The first week of May ended with the US Federal Reserve raising its key interest rate by 50 basis points. Investors, who expected a hike of that magnitude but feared the Fed might opt for a 0.75% increase, spent most of the week taking defensive positions. They cut their exposure to emerging markets and high yield debt, technology stocks, alternative assets and real estate. Europe Equity and Bond Funds also experienced significant redemptions as Russia’s invasion of Ukraine grinds into its 12th week.

Confirmation that the Fed no longer sees inflation as transitory triggered the biggest outflow from EPFR-tracked Inflation Protected Bond Funds since 1Q20. Gold Funds, meanwhile, recorded consecutive weekly outflows for the first time since mid-December.

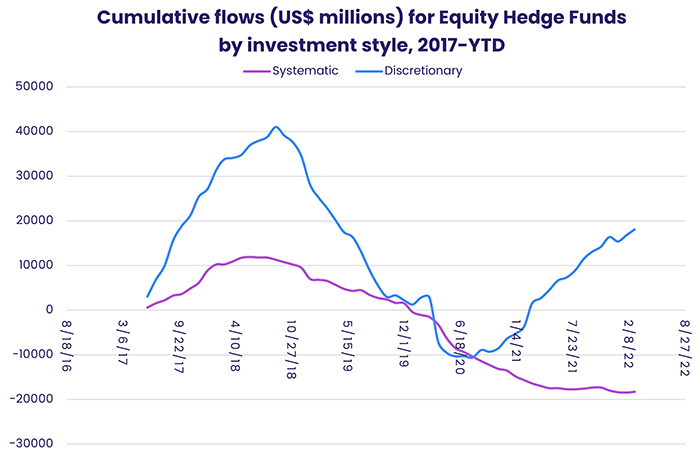

The latest hedge fund flows data shows Balanced and Equity Hedge Funds enjoying the largest inflows while funds with a fixed income focus posted their biggest collective outflow since April 2020. Among Equity Hedge Funds, investors are showing a clear preference for those with discretionary rather than systematic investment strategies.

Overall, investors pulled $3.4 billion out of all Equity Funds during the week ending May 4. Bond Funds saw $9.1 billion flow out while redemptions from Alternative Funds totaled $478 million. Money Market Funds also posted a collective outflow as redemptions from Europe Money Market Funds hit a year-to-date high.

At the asset class and single country fund levels, France Equity Funds posted their 16th outflow in the past 20 weeks and Germany Equity Funds experienced net redemptions for the 12th straight week while Italy and France Bond Funds recorded their biggest inflows since 2Q21 and mid-1Q21, respectively. Cryptocurrency Funds snapped their two-week run of outflows, Municipal Bond Funds chalked up their 12th straight outflow and Bank Loan Funds their 16th inflow in the 18 weeks YTD.

Did you find this useful? Get our EPFR Insights delivered to your inbox.