Another volatile week for global asset markets saw investors gravitate to funds offering exposure to gold, technology, diversified developed markets equity, dollar-denominated liquidity and European stocks during the fourth week of March.

With risk appetite still at a low ebb, especially among fixed income investors, Bank Loan Funds extended their longest run of outflows since mid-3Q24, High Yield Bond Funds posted their second outflow over the past three and there was a strong reaction to the latest bout of political unrest in Turkey with EPFR-tracked Turkey Bond and Money Market Funds both setting new outflow records.

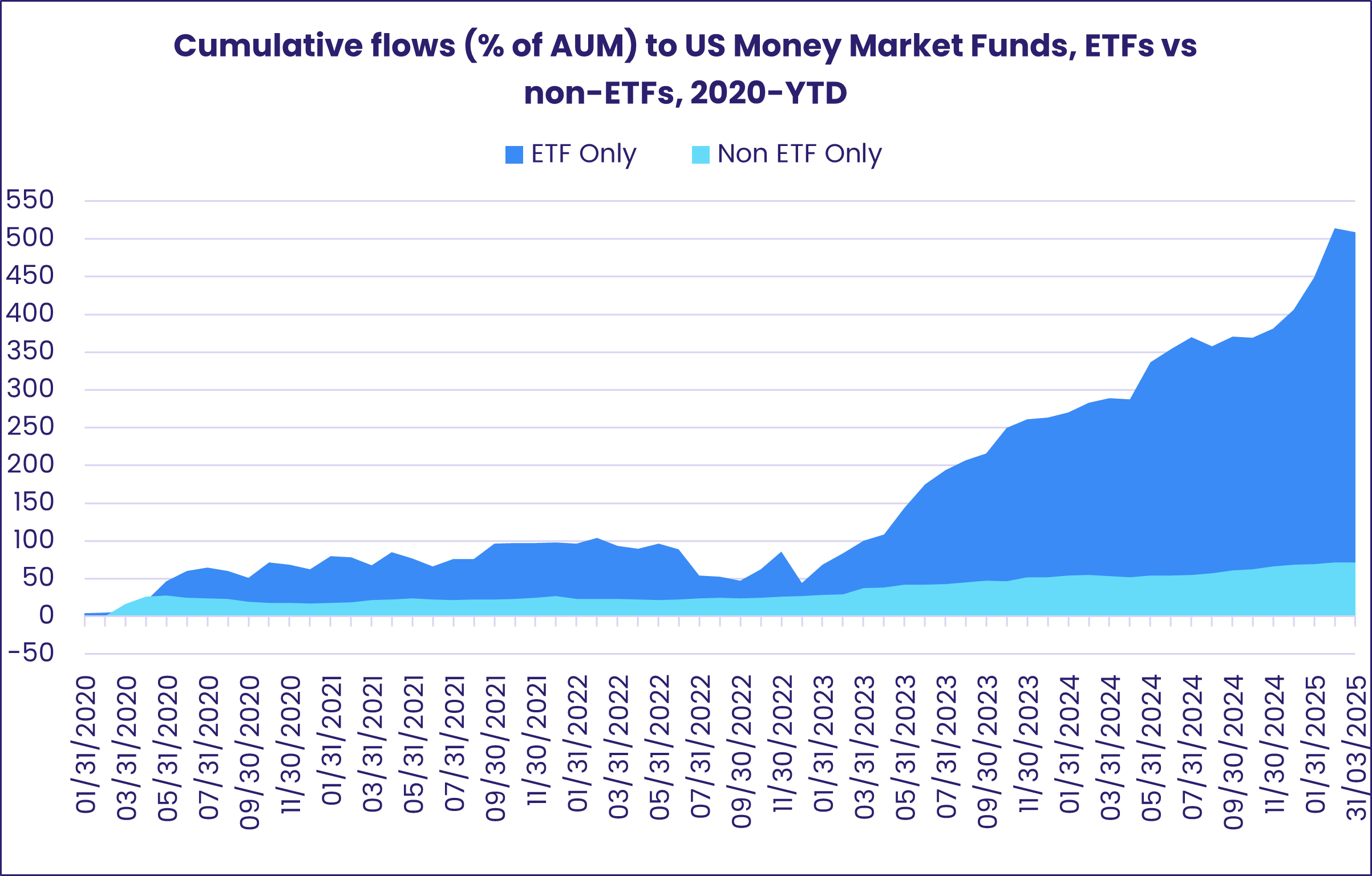

Turkey-mandated Money Market Funds were not the only liquidity fund group to endure a rough week. Redemptions from UK Money Market Funds hit a year-to-date high as British growth forecasts were slashed and markets braced for the implementation of previously announced tax hikes. But US Money Market Funds posted their eighth inflow of 2025, although US MM ETFs, which have seen a dramatic increase in assets and interest over the past year, recorded their biggest weekly outflow since EPFR started tracking them in 2010.

Overall, Money Market Funds posted a collective outflow of $13.1 billion during the fourth week of March. Investors also pulled $1.6 billion out of Balanced Funds and $12 billion out of Equity Funds while Alternative Funds absorbed a net $3.7 billion and Bond Funds $4 billion.

At the single country and asset class fund levels, Indonesia Equity Funds extended their longest run of inflows since 1Q12, Switzerland Equity Funds snapped their longest outflow streak in over eight months and Spain Money Market Funds posted their 50th inflow over the past 12 months. Derivatives Funds posted their first outflow since late August and their biggest since late 1Q23, redemptions from Copper Funds hit a six-month high and Collateralized Loan Obligation (CLO) Funds experienced record-setting redemptions.

Emerging Markets Equity Funds

Flows to Emerging Markets Country Fund groups broadened during the week ending March 26, with Korea and India-mandated funds seeing a modest influx of fresh money, offsetting the ninth outflow recorded by the diversified Global Emerging Markets (GEM) Equity Funds year-to-date. As a result, all EPFR-tracked Emerging Markets Equity Funds posted back-to-back inflows for the first time since early December.

The latest week saw EM Leveraged Equity Funds post their fourth inflow of the year and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates chalk up their biggest outflow in over four months. European domiciled funds recorded their fifth inflow over the past six weeks while funds based in Japan tallied their 24th outflow since mid-October.

