Going into the second half of December, global markets were digesting the sting in the tail of the US Federal Reserve’s latest 0.25% cut in its key interest rate: the prospect of only half of the previously projected rate cuts in 2025.

Flows to EPFR-tracked Bond Funds reflected the market’s discomfort, posting their first collective outflow since the first week of the year and their biggest since late 4Q22. But Equity Funds chalked up their biggest headline number on record as technical factors tied to the reinvestment of dividend payments and positioning around the expiration of major option and futures contracts – known as the ‘triple witching’ – impacted flows.

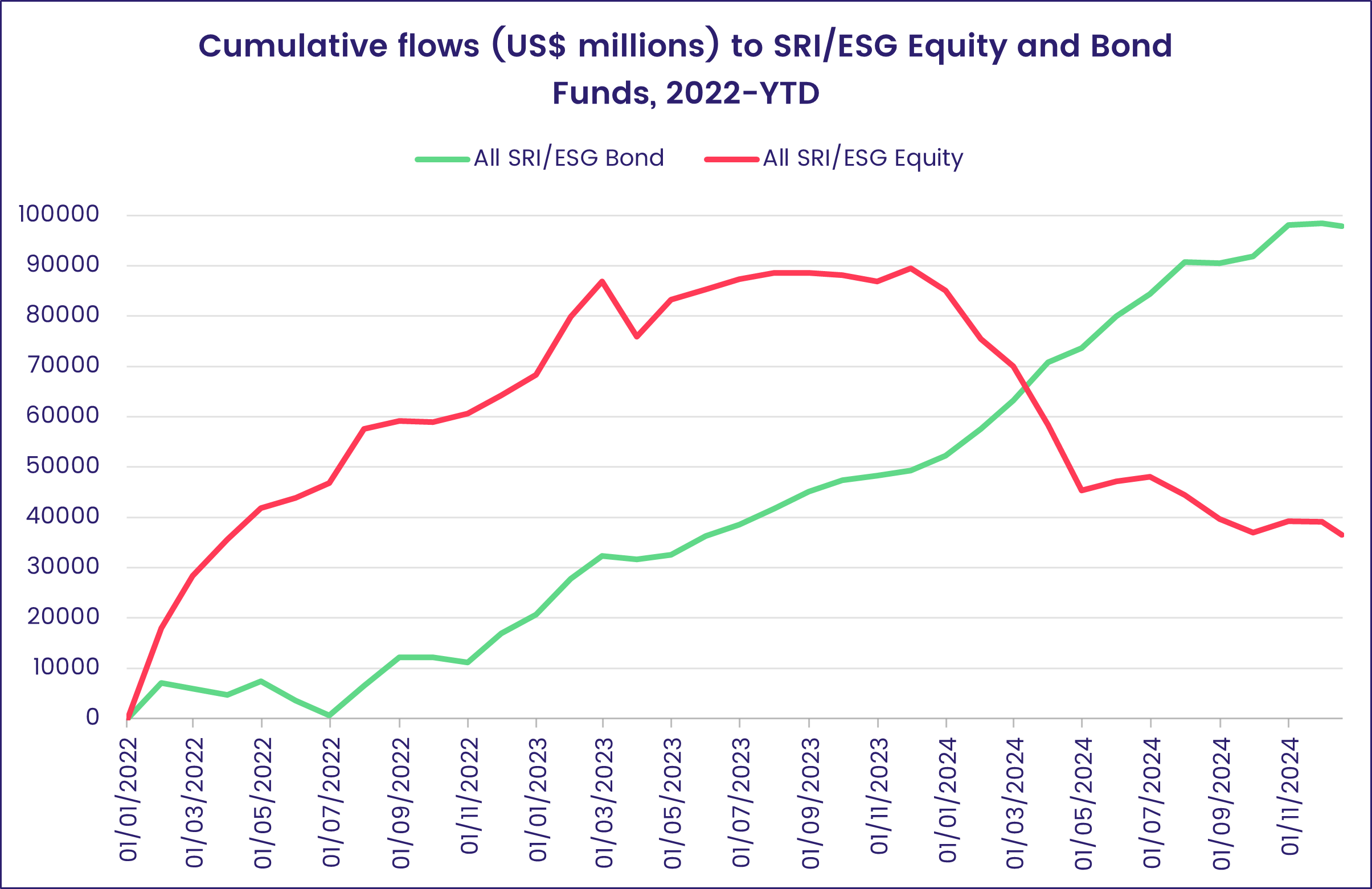

The week ending Dec. 18 saw funds dedicated to some of the major investment themes over the past two years enjoy mixed fortunes. While Cryptocurrency Funds pulled in another $3 billion, Technology Sector Funds posted their third straight outflow and seventh since the second week of October and Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates experienced net redemptions for the 38th week year-to-date.

Overall, Equity Funds posted a collective inflow of $68.6 billion during the latest week and Alternative Funds attracted a net $6.9 billion while redemptions from Balanced, Bond and Money Market Funds totaled $3.5 billion, $5.9 billion and $63.8 billion, respectively.

At the single country fund level, outflows from Switzerland Money Market Funds hit a record high, Turkey Money Market Funds enjoyed record-setting inflows, Thailand Equity Funds extended a redemption streak stretching back to early January and Greece Bond Funds posted their biggest inflow since early Q21.

Emerging Markets Equity Funds

The influx of fresh money into China-mandated funds in response to the latest stimulus measures proved short-lived. With China Equity Funds recording their ninth outflow over the past 10 weeks and redemptions from the diversified Global Emerging Markets (GEM) Equity Funds climbing to a 155-week high, all EPFR-tracked Emerging Markets Equity Funds posted their eighth outflow of the fourth quarter.

