US politics, Chinese economic policy making and mixed second quarter corporate earnings moved asset markets in multiple directions going into the final week of July. But investors remain inclined to pencil in benign outcomes and discount geopolitical and other risks.

A week that ended with the so-called Magnificent 7 mega cap stocks pulling US markets lower, China’s ruling Communist Party largely reaffirming its current policy mix and new Democratic Party candidate Kamala Harris campaigning for the White House also saw EPFR-tracked Technology Sector Funds pull in another $2 billion, a combined $4 billion flow into Bank Loan and High Yield Bond Funds, flows into China Equity Funds jump to a 24-week high and US Equity Funds chalk up their 13th inflow since mid-April.

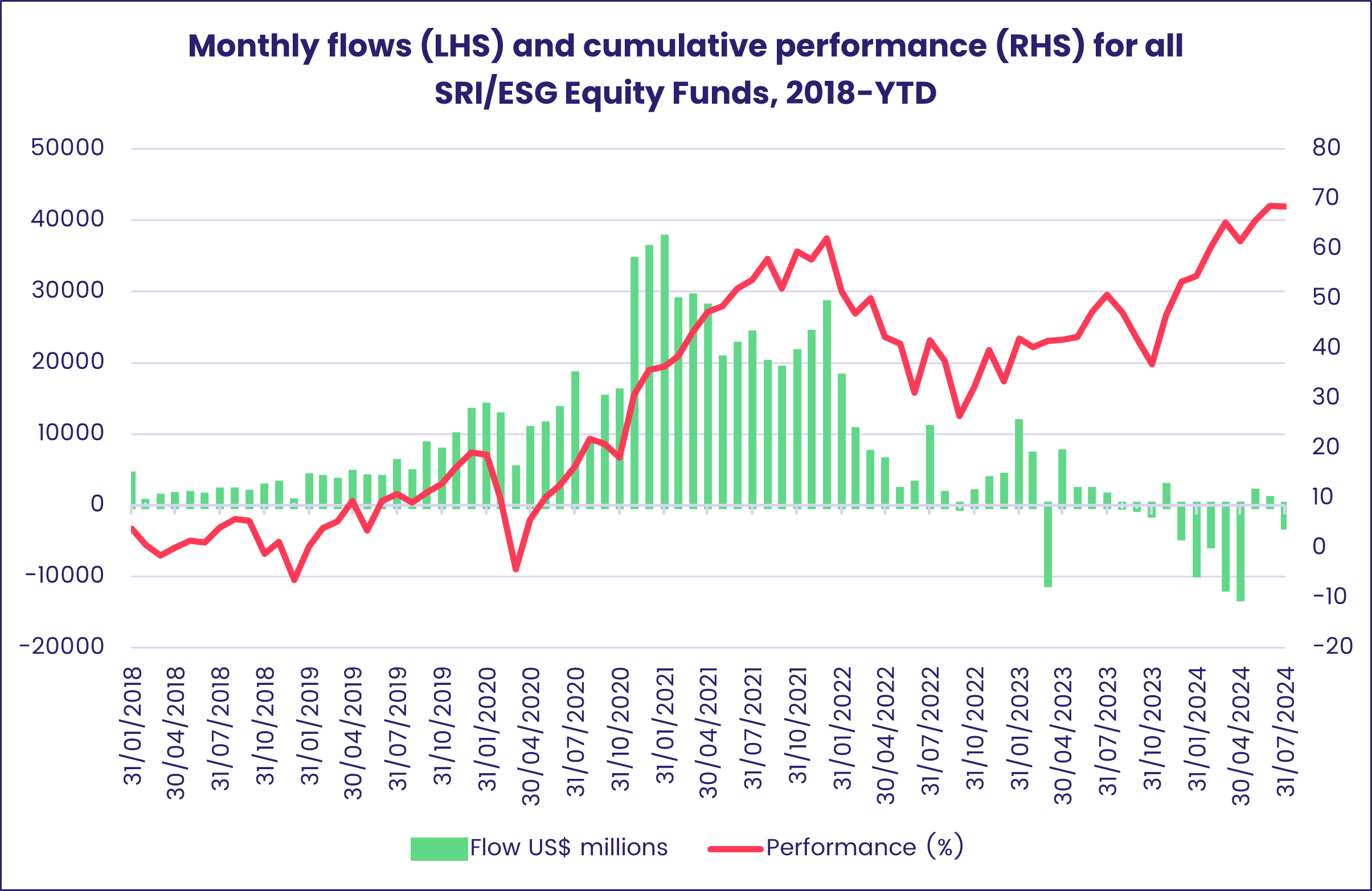

The prospect of a further backlash against Chinese clean energy exports and disappointing earnings reports from companies with electric vehicles in the product mix did weigh on Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates. Redemptions from these funds hit a 13-week high as they posted their 24th outflow year-to-date.