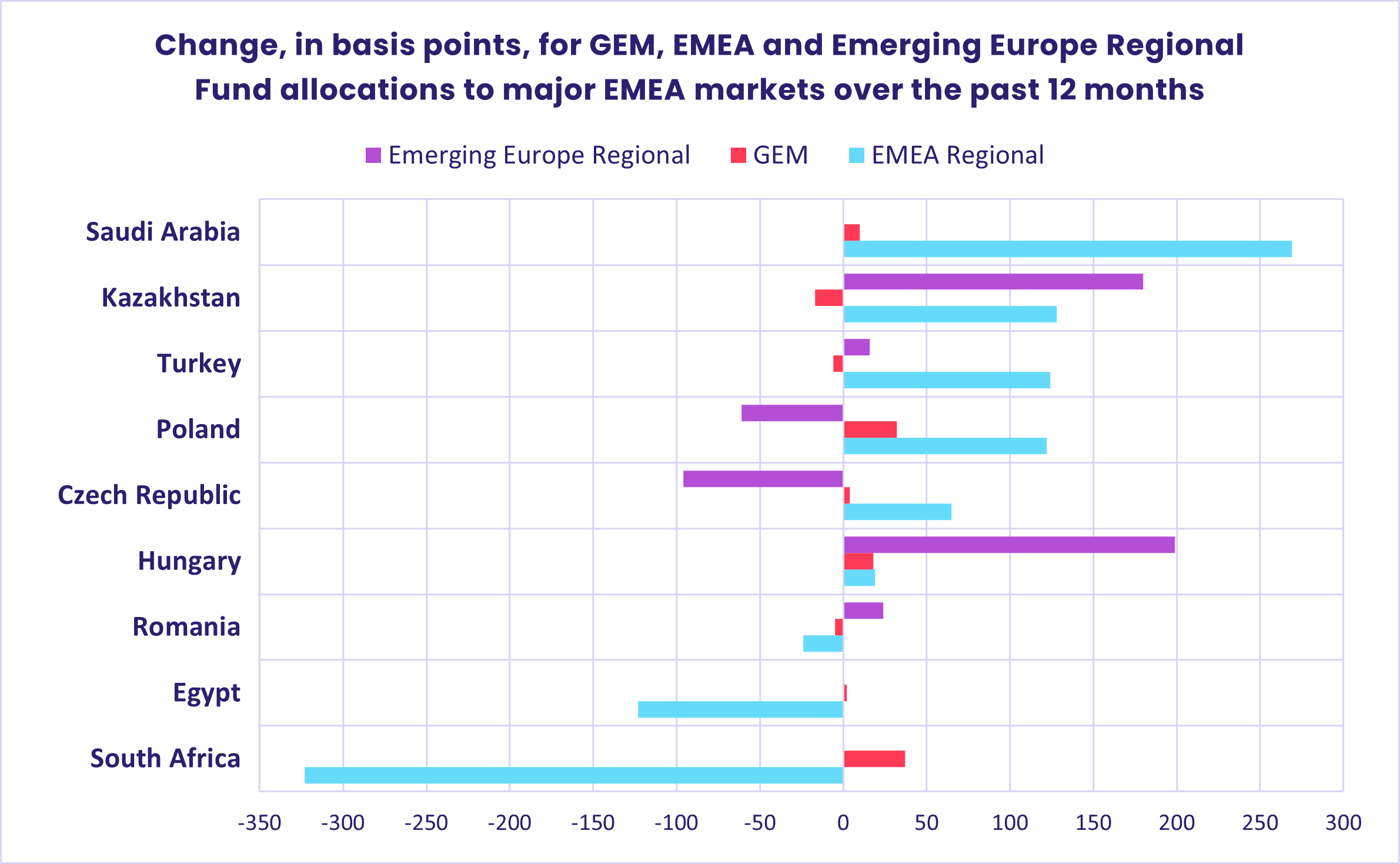

Interest in EMEA markets remains high, with oil producers getting a closer look after US President Donald Trump threatened fresh tariffs on oil products originating from Venezuela. Flows into Qatar and Kuwait Equity Funds hit their highest levels since 1Q24 and 4Q19, respectively, while Saudi Arabia Equity Funds extended their longest inflow streak in over five years. Saudi Arabia is the market that has seen the biggest increase in its allocation among EMEA Regional Funds during the past 12 months.

While the arrest of opposition politician Ekrem Imamoglu roiled Turkish debt and cash markets, equity investors saw an opportunity. Over $200 million, a two-year high, flowed into Turkey Equity Funds.

Among the Asia ex-Japan Country Fund groups, India Equity Funds posted their first inflow since the final week of 2024 and their biggest since late September as Indian equity markets staged a rally. Meanwhile, flows into Korea Equity Funds climbed to a 15-week high as that country’s benchmark index picked up a tailwind from renewed interest in semiconductor plays.

Latin America Equity Funds recorded an overall inflow despite further redemptions from Argentina Equity Funds and the first consecutive outflows from Mexico Equity Funds since late December.

Developed Markets Equity Funds

EPFR-tracked Developed Markets Equity Funds posted their biggest outflow of 2025 during the week ending March as redemptions from US Equity Funds offset solid flows into the other major groups. Year-to-date, the overall group has absorbed a net $166 billion compared to $79.5 billion during the first three months of last year and $225 billon during the final three.

