With the 2024 US Presidential election now less than two weeks away and the outcome still viewed as a toss-up, investors spent the third week of October positioning themselves for a range of outcomes. These include the ‘Trump Trade’, the continuation of the Biden/Harris agenda or a disputed election.

The week ending Oct. 23 saw flows into EPFR-tracked Alternative Funds hit a level last seen in early 2Q20, with Derivatives Funds posting their biggest inflow on record, flows into Physical Gold Funds hitting their highest weekly total since late 1Q22 and Cryptocurrency Funds absorbing over $1 billion for the second straight week. Funds dedicated to Canada proved popular, with Canada Bond Funds taking in over $1.3 billion and Canada Equity Funds pouting their third largest inflow year-to-date, and Switzerland Equity Funds recording their 16th inflow over the past 17 weeks.

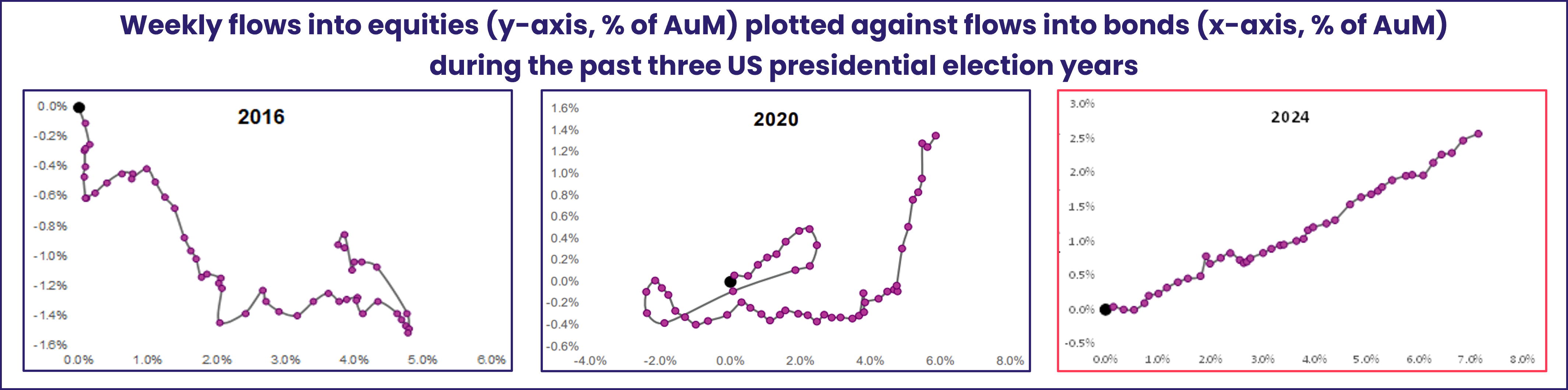

Overall, relative flows into both Equity and Bond Funds have followed a consistently positive path so far this year. That was not the case in the two previous presidential election years.

At the asset class and single country fund level, Saudi Arabia and Brazil Bond Funds posted their biggest weekly outflow since early 4Q22 and late 1Q20, respectively, US Money Market Funds recorded inflows for the 10th time during the past 12 weeks and flows into Singapore Equity Funds hit a nine-week high. Physical Silver Funds chalked up their biggest inflow in three months, Municipal Bond Funds added to their longest inflow streak since 2021, and Momentum Funds posted their fourth inflow during the past five weeks.

Emerging Markets Equity Funds

China Equity Funds were hit with over $6 billion worth of redemptions for the second week running heading into the final week of October. With none of the other major country fund groups taking up even a small part of the slack, the net effect was the first consecutive weekly outflows for all EPFR-tracked Emerging Markets Equity Funds since the first half of May and their biggest since early 2Q20.