Net flows to all EPFR-tracked Equity Funds during the week ending July 24 totaled $22.2 billion, with Alternative Funds pulling in $1.4 billion and Bond Funds $16.1 billion while $1.6 billion flowed out of Balanced Funds and $42.5 billion from Money Market Funds.

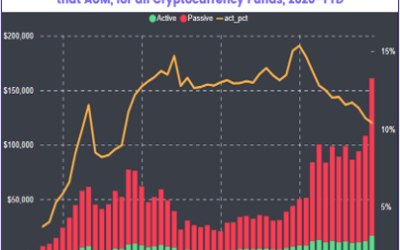

At the asset class and single country fund level, Inflation Protected Bond Funds recorded their biggest inflow in two months, flows into Physical Silver Funds hit their highest level since mid-1Q21 and Cryptocurrency Funds absorbed over $1 billion for the third week running. Redemptions from Japan Money Market Funds climbed to an 18-week high, Canada Bond Funds extended their longest inflow streak since EPFR started tracking them and Vietnam Equity Funds posted their biggest inflow since the final week of January 2023.

Emerging Markets Equity Funds

The fourth week of July saw China and India Equity Funds post their third and fourth largest inflow, respectively, during the past 12 months as EPFR-tracked Emerging Markets Equity Funds chalked up their eighth straight inflow. Also underpinning the headline number were the diversified Global Emerging Markets (GEM) Funds, which snapped a nine-week outflow streak, and EMEA Equity Funds which tallied their biggest inflow since late 1Q23.

