Investors took a cautious approach to most asset classes during the third week of April, with lackluster inflows or modest outflows being the norm for many EPFR-tracked fund groups. Japan Equity and Mortgage-Backed Bond Funds were notable exceptions.

The caution, which stemmed from uncertainty about inflation in the US, turned out to be justified. The day after the latest reporting period ended, data showed first quarter economic growth in the world’s largest economy significantly undershot expectations while the Federal Reserve’s preferred measure of inflation – the core Personal Consumption Expenditure (PCE) index – went up 3.7% year-on-year for the same period. That added to existing fears that the Fed, which at the beginning of 2024 was expected to cut rates six times by the year’s end, may feel compelled to raise them further.

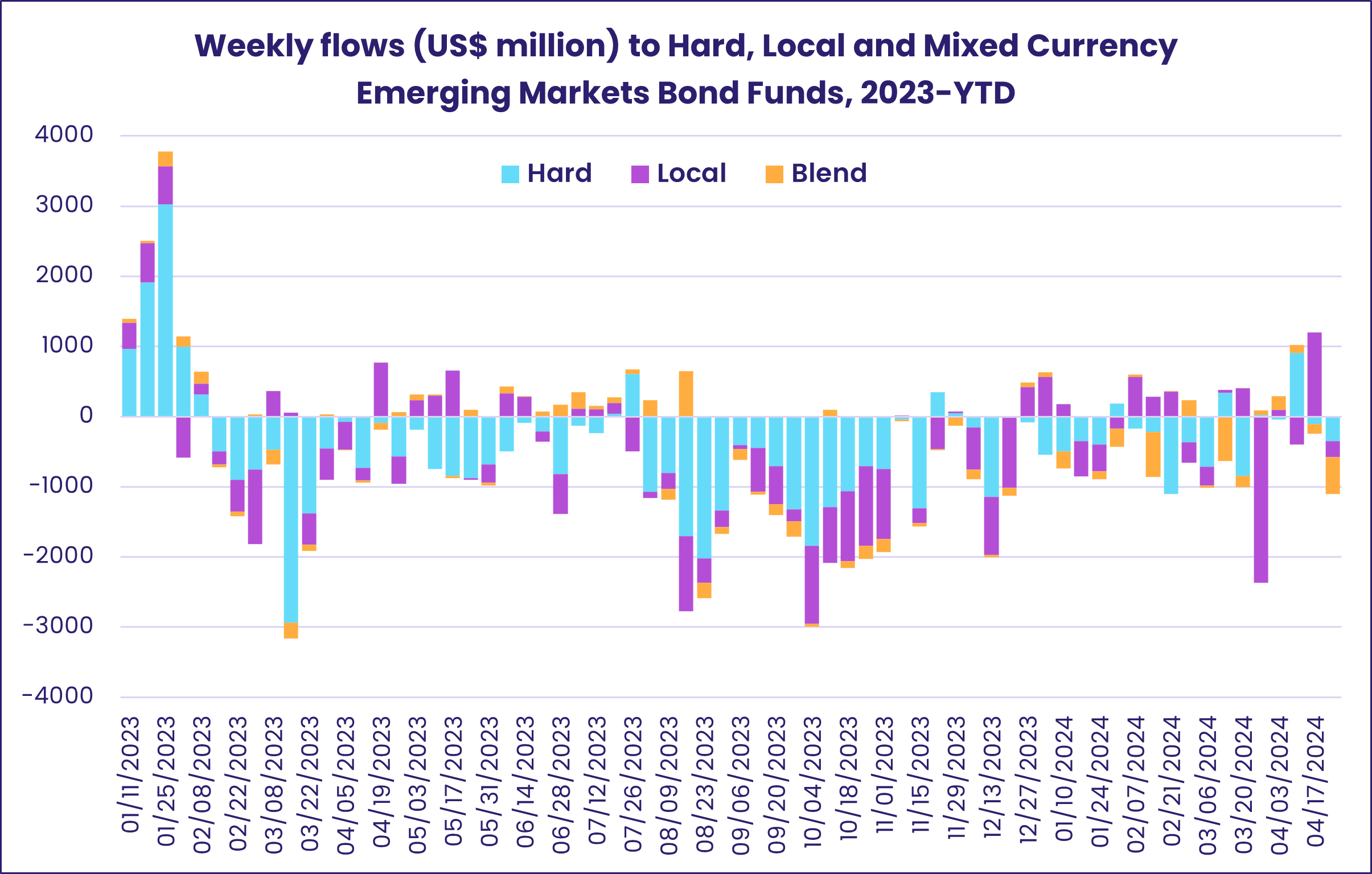

Ahead of these numbers, eight of the 11 major Sector Fund groups posted outflows, Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates extended their record-setting outflow streak and Emerging Markets Bond Funds saw their longest run of inflows since the first half of 1Q23 come to an end.