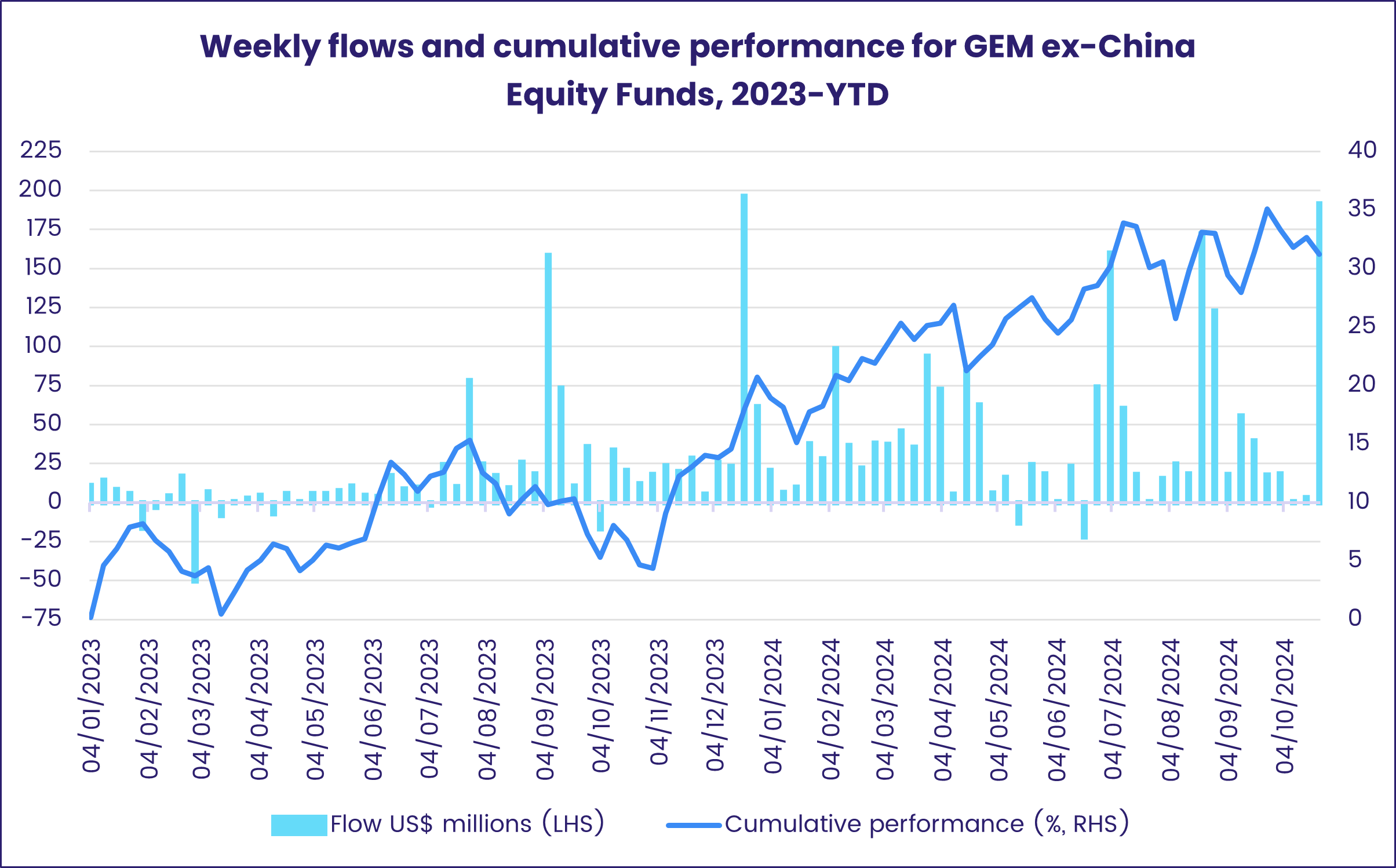

Among the major groups by geographic mandate, only Frontier Markets and the diversified Global Emerging Markets (GEM) Equity Funds ended the latest week with a collective inflow. In the case of the latter, funds with ex-China mandates saw inflows climb to a 44-week high. The latest country allocations shows that actively managed GEM Equity Funds with fully global mandates lifted their average exposure to China to an 11-month high coming into October.