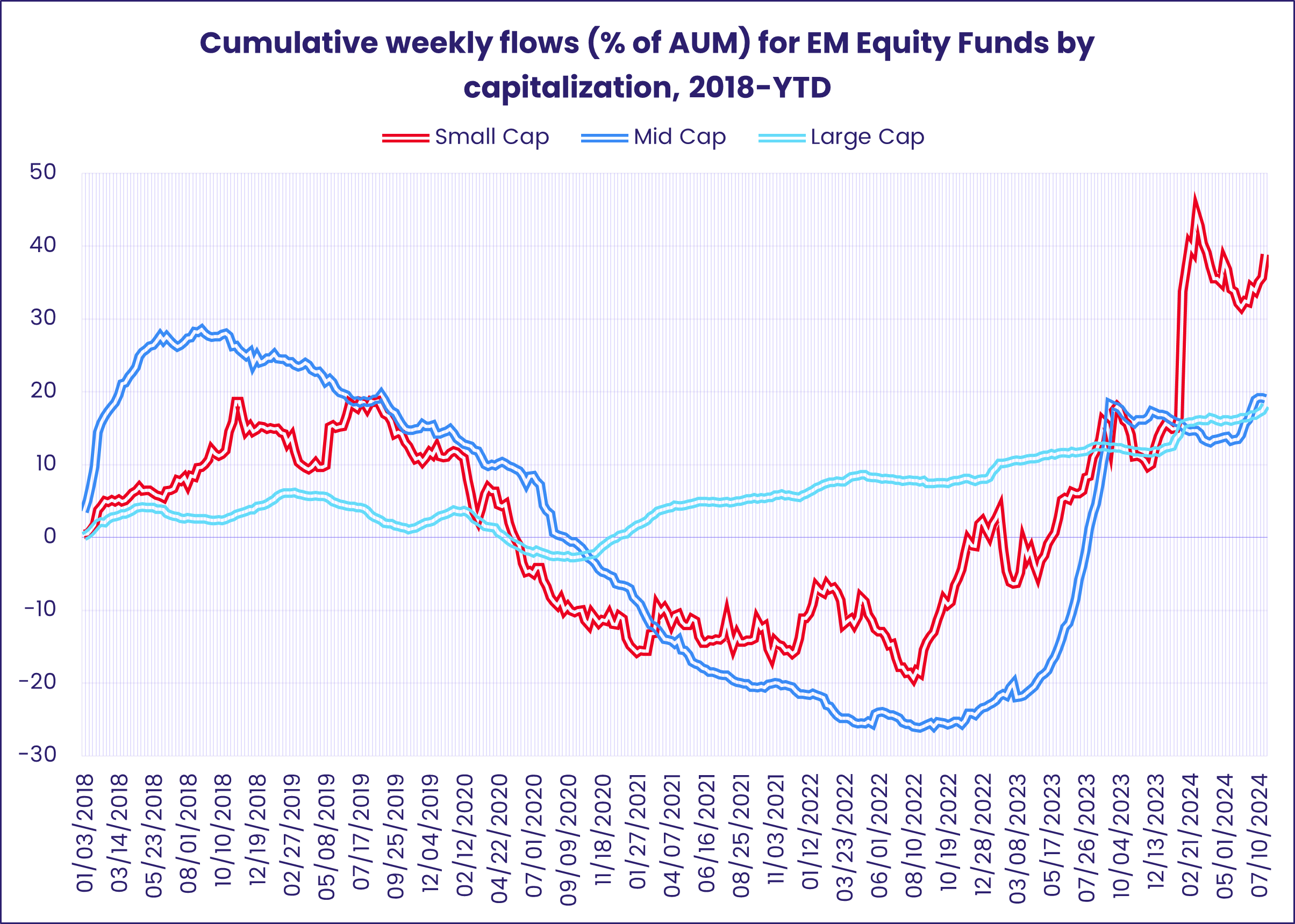

While the recent rotation from US mega cap stocks to small cap plays has been garnering a lot of attention, Emerging Markets Equity Funds have seen a relative shift in favor of funds with small and mid cap mandates that started in 3Q22.

The latest flows into China Equity Funds came on the heels of a widely anticipated policy meeting, the Chinese Communist Party’s Third Plenum, which largely reaffirmed the current direction of travel for Chinese economic policy. Retail share classes saw money flow out for the ninth week running and redemptions from overseas domiciled funds climbed to a 13-week high.

India Equity Funds, meanwhile, pulled in over $1 billion ahead of the 2024-25 budget which includes higher capital gains and transaction taxes aimed at curbing retail speculation.

EMEA Equity Funds recorded another solid collective inflow as Saudi Arabia Equity Funds enjoyed above average inflows for the third week running, South Africa Equity Funds extended their longest inflow streak since 1Q19 and Turkey Equity Funds posted their 13th inflow of the past 14 weeks.

The latest GEM Equity Fund country allocations data shows average allocations to Mexico and Brazil at 22 and 24-month lows, respectively. Flows into Brazil Equity Funds did jump to a 14-week high, but appetite for Argentina’s reform story remains at a low ebb with Argentina Equity Funds posting their fifth outflow over the past seven weeks.

Developed Markets Equity Funds

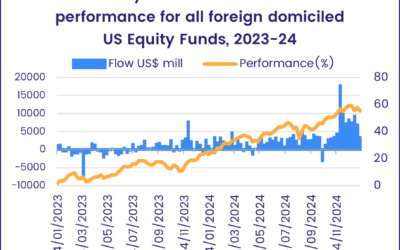

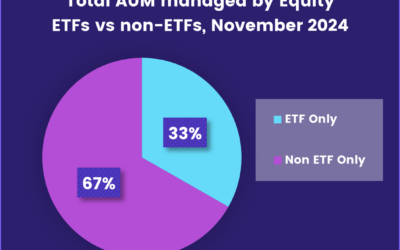

With US Equity Funds continuing to attract fresh money and flows to Japan Equity Funds rebounding sharply, EPFR-tracked Developed Markets Equity Funds ended the fourth week of July with their 14th consecutive inflow. Australia and Global Equity Funds also recorded modest inflows that offset net redemptions from Europe, Canada and Pacific Regional Equity Funds.

The flows into Japan Equity Funds were the biggest in over three months, with over half of the net total going to a single ETF tracking the TOPIX index. Retail share classes recorded their largest inflow in 13 weeks but funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates extended an inflow streak stretching back to early May. Investors are expecting further tightening from the Bank of Japan when it meets at the end of the month, and the average Japan Equity Fund allocation to financial plays currently stands at its highest level since 1Q18.

