A ‘soft landing’ for the global economy, with inflation broadly tamed while avoiding a recession, remains the dominant narrative in asset markets, freeing investors to indulge their risk appetite and keep driving key indexes to fresh record highs. But the latest round of US tariffs aimed at Chinese electric vehicle (EV) and technology exports made that narrative harder to sustain going into the final week of May.

In the wake of the Biden administration’s decision to increase tariffs on Chinese EVs to 100%, funds dedicated to markets that depend on exports to drive economic growth took a hit. Redemptions from Japan Equity Funds hit their highest weekly total since EPFR-started tracking the group while Europe Equity Funds saw their longest inflow streak in over 14 months come to an end.

If risk appetite was dented, however, it remained in positive territory. Flows into Cryptocurrency Funds climbed to a 10-week high, Emerging Markets Equity and Bond Funds both posted net inflows and High Yield Bond Funds absorbed another $2.9 billion.

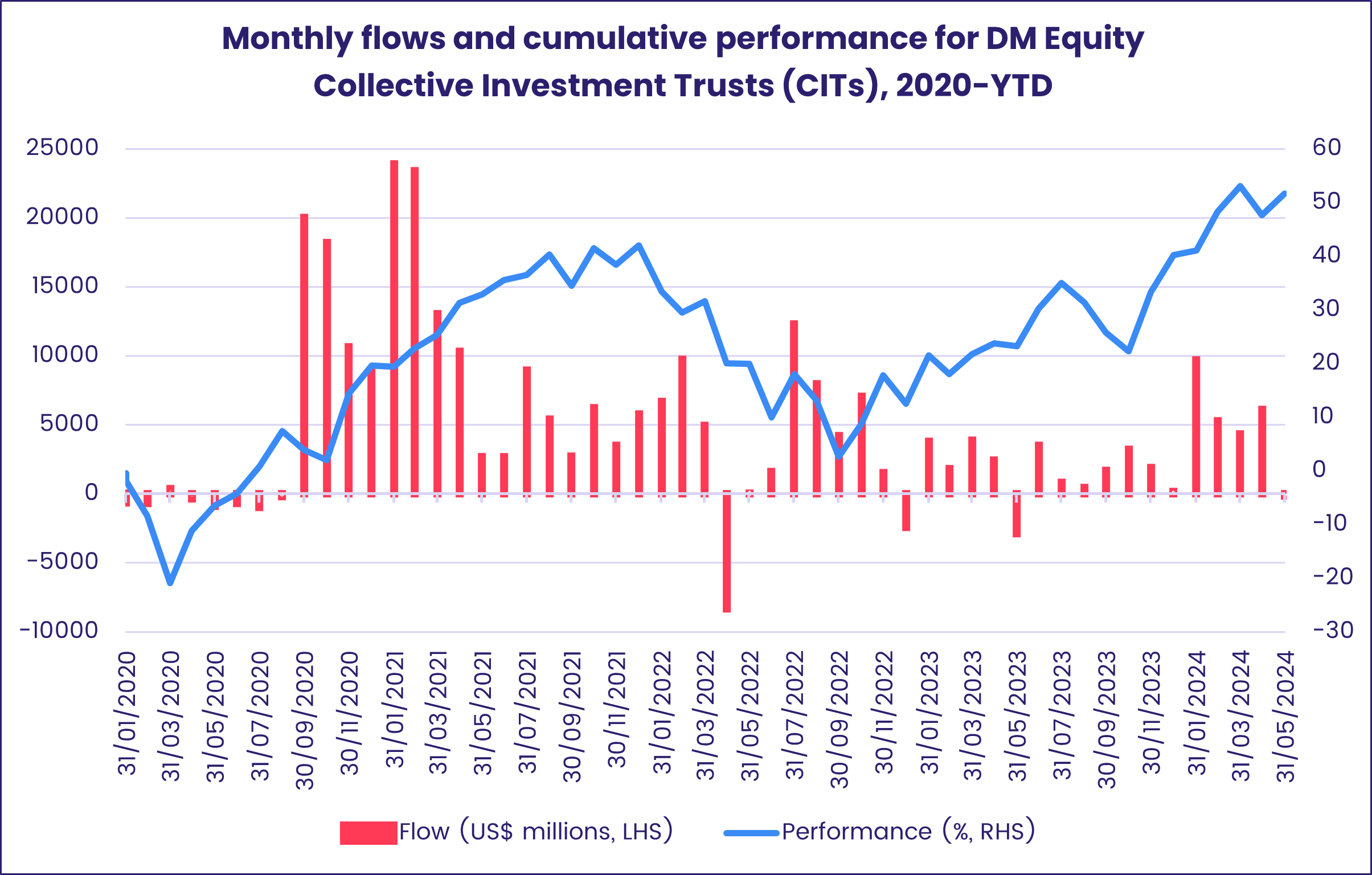

Overall, the week ending May 22 saw a net $12.4 billion flow into all EPFR-tracked Bond Funds. Investors also steered $2.7 billion into Alternative Funds, $24 billion into Money Market Funds and $10.4 billion into Equity Funds. Investors pulled money out of Equity Collective Investment Trusts (CITs) for the eighth time over the past 10 weeks, with developed markets-mandated CITs seeing the heaviest redemptions.