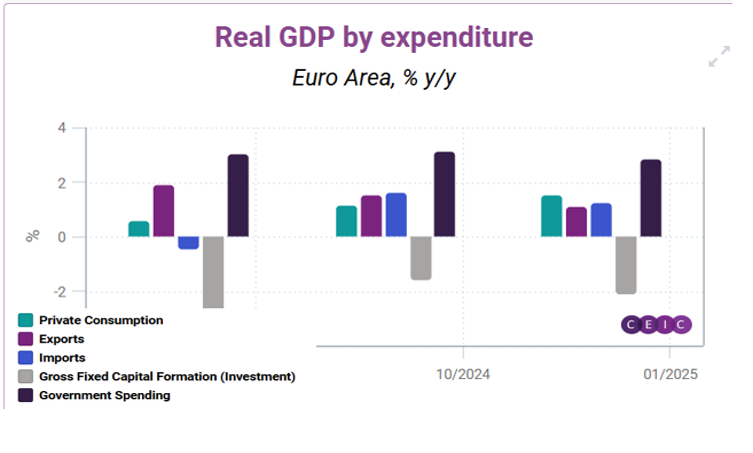

Europe Equity Funds extended their latest inflow streak, but the headline number was lower than the previous week’s for the first time since the fourth week of February. Investors continue to favor exposure to core European markets over those outside the European Union, with Germany Equity Funds pulling in over $800 million and UK Equity Funds surrendering north of $900 million. Some analysts are beginning to ask if the European rearmament is beginning to run too far ahead of the facts on the ground. This includes another quarter where private business investment in the Eurozone was down year-on-year.

The Asia Pacific Equity Fund groups also enjoyed a good week. Japan Equity Funds took in over $1 billion for the fourth time during the past five weeks, flows into Pacific Regional Equity Funds hit their highest level since late 3Q23 and Australia Equity Funds tallied their 11th inflow of the year so far. In the case of the latter, investors are responding to the more accommodative fiscal and monetary policies being deployed to counter the uncertain outlook for global trade.

US Equity Funds saw two-thirds of the previous week’s inflows reversed, with Large Cap Value Funds making the biggest contribution to the headline number and Large Cap Blends Funds the only major group to post a collective inflow. US Leveraged Equity Funds tallied their fifth straight inflow while flows into US Bear Funds climbed to a five-week high. The latest sector allocations data shows that exposure by actively managed US Equity Funds to financial plays is at its highest level since mid-1Q20 while allocations to industrial stocks are at a 28-month low.

The largest of the diversified Developed Markets Equity Funds groups, Global Equity Funds, saw flows continue their recent rebound.

Global sector, Industry and Precious Metals Funds

The final week of March saw a spike in the total trading volume (the absolute value of outflows + inflows) for the 11 EPFR-tracked Sector Funds, as it climbed to nearly $10.5 billion. That was the second-largest total over the past six months, following close behind the $13 billion experienced in late January. Four of the 11 EPFR-tracked Sector Fund groups posted inflows, with Financials and Technology Sector Funds both seeing over $1 billion flow in. Meanwhile, redemptions for Consumer Goods and Energy Sector Funds neared or exceeded the $1 billion mark, and Real Estate Sector Funds saw over $1.6 billion flow out.

