Fixed income investors saw these trends as further evidence of the pressure for compromise and a return to ‘normal’ policymaking is reaching irresistible levels. Risk appetite rose appreciably during the week ending April 30, with High Yield Bond and Bank Loan Funds snapping their longest outflow streaks since 4Q23 and 2Q23, respectively, while Emerging Markets Bond Funds posted consecutive weekly inflows for the first time since early March.

Equity-focused investors, concerned that any compromises will come too late to prevent the world’s two largest economies from taking serious hits, continued to look past the US and China to Europe and Japan. US Equity Funds posted a third consecutive outflow for the first time since mid-3Q23 and China Equity Funds chalked up their second outflow over the past three weeks.

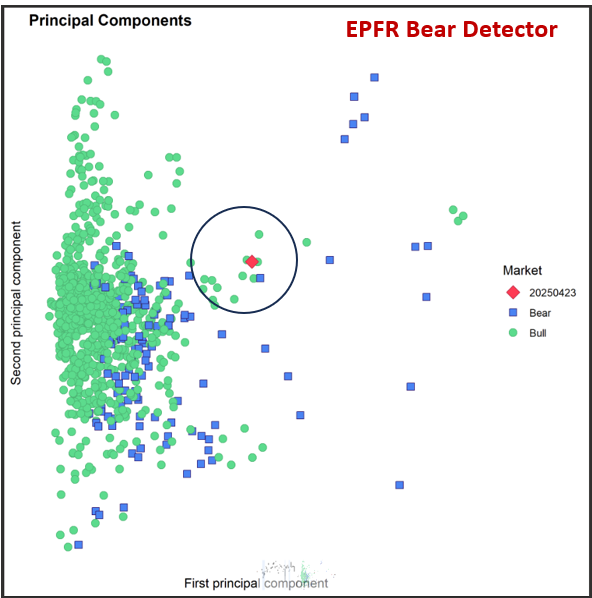

In the Alternative Funds universe, Physical Gold Funds posted their first outflow since early January and their biggest since the second week of November while Cryptocurrency Funds posted their second consecutive inflow exceeding $2 billion. Flows into Bear Funds jumped to a 10-week high, and an EPFR model designed to capture bearish sentiment is sending a strong signal.

Overall, the final week of April saw EPFR-tracked Equity Funds absorb another $8.3 billion, with a net $3.1 billion flowing into Alternative Funds and $3.6 billion into Bond Funds. Net redemptions from Money Market Funds totaled $10 billion as the biggest outflow since mid-January from Europe Money Market Funds offset modest flows into other groups.

At the single country and asset class fund levels, Chile Equity Funds posted their biggest inflow since 4Q23, flows into Norway Equity Funds hit a 49-week high and Australia Bond Funds extended an inflow streak stretching back to early 2Q24. Flows into Momentum Equity Funds climbed to their highest level in nearly three months, Synthetic Funds posted consecutive weekly inflows for the first time since mid-January and Mortgage Backed Bond Funds recorded their biggest inflow year-to-date.

Emerging Markets Equity Funds

Although the diversified Global Emerging Markets (GEM) Equity Funds ended April by posting their biggest weekly inflow in over two years and flows into Latin America Equity Funds hit a 21-month high, EPFR-tracked Emerging Markets Equity Funds recorded their ninth outflow year-to-date as funds dedicated to mainland China surrendered over $3 billion.

The final week of April saw EM Dividend Equity Funds tally their 14th inflow of the year and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates record their biggest weekly inflow since mid-1Q23. Retail money continues to stay away: the last time retail share classes posted a collective inflow was over nine months ago.

