View from EPFR

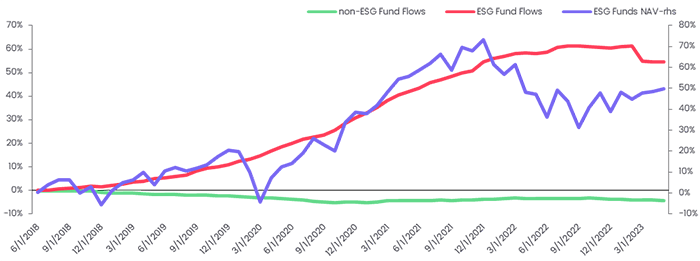

According to a recent article in the Financial Times, ESG is no longer the buzz phrase it used to be for private wealth managers looking to bring fresh client money through the door. But politics, performance and costs have – at least temporarily – taken much of the shine off the ESG theme. EPFR’s data has captured this shift, which started in 4Q21 but has accelerated this year. Going into the final weeks of June, US ESG focused funds (including ETFs and mutual funds) had suffered a collective $12.4 billion outflow YTD.

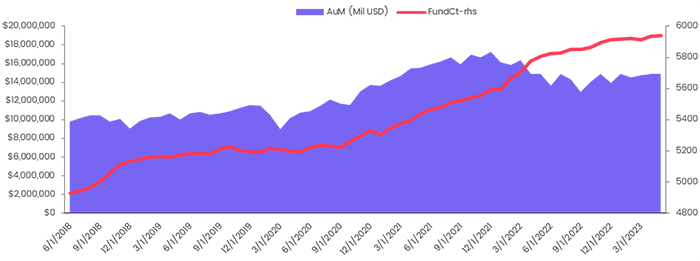

The total assets managed by ESG-focused funds has also dropped, hit by the outperformance of oil, gas and defense stocks in the aftermath of Russia’s attack on Ukraine in 1Q22. But the total count of ESG funds is still in the rise, albeit at a slower pace than the 2019-21 period.

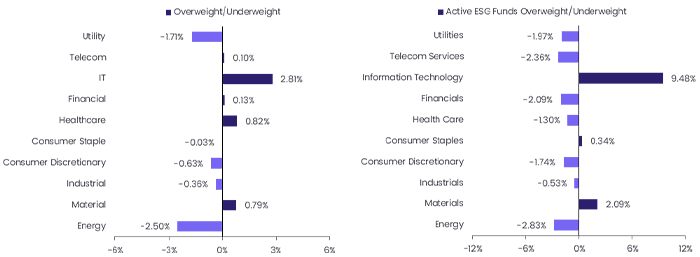

Looking at the longer-term picture, funds with ESG mandates remain significantly overweight technology stocks. At the end of May 2023, ESG funds on average allocated 2.81% more than non-ESG funds to the Information Technology (IT) sector and 2.5% less to Energy sector plays. On top of that, active ESG funds took a step further, allocating 9.48% more to IT than non-ESG funds do.

Nick Murphy, a partner at Evelyn Partners who was quoted in the FT piece, believes these allocations will pay off over time. “Despite recent setbacks, we anticipate an acceleration in investment in carbon emission reduction and an opportunity for investors who are keen to promote it.”

Meanwhile, most of the IT stocks favoured by ESG fund managers are enjoying a tailwind from the broad enthusiasm for exposure to artificial intelligence plays. While the prospect of another tech bubble remains a concern, fund flows suggest the partnership between ESG and the technology sector will be beneficial for both in the years ahead.

Did you find this useful? Get our EPFR Insights delivered to your inbox.