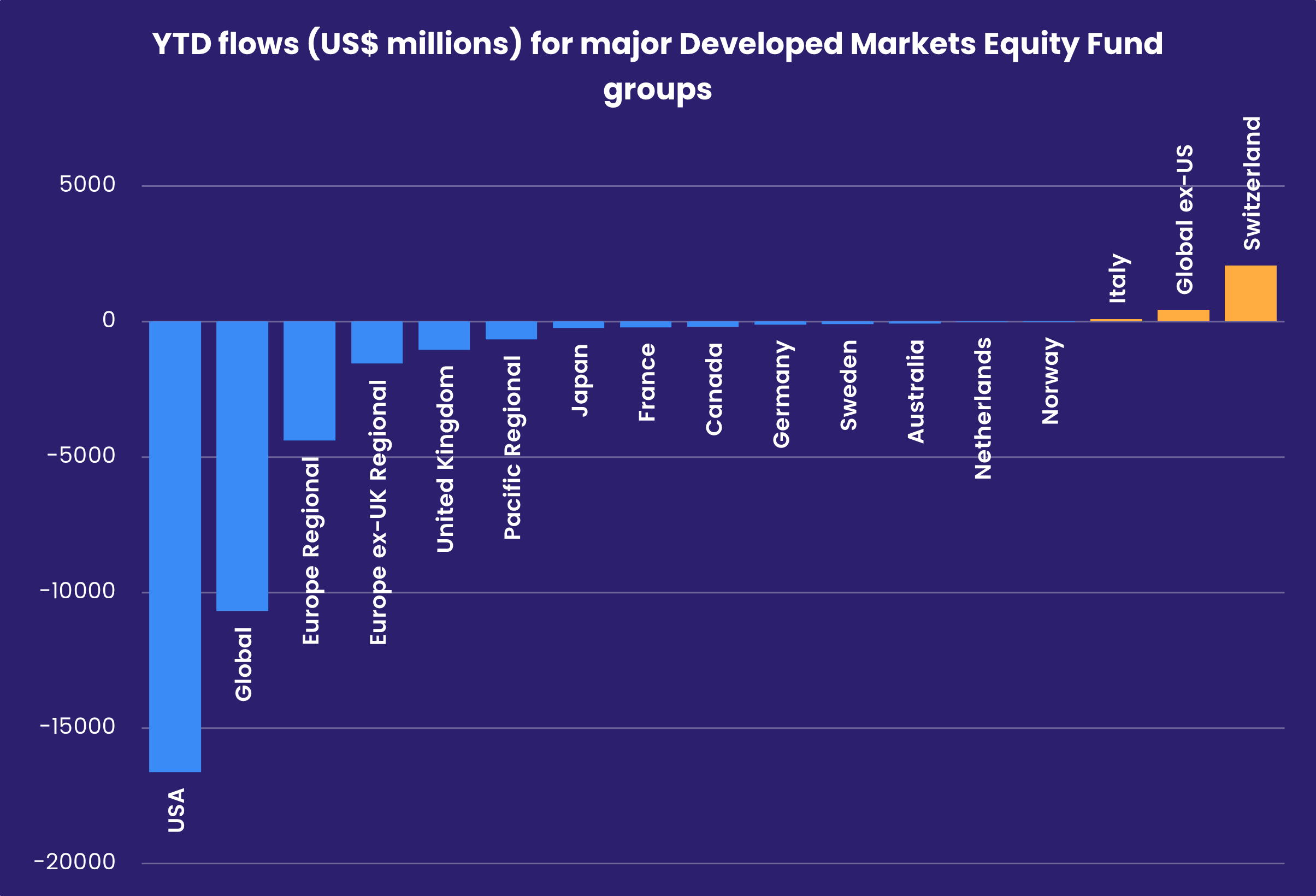

At the single country and asset class fund level, France Equity Funds posted their 18th outflow year-to-date, redemptions from Italy Equity Funds hit a 45-week high and Romania Equity Funds posted their 12th consecutive inflow. Silver Funds snapped a six-week run of outflows and Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their third inflow so far this year.

Emerging Markets Equity Funds

Investors seeking emerging markets exposure during the third week of May focused on major semiconductor producers and countries with strong domestic demand stories. Funds dedicated to Taiwan (POC), India and Korea accounted for most of the week’s headline number for all EPFR-tracked Emerging Markets Equity Funds, which chalked up only their fourth inflow since the beginning of March.

It was another bad week for Emerging Markets Dividend Funds, which posted consecutive outflows for the first time in nearly 10 months and their biggest outflow since 4Q18.

The latest round of tariffs hikes on Chinese electric vehicles, solar panels and technology component continued to weigh on China Equity Funds, which did eke out a modest inflow, and funds dedicated to countries – Mexico and Vietnam – that re-export significant amounts of Chinese produced goods to the US.