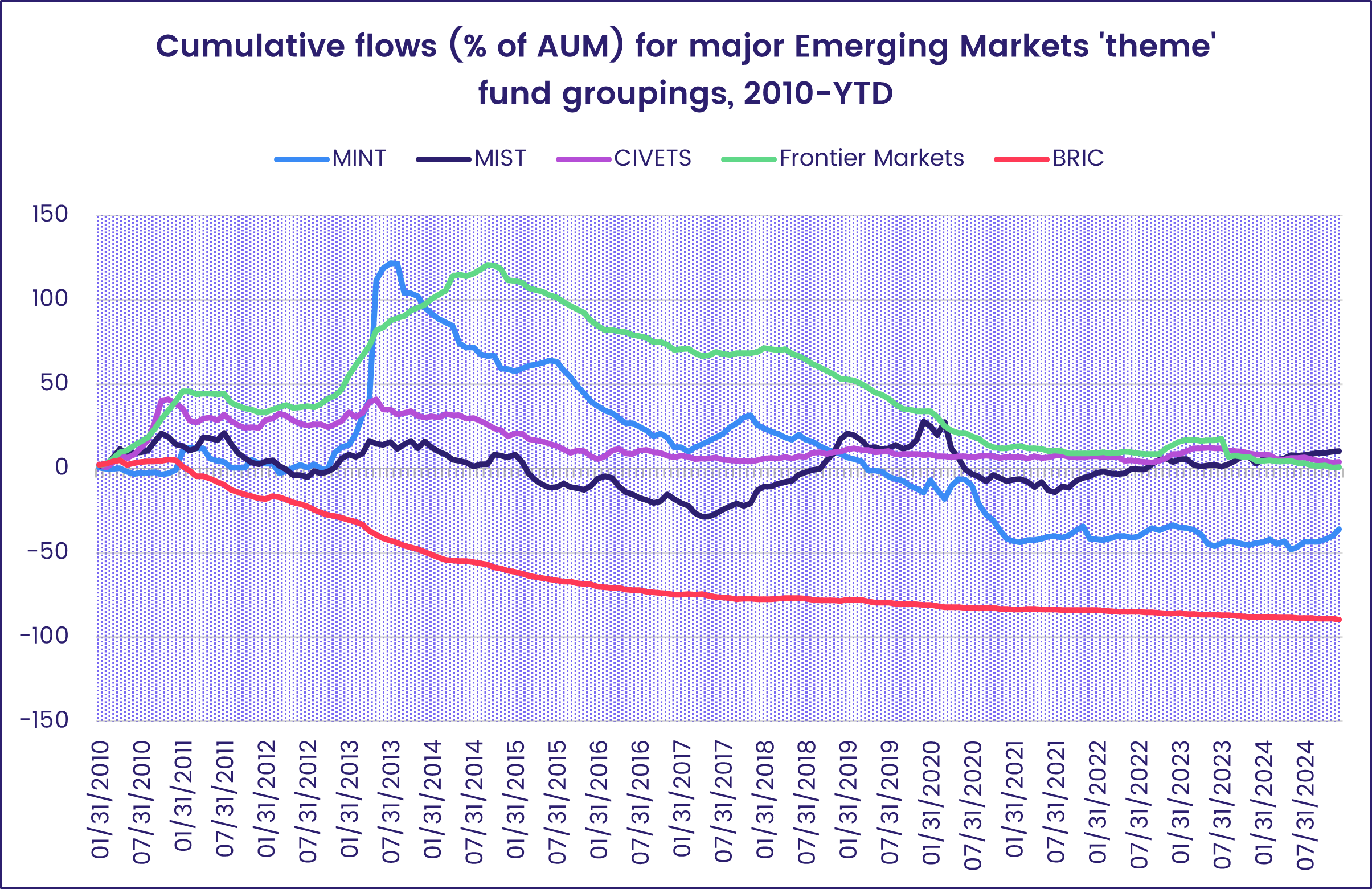

Among the major thematic fund groups, BRIC (Brazil, Russia, India and China) Equity Funds posted their 31st consecutive outflow and their 50th over the past 12 months. Other thematic EM groups are also struggling, with Frontier Markets Equity Funds seeing money flow out five of the past six months and flows to the CIVETS (Colombia, Indonesia, Vietnam, Egypt, Thailand and South Africa) group of funds falling off as 2024 progressed. The MIST (Mexico, Indonesia, South Korea and Turkey) group has fared best this year, collectively pulling in over $2.5 billion since the beginning of the second quarter.

Hopes that 2025 will see a ‘peace dividend’ for key EMEA markets if the conflicts in Ukraine, Syria and Gaza wind down were reflected in the solid flows into Israel and Turkey Equity Funds during mid-December. But the bearish outlook for oil prices took a toll on investor appetite for Saudi Arabia, Qatar and Kuwait-dedicated funds.

Investor appetite for exposure to Mexico is also at a low ebb thanks to that country’s statist policymaking, which has hobbled the key energy sector, and the threat of higher US tariffs when President-elect Donald Trump takes office next month. Mexico Equity Funds have now posted nine weekly outflows since the current quarter started. Argentina’s reform story, meanwhile, continued to resonate with flows into Argentina Equity Funds hitting another record high.

Among the major Asia ex-Japan Country Fund groups, the latest outflows from China Equity Funds were partially offset by the $500 million that flowed into Taiwan (POC) Equity Funds. But Korea Equity Funds posted their first outflow since early November and their biggest since the second week of June as the political aftershocks from President Yoon Suk Yeol’s declaration of martial law earlier this month continue to reverberate.

Developed Markets Equity Funds

For US Equity Funds to dominate the Developed Markets Equity Fund flow picture in mid-December came as no surprise. But the size of the inflow, and the technical drivers, made it difficult to interpret the massive headline number.

Flows into US Equity Funds during the week ending Dec. 18 totaled $82.2 billion, the largest weekly total since EPFR started tracking the group in 4Q00. While flows to US Equity Funds have surged since Republican candidate and former US President Donald Trump won a second term in early November, the latest number was influenced by the reinvestment of ex-dividend payouts and positioning ahead of options expiring at the end of the week. Retail share classes recorded a net outflow, funds socially responsible (SRI) or environmental, social and governance (ESG) mandates saw their longest inflow streak since come to an end and Leveraged US Equity Funds chalked up their 12th outflow over the past three months.