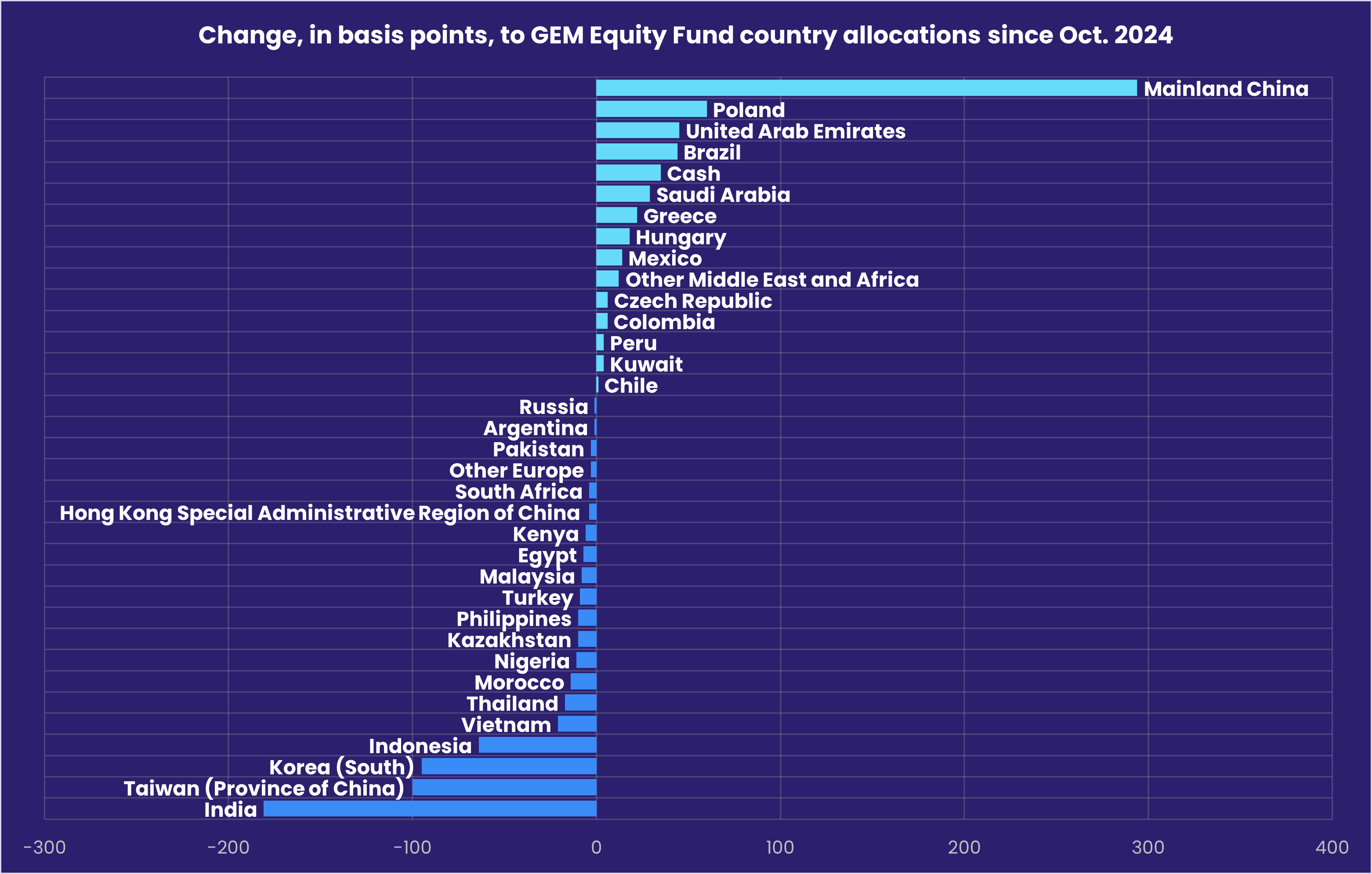

Against a backdrop of underwhelming export data and renewed fears about delisting of Chinese stocks in the US, China Equity Funds posted another outflow – their ninth so far this year – while India Equity Funds racked up their biggest inflow since late September despite the spike in tension with Pakistan over Kashmir. That runs counter to the post US-presidential election trend in GEM Equity Fund allocations, which has seen those funds rotate exposure from India to China.