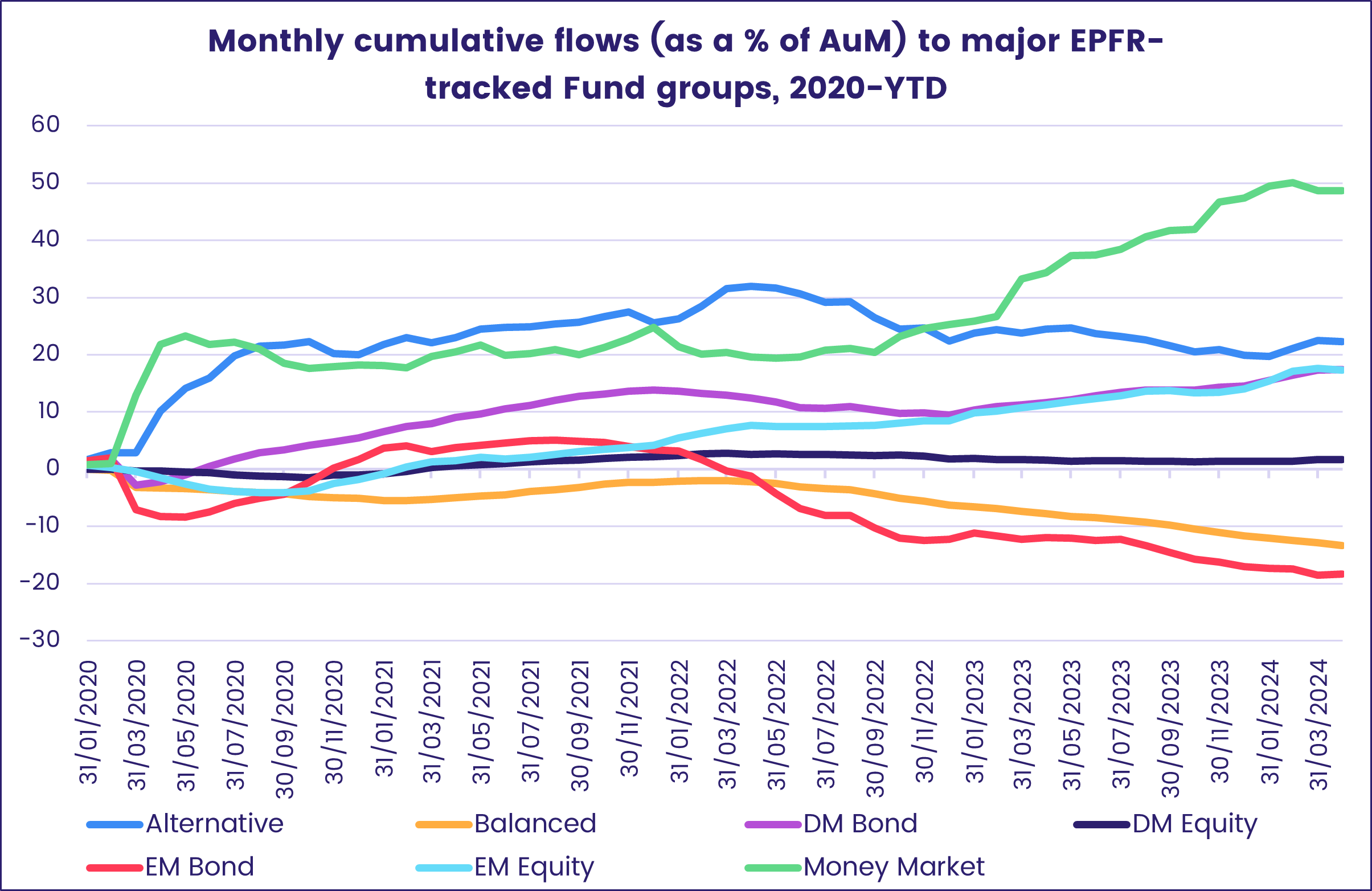

Overall, EPFR-tracked Equity and Bond Funds both posted collective inflows of over $3.5 billion during the week ending April 24 while Alternative, Balanced and Money Market Funds posted outflows of $807 million, $4.4 billion and $5.7 billion, respectively.

At the single country and asset class fund levels, flows into South Africa Money Market and France Bond Funds hit 21 and 77-week highs, respectively, while Spain Equity Funds posted their ninth straight outflow and redemptions from Spain Bond Funds hit a level last seen in early 3Q22. Convertible Bond Funds chalked up their 14th outflow year-to-date, investors pulled over $1 billion out of Derivatives Funds and Physical Gold Funds saw money flow out for the 15th time over the past 17 weeks.

Emerging Markets Equity Funds

With the year not yet a third over, emerging markets are looking at a global landscape marked at one end by an increasingly protectionist US where interest rates might even get higher before the longed-for pivot occurs and, at the other end, by Chinese exporters competing even more aggressively to sell what domestic consumers can’t or won’t buy. During the latest week, EPFR-tracked Emerging Markets Equity Funds posted their sixth outflow since the beginning of March as redemptions from EMEA and the diversified Global Emerging Markets (GEM) Equity Funds offset modest flows into Latin America and Asia ex-Japan Equity Funds.