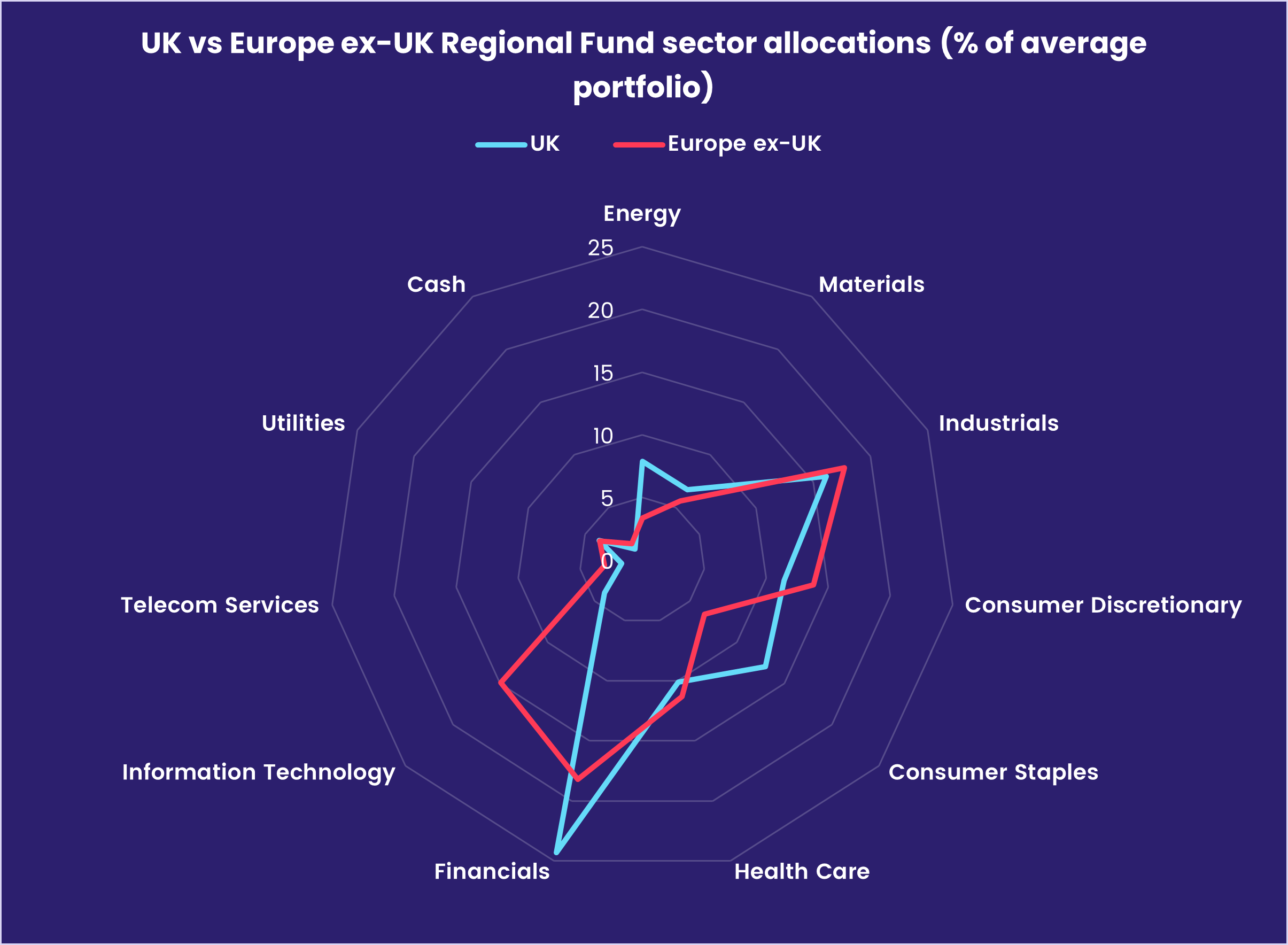

Europe Equity Funds recorded their 28th outflow of the year as investors continue to weigh the implications of recent elections in France and the UK and digest the weak macroeconomic data coming out of Germany. During the latest week, France Equity Funds added to their longest run of inflows in over three years and UK Equity Funds took in fresh money for the first time since the third week of November.

