Coming out of the Thanksgiving holiday, investors stuck to their US-centric course ahead of more good news on the inflation front. US Money Market, Equity and Bond Funds pulled in another $94 billion between them during the final week of November, lifting combined month-to-date inflows for the three groups over the $245 billion mark.

The focus on the US left other groups in the shade. Emerging Markets Equity and Bond Funds posted their seventh and 18th consecutive outflows, Europe Equity Funds extended a redemption streak stretching back to mid-March and Japan Equity Funds recorded their biggest outflow in over eight months.

Overall, EPFR-tracked Equity Funds absorbed a collective $2.6 billion during the final week of November while Bond Funds pulled in $3.7 billion and Money Market Funds added $75.6 billion despite the second largest weekly outflow from Europe Money Market Funds year-to-date. Balanced Funds saw another $3.4 billion flow out and Alternative Funds experienced their heaviest redemptions since the first week of October.

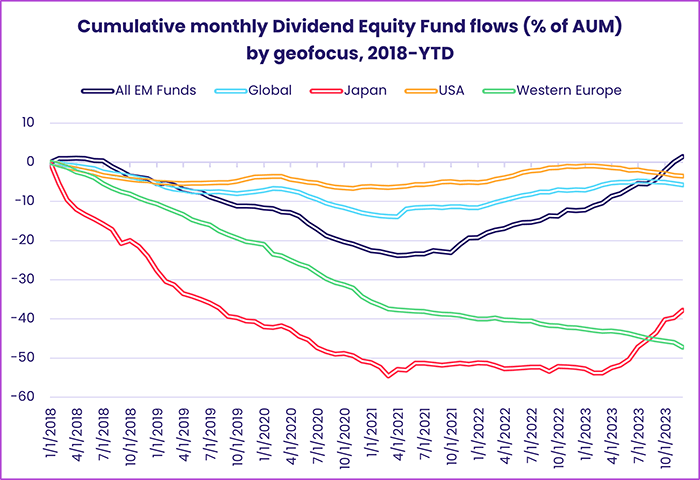

Dividend Equity Funds posted their third inflow of the past eight weeks. Since the beginning of August, Developed Markets Dividend Equity Funds have surrendered $17.2 billion while their emerging markets counterparts have absorbed $4.8 billion.

At the single country and asset class fund levels, redemptions from Korea Equity Funds hit an 18-week high while Korea Bond and Money Market Funds posted their biggest inflows since early 1Q23 and on record, respectively. Cryptocurrency Funds extended their longest inflow streak in nearly two years, Inflation Protected Bond Funds chalked up their 12th consecutive outflow and Mortgage-Backed Bond Funds recorded their seventh inflow over the past eight weeks.

Emerging markets equity funds

Although hopes of easier US monetary policy usually provides a tailwind for emerging markets assets, EPFR-tracked Emerging Markets Equity Funds ended November by extending their longest redemption streak in over three years. Uncertainty about the trajectory of Chinese economic growth, the mixed outlook for commodity prices and geopolitical clouds over the EMEA universe have sapped investor sentiment during the current quarter.

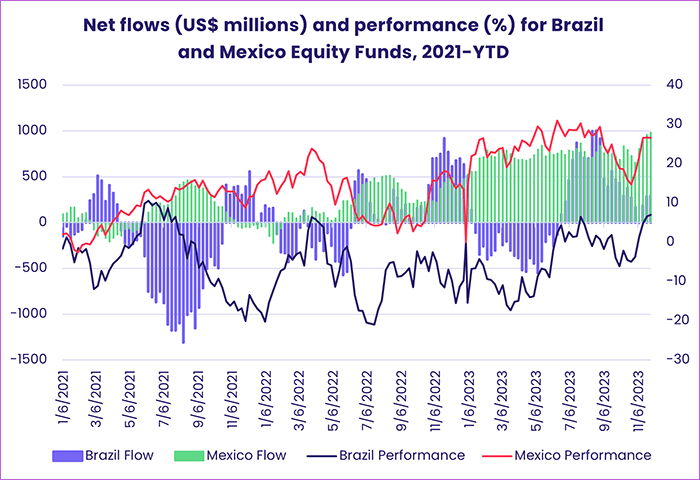

While Asia ex-Japan, EMEA and the diversified Global Emerging Markets (GEM) Equity Funds have struggled to attract fresh money in 4Q23, the prospect of a reform story in Argentina and new leadership in Mexico next year have given Latin America Equity Funds a lift. The group as a whole took in fresh money for the fourth straight week as both Mexico and Brazil Equity Funds recorded solid inflows.

Among the major Asia ex-Japan Country Fund groups, India Equity Funds absorbed another $342 million while China, Taiwan (POC) and Hong Kong (SAR) Equity Funds pulled in over $100 million apiece. Both domestically and foreign-domiciled Korea Equity Funds posted outflows, the former being the biggest since the fourth week of July, and the biggest since the second week of April for the latter.