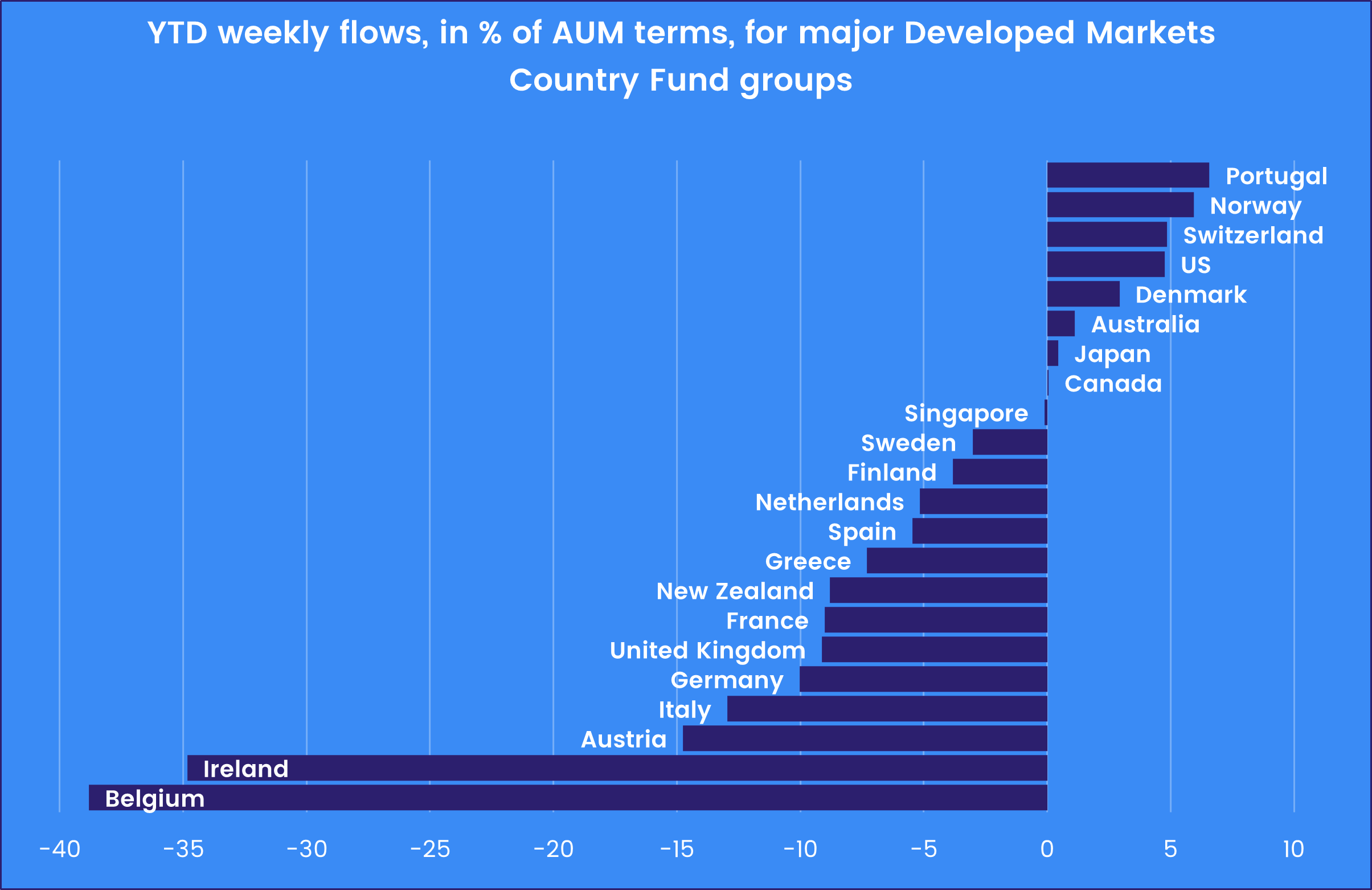

While US Equity Funds have recorded by far the biggest year-to-date inflows in cash terms, they rank fourth behind three European markets in relative terms.