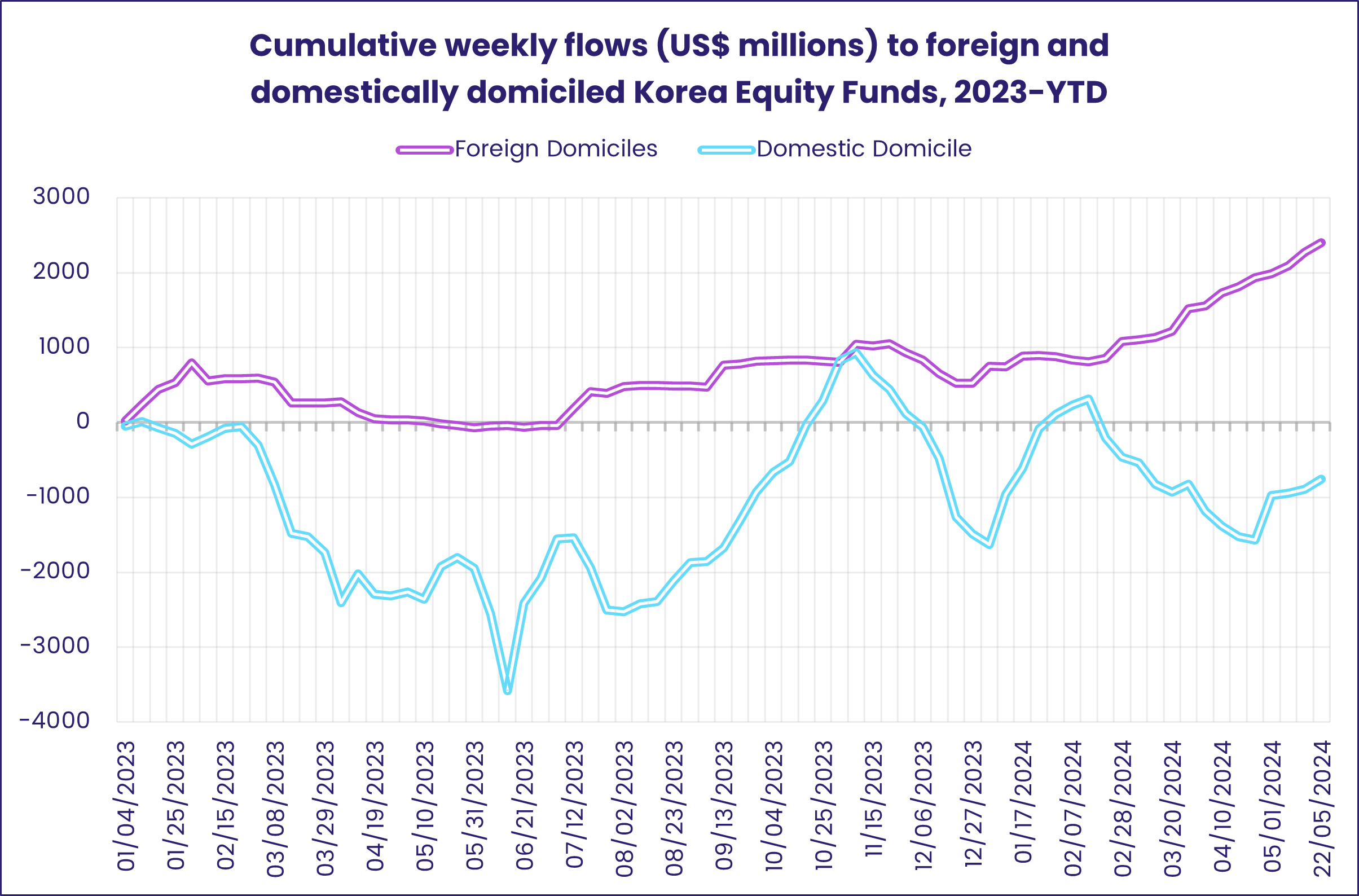

The search for alternative technology producers helped Korea and Taiwan (POC) Equity Funds record their fifth and eighth consecutive inflows, respectively, with the former picking up a fresh tailwind in the shape of the Korean government’s $19 billion package to support domestic chipmakers. Foreign-domiciled Korea Equity Funds extended their longest inflow streak since a 15-week run ended in mid-3Q07.

The latest country allocations data shows that the average Global Emerging Markets (GEM) Equity Fund allocations to Taiwan (POC) and Korea both skipped a notch coming into May. The average weighting for China jumped over 100 basis points and exposure to India hit its highest level since EPFR started tracking it in 1995.

Both passive and active GEM Equity Fund managers cut their exposure to Mexico, with the latter preserving a small overweight, ahead of that country’s general election in early June. Investors, meanwhile, pulled money out of Mexico Equity Funds for the sixth time since the beginning of the quarter. Enthusiasm for Argentina’s reform story continues to run hot, with Argentina Equity Funds posting their second-biggest weekly inflow on record.

Further flows into Turkey Equity Funds were not enough to stop EMEA Equity Funds collectively from chalking up their first outflow in a month and their biggest since mid-December.

Developed Markets Equity Funds

EPFR-tracked Developed Markets Equity Funds recorded another solid inflow during the week ending May 22. But, behind the headline number was a swerve away from the export stories of Japan and, to a lesser extent, Europe as investors digested the latest turn in Sino-US trade.

With the latest sector allocations data showing the average US Equity Fund committing over 30% of their portfolios to technology stocks, Nvidia’s earnings – which again exceeded expectations and helped propel the benchmark Nasdaq index to a fresh record high – commanded more attention that the previous week’s tariff increases. Flows into all US Equity Funds climbed to a seven-week high with Large Cap Blend ETFs attracting the bulk of the fresh money.

Investors also steered over $4 billion into Global Equity Funds. Funds with fully global mandates pulled in $4 for every $1 committed to Global ex-US Equity Funds. Funds within the overall group that have socially responsible (SRI) or environmental, social and governance (ESG) mandates also stood out among major DM Country and Regional Fund groups, taking in over $700 million.

