In this blog, EPFR expands on a Financial Times’ recent article, Money market funds swell by more than $286bn amid deposit flight.

View from EPFR

The collapse of several US regional banks and the UBS-Credit Suisse merger in March spurred investors to look for alternative homes for their money. For many the answer was Money Market Funds.

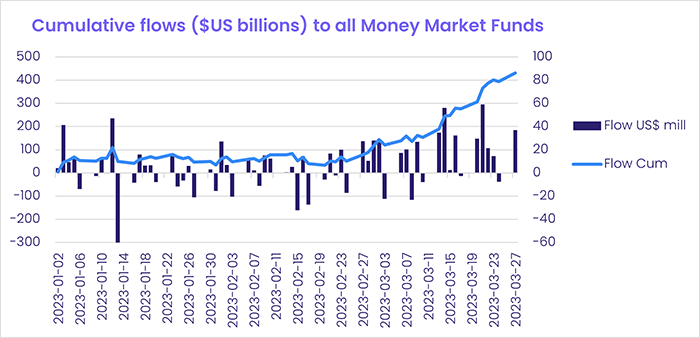

As the Financial Times article highlights, Money Market Funds offer more attractive yields than most cash management options, such as certificates of deposit (CDs), offered by banks. Amidst the recent turmoil, the US Money Market Funds tracked by EPFR absorbed over $286 billion in just a few weeks. That influx accounts for more than half of their total dollar inflow year-to-date.

Utilizing EPFR’s data, however, allows us to look at how funds dedicated to non-US assets are faring and see which mandates investors favored when making the switch.

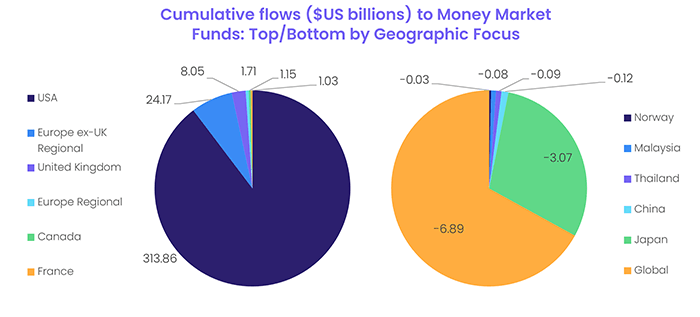

Breaking down daily flows throughout March by fund geographic mandate, the charts below demonstrate that the clear winners from this huge reallocation are US and, to a much lesser degree, Europe Money Market Funds. On the flip side, however, Global and Japan Money Market Funds recorded net outflows of $6.89 billion and $3.07 billion, respectively, over the same period.

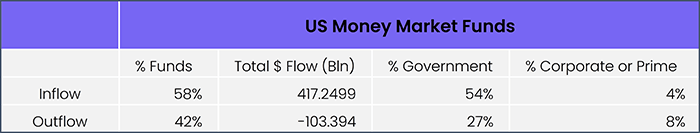

Looking at just US Money Market Funds, and using EPFR’s fund-level tags, shows that just over half of the funds tracked pulled in the bulk of the money. Moreover, within the subset of funds receiving net inflows in March, a large proportion consisted of those investing primarily in T-bills and other government assets.

Note: “Government” and “Corporate or Prime” funds were identified based on fund name tags.

Note: “Government” and “Corporate or Prime” funds were identified based on fund name tags.

Did you find this useful? Get our EPFR Insights delivered to your inbox.