Attracting inflows in any terms has been a struggle for Europe Equity Funds in 2024 as the proximity of real wars in Ukraine and the Middle east, the specter of intensifying US-Sino trade tensions and the economic and political weakness dogging France and Germany sapped investor confidence. Those investors pulled another $2.6 billion out of the group in mid-December. At the country level, redemptions from France Equity Funds hit an 11-week high while both Switzerland and Finland Equity Funds recorded their third largest inflow of 2024.

Japan Equity Funds tallied their fifth consecutive inflow despite the biggest collective inflow for funds domiciled overseas since the second week of August. In the wake of the late October snap election, Japan faces fresh tests from US trade policymakers and North Korea’s bellicose government with a minority government at the helm. However, fears that the Bank of Japan would end 2025 by hiking interest rates were not realized.

Global sector, Industry and Precious Metals Funds

For the first time since late October, the number of EPFR-tracked Sector Fund groups reporting inflows fell to just two – Real Estate and Consumer Goods Sector Funds – while the other nine groups experienced redemptions ranging from just $4 million for Telecoms Sector Funds to $1.8 billion for Technology Sector Funds.

Though Consumer Goods Sector Funds are on track to post record-setting outflows this year of over $12 billion – topping the $10 billion redeemed in 2016 – they are ending 2024 on a more positive note. The latest week’s inflow was the fourth of the past six weeks as a single passively-managed Consumer Discretionary ETF pulled in close to $1 billion. The two ETFs with the heaviest outflows included one that was benchmarked to CSI Liquor and another focused on Consumer Staples.

A third consecutive outflow for Technology Sector Funds continued to chip away from their yearly inflow total, which has reached over $50 billion. Underlying this week’s headline number was over $1.5 billion flowing out of Semiconductor & Chip Industry Funds, a fifth straight redemption for Internet Funds and Software Funds experiencing their heaviest redemption since late July. , meanwhile, extended their inflow streak to six weeks.