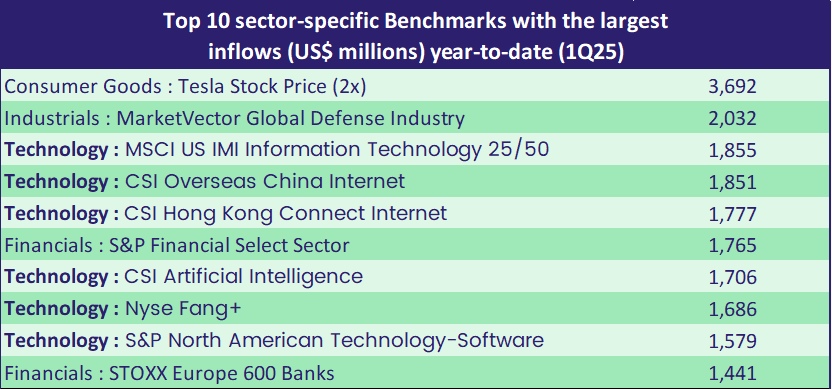

Analyzing flows through the prism of benchmarks, investors have pumped over $3.5 billion so far this year into all funds tracking a benchmark that offers 2x leveraged exposure to Tesla’s stock price movements. This has been followed by over $2 billion flowing into an Industrials Sector, Defense benchmark. Meanwhile, themes among the Technology-specific benchmarks with the biggest inflows this quarter include Internet, Artificial Intelligence, and Software. And in the 10th rank, funds tracking European Banks have seen a net positive flow, while those tied to a Regional Banks benchmark have been dumped.

Industrials and Financials Sector Funds both extended their inflow streaks to four weeks. In the case of the latter, a record high inflow for Bank Funds (excluding regional banks) at 3.3% of assets underpinned the headline number for all Financials Sector Funds. That group has experienced just a single outflow since mid-December and has seen the level of inflows climb consecutively for six straight weeks. Flows have exceeded $5 billion in the first quarter of this year, far above their previous record of $3.6 billion just last quarter. Prior to last year, quarterly flows exceeded $3 billion only twice but followed a similar pattern with once in 4Q20 and the next quarter in 1Q21.

Technology Sector Funds posted their biggest inflow in eight weeks. Flows were more broadly based than in previous weeks, with 13 funds attracting over $100 million each. Of which, seven were dedicated to China and four to the US.

Flows into Physical Gold Funds pushed higher for a fourth consecutive week. That put the total for their current streak over the $20 billion mark, with half of that directed by funds tracking the LBMA Gold Price, the global benchmark for unallocated gold delivered in London. The price of gold dipped at the end of February to below $2,850 per ounce, but 10 days later it surpassed $3,000 and another 10 days later – bringing us to Mar 26 – it has reached a record $3,052 per ounce.

Bond and other Fixed Income Funds

EPFR-tracked Bond Funds saw net flows drop for the fourth week running in late March, coming in at their lowest level since the final week of 2024, against a backdrop of rising sovereign issuance worldwide.

This month has seen the UK’s fiscal watchdog increase its estimate of the five-year borrowing requirement by $50 billion, Germany’s incoming government signal that it will take its foot off the country’s so called debt brake, Japan facing a significant jump in the cost of servicing of its debt, Australia unveil a deficit-boosting budget, China lift its debt ceiling and the US remain on track for another $1 trillion plus deficit.

US Bond Funds posted their smallest inflow year-to-date during the week ending March 26, Global Bond Funds extended their longest redemption streak since mid-4Q23 and Emerging Markets Bond Funds chalked up their third consecutive outflow.