Among EMEA markets, Poland has seen the biggest increase in its average GEM Fund allocation since Donald Trump reclaimed the US presidency. Investors also favor this market. Poland Equity Funds have now posted inflows 13 of the past 14 weeks. Meanwhile, soft oil prices have not deterred investors from adding to their exposure to Saudi Arabia. Funds dedicated to the market carried a 17-week inflow streak into May.

The headline number for all Latin America Equity Funds was boosted by a shift in flows to Brazil Equity Funds, which rebounded to their highest level in over 19 months. The bulk of the fresh money was absorbed by a single US-domiciled ETF and offset the biggest outflow YTD from Mexico Equity Funds.

Developed Markets Equity Funds

EPFR-tracked Developed Markets Equity Funds chalked up their fourth straight inflow going into May as Global, Japan and Europe Equity Funds pulled in a combined $18.3 billion. That more than offset $9.4 billion redeemed from the two major North American groups.

Flows into the largest of the diversified Developed Markets Equity Funds groups, Global Equity Funds, tallied their biggest inflow since the first week of the year. Global Equity ETFs absorbed $8 for every $1 committed to actively managed funds, and flows into funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates picked up for the third straight week.

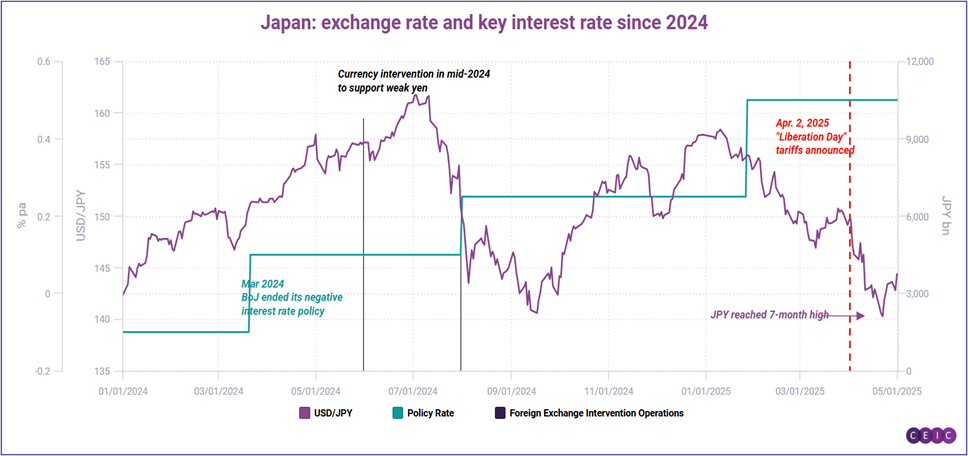

Also in the money were Japan Equity Funds, which posted their ninth inflow since the final week of February – and their largest in just over a year – as retail share classes extended their longest run of inflows since 3Q24. Japan’s export-driven economy remains vulnerable to higher US tariffs. But the threat of those tariffs has reversed the yen’s strengthening versus the US dollar, as the chart below from sister company CEIC illustrates, and given those exporters a modest competitive boost.

It was another solid week for Europe Equity Funds, as investors sought shelter from the more expensive and volatile US market. The prospect of a less frugal Germany spending meaningful sums to bolster its defense capabilities continues to appeal, with Germany-mandated funds pulling in another $777 million. But, with the UK on the outside looking in when it comes to European defense contracts, and tax increases announced last year coming into effect this quarter, appetite for UK exposure remains subdued at best.

A better week for the US stock market did not stem the outflows from US Equity Funds in late April. The latest allocations data shows the average exposure in information technology and industrial plays stands at 11 and 31-month lows, respectively, while the average weighting for utilities has climbed to a 27-week high.

Global sector, Industry and Precious Metals Funds

Sector-oriented investors maintained a strong preference in Technology Sector Funds in late April. But they showed equal conviction when it came to cutting their exposure to commodities, financials and real estate.