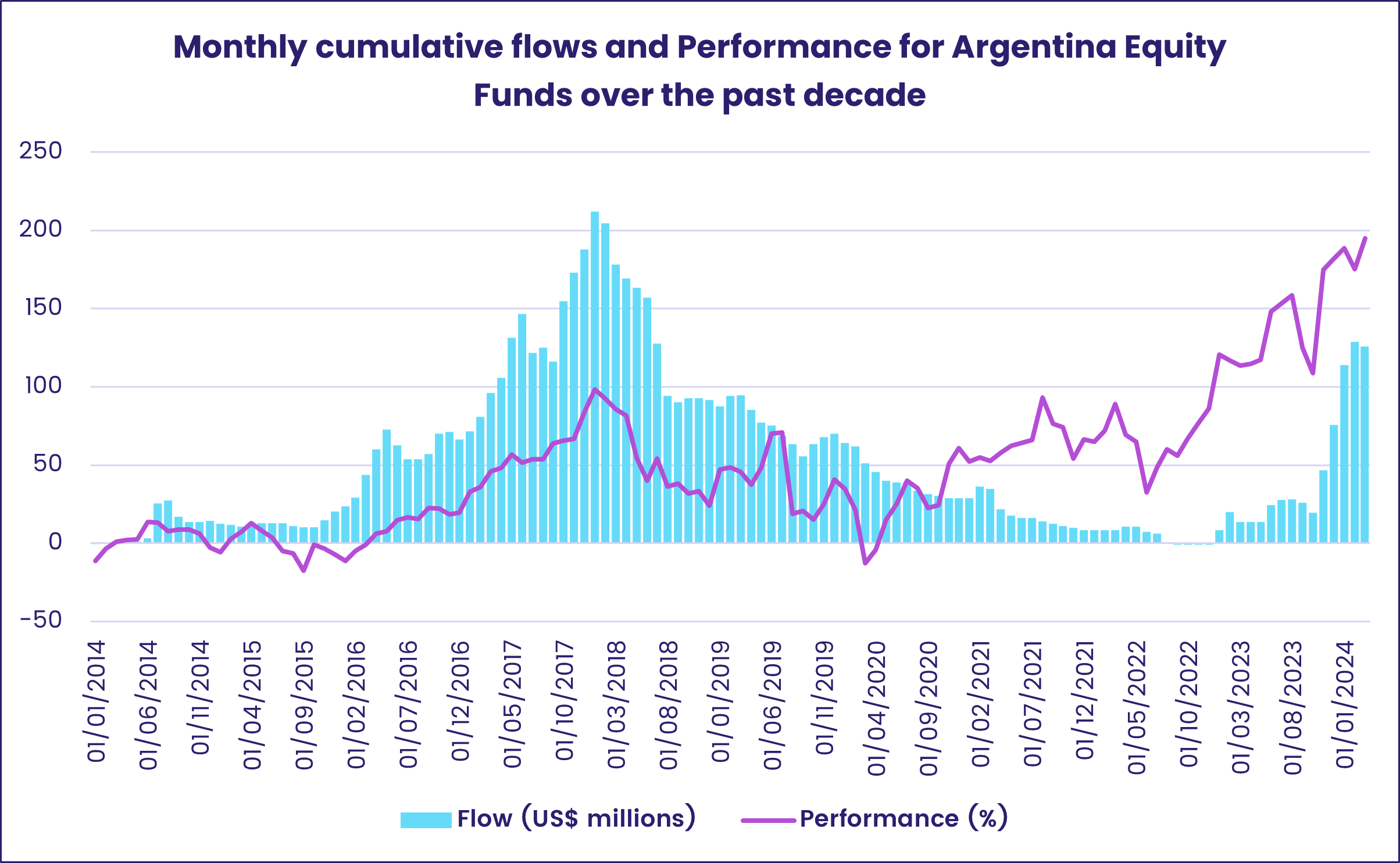

The flows into Latin America Equity Funds snapped their six-week outflow streak, with Brazil Equity Funds posting consecutive weekly inflows for the first time since mid-December and Argentina’s reform story attracting the biggest weekly commitment to Argentina Equity Funds in three months. But GEM Equity Fund managers have a less bullish perspective when it comes to Javier Milei’s efforts to shake up Argentina’s economy: the latest country allocations data shows the country’s average weighting at a 51-month low.

Among the Emerging Asian markets, GEM Fund allocations for Korea and Taiwan (POC) hit 30-month and record highs coming into the second quarter. Taiwan (POC) Equity Funds pulled in another $1.1 billion during the latest week and India Equity Funds racked up their 58th consecutive inflow while China Equity Funds extended their longest redemption streak since 2Q20. India Equity Funds domiciled in Japan have not posted a collective outflow since the first week of 4Q22.

EMEA Equity Funds recorded their eighth consecutive outflow despite Israel and Iran pulling their punches. Investors pulled money out of South Africa Equity Funds for the ninth time over the past 12 weeks as they looked ahead to the general election scheduled for late May. The ruling African National Congress Party is expected to lose its majority, and markets fear it will be forced to seek a coalition with more radical parties.

Developed Markets Equity Funds

The third week of April saw the latest corporate earnings season kick into high gear ahead of key GDP and inflation updates for the US economy. Against this backdrop, EPFR-tracked Developed Markets Equity Funds posted a modest inflow driven by strong flows to Japan Equity Funds and more pedestrian flows to US Equity Funds.

Japan Equity Funds recorded their biggest weekly inflow since mid-2Q13, when the benchmark Nikkei-225 index climbed past the 15,000 point level for the first time in five years and 1Q13 GDP growth accelerated to an annualized rate of 3.5%. During the latest week the Nikkei-225 was camped around 37,500 points and 22 funds took in over $30 million with 12 of those absorbing over $100 million. Flows into retail share classes hit a 29-week high and Leveraged Japan Equity Funds posted their biggest headline number in 18 months.