Dedicated China Equity Funds, meanwhile, posted their biggest outflow since 2Q15 as redemptions from domestically domiciled funds offset a fifth straight week of flows into foreign domiciled funds. Those outflows, and the previous weeks, still represent a little over a quarter of the money that rushed in during the first week of October.

During September, managers of China Equity Funds cut their allocations to technology, healthcare and telecom plays to 11, 63 and 73-month lows, respectively, while the average weighting for financials climbed to a 30-month high and exposure to consumer discretionary names hit a record high.

Among the other Asia ex-Japan Country Fund groups, India Equity Funds posted their second outflow since the beginning of October, Taiwan (POC) Equity Funds narrowly extended a redemption streak stretching back to mid-June, Thailand Equity Funds posted their 42nd consecutive outflow and Vietnam Equity Funds chalked up their biggest inflow in 13 weeks.

Questions about oil prices, the prospect of North Korean troops fighting in Ukraine and Israel’s continuing engagement in Lebanon kept the pressure on EMEA Equity Funds during the week ending Oct. 23. Israel Equity Funds did swim against the overall tide, chalking up their biggest inflow since the third week of March.

With inflation accelerating in the region’s two biggest markets and the growing volume of Chinese imports triggering region-wide discussions about tariffs, Latin America Equity Funds tallied their 32nd outflow of 2024. The group is on track to post its biggest yearly outflow since 2015.

Developed Markets Equity Funds

Investors committed fresh money to US, Global, Australia, Japan and Canada Equity Funds during the third week of October as they parsed corporate earnings reports, US presidential polls and predictions for the Federal Reserve’s next move on interest rates. They allowed EPFR-tracked Developed Markets Equity Funds to record their second straight inflow and 32nd year-to-date.

The biggest contributor to the latest headline number were US Equity Funds, which posted their third straight inflow and fifth over the past six weeks despite another $2.3 billion being pulled out of retail share classes. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates did see inflows climb to a 19-week high. Although the recent strength of US macroeconomic data raises questions about the pace and trajectory of the latest US rate cutting cycle, it has reinforced the narrative that corporate earnings are on the next leg up.