US equity markets were roiled by earnings for two of the Magnificent 7 plays that undershot expectations and the latest twist in the run-up to the 2024 presidential election. But US Equity Funds, despite the continued absence of retail support, pulled in over $7 billion with the bulk of that going to Large Cap Blend Funds while Large Cap Growth Funds experienced the heaviest redemptions.

Investors again showed markedly less appetite for exposure to America’s northern neighbor. Canada Equity Funds, which posted their biggest outflow in six months the previous week, saw money flow out for the second week running as redemptions from domestically domiciled funds climbed to a 12-week high.

Global sector, Industry and Precious Metals Funds

With electric vehicle and automotive industry earnings flashing orange and markets jolted by a US presidential election in constant flux, a number of the 11 major EPFR-tracked Sector Fund groups saw outflows reach multi-week highs during the week ending July 24. Bucking this trend were Technology Sector Funds and Infrastructure Sector Funds, with the latter extending an eight-week inflow streak.

Of the eight Sector Fund groups suffering redemptions, those for Energy Sector Funds were most eye-catching as they surpassed their previous record set in early 4Q14 by over $800 million. Nearly two-thirds of the headline number was directed by a single leveraged 3x ETF designed to amplify the returns of an index focusing on large-cap oil companies in the US. That also sent outflows for Oil & Gas Funds to a record $2.4 billion.

Among other energy sub-groups, Nuclear & Uranium Funds saw their first outflow in 12 weeks and their heaviest since early March. Kazakhstan’s increase of the Mineral Extraction Tax (MET) on uranium from 6 to 9% will hit the world’s largest producer of this heavy metal, Kazatomprom, starting in 1Q25.