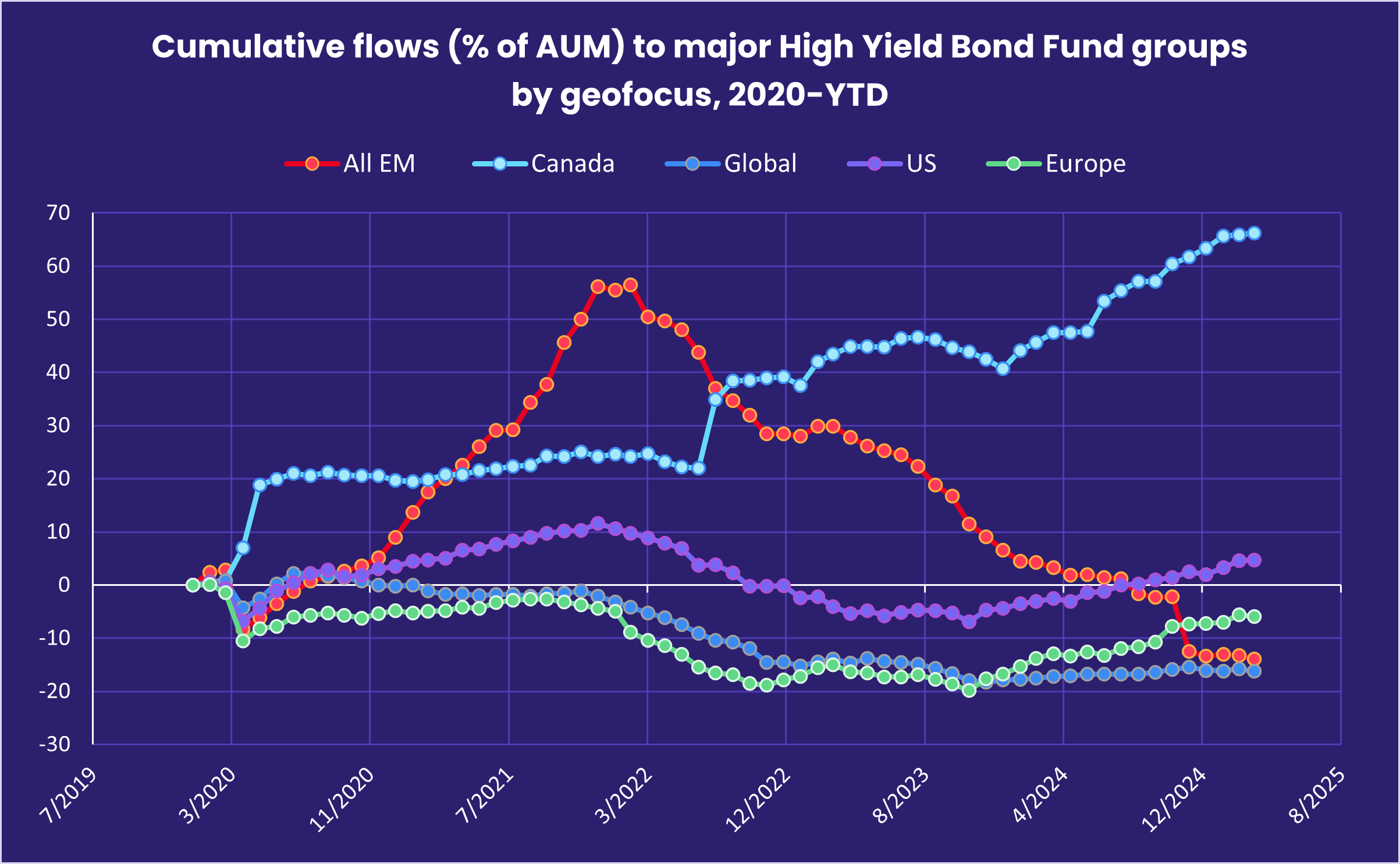

At the asset class level, Inflation Protected Bond Funds took in fresh money for the 11th straight week, investors pulled money out of Bank Loan Funds for the third week running and High Yield Bond Funds posted their second outflow of the month.

The latest flows into US Bond Funds did include the first inflow for retail share classes in three weeks, the ending of the longest outflow streak for funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates since 4Q23 and another week of flows into foreign domiciled US Bond Funds. In relative terms, investors looked north with Canada Bond Funds recording an inflow that in % of AUM terms was 15 times larger than the one recorded by US Bond Funds.

Europe Bond Funds recorded solid inflows that favored regional over dedicated country groups and funds with sovereign debt mandates over their corporate counterparts.

Two country fund groups dominated the flow picture for Emerging Markets Bonds Funds, with China Bond Funds posting their fourth-largest inflow since the beginning of 2022 and Turkey Bond Funds experiencing their heaviest redemptions since EPFR started tracking them. In the case of the latter, which followed the arrest of Istanbul’s mayor, the outflows were broadly based with 24 funds seeing more than a fifth of their AUM redeemed.

Did you find this useful? Get our EPFR Insights delivered to your inbox.