In this blog, EPFR’s Azalea Micottis expands on a recent CNBC article, Bitcoin is one year away from a major technical event. History suggests the start of another bull run.

View from EPFR

Bitcoin’s next “halving” is expected to take place in 2024. These events take place when Bitcoin miners have added 210,000 “blocks” to the blockchain leger and are marked by a halving of the Bitcoins that miners get for adding each block. Given the implications for future supplies of Bitcoin, these ‘halvings’ usually push Bitcoin’s price significantly higher, both in the run up to the event and for several months afterwards. This time around seems – so far – to be conforming to the pattern: Bitcoin’s price has risen steadily in recent weeks.

EPFR’s data, however, suggests that investors aren’t really buying it.

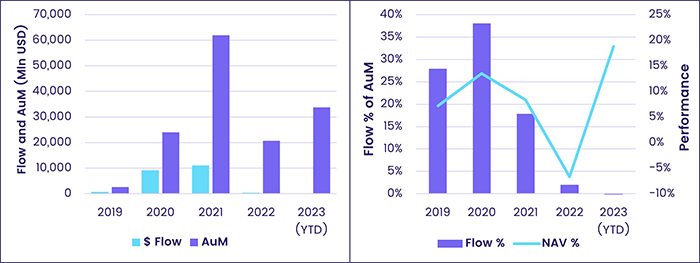

EPFR tracks the flows into globally-domiciled exchange-traded products and mutual funds. Below, we show the total amount of money invested into, and overall assets held by, funds tracking cryptocurrencies over the past five years.

Calendar Year Flows & AuM in $US millions (left), and Flow % and Performance (right) for All Cryptocurrency Funds

This data illustrates that, although Bitcoin prices have risen almost 80% since the start of this year and the average performance of EPFR-tracked funds this year exceeds those prior, investor appetite for those funds is lackluster at best.

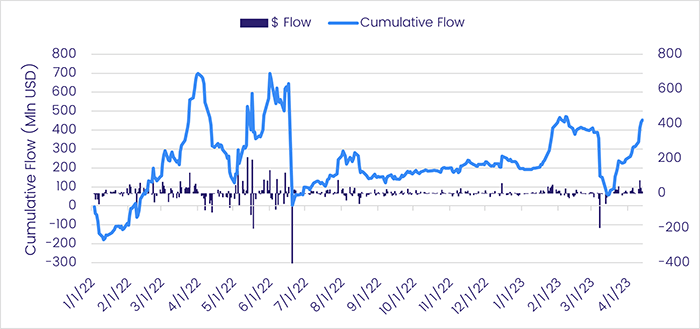

There are signs this may be changing. Analysis of daily flow data shows that investors have pumped almost $400 million into Bitcoin funds since mid-March.

Daily Flows in $US millions for Bitcoin Funds

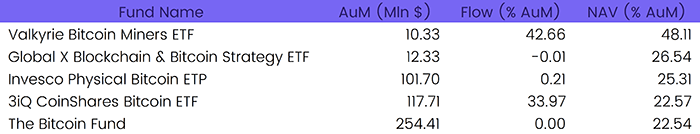

Between March 15th and April 13th 2023, over 90% of these funds produced positive returns, the top five of which are reported in the table below.

Our data suggests that history, when it comes to the price of Bitcoin, is likely to repeat itself. But the hits taken by the cryptocurrency business as a whole over the past 16 months has left its mark on investor sentiment towards the asset class.

Did you find this useful? Get our EPFR Insights delivered to your inbox.