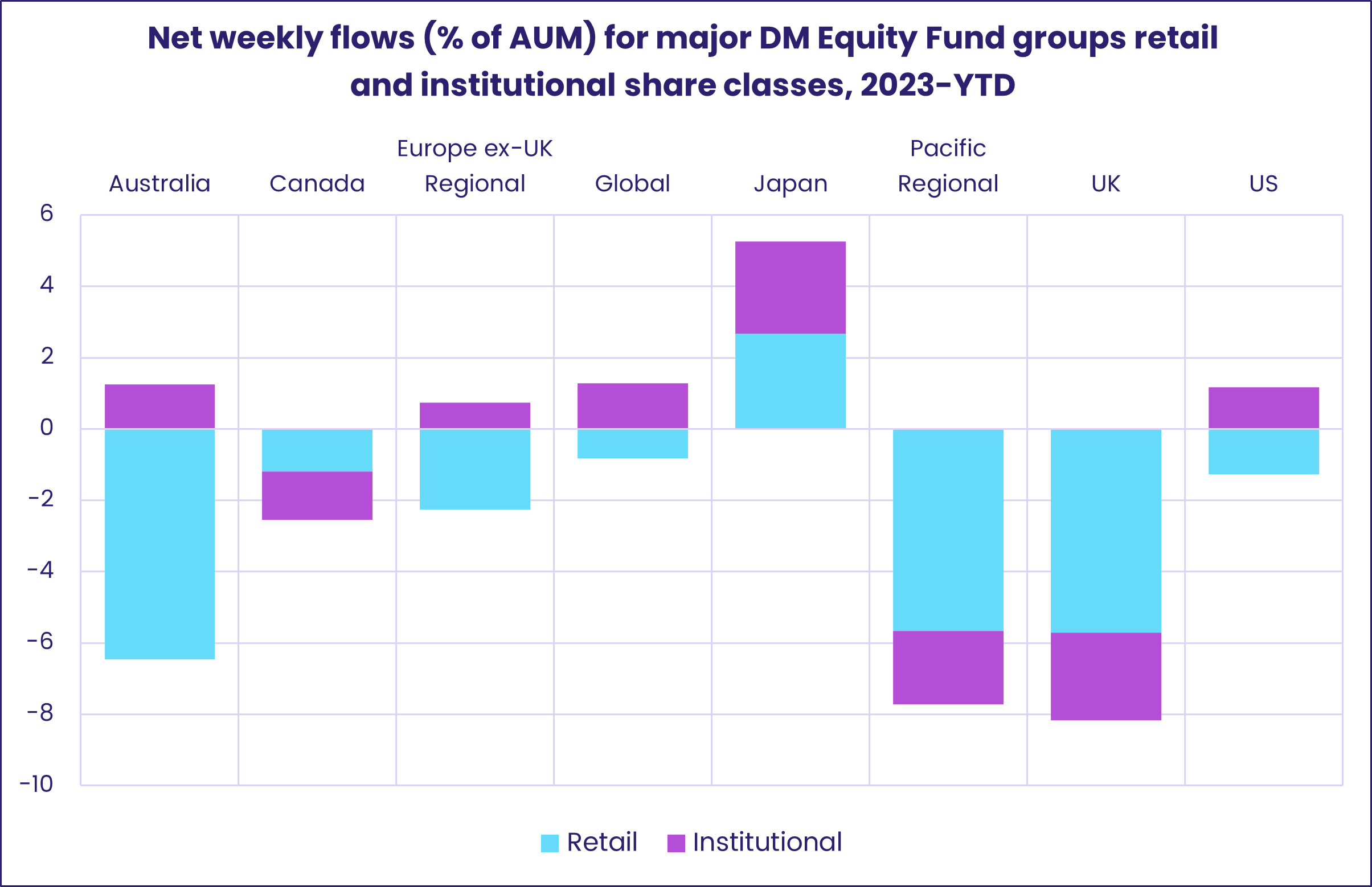

April ended with EPFR-tracked Developed Markets Equity Funds recording their 12th inflow of the year. Although US Equity Funds eked out a minimal inflow, the bulk of the fresh money deployed during the latest week found its way into Japan and Global Equity Funds. There was also a rare inflow for Europe Equity Funds.