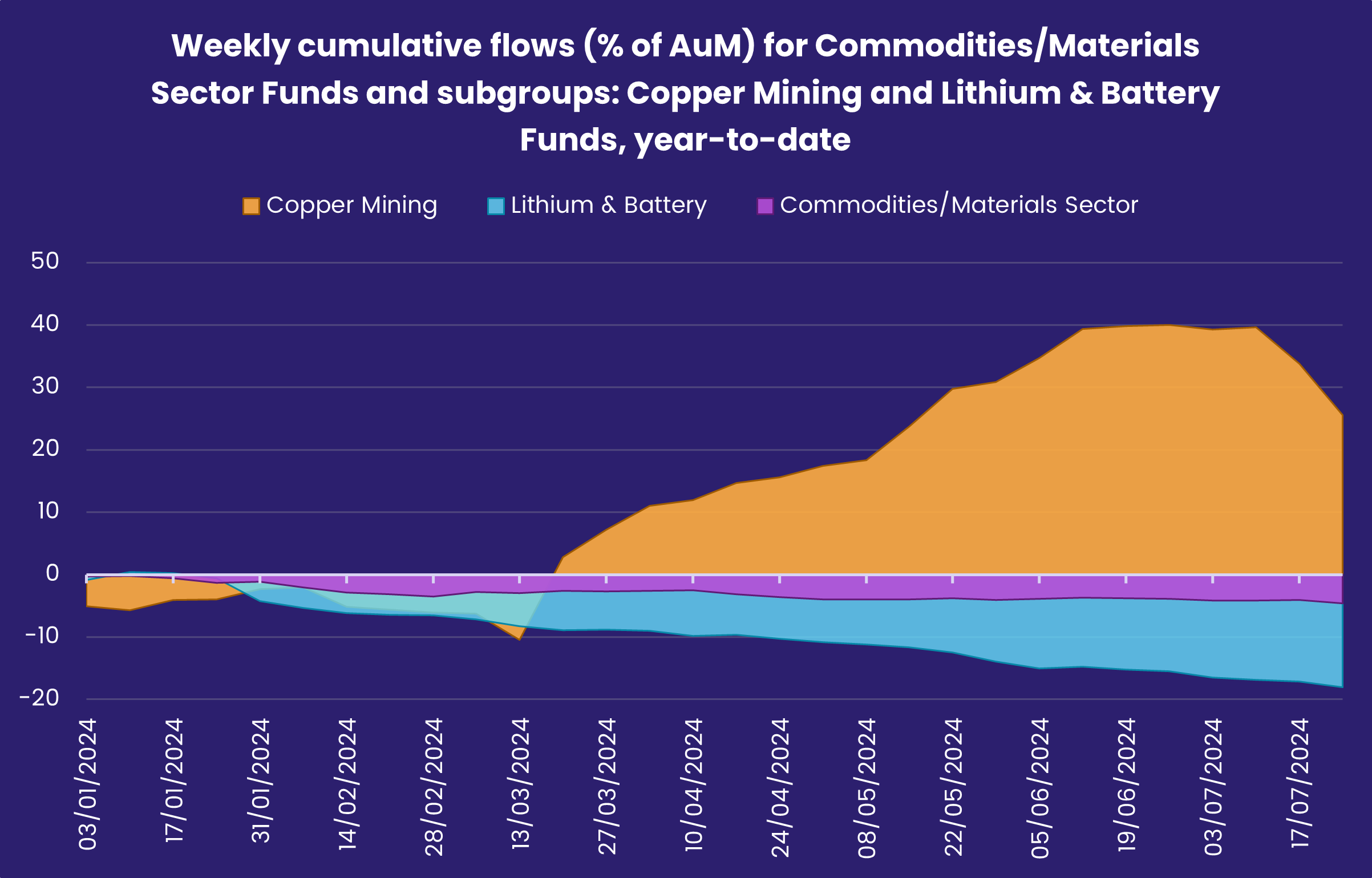

Increased competition and price wars hit US EV bellwether Tesla’s profitability, while contending against deep discounts in the US troubled Japanese automaker Nissan, and a hike in warranty expenses by Ford roiled markets, sending its stock on its biggest daily decline since 2008. Through the lens of metals tied to the EV industry, redemptions for Copper Mining Funds were the second largest on record at nearly $200 million as the group saw a second consecutive outflow for the first time since mid-March.

This contributed substantially to Commodities/Materials Sector Funds’ heaviest outflow in 14 weeks. For another EV related commodity group that has seen just four inflows in the 30 weeks year-to-date, the latest week saw redemptions for Lithium & Battery Funds climb to a seven-week high.

Outflows for Consumer Goods Sector Funds were the biggest in roughly three months and nearly three times the size of last week’s inflow. But flows at the fund level revealed little ties directly to the electric industry, as one might have expected. Instead, redemptions were centered on three funds: two staples and discretionary funds benchmarked to the S&P, and another benchmarked to the MSCI World. Electric Vehicle Funds did, however, extend their outflow streak that stretches back to the beginning of the year.

After a strong week of positive sentiment post-earnings, flows for Industrials and Financials Sector Funds took a turn towards negative territory, with outflows at 60% and 30% of the size of last week’s inflow, respectively. Redemptions for Real Estate Sector Funds were double the level of inflows seen last week, resulting in the biggest outflow the group has seen in 14 weeks.

Bond and other Fixed Income Funds

EPFR-tracked Bond Funds carried an inflow streak into the final week of July that stretches back to mid-December. The latest inflows encompassed all of the major geographic and asset class groups.

Among the former, Europe Bonds attracted over $3 billion for the second week running, US Bond Funds saw year-to-date inflows move past the $320 billion mark, flows into Asia Pacific Bond Funds climbed to a 13-week high and Emerging Markets Bond Funds posted a third consecutive inflow for the first time since mid-April.

At the asset class level, Bank Loan Funds racked up their 26th inflow of the year so far, Mortgage-Backed Bond Funds absorbed fresh money for the 30th consecutive week, investors steered money into Hstrong igh Yield Bond Funds for the 12th time over the past 14 weeks and Convertible Bond Funds recorded their biggest inflow since late March.