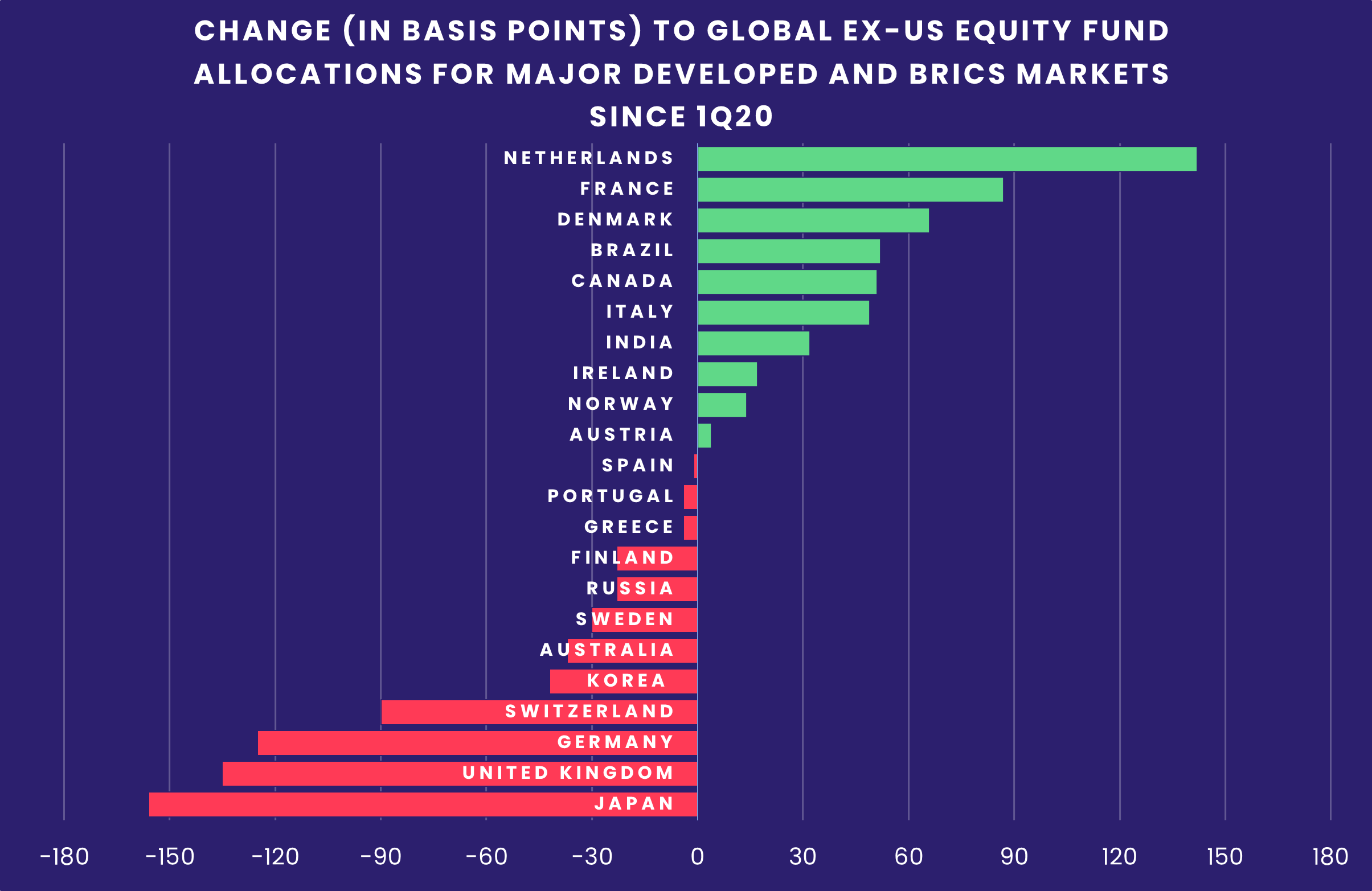

The enthusiasm for Japan displayed by investors has spread to Global ex-US Equity Fund managers, who increased their exposure to Japan by nearly 2% between April 2023 and January before tapping the brakes. But, over the past four years Japan’s average allocation has seen the biggest drop among major developed markets.

Since 2020, Global ex-US Equity Funds have rotated exposure from Australia to the developed markets resource play – Canada – geared to US economic growth. But, going into the final week of April, both Canada and Australia Equity Funds saw over $250 million redeemed.

US Equity Funds posted an inflow despite growing fears that the Federal Reserve will not cut rates until 2025. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates extended their longest outflow streak since 2Q17 and over $2 billion flowed out of retail share classes. In the previous week to April 17, foreign-domiciled US Equity Funds posted their second collective outflow since the third week of December and biggest in over 10 months.