Some mixed earnings reports, dashed hopes for multiple interest rate cuts and fresh evidence of deep-seated political divisions all weighed on US asset markets during the final week of April. They also undercut investor appetite for US Equity Funds, which took in a net $105 million – equal to 0.001% of the overall group’s AUM – in the week to May 1. The week did see the first net flows into retail share classes since late 3Q23, which was also their biggest collective inflow in 14 months.

Europe Equity Funds also attracted fresh retail money coming into May. It was only the second inflow during the past 13 months. Also contributing to the overall group’s positive headline was the biggest inflow recorded by Germany Equity Funds since mid-2Q17. All of the top five individual funds ranked by inflows were ETFs that track the DAX index.

While not as big as the previous week’s total, Japan Equity Funds attracted another $3 billion with overseas domiciled funds recording their 13th inflow over the past 16 months. The latest sector allocations data show that, coming into the second quarter, Japan Equity Fund managers were increasing their exposure to financial and information technology plays. That additional exposure came at the expense of the consumer staples and healthcare sectors, with the latter’s average allocation falling to a 68-month low.

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, took in over $3 billion for the fourth time so far this year. Funds with fully global mandates absorbed over $5 for every $1 committed to Global ex-US Equity Funds.

Global sector, Industry and Precious Metals Funds

With progress in bringing US inflation down to its 2% target stalling, and the latest Federal Reserve minutes talking about an “uncertain path forward”, investors are getting a head start on the “sell in May, go away” mantra. For the third week running, eight of the 11 major EPFR-tracked Sector Fund groups posted outflows.