Europe Equity Funds saw their three-week run of inflows come to an end as investors weighed the impact of higher US tariffs on the flow of Chinese car exports to Europe and fretted about the latest inflation numbers from the UK. Funds dedicated to Germany, whose automotive industry is a cornerstone of Europe’s largest economy and is regarded as highly vulnerable to Chinese competition, posted their biggest outflow since mid-2Q17.

Trade barriers were also on the minds of investors reviewing Japan’s export story. Japan Equity Funds posted a record outflow going into the final week of May, with domestically domiciled ETFs driving the headline number while overseas domiciled funds posted a modest collective inflow. Redemptions from retail share classes hit a 21-week high.

Global sector, Industry and Precious Metals Funds

Flows for EPFR-tracked Sector Fund groups during the third week of May were notable for their generally modest totals either way as the 1Q24 earnings season begins to wind down and investors look ahead to the June policy meetings of major central banks.

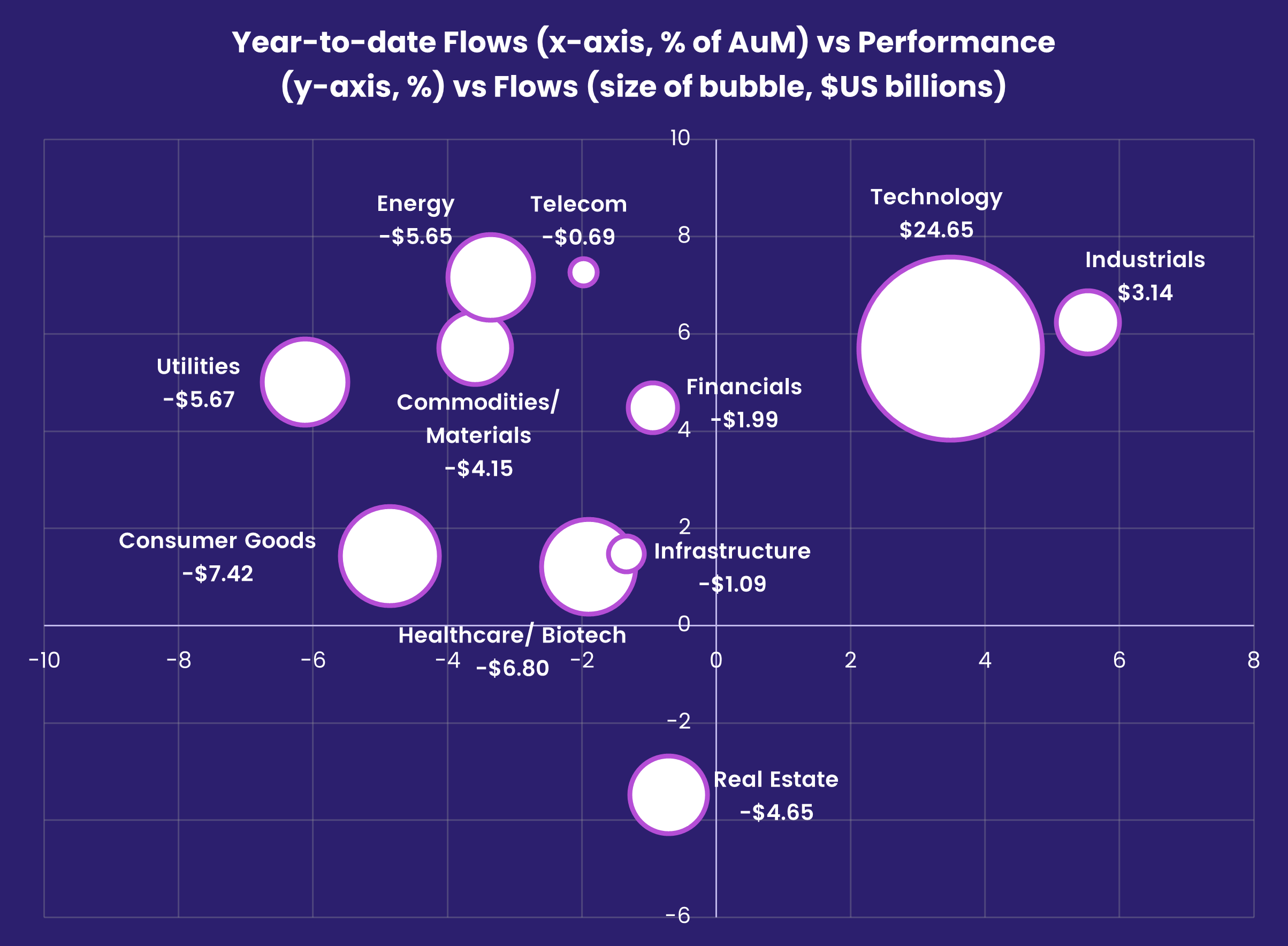

Five of the 11 major groups recorded inflows during the latest week, with Technology Sector Funds pulled into that camp by an influx of fresh money on the day artificial intelligence bellwether Nvidia reported another quarter of stellar earnings. Three passively-managed Semiconductor ETFs pulled in over $600 million between them, and another $230 million went to a Nvidia-dedicated ETF on May 22.

Despite falling short of last year’s heights, Technology Sector Funds remain the biggest money magnet year-to-date. Industrials Sector Funds are the only other offering positive flows and performance as monthly data for April steered a nine-month high inflow of $1.5 billion into the group.