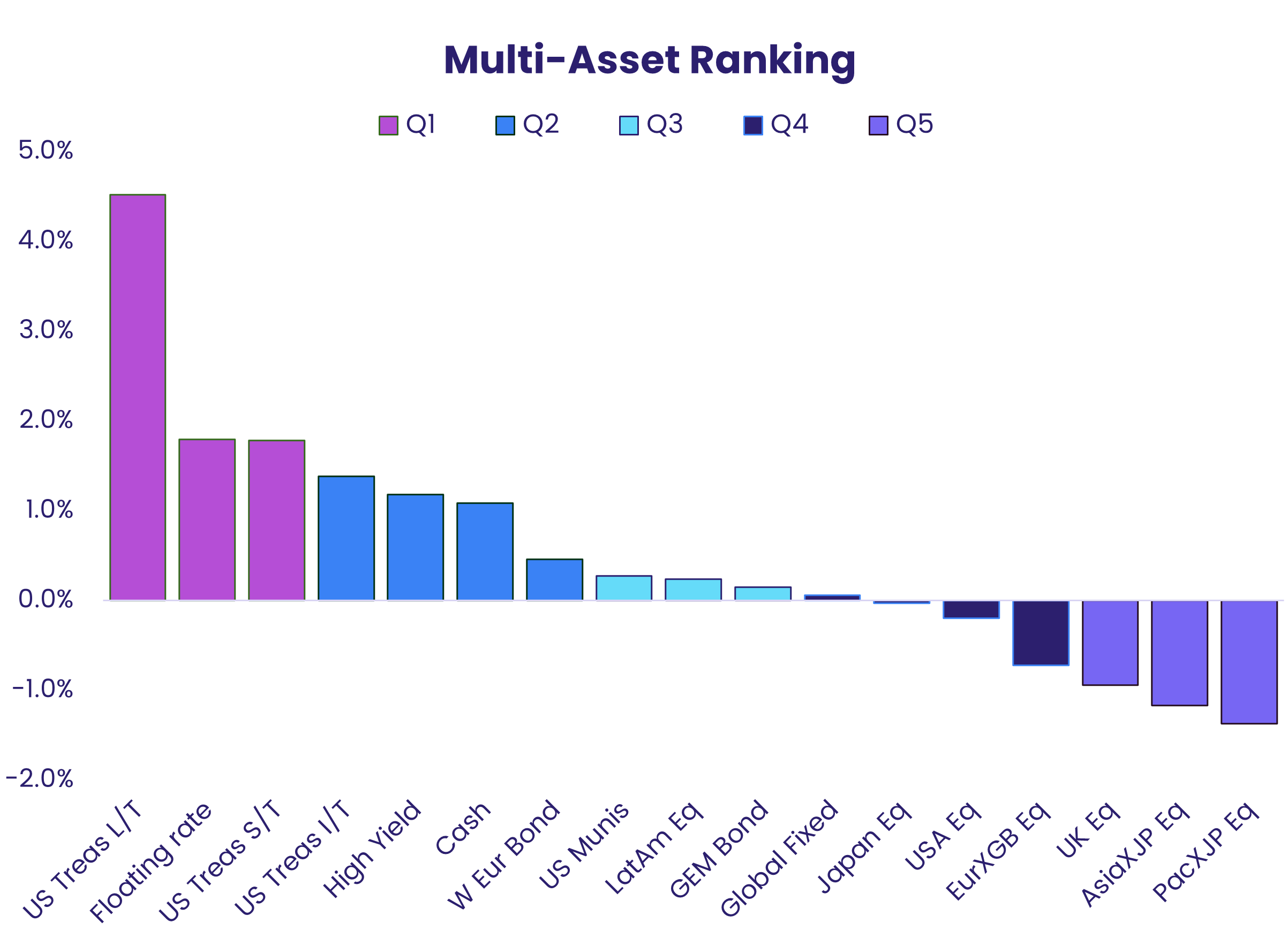

Junk bonds and bank loans remain in the top two quintiles of EPFR’s weekly Multi-Asset Rankings, while intermediate term Treasuries and emerging markets debt have climbed over the past two months out of the third and fourth quintiles, respectively.

Local Currency Emerging Markets Bond Funds enjoyed their biggest inflow since mid-April, offsetting the more than $600 million that flowed out of their hard currency counterparts, as domestically domiciled China and Korea Bond Funds both attracted solid amounts of fresh money. The latest country allocations data for GEM Bond Funds shows allocations to Mexico at a 31-month low and exposure to Brazil at its lowest level on record while weightings for Turkey, Poland and Saudi Arabia are at 40-month, 66-month and record highs respectively.

Europe Corporate Bond Funds again outgained sovereign funds by a more than 2-to-1 margin as investors keep a weather eye on France’s post-election fiscal dynamics and Italy’s uncomfortably high budget deficit.

Flows to US Bond Funds favored Long Term Corporate and Short Term Sovereign Funds as investors brace for a steeper yield curve based on the spending plans of both presidential candidates.

Did you find this useful? Get our EPFR Insights delivered to your inbox.