In this blog, EPFR expands on a recent Financial Times’ article, Google launches Bard chatbot to rival OpenAI’s ChatGPT.

View from EPFR

In late November 2022, OpenAI launched ChatGPT – an AI driven chatbot that can answer complex questions and handle almost any topic. A couple of months later, Microsoft (who is the primary investor) added a similar function to its Office suite. This allows users to utilize the AI tool to create content in Word and PowerPoint. Google has been relatively slow to release similar products. That doesn’t mean, however, that Google is falling behind. Both of these companies — and the investment community — developed the capabilities of chatbot technologies before the general public began to pay attention.

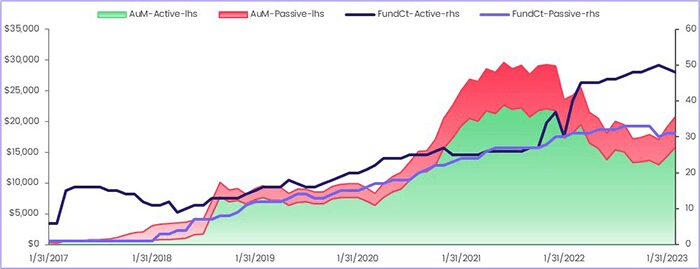

Artificial Intelligence is one of the few themes that active investors bet heavily on over the past five years. From January 2020 to December 2021, the total AuM of EPFR-tracked artificial intelligence funds grew an astonishing 290%. Even when the peak of the COVID crisis had passed, and the total AUM of those funds shrank due to weak market performance, the total number of active funds continued to grow.

Monthly data in February shows the total AuM of Artificial Intelligence Funds stood at $20.9 billion with active funds accounting for $15.9 billion and passive funds $5 billion.

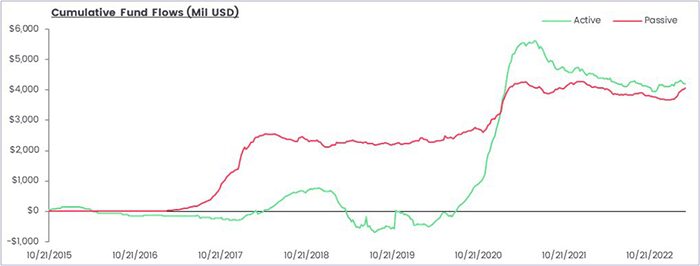

Some suspect AI is the next bubble. The $6 billion that has flowed into active funds over the past six years shows investor sentiment peaking in Q4 2020 and Q1 2021. But, since mid-2021, flows have been relatively flat.

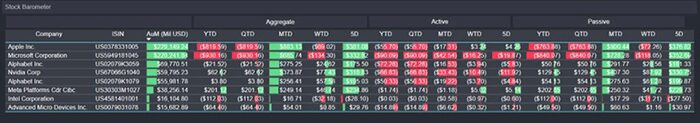

In the EPFR Stock Barometer shown below, we handpicked several AI related companies. On a year-to-date basis, net selling of Apple has totalled $820 million and funds have disposed of $930 million worth of Microsoft stock while $20 million flowed into Alphabet.

It is too early to tell whether there will be an AI bubble. However, in the short run the field continues to garner compelling headlines, and it is likely to see more portfolio capital that the fund as benchmark-tracking ETFs mirror the growth seen in mutual funds.

Did you find this useful? Get our EPFR Insights delivered to your inbox.