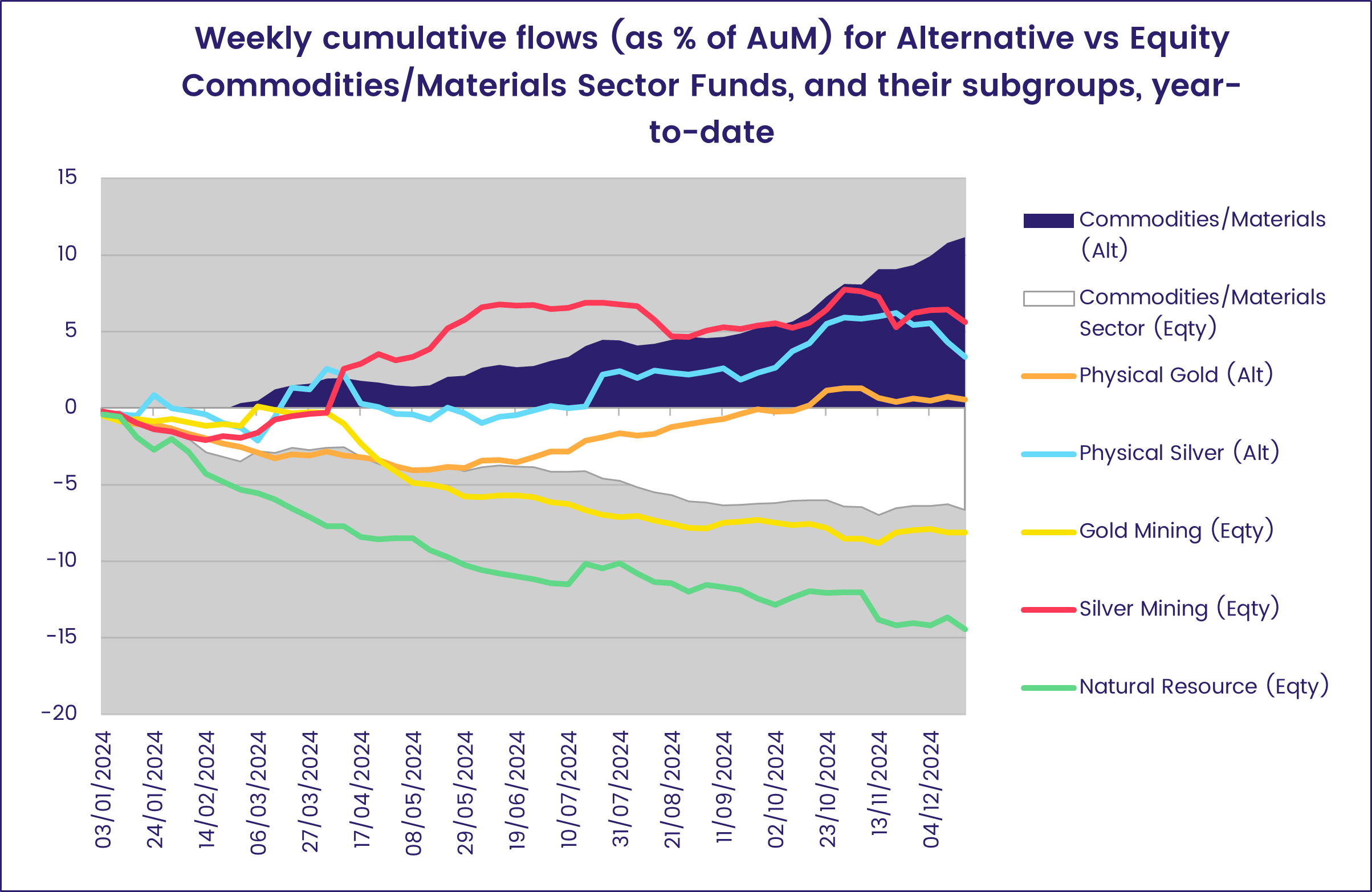

Commodities Sector Funds were also hit by outflows after pulling in roughly $830 million over the past month. Among the major subgroups, Natural Resources Funds saw $150 million flow out, Copper Mining Funds posted a small inflow, while flows at the fund-level for Gold Mining Funds moved in opposite direction.

While Commodities Sector Funds provide exposure to commodity-related companies, Alternative Commodities Funds track a much larger universe of funds that provide direct exposure to the commodities – gold, coffee, zinc, etc. – themselves. Inflows for this second group over the past two months have risen to levels previously seen in 1Q22. From mid-April 2022 until early February of this year, the group posted only 16 weekly inflows (out of 94) and racked up redemptions of $67.8 billion. Since then, Alternative Commodities Funds have seen just nine weeks of outflows (out of 45) with inflows amounting to $51 billion.