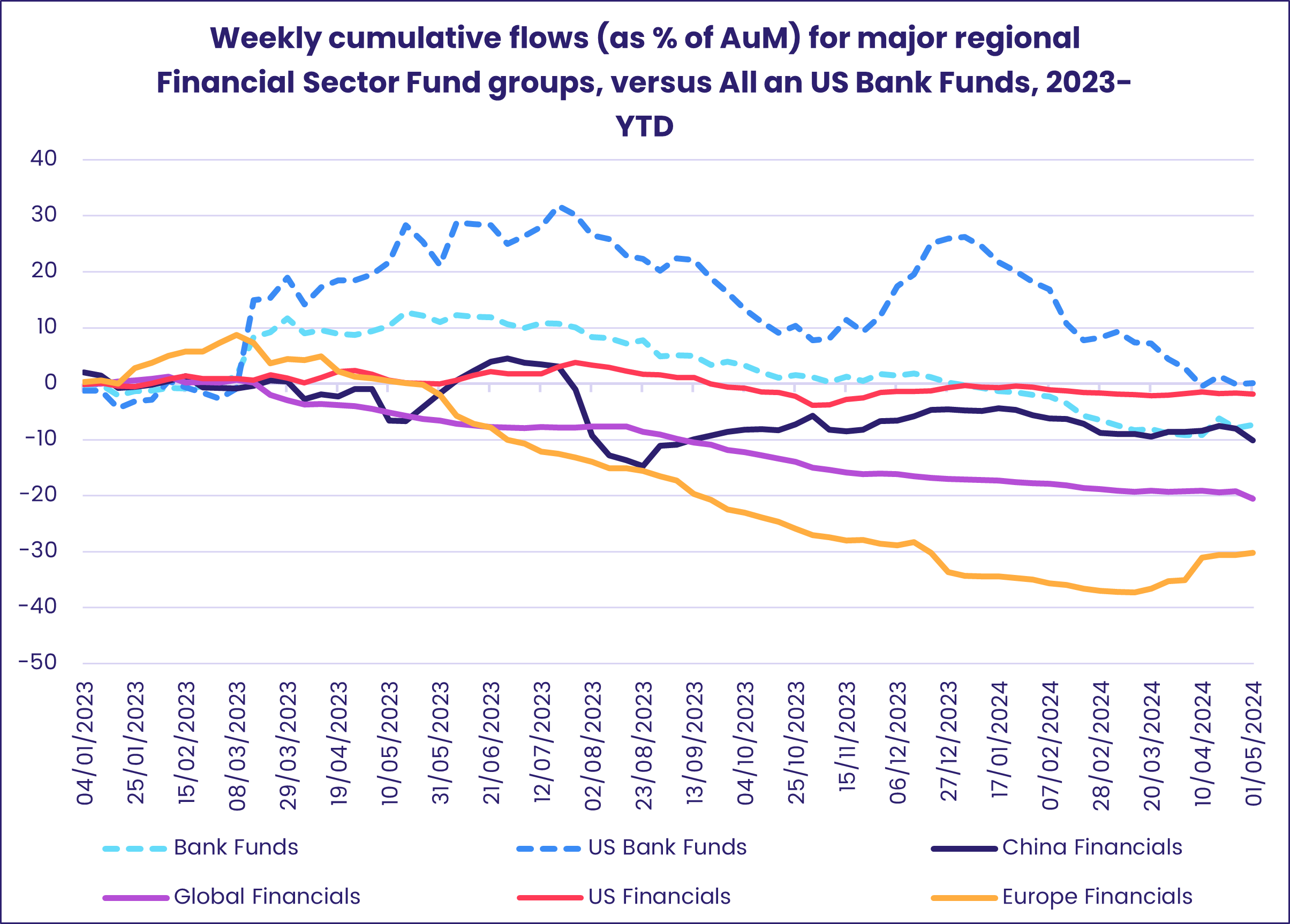

The prospect of higher-for-longer US interest rates is a mixed blessing for major financial plays, boosting earnings tied to interest rate spreads but increasing their wholesale funding costs and keeping the pressure on businesses that owe those institutions money. Financials Sector Funds posted their second consecutive outflow, and largest in eight weeks, with globally-mandated funds accounted for roughly half of the overall headline number, while US and China Financials Sector Funds dragged it down by another $250 million each.

Energy Sector Funds posted their third consecutive outflow as redemptions from Oil & Gas Funds hit their highest level since mid-December. But other niche groups saw money flow in. Nuclear & Uranium Funds enjoyed their seventh inflow of the past eight weeks and flows into Fossil Fuel and Coal Funds both reached six-week highs.

Flows into Industrials Sector Funds remained positive for the 10th week running. All major subgroups reported inflows, among them Aerospace & Defense Funds, which saw a fourth week of inflows, and Construction Funds, which saw inflows hit an eight-week high.

Technology and Utilities Sector Funds were the other groups to attract fresh money coming into May. In the case of Utilities Sector Funds, their inflow ended a 15-week run of redemptions that saw $5.88 billion flow out. Investors continued to pull money out of Water Funds, although the latest week’s total was the second smallest of their seven-week outflow streak.

Bond and other Fixed Income Funds

EPFR-tracked Bond Funds ended April with their 19th consecutive inflow as the US Federal Reserve kept rates on hold and investors looked ahead to its June meeting and that of the European Central Bank. US, Asia Pacific, Global, Europe, Canada and Latin America Bond Funds posted inflows ranging from $21 million to $2.1 billion while the other major regional EM groups saw money flow out.

At the asset class level, Mortgage-Backed Bond Funds posted above average inflows for the second week running, flows into Inflation Protected Bond Funds hit their highest weekly total in over two years and Bank Loan Funds absorbed another $724 million.

The week ending May 1 did see Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates post their biggest outflow since late 1Q23. But a key sub-group, Green Bond Funds, recorded their ninth straight inflow.

In contrast to SRI/ESG Bond Funds, which generally buy bonds that are issued by companies or governments that meet certain social or environmental criteria, Green Bond Funds invest in a portfolio of bonds that are specifically earmarked for financing environmentally friendly projects. Another sub-group, SDG Bond Funds, whose investment strategies align with the United Nations’ Sustainable Development Goals (SDGs), experienced their third biggest weekly outflow on record.

Local Currency Emerging Markets Bond Funds bore the brunt of the latest outflow from all funds as China Bond Funds saw their four-week run of inflows come to an end and redemptions from Frontier Markets Bond Funds hit an eight-week high. Among the EMEA Country Fund groups, South Africa Bond Funds chalked up their third outflow over the past five weeks and Russia Bond Funds posted their biggest inflow since late 4Q21.

Over half of the headline number for all Europe Bond Funds was attributable to Switzerland Bond Funds, which recorded their biggest inflow in nearly 21 months and offset the largest outflow from Spain Bond Funds since 2Q22. Overall, Europe Corporate Bond Funds took in five times the amount of fresh money absorbed by funds with sovereign mandates, and short term was the preferred duration.

US Investment Grade Bond Funds posted their first collective outflow since the final week of January as the latest inversion of the yield curve for the two and 10-year notes hit a record 22 months and counting.

Did you find this useful? Get our EPFR Insights delivered to your inbox.