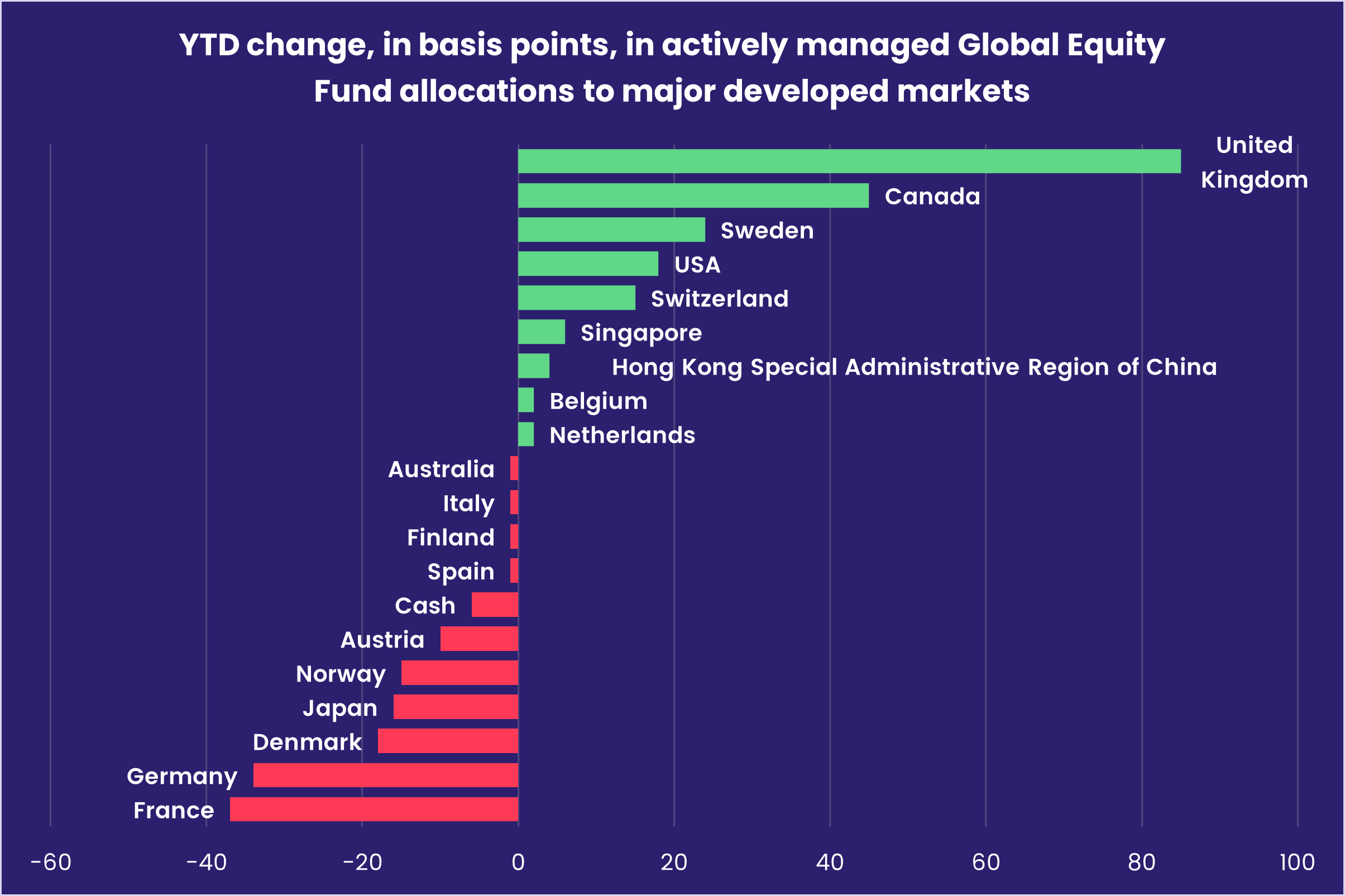

US equity markets are also getting solid support from Global Equity Funds, which extended their current inflow streak to 11 straight weeks as year-to-date inflows climbed past the $90 billion mark. Actively managed funds with fully global mandates are currently allocating – on average – over 50% of their portfolios to US stocks.

While these funds’ allocation to the US has changed little so far this year, their exposure to the UK is up 0.85% during the first nine months of 2024. In this, the managers are at odds with the perceptions of investors who have pulled $25 billion out of dedicated UK Equity Funds so far this year.

UK-mandated funds were among the contributors to the latest headline number for all Europe Equity Funds, which got a limited boost from the latest European Central Bank interest rate cut and the news that natural gas storage is over 90% of its target ahead of the Northern hemisphere’s winter heating season.

Going into a snap election on Oct. 27, Japan Equity Funds saw a two-week run of outflows come to an end despite the 10th consecutive week of redemptions from foreign domiciled funds. Meanwhile, so far this year, Japan-domiciled Global and US Equity Funds have absorbed $19 billion and $15 billion, respectively.

Global sector, Industry and Precious Metals Funds

US corporate earnings season trickled along during the third week of October and the presidential election came into sharp focus. Investors cheered Tesla’s growth in vehicle deliveries and preparation for more affordable models and Netflix’s successful password share crackdown, but frowned for Boeing struggling with a $6 billion loss and its largest union on strike for a sixth week running.