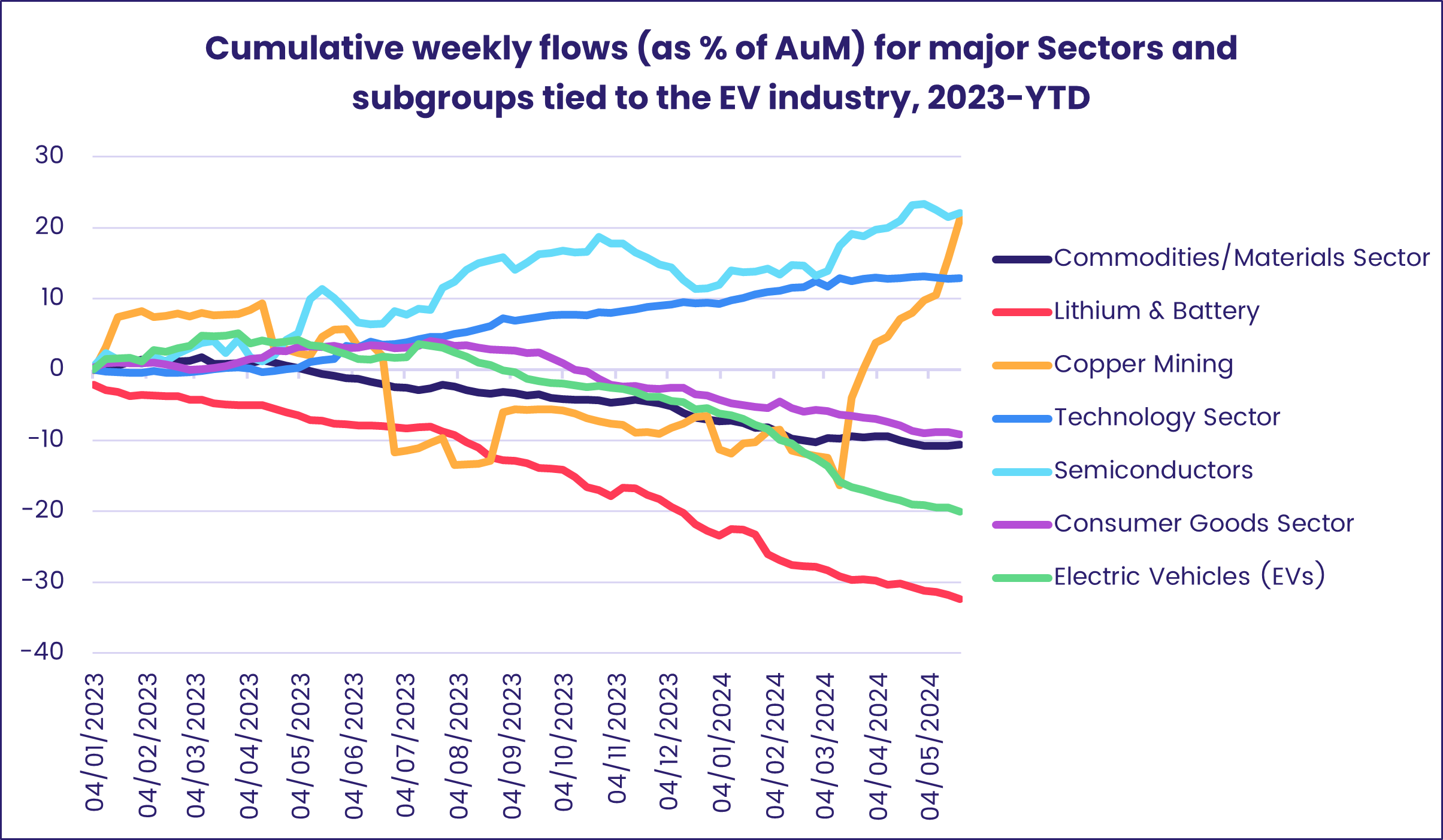

The interest in technology plays, and in clean energy, has been accompanied by a growing awareness of the raw materials needed for these themes to realize their potential. During the latest week, Copper Mining Funds enjoyed their 10th straight inflow while the other precious metal prized in the ESG space for its use in solar panels, Silver Mining Funds, chalked up their 11th inflow of the past 12 weeks. But funds dedicated to electric vehicles and the lithium needed for their batteries remain under a cloud as trade tensions around these sub-sectors increase.

Elsewhere, China, US and Japan Real Estate Sector Funds attracted inflows ranging from $85 million to $97 million, but redemptions from the more diversified groups – Global, Pacific Regional and Europe Regional RE Sector Funds – brought the overall headline number down. For China-dedicated funds, it was the biggest inflow in 38 weeks and Real Estate Sector Funds overall posted their first inflow in six weeks.

High-profile cyberattacks resulting in major investigations, closer scrutiny of the “hype” surrounding weight loss drugs, and US presidential candidates airing their plans for healthcare all weighed on investor sentiment towards Healthcare/Biotechnology Sector Funds. Though this week’s figure included the largest daily inflow since mid-March, the group still extended its longest run of weekly outflows since 1Q23.

Bond and other Fixed Income Funds

Despite some late-week jitters tied to US macroeconomic data, the latest UK inflation numbers and the US Federal Reserve’s reminder that interest rates could still increase if the data warrants it, EPFR-tracked Bond Funds saw year-to-date inflows climb by another $14 billion during the third week of May to $315 billion.

The latest week saw US Bond Funds record their 22nd consecutive inflow, Global Bond Funds take in fresh money for the 27th time since the beginning of November and flows into Europe Bond Funds hit their highest level in over 12 months. Asia Pacific, Canada and Emerging Markets Bond Funds also recorded modest inflows.

At the asset class level, High Yield Bond Funds pulled in nearly $3 billion, Bank Loan Funds chalked up their 17th inflow so far this year, Inflation Protected Bond Funds recorded their third inflow quarter-to-date and Mortgage-Backed Bond Funds extended an inflow streak stretching back to late December.

Although flows to most Emerging Markets Bond Country Fund groups during the latest week were slim-to-none, monthly data for April showed flows into India Bond Funds hitting a 12-month high as investors position themselves for the country’s inclusion in key indexes later this year. April also saw China Bond Funds record their biggest collective inflow since January 2022.