Of the 11 major Sector Fund groups tracked by EPFR, six reported outflows during the final week of April that ranged from $321 million for Consumer Goods Sector Funds to $1.18 billion for Commodities/Materials Sector Funds. Of the five groups posting an inflow, three – Industrials, Telecom, and Utilities Sector Funds – recorded inflows well below the $100 million mark as daily flows flip-flopped between positive and negative territory.

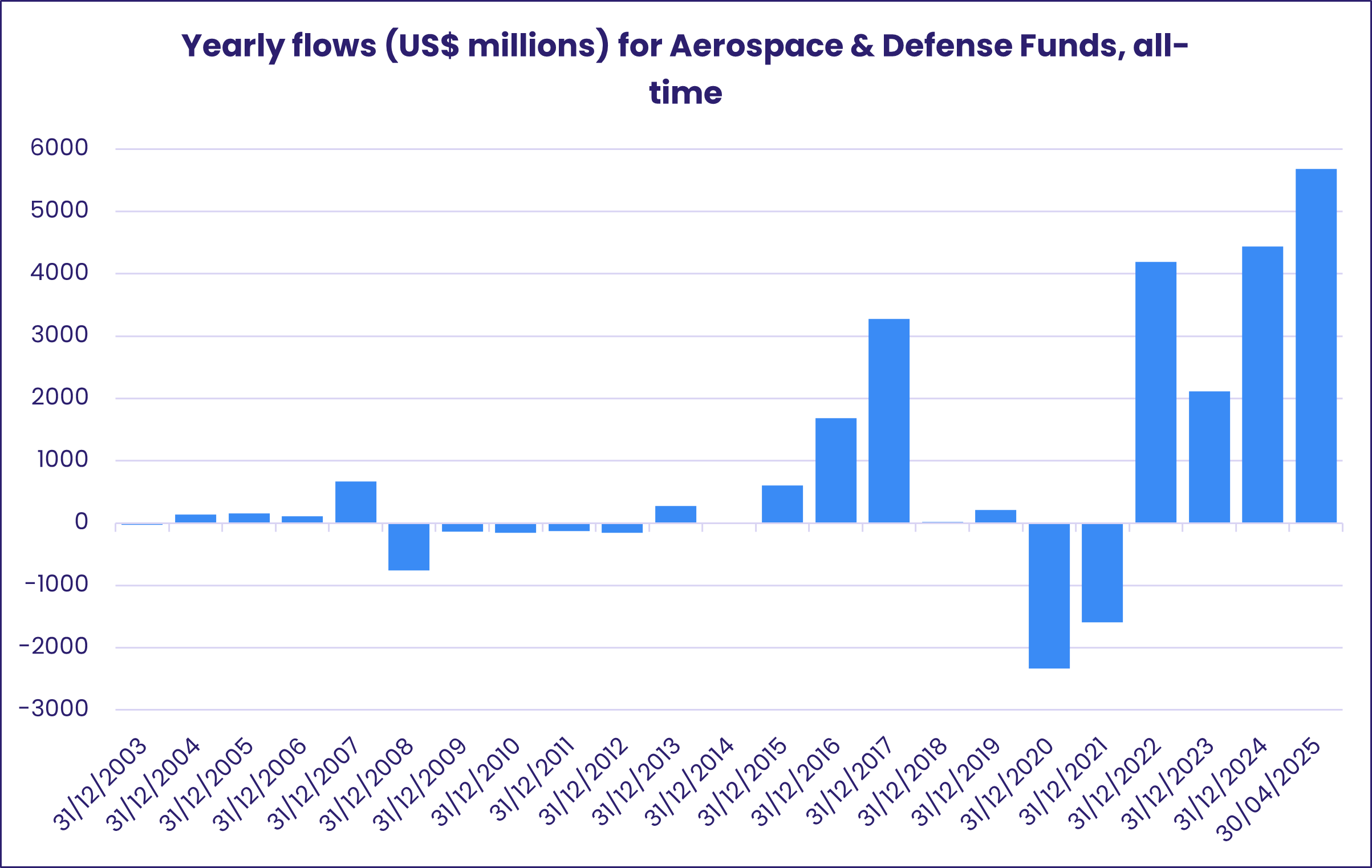

Although Industrials Sector Funds saw modest inflows of just $5 million, Aerospace & Defense Funds – one of the major subgroups – attracted over $250 million, a gain that was largely offset by outflows from a single broadly-focused industrials ETF. Aerospace & Defense Funds posted their 17th consecutive weekly inflow, also the 26th inflow of the past 30 weeks. Inflows have totaled roughly $5.9 billion year-to-date, surpassing the previous record set just last year by $1.2 billion. While market volatility has largely stemmed from tariff-related trade tensions, rearmament efforts in Europe have strengthened the defense sector’s appeal as a secure investment.

After a week of inflows, Real Estate Sector Funds saw nearly $1 billion flow out as they posted their 11th outflow of the past 13 weeks. Accounting for half of this week’s headline number was a single mutual fund that provides exposure to global real estate securities, many of which are REITs. US-dedicated Real Estate Sector Funds have also been directing this trend, posting just four inflows over the past 21 weeks.

The seven-week stretch of inflows for Technology Sector Funds now totals $15.3 billion. One of the most closely followed subgroups, Artificial Intelligence Funds, have posted inflows almost consecutively since mid-November with continuous demand for data centers, capabilities of AI platforms alarmingly impressive, and the pressing integration of AI into everyday life holding investors’ keen interest.