When it came to committing fresh money, however, there was more frowning than cheering, with nine of the 11 major Sector Fund groups tracked by EPFR ending the week with net outflows. Technology Sector Funds posted the biggest outflows of any group, with redemptions hitting a 17-week high, as investors waited for key earnings reports and fretted about excess capacity in the semiconductor space.

Six of the top 10 funds with the biggest outflows during the latest week are dedicated to China, including the top two funds benchmarked to SSE Science & Technology Innovation Board 50 which saw a combined $1.2 billion flow out, while three have “semiconductor” in their name, and one tracks the CSI Anime Comic and Game index.

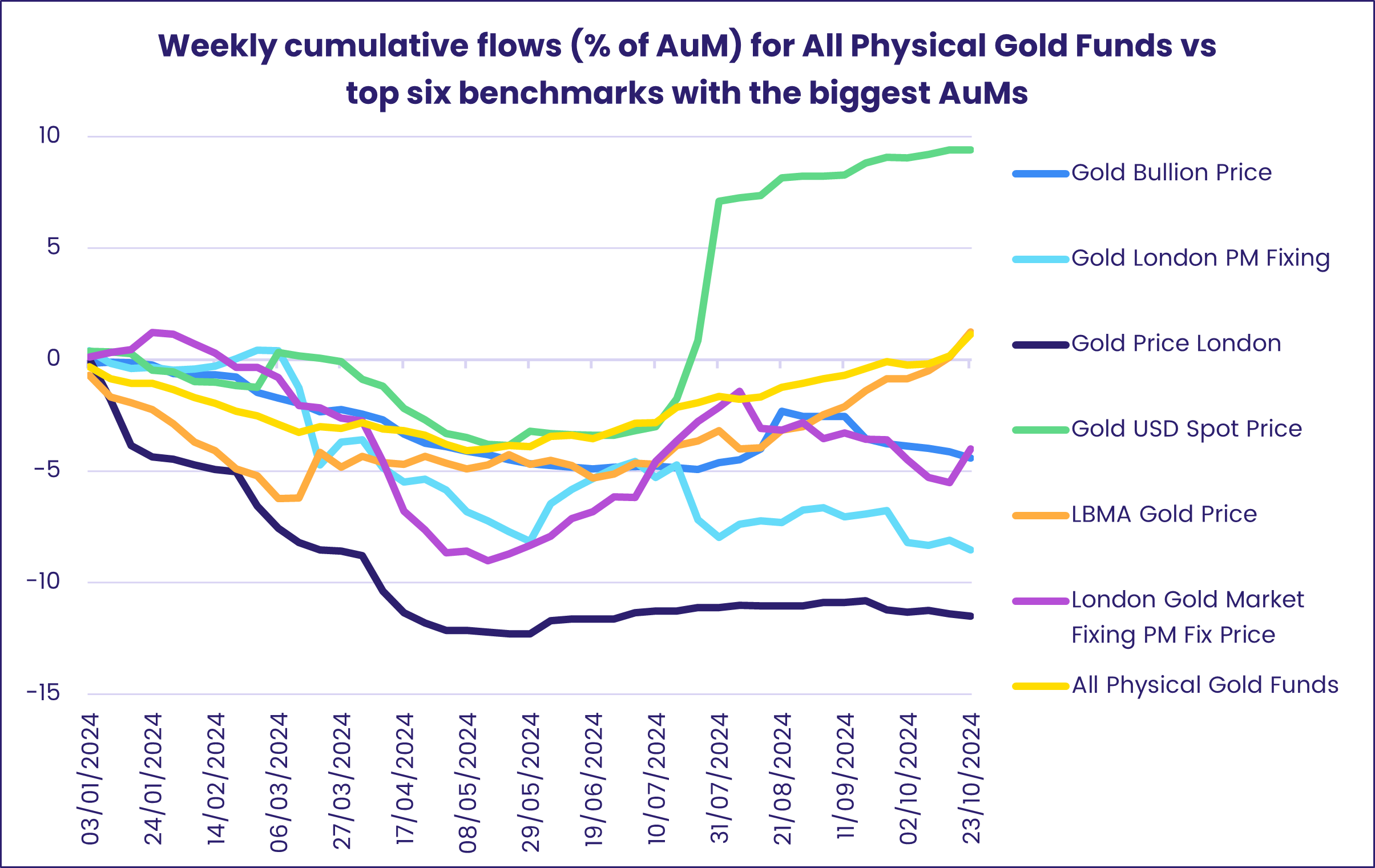

While Commodities Sector Funds posted a small outflow overall, one commodity shone when it came to attracting fresh money. Flows into Physical Gold Funds have picked up in the second half of the year, with just four weeks of outflows since mid-May and the latest week taking in over $2.7 billion total. Geopolitical issues and a dearth of fiscal discipline has pushed the price of gold up over $200 to a record $2,734 per ounce since our last update in late August.

Funds benchmarked to LBMA Gold Price have racked up inflows of over $3.6 billion year-to-date, with inflows in October accounting for over 70% ($2.6 bn) and the latest week roughly 40% ($1.4 bn). A combined $3.1 billion has flowed into those following the China Gold Spot Price and Shanghai Gold Exchange, and the benchmark that ranked first at the end of September – Gold USD Spot Price – has dropped to