For the second week running, Turkey Equity Funds made the biggest contribution to the headline number for all EMEA Equity Funds as Turkish policymakers struggle to bring an inflation rate still running north of 60%. With Russia off limits, South Africa is now the EMEA market with the biggest allocation among GEM Equity Funds followed by Saudi Arabia, Poland, Turkey and Kazakhstan.

Frontier Markets Equity Funds, which are dedicated to the riskiest emerging markets, posted a third straight outflow for the first time since August.

Developed markets equity funds

Investors kept faith with the US ‘soft landing’ narrative in late November, steering another $8 billion into US Equity Funds and shunning most of the other major Developed Markets Equity Funds groups. Their faith was rewarded with the lowest reading for the Federal Reserve’s preferred measure of inflation, the Core Personal Consumption Expenditures (PCE), since April 2021.

While US Equity Funds are making up some of the ground they lost during the first five months of the year, when $95 billion was redeemed, Europe Equity Funds continue to see money flow out. Going into the final month of 2023, investors have pulled over $65 billion out of Europe Equity Funds year-to-date.

The latest redemptions came as recent data shows the French and German economies shrank during the third quarter, though Eurozone inflation in November moved another step closer to the European Central Bank’s 2% target. At the country level, outflows from Sweden Equity Funds hit a 34-week high and Austria Equity Funds extended a redemption streak stretching back to mid-February.

Japan Equity Funds posted their biggest outflow since early March on the heels of disappointing 3Q23 GDP data and uncertainty about the timing of any shift by the Bank of Japan to a less accommodative suite of policies. The growing willingness of Japanese companies to return money to shareholders, however, was reflected in the flows into Japan Dividend Funds which hit a level last seen in mid-3Q19.

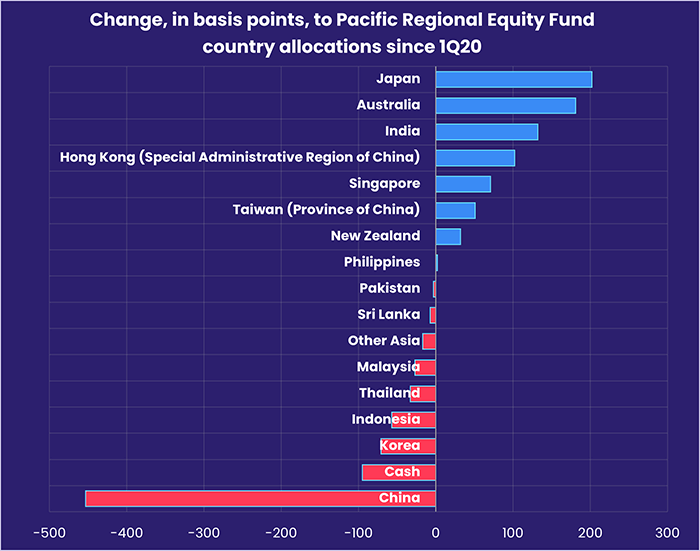

With Global and Pacific Regional Equity Fund flows also in the red, Japanese equities faced a headwind from the major diversified Developed Markets Equity Fund groups.

Lack of retail support and outflows from foreign domiciled funds did not stop US Equity Funds overall from posting their sixth straight inflow, the longest such run since 2Q22. Leveraged Funds recorded their first collective inflow since mid-October, and US Dividend Funds posted consecutive weekly inflows for the first time since late March.

Looking ahead, US Equity Funds are heading into peak ex-dividend season, a dynamic that can produce big swings in flow numbers because of the gap between dividends being paid and re-invested. “When funds pay out accumulated dividends they appear as outflows,” explains EPFR Data Director Ian Wilson. “The bulk of these dividends are reinvested, showing up as inflows a few days later, so if a lot of funds go ex-dividend towards the end of a given reporting period you end up with exaggeratedly large outflows one week and correspondingly outsized inflows the following week.”

Global sector, industry and precious metals funds

For three out of every four weeks year-to-date, and for the past 16 consecutive weeks, the number of EPFR-tracked Sector Fund groups posting outflows has exceeded those recording inflows. In the final week of November, four of the 11 major groups reported inflows ranging from $103 million for Utilities Sector Funds to $1.38 billion for Financials Sector Funds.

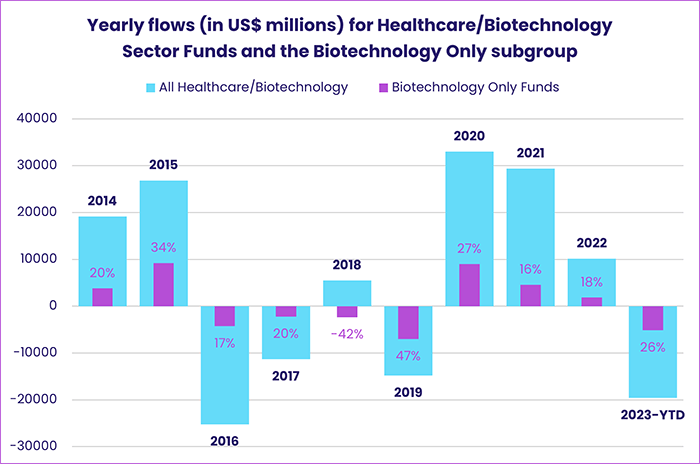

Healthcare/Biotechnology Sector Funds experienced the heaviest redemptions among all groups for the third week running. If this pattern continues, year-to-date redemptions, which already stand at a seven-year high, will likely hit $20 billion with pure Biotechnology Funds accounting for a quarter of that total.