Redemptions from Commodities/Materials Sector Funds were the heaviest since early 3Q22, extending their current outflow streak to four weeks. The top five funds with the heaviest outflows ranged from $136 million for a copper mining ETF to $227 million for a gold mining ETF. All Gold Mining Funds – a major subgroup – posted their third-largest weekly outflow on record at $890 million.

On the Alternatives side, redemptions this week of $1.7 billion arrested, for at least one week, the steady flows into Physical Gold Funds that had persisted for 15 straight weeks. With roughly $33 billion flowing into Physical Gold Funds during the first 17 weeks of the year, it has been the hottest start to any year for these funds.

Bond and other Fixed Income Funds

There was a pause in the recent post-Liberation Day flight from US corporate debt to Treasuries as April ended. It was another sign that fixed income investors are recovering some of the risk appetite they lost as global asset markets convulsed in the wake of the tariff proposals unveiled by US President Donald Trump on April 2.

EPFR-tracked Bond Funds saw a three-week run of outflows come to an end going into May, snapping the overall group’s longest redemption streak since 4Q22, as flows into High Yield, Emerging Markets and Investment Grade Corporate Bond Funds rebounded and US Sovereign Bond Funds posted their biggest outflow in 15 months.

The week ending April 30 also saw US Bond Funds post their first inflow of the quarter, flows into Asia Pacific Bond Funds climb to a six-week high, Europe Bond Funds chalk up their 14th inflow year-to-date and Global Bond Funds tally their eighth outflow over the past nine weeks. At the asset class level, Bank Loan, Mortgage-Backed and Municipal Bond Funds saw their latest redemption streaks come to an end while Inflation Protected Bond Funds recorded their second outflow over the past three weeks.