fourth but still with inflows of $1.4 billion this year. Meanwhile, nearly $5 billion has been redeemed collectively from funds tracking three benchmarks focused on London’s gold market or those reflecting current exchange rates between gold and the Euro.

Elsewhere, Infrastructure Sector Funds narrowly extended their inflow streak to four weeks and Utilities Sector Funds took in a six-week high of nearly $300 million.

Bond and other Fixed Income Funds

Although the vision of higher spending and borrowing offered by both candidates for the US presidency hit US bond yields during the third week of October, EPFR-tracked Bond Funds pulled in another $13.4 billion which lifted their year-to-date total over the $685 billion mark.

Behind that headline number, however, was a rotation from US-mandated funds to Global and Europe Bond Funds, with the latter recording their biggest inflow since EPFR started tracking them weekly in 4Q01. Emerging Markets Bond Funds saw their longest run of inflows in over 15 months come to an end and Asia Pacific Bond Funds chalked up their biggest outflow since the beginning of April.

Although the futures market sees another 25-basis point rate cut as a near certainty when the US Federal Reserve meets next month, and hasn’t ruled out a 50-basis point cut, some of the certainty about falling US prices has ebbed away going into the final week of October. Strong US macroeconomic data, the spending and trade policies embraced by both Donald Trump and Kamala Harris, a resurgence of price pressures in several major emerging markets and the soaring gold prices have raised a number of reddish flags.