Although Technology Sector Funds extended their current run of inflows to four weeks, with a single information-related fund taking in over $1.3 billion, two major subgroups brought the headline number down. Redemptions from Software Funds hit $1 billion this week – the largest since EPFR started tracking these funds in the early 2000s – and brought an end to their four-week, $1.85 billion inflow streak while Semiconductor Funds extended their outflow streak to five weeks and $1.5 billion, the longest since a seven-week stretch in early 3Q21.

On the back of a second weekly inflow above $1 billion for US Financials Sector Funds and a 37-week high inflow for Canada-dedicated funds, Financials Sector Funds posted their biggest inflow since mid-3Q22. China Financials Sector Funds saw their biggest inflow since the final week of August while Japan Financials Sector Funds posted their biggest outflow on record after receiving inflows for the past six weeks.

The fifth straight week of inflows for China Real Estate Sector Funds and the largest for South Africa-dedicated funds since mid-2Q23 did little to move the needle for the overall group, which posted its fifth consecutive outflow.

Bond and other fixed income funds

EPFR-tracked Bond Funds ended November by chalking up their eighth consecutive inflow and 44th year-to-date ahead of inflation data for the US and Eurozone showing further progress towards central bank targets.

Risk appetite among fixed income investors remains higher than it was in August, September and October. Investors steered another $1.4 billion into High Yield Bond Funds while flows into Local Currency Emerging Markets Bond Funds hit a 19-week high and Hard Currency EM Bond Funds posted consecutive inflows for the first time since mid-July.

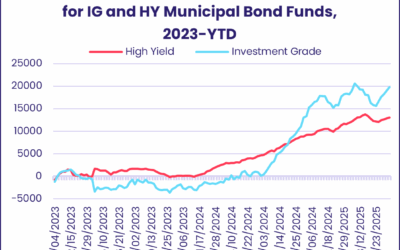

With inflation rates dropping on both sides of the Atlantic, Inflation Protected Bond Funds saw year-to-date redemptions hit $33 billion and Municipal Bond Funds extended their longest inflow streak since a six-week run ended in early 1Q22.

Total Return Funds posted their first inflow since early October but the other major multi asset group, Balanced Funds, racked up their 34th consecutive outflow despite the fact their collective YTD performance stands at 5.6% versus 0.8% for Total Return Funds.

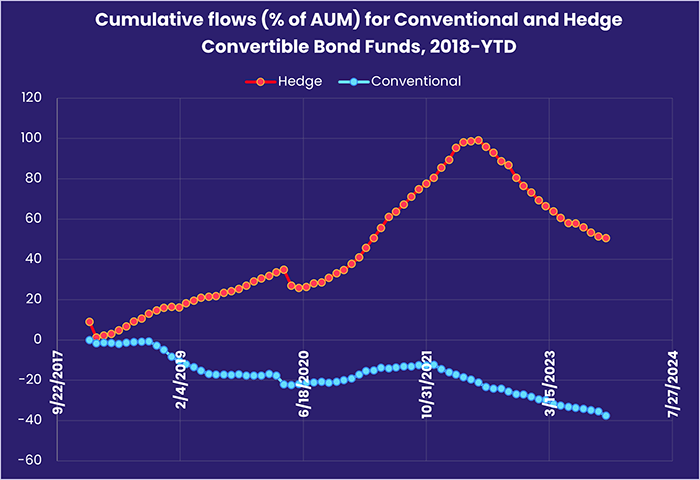

Appetite for exposure to convertible bonds is also subdued. Conventional funds dedicated to these bonds, which provide the option for conversion to equity if preset conditions are met, have now posted outflows for 22 straight weeks. Flows for Convertible Bond Hedge Funds, which peaked in 2Q22, are also on the downswing.

Among the major groups by geographic focus, Europe Bond Funds recorded their biggest inflow since early June as investors showed a marked preference for diversified regional exposure. Meanwhile, redemptions from Austria and Germany Bond Funds hit 42-week highs while outflows from France and Belgium Bond Funds came in at 202-week and record highs, respectively.

US Bond Funds racked up their 47th weekly inflow year-to-date as flows into both High Yield and Investment Grade Corporate Funds offset redemptions from US Sovereign Bond Funds, which extended their longest run of outflows since 4Q20 despite solid commitments to Long Term Sovereign Funds.

While Emerging Markets Bond Funds again came close overall to snapping their current outflow streak, retail share classes saw money flow out for the 12th week running, and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their 16th outflow over the past 17 weeks.

Did you find this useful? Get our EPFR Insights delivered to your inbox.