Redemptions from Europe Equity Funds moderated, but did not end, as investors continued to debate whether or not the European Central Bank will start cutting interest rates at its June meeting and the earnings calendar moved into a higher gear. At the country level, redemptions from Italy Equity Funds hit a 25-week high, Spain Equity Funds chalked up their ninth straight outflow and Greece Equity Funds added to their current outflow streak.

Global sector, Industry and Precious Metals Funds

As waves of mixed US earnings results rolled in from the likes of Tesla, Boeing, Ford and Meta, sector-oriented investors struggled to get a fix on a market where interest rates could stay at current levels into 2025. For the second week running, eight of the 11 EPFR-tracked Sector Fund groups reported outflows. The usual suspects – Industrials and Technology Sector Funds – recorded inflows while Consumer Goods and Utilities Sector Funds saw the pace of redemptions accelerate.

The week’s biggest inflow was – as expected – posted by Technology Sector Funds. However, although over $1 billion flowed into dedicated Semiconductor Funds, the latest total was nowhere near the magnitude of flows seen during the first 15 weeks of 2024 which averaged $2.5 billion.

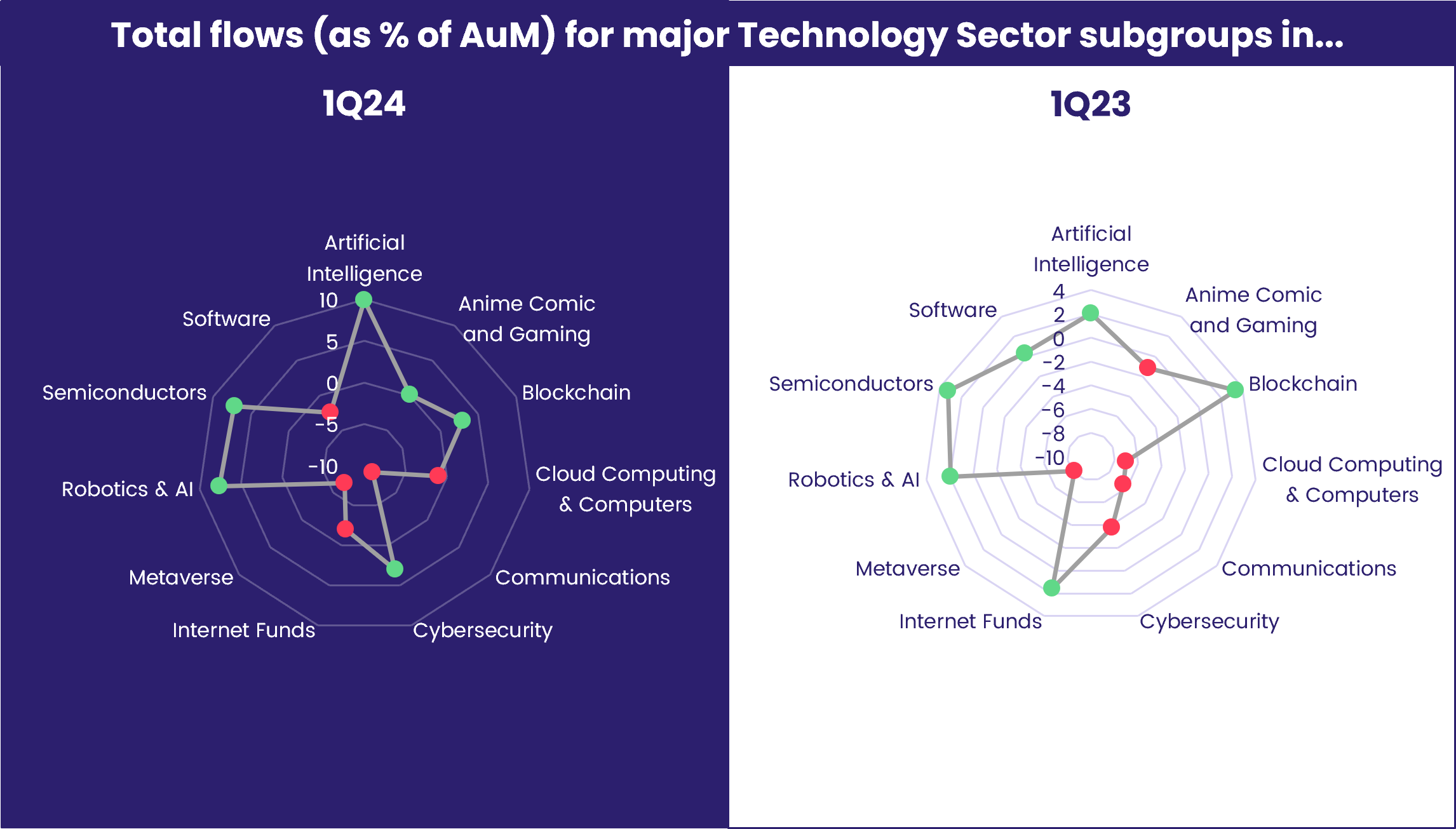

Within the technology universe, major trends and themes emerge that require investors to weigh their chances of turning into profitable businesses. At the start of 2020, a pandemic-induced shift to being at-home and online sent flows into Anime, Comic and Gaming Funds skyrocketing. Blockchain Funds dominated the storyline in early 2021 with NFTs and play-to-earn games exploding in popularity. That rippled into 2022 as Metaverse Funds gained traction and a surge in the demand for chips boosted flows into Semiconductor Funds.

The emphasis in 1Q23 – while still on Blockchain and Semiconductors – broadened to include Artificial Intelligence, Internet and Robotic Funds. This year, there has been an even more marked preference for Artificial Intelligence Funds as more and more sectors integrate generative AI into their practices and renewed interest in cybersecurity plays.

Financials Sector Funds were on track for much of the week to extend their inflow streak, but redemptions on the final day of the reporting period pulled the headline number into negative territory and snapped their four-week inflow streak.

A group that typically struggles to perform well in an inflationary environment – Consumer Goods Sector Funds – saw redemptions hit a 10-week high, surpassing $1 billion for the third time in the past 20 weeks. The group extended their weekly outflow streak to eight weeks and $4.2 billion total. Over the past 40 weeks, the group has attracted inflows just six times.