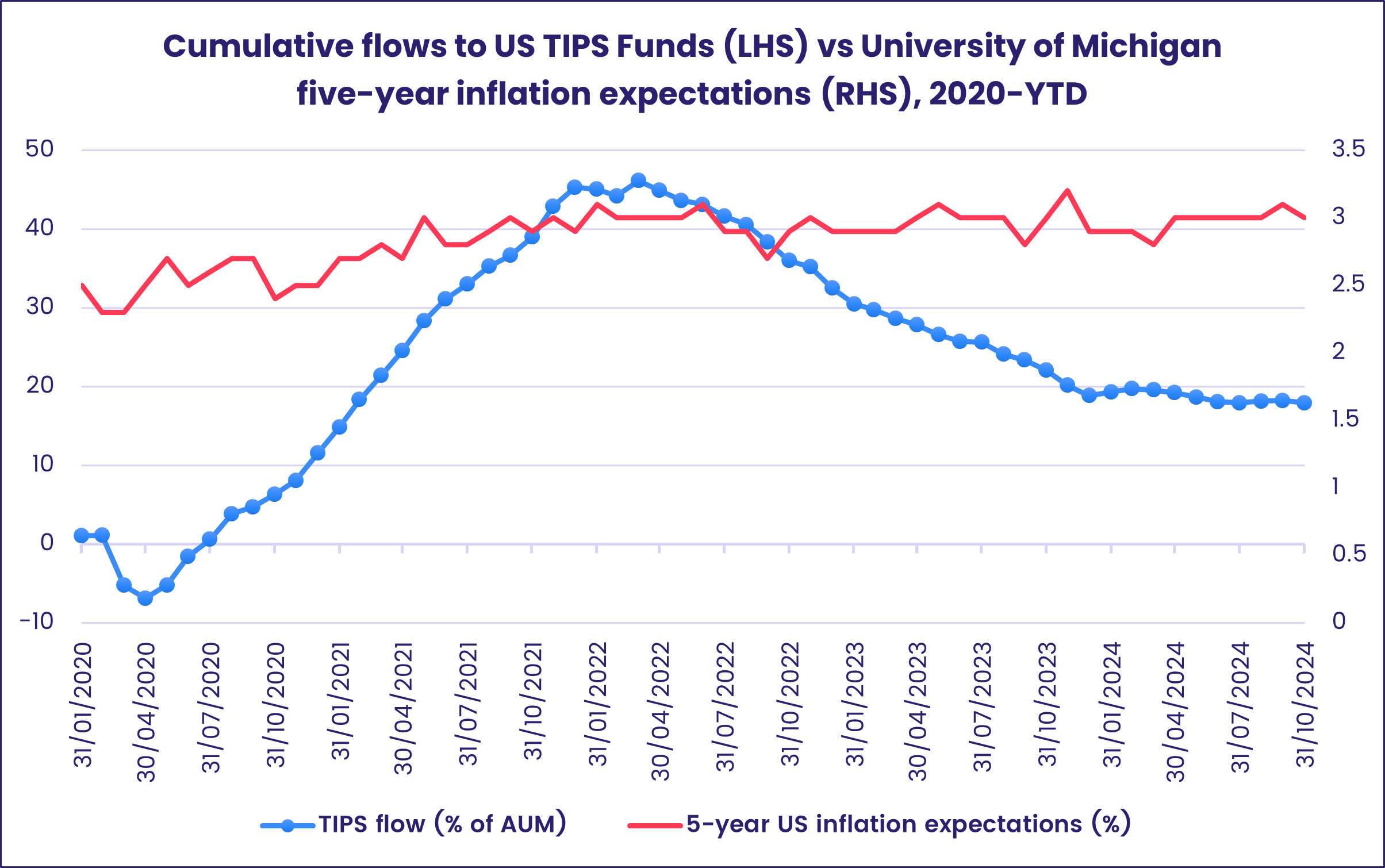

US Treasury Inflation Protected Securities (TIPS) Funds posted another outflow during the latest week. But flows for this group are starting to look out-of-step with higher medium-term expectations which have settled above the Fed’s 2% target rate.

At the asset class level among Europe Bond Funds, those with inflation protected mandates have now posted outflows for six straight weeks while Europe High Yield Bond Funds’ last outflow came during the second week of August. Germany, Italy and Switzerland Bond Funds stood out at the country level, with flows into the former groups hitting 11 and 65-week highs, respectively, while redemptions from Switzerland Bond Funds climbed to a 10-week high.

Emerging Markets Bond Funds posted their first outflow in over a month, and their biggest in over two months, as investors revisited some of their assumptions for US interest rates. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates extended their longest run of inflows since the winter of 2021-22, and Frontier Markets Bond Funds also attracted some fresh money.

Retail flows to US Bond Funds were positive for the 12th week running, and funds domiciled overseas extended their current inflow streak.

Did you find this useful? Get our EPFR Insights delivered to your inbox.