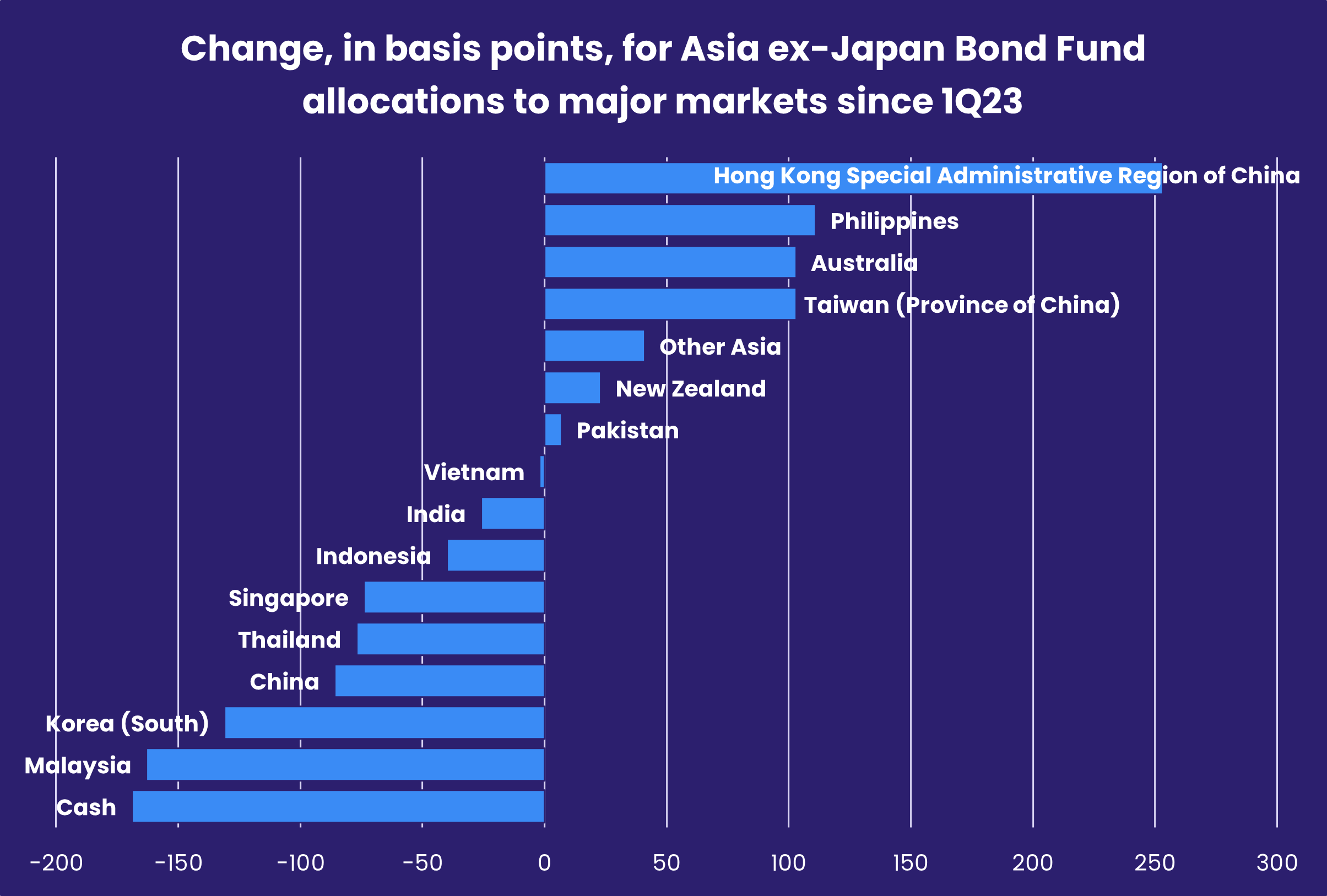

Both China and India have seen their average Asia ex-Japan Regional Bond Fund allocation slip over the past 16 months, with managers rotating exposure to the Philippines and the developed markets that are within their mandates.

Flows into Europe Bond Funds favored regional rather than country-specific exposure, although UK Bond Funds did post their biggest inflow in five weeks. Retail share classes extended an inflow streak stretching back to early September and Europe Bond Funds with sovereign mandates recorded their largest collective inflow since late 3Q23.

US Bond Funds domiciled overseas chalked up their 21st straight inflow and Leveraged US Bond Funds took in fresh money for the ninth week running.

Flows for the two major EPFR-tracked multi asset fund groups have tilted back in favor of Total Return Funds, which posted their 19th inflow so far this year while Balanced Funds saw YTD redemptions climb past the $65 billion mark.

Did you find this useful? Get our EPFR Insights delivered to your inbox.