Bond and other Fixed Income Funds

Going into the final week of April, EPFR-tracked Bond Funds kept their current inflow streak alive. But the net flow was the smallest since the current run began in mid-December. US, Europe, Canada and Global Bond Funds posted fair-to-modest inflows that offset redemptions from Emerging Markets and Asia Pacific Bond Funds.

The subdued flows reflected yet another shift in the consensus at the start of the year, when markets were anticipating up to six US interest rate cuts and a soft landing for the world’s largest economy. Now, the consensus is close to zero for rate cuts and some analysts are beginning to talk about stagflation. At the asset class level, Inflation Protected Bond Funds chalked up a small outflow, High Yield Bond Funds a modest inflow and Mortgage-Backed Bond Funds their biggest inflow since EPFR started tracking them.

The latest outflows from Emerging Markets Bond Funds were equally distributed between funds with hard, local and mixed currency mandates. Frontier Markets Bond Funds swam against the tide, recording their biggest inflow since the first week of 3Q23, and flows into Sharia Bond Funds climbed to a nine-week high as they extended their longest run of inflows since late September.

Also swimming against the tide were China Bond Funds, which posted a fourth consecutive inflow for the first time in over two years. Funds with corporate mandates have attracted the bulk of the fresh money during this run as Chinese corporate prices have rallied on the back of strong domestic demand.

Investors looking to Europe also favored Europe Corporate Bond Funds over their sovereign counterparts. Appetite for the latter have cooled as the scale of French and Italian borrowing to cover fiscal deficits has caught the attention of rating agencies, though flows into France Bond Funds during the latest week climbed to their highest level in over a year.

Among US Bond Fund groups, Short and Intermediate Term Corporate Funds experienced the heaviest redemptions while Long Term Corporate and Intermediate Term Mixed Funds were among the groups recording the biggest inflows. Retail share classes posted their second-biggest outflow year-to-date.

For only the second time during the past four months, both of the major multi-asset fund groups posted outflows. The redemptions from Total Return Funds were the biggest since the second week of December while outflows from Balanced Funds climbed to an 18-week high.

Did you find this useful? Get our EPFR Insights delivered to your inbox.