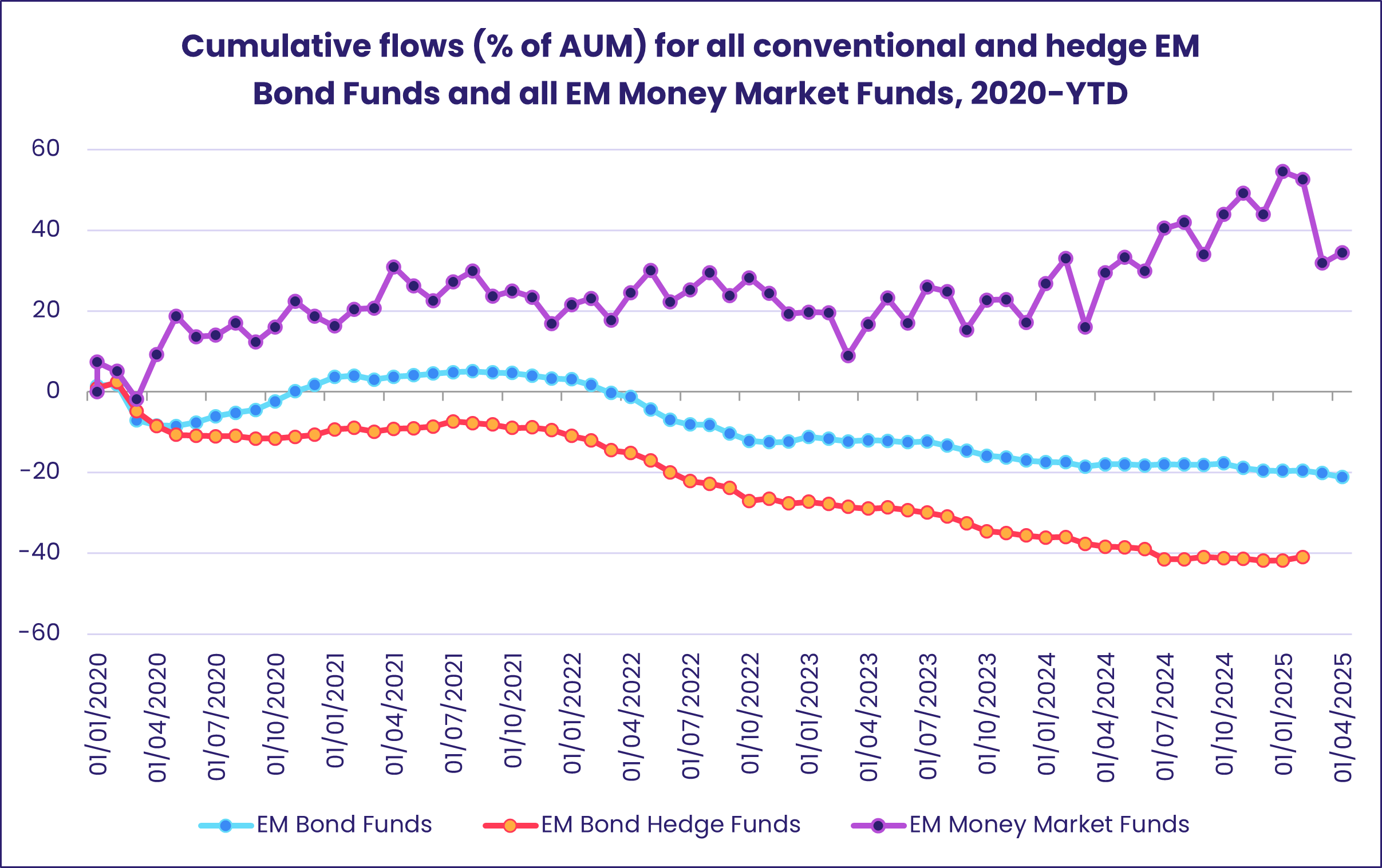

Both Hard and Local Currency Bond Funds absorbed fresh money during the latest week. China Bond Funds stood out at the country level, with that group’s current inflow streak hitting seven weeks and $4.6 billion. Data for EM Bond Hedge Funds, which has a bigger lag than the data for conventional funds, shows sentiment towards emerging market debt bottomed out earlier this year.

US Bond Funds posted a modest inflow that fell shy of the $500 million mark. Municipal, Mortgage-Backed and mixed-mandate Intermediate and Short Term Funds were the biggest contributors to the headline number and Short Term Sovereign Funds the biggest detractors.

For the second week running, Europe ex-UK Regional Bond Funds absorbed the biggest share of the fresh money committed to all Europe Bond Funds. So far this year, actively managed funds have attracted $25.5 billion versus $6.5 billion for passively managed funds. In comparison, the split among US Bond Funds favors passively managed funds, $66 billion YTD versus $49 billion for actively managed funds.

Did you find this useful? Get our EPFR Insights delivered to your inbox.