Bond and other Fixed Income Funds

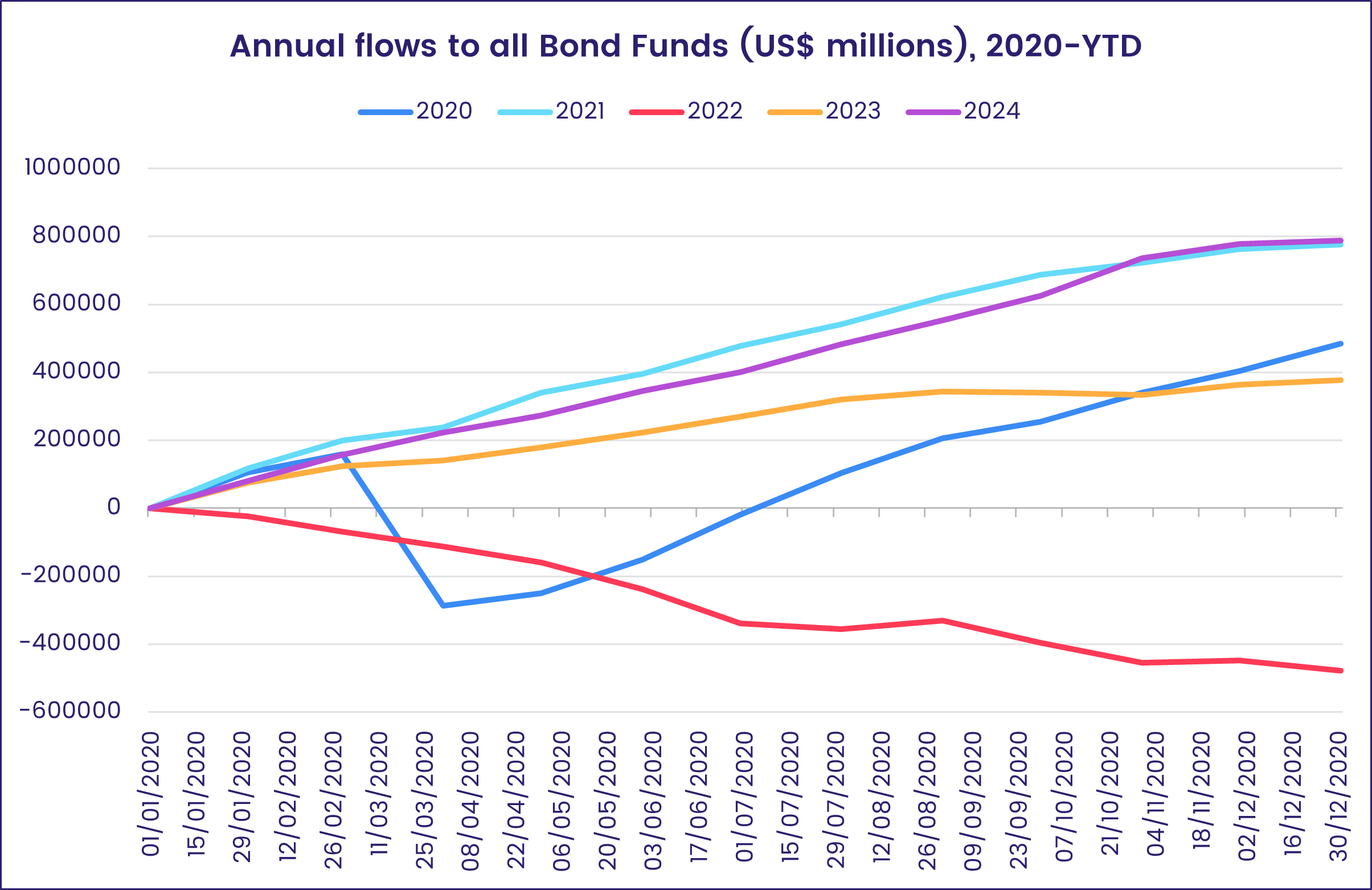

With stubborn inflation changing the anticipated trajectories of US and British monetary policy in mid-December and the prospect of another debt ceiling brawl in the US, EPFR-tracked Bond Funds posted their second outflow of the year as US Bond Funds saw a 51-week inflow streak come to an end. Investors also pulled over $1 billion out of Global and Emerging Markets Bond Funds. Year-to-date, however, the overall group remains positioned to set a new full-year inflow record.

At the asset class level, redemptions from High Yield Bond Funds climbed to a 19-week high, Municipal Bond Funds posted their biggest inflow since mid-1Q23 and investors pulled money out of Green Bond Funds for the seventh time over the past eight weeks. Flows into Inflation Protected Bond Funds topped $200 million for the fifth time this year, Bank Loan Funds absorbed more than $1 billion for the seventh week in a row and Collateralized Loan Obligation (CLO) Bond Funds recorded their 101st inflow during the past two years.

The prospect of US interest rates going lower at a slower pace added to the headwinds facing Emerging Markets Bond Funds, with hard currency-mandated funds seeing over $1 billion flow out. Rising inflation and the possibility of further barriers to global trade flows are also weighing on this fund group.

Among US Bond Fund groups, those with corporate mandates saw a 13-week inflow streak snapped as redemptions hit their highest level since late 3Q23. Short Term Sovereign Bond Funds posted their biggest outflow in three months as redemptions from Long Term Sovereign Funds moderated sharply.

With a tailwind from the European Central Bank’s 25 basis point rate cut the previous week, Europe Bond Funds attracted another $1.8 billion with investors again gravitating towards funds offering exposure to corporate debt and showing strong conviction at the country level. France Bond Funds posted a record-setting outflow for the second week in a row while UK Bond Funds chalked up their second largest inflow so far this year.

Did you find this useful? Get our EPFR Insights delivered to your inbox.